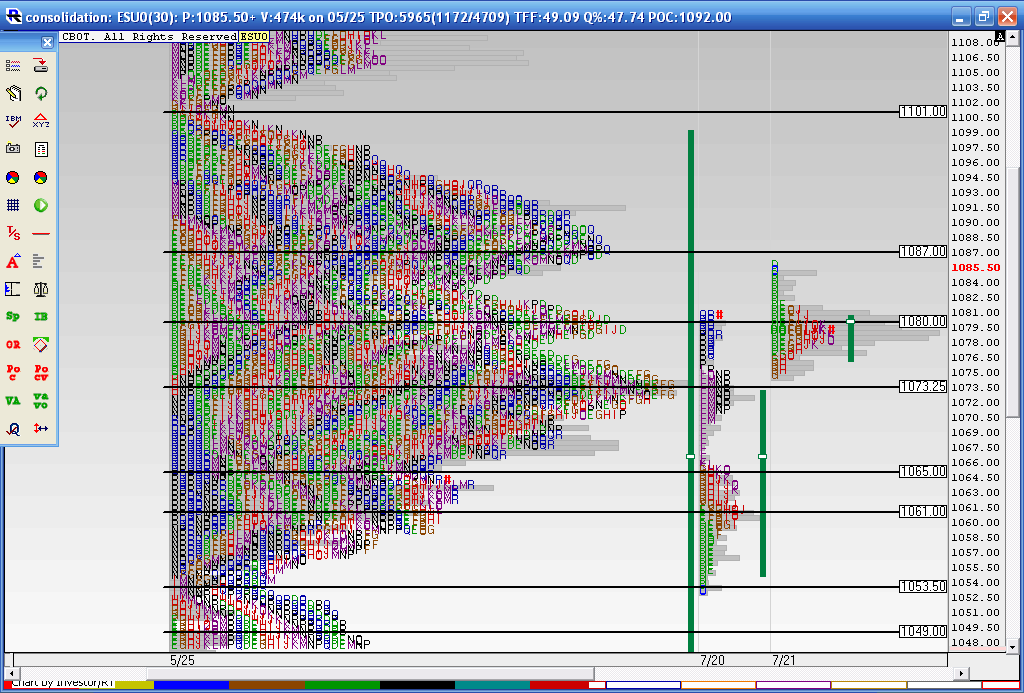

ES short term trading 7-21-10

Here are the zones I'm watching

1101 is low volume based on composite work

90.50 - 93 ***** HV area from the composite

85 - 86 - Fridays high and POC from Thursday

80 - 81 Tuesdays high and volume node

70 - 73 ************ key support, high volume , Va high ---Bold intentional

66 **** single prints

61.50*** High volume

56.50 ****high volume

My plan will be to sell rallies with high $ticks...especially if we gap up in RTH into one of our two key zones above today's highs....we know what usually happens after trend days

1101 is low volume based on composite work

90.50 - 93 ***** HV area from the composite

85 - 86 - Fridays high and POC from Thursday

80 - 81 Tuesdays high and volume node

70 - 73 ************ key support, high volume , Va high ---Bold intentional

66 **** single prints

61.50*** High volume

56.50 ****high volume

My plan will be to sell rallies with high $ticks...especially if we gap up in RTH into one of our two key zones above today's highs....we know what usually happens after trend days

btw, I VOTED YOU AND LORN UP...RIGHT OR WRONG GOOD SOLID ANALYSIS AND POINTS

Fantastic stuff. 1074.50 L of RTH so far.

Thanks Paul.

Thanks Paul.

Originally posted by PAUL9

Lorn,

here's how I calc H vs O and L vs open (and BTW, I have noticed that on MATD days, if either one is hit in the morning, it is usually some sort of a bounce/retrace price point, it 'can' (does not have to, but CAN) represent a turning point for the day)

must use daily chart, RTH only H,L,O

formula: average(H-O,5) (the 5 day average of High minus open. you can do it this way, or you can take 5 consecutive days' values of H-O, add them all together and divide by 5.

average (O-L,5)

at the end of the day, I have the values for the next day.

for today, the values were

H vs O = 9.15

L vs open = -10.95

Once the market has opened RTH, take the Opening price, add the H vs O number to the Opening Price, and do the same for the Low versus the open

For today:

RTH Open = 1085.00

1085 + 9.15 = 1094.15

1085 - 10.95 = 1074.05

also, big super trend days usually see one of these levels violated before 11:00am.

example of potential for a BULL trend day, yesterday, H versus Open calculated to 1058.85. Price moved above that level before 11 am and only printed 2 ticks under it twice. and we all know what happened yesterday.

