eminiviper.com

I started this topic because some questions I asked and answers I got from cba33558 were getting lost in this rather extensive topic here:

http://www.mypivots.com/forum/topic.asp?TOPIC_ID=2300&whichpage=30

We started this discussion on page 30 of that thread, and I thought I'd move it here so we can continue it (since no one took me up on my offer to start this thread). I'll cut and paste the three posts made after cba33558 posted a chart about eminiviper.com

From 6/8/09:

jimkane: Hey, cba. I checked out that EminiViper.com page. Very impressive. Seems like they don't have any losing days, or even losing trades (or do they not post those?). Is that so? If not, how many stop outs or false signals are you seeing on an average day? It doesn't mean much to me to see winners, I am more interested in the losers I have to take to get those winners. Also, are you the owner of EminiViper.com, or do you work for them? If not, what is your association? If I don't ask, that will likely be the first question from everyone else. Thanks.

cba33558: Hey Jim -

Thanks for visiting the Web site and offering your constructive questions and feedback...

The videos are intended to show the NQ Emini trades that are triggered by the system each day. Currently the system is designed to issue trade signals only the Nasdaq Emini. In addition to the Viper indicator, the system uses a combination of guidance charts and a trading chart that very rarely has a losing trade. With all of these constraints, it should be noted however, that there are not many signals that trigger in any given trading day. Depending on the volatility - usually one or two trades may trigger - a busy day would be 3 trades.

The entire trading system is not shown in the videos; however, all of the details regarding these trade signals are shown in an eBook and training videos. The actual trade signals themselves are analyzed in real-time in the live Webinars. The entire goal of this system was accuracy - not catching every trade.

In answer to your other question, I have been a trader for a little over 12 years now, I am a partner in the firm; and was involved extensively in developing, actively trading and back-testing the Viper system over the past year and a half.

Once again, thank you for your input, and I look forward to opportunity of respectfully participating in your Forum...

jimkane: Thanks for the response, cba. Wow, those are some incredibly impressive stats. Given these are intraday trend trades, it's almost incomprehensible to me. My style is intraday trend trading, and with the 3 to 5 to 1 or sometimes higher reward/risk profiles I'm happy anywhere in the 30% to 50% winners range.

I have a few more questions. Is there a way to follow along and see live trade signals the moment they develop, on a trial basis? The web site mentions visiting a live webinar for a day. Would one see live signals in time to act, or only after they have started? What if no signals are generated that day, can someone try another day? It's very hard to evaluate a system with a one-day trial, especially one that generates only a few signals.

Next, what is the difference between live webinars and live trading room, as far as signals given in real-time? Also, if one signs on to your room and gets all that training, does that do any good without the software? What is the cost of the license, since the website doesn't specify this? I'd love to follow along real-time for a period and evaluate your system, but I'm not sure you have any provisions where I could do that without laying out money first. Again, if I don't ask all these questions, someone else will. Since I'm probably the longest-winded character at this forum, I figured I'd just get the ball rolling. It's not often I hear about a system that has almost no losers at all.

Lastly, if we go much further with this discussion it may be appropriate to move it from this thread to one you or someone else could create in Trading Advisory Services.

http://www.mypivots.com/forum/topic.asp?TOPIC_ID=2300&whichpage=30

We started this discussion on page 30 of that thread, and I thought I'd move it here so we can continue it (since no one took me up on my offer to start this thread). I'll cut and paste the three posts made after cba33558 posted a chart about eminiviper.com

From 6/8/09:

jimkane: Hey, cba. I checked out that EminiViper.com page. Very impressive. Seems like they don't have any losing days, or even losing trades (or do they not post those?). Is that so? If not, how many stop outs or false signals are you seeing on an average day? It doesn't mean much to me to see winners, I am more interested in the losers I have to take to get those winners. Also, are you the owner of EminiViper.com, or do you work for them? If not, what is your association? If I don't ask, that will likely be the first question from everyone else. Thanks.

cba33558: Hey Jim -

Thanks for visiting the Web site and offering your constructive questions and feedback...

