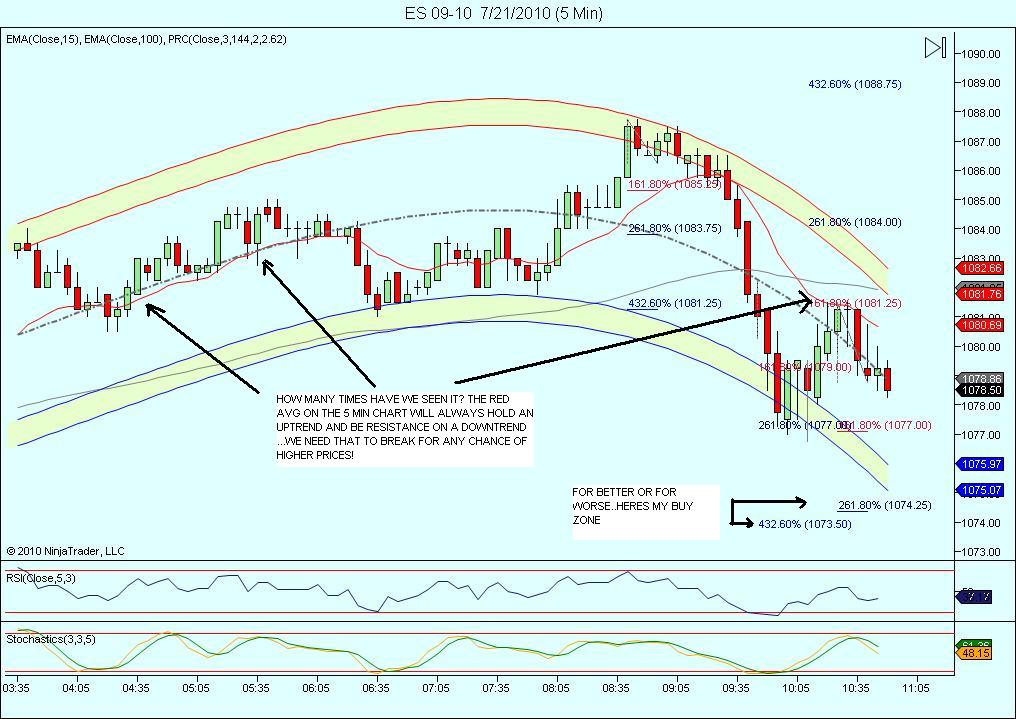

ES short term trading 7-21-10

Here are the zones I'm watching

1101 is low volume based on composite work

90.50 - 93 ***** HV area from the composite

85 - 86 - Fridays high and POC from Thursday

80 - 81 Tuesdays high and volume node

70 - 73 ************ key support, high volume , Va high ---Bold intentional

66 **** single prints

61.50*** High volume

56.50 ****high volume

My plan will be to sell rallies with high $ticks...especially if we gap up in RTH into one of our two key zones above today's highs....we know what usually happens after trend days

1101 is low volume based on composite work

90.50 - 93 ***** HV area from the composite

85 - 86 - Fridays high and POC from Thursday

80 - 81 Tuesdays high and volume node

70 - 73 ************ key support, high volume , Va high ---Bold intentional

66 **** single prints

61.50*** High volume

56.50 ****high volume

My plan will be to sell rallies with high $ticks...especially if we gap up in RTH into one of our two key zones above today's highs....we know what usually happens after trend days

they should run it now,,,,ovb on 5 minute up!!

