Merged Profile

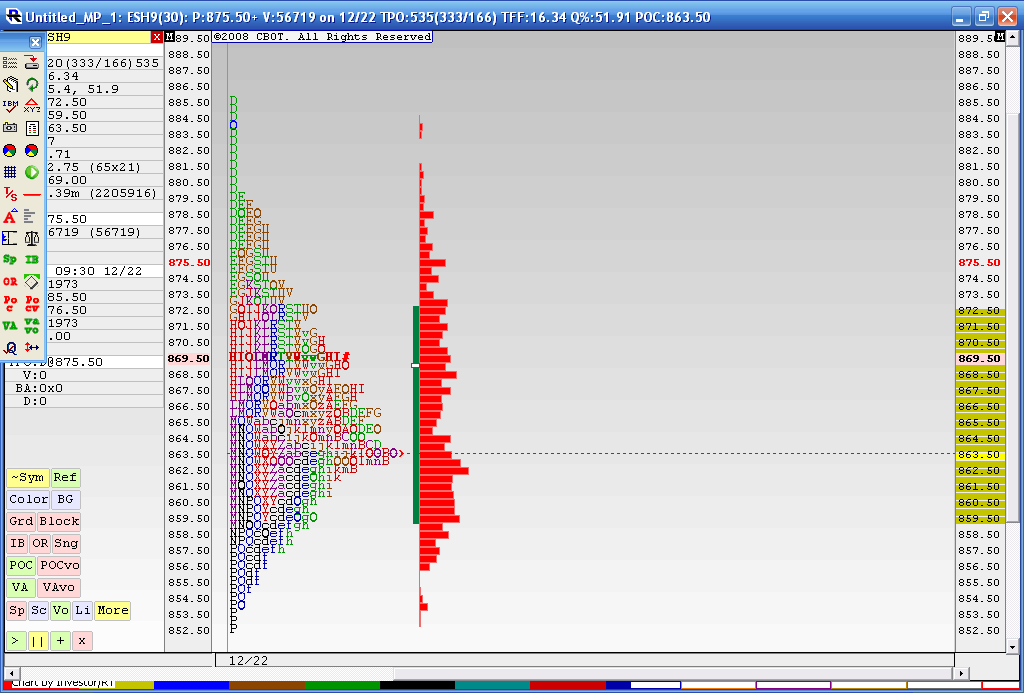

Below is the result from a 4 day merged profile as this is where we most recently have consolidated during holiday trade. The Value area high of this merge is 872.50 and the Value area low is 59.50. You may also notice that the 863.50 price has had the most trade through so far. This chart doesn't include today's trading. I think that 59.50 - 63.50 is the area we need to beat for any upside to take hold as we have the Va low and that Volume node. Current overnight high is 73.50 so it was fairly close to the merged VA high of 72.50.

In today's trading we have single prints created to the downside and through that high volume node. I'm skeptical because of the holidays and low volume but as most know we will trend many times after consolidations. I'm not sure if this counts. Anyway it's been fun firing up the old MP software for a change.

To make a long story longer: That 859.50 - 863.50 is the critical zone to watch.

In today's trading we have single prints created to the downside and through that high volume node. I'm skeptical because of the holidays and low volume but as most know we will trend many times after consolidations. I'm not sure if this counts. Anyway it's been fun firing up the old MP software for a change.

To make a long story longer: That 859.50 - 863.50 is the critical zone to watch.

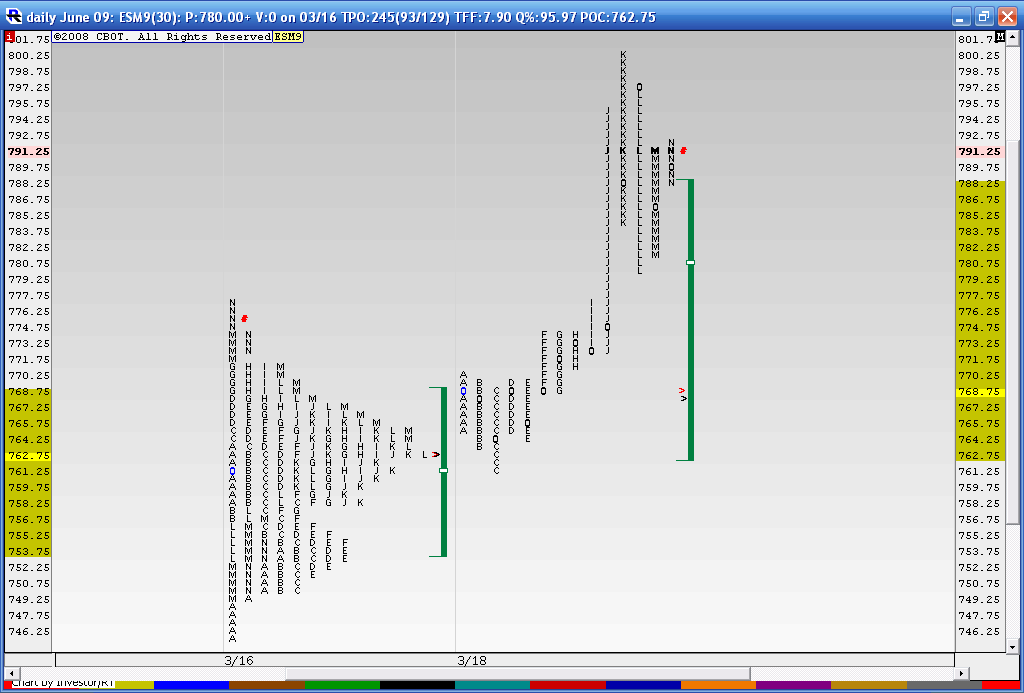

Here is Monday and Tuesdays Combined profile and the breakout today...