The videos are intended to show the NQ Emini trades that are triggered by the system each day. Currently the system is designed to issue trade signals only the Nasdaq Emini. In addition to the Viper indicator, the system uses a combination of guidance charts and a trading chart that very rarely has a losing trade. With all of these constraints, it should be noted however, that there are not many signals that trigger in any given trading day. Depending on the volatility - usually one or two trades may trigger - a busy day would be 3 trades.

The entire trading system is not shown in the videos; however, all of the details regarding these trade signals are shown in an eBook and training videos. The actual trade signals themselves are analyzed in real-time in the live Webinars. The entire goal of this system was accuracy - not catching every trade.

In answer to your other question, I have been a trader for a little over 12 years now, I am a partner in the firm; and was involved extensively in developing, actively trading and back-testing the Viper system over the past year and a half.

Once again, thank you for your input, and I look forward to opportunity of respectfully participating in your Forum...

jimkane: Thanks for the response, cba. Wow, those are some incredibly impressive stats. Given these are intraday trend trades, it's almost incomprehensible to me. My style is intraday trend trading, and with the 3 to 5 to 1 or sometimes higher reward/risk profiles I'm happy anywhere in the 30% to 50% winners range.

I have a few more questions. Is there a way to follow along and see live trade signals the moment they develop, on a trial basis? The web site mentions visiting a live webinar for a day. Would one see live signals in time to act, or only after they have started? What if no signals are generated that day, can someone try another day? It's very hard to evaluate a system with a one-day trial, especially one that generates only a few signals.

Next, what is the difference between live webinars and live trading room, as far as signals given in real-time? Also, if one signs on to your room and gets all that training, does that do any good without the software? What is the cost of the license, since the website doesn't specify this? I'd love to follow along real-time for a period and evaluate your system, but I'm not sure you have any provisions where I could do that without laying out money first. Again, if I don't ask all these questions, someone else will. Since I'm probably the longest-winded character at this forum, I figured I'd just get the ball rolling. It's not often I hear about a system that has almost no losers at all.

Lastly, if we go much further with this discussion it may be appropriate to move it from this thread to one you or someone else could create in Trading Advisory Services.

Wanted to share a 5-Range Bar chart on the Emini Nasdaq that has proven useful as guidance as to which direction to take trades on a smaller range bar chart.

As you can see today, short was the way to be for most of the day.

As you can see today, short was the way to be for most of the day.

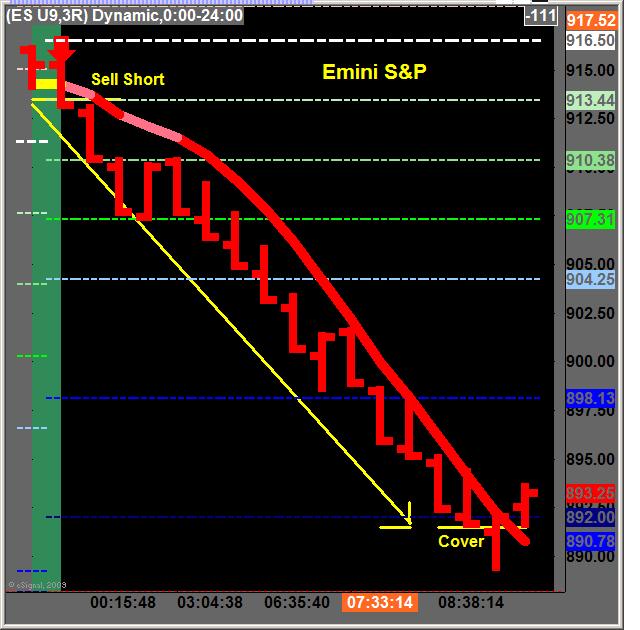

Wanted to also share a 3-Range Bar chart on the Emini S&P that has proven useful as guidance as to which direction to take trades on a smaller range bar chart.

The guidance chart was clearly pointing toward the short direction most of the day.

The guidance chart was clearly pointing toward the short direction most of the day.

I've been attending the room for a few weeks and haven't made a final decision if this indicator has any more value than a variety of others available in the public domain. The developers will soon be releasing it in NT and then I'll have some hands on experience.