damn that previous close is tough

Originally posted by BruceM

damn that previous close is tough

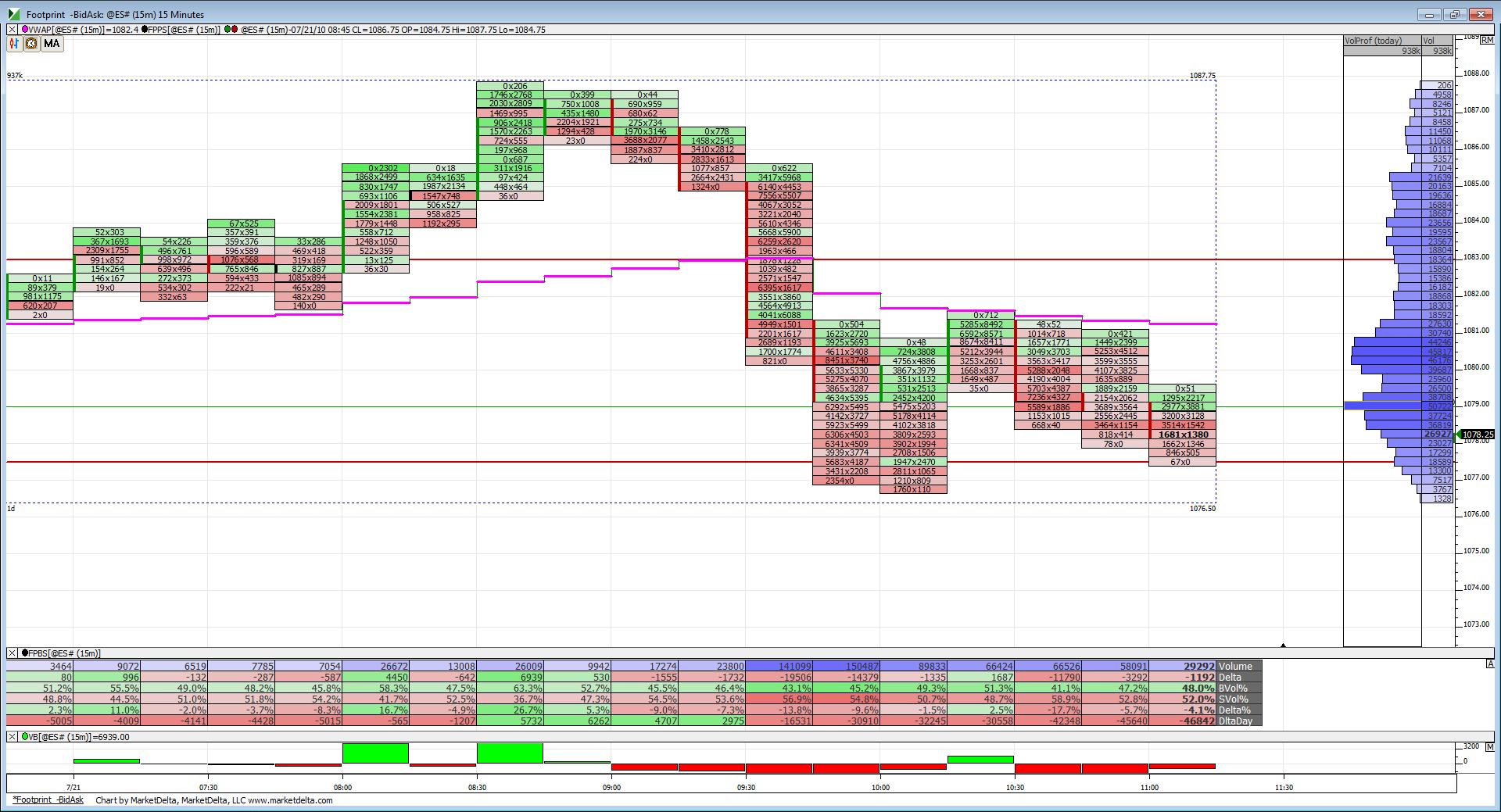

Got an HVN building up right around it too. And price is now below previous close, but coiled for a breakout move either way.

minus 800 $ticks....

You can see prices have been unable to not only close above but trade above VWAP since the RTH close beneath it at 9:45am.

added 75....would have prefered a volume flush.....but didn't get it

72 - 73 .50 is my key number today...at least the begining of it...

72 - 73 .50 is my key number today...at least the begining of it...

FWIW,

5 day average of L versus open comes in today at 1074.05

price has printed within 3 ticks of it.

I have noticed that after 2 days of hitting H versus Open (which has occurred) the first test of the L versus the open is good for at the least an intraday bounce of 2-3 pts.

sometimes it represents a good reversal point.

5 day average of L versus open comes in today at 1074.05

price has printed within 3 ticks of it.

I have noticed that after 2 days of hitting H versus Open (which has occurred) the first test of the L versus the open is good for at the least an intraday bounce of 2-3 pts.

sometimes it represents a good reversal point.

that was good volume for this time of day...and agree about coil and Vwap concept..agressive for the 76.50 air....I still have my 77 and those 79 adds to trade out of though

L verses Open.

Do you mean the difference between the two? Or the actual numbers and then take an average of them?

Do you mean the difference between the two? Or the actual numbers and then take an average of them?

Originally posted by PAUL9

FWIW,

5 day average of L versus open comes in today at 1074.05

price has printed within 3 ticks of it.

I have noticed that after 2 days of hitting H versus Open (which has occurred) the first test of the L versus the open is good for at the least an intraday bounce of 2-3 pts.

sometimes it represents a good reversal point.

Sounds interesting to me Phileo - looking forward to it.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.