Look at that great buying tail in "c" period off of the high volume node of the composite. Missed that trade! So we have some good numbers to watch. The Mon - Tuesday high, the single prints from today ( near 780)and the High volume node which is Wednesdays low... 768 - 770 is an auction point so that is another key..

Look at that great buying tail in "c" period off of the high volume node of the composite. Missed that trade! So we have some good numbers to watch. The Mon - Tuesday high, the single prints from today ( near 780)and the High volume node which is Wednesdays low... 768 - 770 is an auction point so that is another key..

I had to buy the ultra shorts near the close as I just can't hold ES well overnight......we hit into the low volume from page 16.....we'll see...I've been expecting selling for 4 days now and none has come.....perhaps tomorrow is my day..

[quote]Originally posted by BruceM

any chance I could convince you to start a thread on OBV DW ? I've read a great article by a great writer but I'm a bit weak at putting it to use so far.....my work with Volume needs more effort on my part[quote]

Bruce, Thanks for the kind words and the invitation to start an OBV thread. However I must decline due to health problems. I cannot always be available.

However one can acquire my article on 'Day trading with On Balance Volume' from Stock & Commodities. I'm sorry but they make a small charge, but it is less than $3.00. I will post OMV alerts on ocassion and answer questions.

Tody is one of my favorite openings - three connsecutive five minute bars, all lower (or higher) and at least one a wide range bar. This is usually one of the few day where you can buy/sell the fifteen minute high/low and hold until the close (or 4.00 p.m. EST).

Have good day.

any chance I could convince you to start a thread on OBV DW ? I've read a great article by a great writer but I'm a bit weak at putting it to use so far.....my work with Volume needs more effort on my part[quote]

Bruce, Thanks for the kind words and the invitation to start an OBV thread. However I must decline due to health problems. I cannot always be available.

However one can acquire my article on 'Day trading with On Balance Volume' from Stock & Commodities. I'm sorry but they make a small charge, but it is less than $3.00. I will post OMV alerts on ocassion and answer questions.

Tody is one of my favorite openings - three connsecutive five minute bars, all lower (or higher) and at least one a wide range bar. This is usually one of the few day where you can buy/sell the fifteen minute high/low and hold until the close (or 4.00 p.m. EST).

Have good day.

I'm sorry to hear of your health problems D.W. I hope you have a fast recovery. That is a great article and encourage anyone who is interested to go get it. I think my IB data does strange things with that indicator for some reason. I'll have to fire up my I/RT to see if that cleans things up a bit. That was a good first push today and I'm hoping they will go get the "air" left over from yesterday at the very least.

so far a nice open and drive!! Thanks for the heads up on the parttern too

so far a nice open and drive!! Thanks for the heads up on the parttern too

quote:

Originally posted by dafydd

[quote]Originally posted by BruceM

any chance I could convince you to start a thread on OBV DW ? I've read a great article by a great writer but I'm a bit weak at putting it to use so far.....my work with Volume needs more effort on my part[quote]

Bruce, Thanks for the kind words and the invitation to start an OBV thread. However I must decline due to health problems. I cannot always be available.

However one can acquire my article on 'Day trading with On Balance Volume' from Stock & Commodities. I'm sorry but they make a small charge, but it is less than $3.00. I will post OMV alerts on ocassion and answer questions.

Tody is one of my favorite openings - three connsecutive five minute bars, all lower (or higher) and at least one a wide range bar. This is usually one of the few day where you can buy/sell the fifteen minute high/low and hold until the close (or 4.00 p.m. EST).

Have good day.

big volume at that 773 area from yesterday.......new lows should try to get to that now...they are trying to break down the singles players from yesterday.....cool battle

Today is one of my favorite openings - three connsecutive five minute bars, all lower (or higher) and at least one a wide range bar. This is usually one of the few day where you can buy/sell the fifteen minute high/low and hold until the close (or 4.00 p.m. EST).

Have good day.

--------------------------------------------------------------------------------

D.W.

great call Sir

Have good day.

--------------------------------------------------------------------------------

D.W.

great call Sir

Bruce,

Have you read Granville's New Key to Stock Market Profits? (1953') Excellent book reminds me I think I should reread it....

Have you read Granville's New Key to Stock Market Profits? (1953') Excellent book reminds me I think I should reread it....

No I haven't.........I'll have to do a search on it to see what it's about......

quote:

Originally posted by CharterJoe

Bruce,

Have you read Granville's New Key to Stock Market Profits? (1953') Excellent book reminds me I think I should reread it....

The bullish prospects of the assinine prospect, that the government might create a market where non exists amongst free people, seems likely to have topped out a shade above last week's high.

The VA Overlay chart coming into this week suggests that if we have found a stopping price, and I think we have, then prices should retrace at least to the 765.00 area if not the 750.00 level before significant support appears.

The VA Overlay chart coming into this week suggests that if we have found a stopping price, and I think we have, then prices should retrace at least to the 765.00 area if not the 750.00 level before significant support appears.

4 letter ledge in mp at 792 on 1 point increment chart ,represents a large buyer,when he's exhausted we fill in below

We had a break out up on yesterdays high Volume fed announcement.....now we need to see if we can attract Volume above...my feeling is that they will fail on this breakout and we will get daily closes back below 867.....Sure hope I'm wrong for the longer term players like myself....I'll get a chart later

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.