But my early belief is the indicator is only as good as the trading experience of the person using it and therefore it is highly discretionary in its application, especially on exits of trades. There are rules for using it, but the developers often tweek them which makes for confusion. This is not an indicator for noobs and not nearly as simple as it appears from screenshots.

There may be some growing pains for Viper as the developers figure out the best way to use it and I'm prepared to see what the near future holds.

But my early belief is the indicator is only as good as the trading experience of the person using it and therefore it is highly discretionary in its application, especially on exits of trades. There are rules for using it, but the developers often tweek them which makes for confusion. This is not an indicator for noobs and not nearly as simple as it appears from screenshots.

There may be some growing pains for Viper as the developers figure out the best way to use it and I'm prepared to see what the near future holds.

Greetings Phantasmagoria -

I must say that is some great feedback...

And we have received additional feedback from other new users which we appreciate. Also, as some of you may already know, we are in the process of porting the Viper scripts over to the Ninja Trader platform.

As a result, we have decided to open up the Viper software as a free public beta for everyone to try.

We will post a link to the free beta download when it is ready.

Thanks again for your helpful input...

I must say that is some great feedback...

And we have received additional feedback from other new users which we appreciate. Also, as some of you may already know, we are in the process of porting the Viper scripts over to the Ninja Trader platform.

As a result, we have decided to open up the Viper software as a free public beta for everyone to try.

We will post a link to the free beta download when it is ready.

Thanks again for your helpful input...

anything to report yet?

Sorry for the delay...

The free Viper download for NinjaTrader can be found at this link:

http://www.FreeViperDownload.com.

Enjoy!

The free Viper download for NinjaTrader can be found at this link:

http://www.FreeViperDownload.com.

Enjoy!

Hey, Bruce. I just got my copy of the software for Ninja, which appears to be working. The problem for me is I can't get back data running Ninja off say IB, so I can't do any looking back. As it is I'll have to leave it running all night so that I can have the back data so the indicators are ready before the open. This isn't any issue with the program, it's my own data issue. I only mention it here to point out that I can't play with this over the long weekend to get a handle on what I think of the signals. Since I use QCharts instead of the eSignal platform (both use the exact same eSignal data manager, but, even though QCharts says it is possible, I just can't get Ninja to see the data manager, nor can some people I know running the same setup...).

I haven't been able to attend a morning session yet, especially because as we all know, ES action is all in the morning right now, and I can't be following along with a live webinar at that time. The afternoon webinars have mostly been about previous setups and how the system works. Some of that is due to the afternoons being non-trending, though.

I do agree with what Phantasmagoria mentioned, in that there is a lot more discretion involved that I expected to see. I have no issue with that, since I'm a discretionary trader myself. Perhaps the level of discretion should be more clearly mentioned, though. The problem, with any 'system', is that you can wind up in the trap of it only works for the system owners, because everyone else is using the wrong discretion. I have no issue with that whatsoever, since it very well could be that it could be a very challenging skill that takes a lot of time to finally learn, perhaps even such that only those that came up with the system may ever really 'see' enough to learn it. If someone who has such a system, though, sees others not consistently profitable and they say they are, they need to provide statements verifying that, no ifs, ands, or buts in my opinion.

Now, I am not saying these guys are in that category, since I just started studying this and haven't even seen a morning session yet. I'm just laying background for where I'm coming from. I also notice that by using webinar format I have no contact with any other viewers. I can't get in touch with them, have discussions on their experiences, or see what comments they may make. I am also a bit hamstrung because a headset is just about mandatory, and I not only don't have one, I am one of those traders who has to give up any hope of doing my own trading while using a headset, and I can't commit to that in the morning session right now.

I will refrain from comments on the trading activity that may be happening during the AM webinars until I actually get into some of them, but I suspect they are going to mostly be designed around explaining how the system works. I have seen mentions in the afternoon sessions about trades being taken, but it isn't very clear. In terms of explaining things it is reasonable, but not for verification that the guys are net profitable. I'm not saying they aren't, only that to have a level of confidence in that one would have to see very clear details on all trades, in a timely manner.