Example of Bear Trend day, 7-16-10 when 5 day average of L vs open calculated to 1080.15 and price undercut that level near 10:00am and never looked back.

This is KISS principle beyond belief.

Hey Kool,

The 10:10 and 11:20 5 min lows are 15 bars. That puts a cycle top at 12:35 bar....pretty close!

The 10:10 and 11:20 5 min lows are 15 bars. That puts a cycle top at 12:35 bar....pretty close!

Originally posted by koolblue

btw, I VOTED YOU AND LORN UP...RIGHT OR WRONG GOOD SOLID ANALYSIS AND POINTS

ideally, I don't want to see this below the hour lows......so 79 - 80 will act as a magnet for how long ??? sure wish I knew....price will only accept it as value for only so long and this is long.....!!!

so I'm not sticking around in a trade for too much longer ..unless it keep going up...seems like we will be due to snap soon and increase volatility

Ledge and triples above....watch that hour low...if it comes out with some actual volume...I'm gonna go watch the paint dry...

so I'm not sticking around in a trade for too much longer ..unless it keep going up...seems like we will be due to snap soon and increase volatility

Ledge and triples above....watch that hour low...if it comes out with some actual volume...I'm gonna go watch the paint dry...

Originally posted by Lorn

Hey Kool,

The 10:10 and 11:20 5 min lows are 15 bars. That puts a cycle top at 12:35 bar....pretty close!

Originally posted by koolblueyup.. always useful!

btw, I VOTED YOU AND LORN UP...RIGHT OR WRONG GOOD SOLID ANALYSIS AND POINTS

another reason I am bullish..here is longer term profile...we are consolidating above the High volume node of 73.25

so now we have two good targets up top..actually three if you count the low volume up at 82.50...trips still and ledge..is it TOO obvious today?

Koolio,

Your question as I suffer ..

I trade very light in O/N so if I have equity losses once day session begins I try not to think about my O/N contracts. In other words, they are meaningless to me.

You will notice that most of the O/N session was contained in the first 30 minute bar of the O/N. So when I sold at the 83 area it was bad trade....why sell in the middle of a giant consolidation range which up to that time was all the O/N range was. Not until the breakout high did we expand that range...so the 87 was a key area and the reason I sold. Planning for it to go back into value..

Back to your question...what was my uncle point ? A difficult question to actually answer because I would have been selling in the day session above 86 but that didn't happen. I'm watching the shape of the profile and the $ticks for confirmation or lack of on these fades. The reality is that if I initiated shorts that went bad in the day session then I would have exited all contracts including my O/N contracts at the same time as my day session trades.....

I figure if the market is stopping out my day session trades then I have no business still holding O/N contracts..so losses would obviously be worse....You usually don't see me add in O/N and today was an exception that happened to work...

You know I enter in the day session and sometimes add twice to my trade ...rarely a third time any more as I'm trying to increase all trade size slowly up front...a long process..

more later...gotta watch this one now..

Your question as I suffer ..

I trade very light in O/N so if I have equity losses once day session begins I try not to think about my O/N contracts. In other words, they are meaningless to me.

You will notice that most of the O/N session was contained in the first 30 minute bar of the O/N. So when I sold at the 83 area it was bad trade....why sell in the middle of a giant consolidation range which up to that time was all the O/N range was. Not until the breakout high did we expand that range...so the 87 was a key area and the reason I sold. Planning for it to go back into value..

Back to your question...what was my uncle point ? A difficult question to actually answer because I would have been selling in the day session above 86 but that didn't happen. I'm watching the shape of the profile and the $ticks for confirmation or lack of on these fades. The reality is that if I initiated shorts that went bad in the day session then I would have exited all contracts including my O/N contracts at the same time as my day session trades.....

I figure if the market is stopping out my day session trades then I have no business still holding O/N contracts..so losses would obviously be worse....You usually don't see me add in O/N and today was an exception that happened to work...

You know I enter in the day session and sometimes add twice to my trade ...rarely a third time any more as I'm trying to increase all trade size slowly up front...a long process..

more later...gotta watch this one now..

taking four off up here at 81.50 print and holding one to try for 82.50

flat 80.25....

Sounds interesting to me Phileo - looking forward to it.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.