For me, I need things like 'I'm getting long the ES on a break above 898.75, I just got filled at 899 even, my stop is at 897.25, my first target is at xxx, I just got filled at xxx, and I'm now trailing my stop at the Viper average, I just got a close below the Viper average at zzz and I've closed my other contract with a fill at zzz-.25 and I'm flat now'. Without that, I not only have trouble following along, I can't even begin to assess the trading skills of the people. So far, I haven't seen this level of detail. I've been in enough chat rooms to know this can be done in real time. It doesn't verify the person is actually taking any trades unless they have a live execution platform up (which some do show), but it's a start.

I also notice that in the afternoon sessions cba is usually very busy, and has to leave early for other appointments many times, and his partner takes over. I have no idea how the morning sessions are, but I suspect (hope) they are better, with the entire period just solid, focused trading. I will wait and see how those go. I am not holding out hope that the sessions are going to be solid, follow my live trades step-by-step sessions, but more discussion about operating the system and the rules, and discussion about the various aspects of the discretionary parts of it. This is all good for learning the system, but many people, I think, are also in there to be convinced the two guys are trading consistently profitable themselves, not to see if the system may work for them.

This gets into some thoughts I have that I will post later, after the entire review is complete. I will say, though, as a preliminary teaser, that you guys here have changed my mind over time, despite my arguments against statements. I now do believe that anyone who has a system (I am not referring to educators who do not make claims) and claims they are using it profitably, step one is automatically to provide verifiable statements. No statements, no point to even check the system or chat room out, in my opinion.

If someone has a system and they say 'Look, I think this system may be pretty useful, try it out, see if you can make some money with it, if so, get involved.', then I don't feel the need for statements. No claims, no statements needed. But, after some experience checking out some systems and chats, I will say that what I need from say the webinars for Viper is to see how the system works, the operating rules under fire, which is what they are providing. I don't need to be spending my time seeing if these guys are profitable, which will be a lot of work and time for me.

This could all be solved, and I'm not specifically referring to cba and partner here, but all system vendors, very simply. Either don't make any claims about your own profitability and offer the system up as something that people may find useful, or make the claims and have the verified statements already posted, there is no need for people to even have to ask for them. I also think it probably isn't a very good idea to post exceptional trades as a form of advertising a system, but that's another topic altogether.

So, I rambled on quite a bit here, but that's where I'm at. I do have a lot of initial observations and ideas on what I've seen so far, but to be fair to cba and the system I need to follow along with the software, in real time, with a good chunk of morning live webinars under my belt before I can say what I think. It is interesting so far, but there are things I must get answers to before I can say much more.

I haven't been able to attend a morning session yet, especially because as we all know, ES action is all in the morning right now, and I can't be following along with a live webinar at that time. The afternoon webinars have mostly been about previous setups and how the system works. Some of that is due to the afternoons being non-trending, though.

I do agree with what Phantasmagoria mentioned, in that there is a lot more discretion involved that I expected to see. I have no issue with that, since I'm a discretionary trader myself. Perhaps the level of discretion should be more clearly mentioned, though. The problem, with any 'system', is that you can wind up in the trap of it only works for the system owners, because everyone else is using the wrong discretion. I have no issue with that whatsoever, since it very well could be that it could be a very challenging skill that takes a lot of time to finally learn, perhaps even such that only those that came up with the system may ever really 'see' enough to learn it. If someone who has such a system, though, sees others not consistently profitable and they say they are, they need to provide statements verifying that, no ifs, ands, or buts in my opinion.

Now, I am not saying these guys are in that category, since I just started studying this and haven't even seen a morning session yet. I'm just laying background for where I'm coming from. I also notice that by using webinar format I have no contact with any other viewers. I can't get in touch with them, have discussions on their experiences, or see what comments they may make. I am also a bit hamstrung because a headset is just about mandatory, and I not only don't have one, I am one of those traders who has to give up any hope of doing my own trading while using a headset, and I can't commit to that in the morning session right now.

I will refrain from comments on the trading activity that may be happening during the AM webinars until I actually get into some of them, but I suspect they are going to mostly be designed around explaining how the system works. I have seen mentions in the afternoon sessions about trades being taken, but it isn't very clear. In terms of explaining things it is reasonable, but not for verification that the guys are net profitable. I'm not saying they aren't, only that to have a level of confidence in that one would have to see very clear details on all trades, in a timely manner.

For me, I need things like 'I'm getting long the ES on a break above 898.75, I just got filled at 899 even, my stop is at 897.25, my first target is at xxx, I just got filled at xxx, and I'm now trailing my stop at the Viper average, I just got a close below the Viper average at zzz and I've closed my other contract with a fill at zzz-.25 and I'm flat now'. Without that, I not only have trouble following along, I can't even begin to assess the trading skills of the people. So far, I haven't seen this level of detail. I've been in enough chat rooms to know this can be done in real time. It doesn't verify the person is actually taking any trades unless they have a live execution platform up (which some do show), but it's a start.

I also notice that in the afternoon sessions cba is usually very busy, and has to leave early for other appointments many times, and his partner takes over. I have no idea how the morning sessions are, but I suspect (hope) they are better, with the entire period just solid, focused trading. I will wait and see how those go. I am not holding out hope that the sessions are going to be solid, follow my live trades step-by-step sessions, but more discussion about operating the system and the rules, and discussion about the various aspects of the discretionary parts of it. This is all good for learning the system, but many people, I think, are also in there to be convinced the two guys are trading consistently profitable themselves, not to see if the system may work for them.

This gets into some thoughts I have that I will post later, after the entire review is complete. I will say, though, as a preliminary teaser, that you guys here have changed my mind over time, despite my arguments against statements. I now do believe that anyone who has a system (I am not referring to educators who do not make claims) and claims they are using it profitably, step one is automatically to provide verifiable statements. No statements, no point to even check the system or chat room out, in my opinion.

If someone has a system and they say 'Look, I think this system may be pretty useful, try it out, see if you can make some money with it, if so, get involved.', then I don't feel the need for statements. No claims, no statements needed. But, after some experience checking out some systems and chats, I will say that what I need from say the webinars for Viper is to see how the system works, the operating rules under fire, which is what they are providing. I don't need to be spending my time seeing if these guys are profitable, which will be a lot of work and time for me.

This could all be solved, and I'm not specifically referring to cba and partner here, but all system vendors, very simply. Either don't make any claims about your own profitability and offer the system up as something that people may find useful, or make the claims and have the verified statements already posted, there is no need for people to even have to ask for them. I also think it probably isn't a very good idea to post exceptional trades as a form of advertising a system, but that's another topic altogether.

So, I rambled on quite a bit here, but that's where I'm at. I do have a lot of initial observations and ideas on what I've seen so far, but to be fair to cba and the system I need to follow along with the software, in real time, with a good chunk of morning live webinars under my belt before I can say what I think. It is interesting so far, but there are things I must get answers to before I can say much more.

Hey Jim - thank you for your thoughtful observations...

We did want to underscore the fact that this Viper release on Ninja is a beta version free for everyone to download and evaluate.

We welcome any and all comments.

Thanks...

We did want to underscore the fact that this Viper release on Ninja is a beta version free for everyone to download and evaluate.

We welcome any and all comments.

Thanks...

quote:

Originally posted by cba33558

Hey Jim - thank you for your thoughtful observations...

We did want to underscore the fact that this Viper release on Ninja is a beta version free for everyone to download and evaluate.

We welcome any and all comments.

Thanks...

cba

your viper is a no-lag moving average

i compared it the hull moving average and its the same with the settings of 25-5

am i correct?

By defintion, every moving average lags if it is priced based. That includes Hull, Jurik and everything else.

- Page(s):

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

Sorry this reply is 2-years late but I just joined the forum.

I know from personal experience that GoToMeeting and GoToWebinar default to showing all users and all comments unless specifically disabled by the Host.

If they're saying what was reported that's a blatant lie.

I know from personal experience that GoToMeeting and GoToWebinar default to showing all users and all comments unless specifically disabled by the Host.

If they're saying what was reported that's a blatant lie.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.