Es short term trading 7-19 -10

Numbers I'm watching on the upside

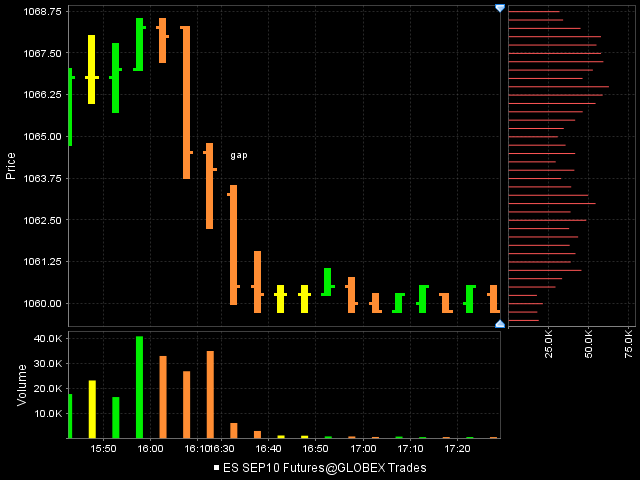

1069 Low Volume as per histogram

1073 - 1075 Pivot, High volume key number

1081 volume spike and 15 minute air pocket

downside numbers

I'm hoping to sell rallies with high $ ticks in the am..that's the plan if we open above Fridays close...but trade down into key numbers BELOW 1061 will be buys for me on low $ tick readings

61 - 62 lots of volume

47 - 50 key number previous volume

39 - 41 key breakout point

Hoping to revise these after I fire up my IRT charts

1069 Low Volume as per histogram

1073 - 1075 Pivot, High volume key number

1081 volume spike and 15 minute air pocket

downside numbers

I'm hoping to sell rallies with high $ ticks in the am..that's the plan if we open above Fridays close...but trade down into key numbers BELOW 1061 will be buys for me on low $ tick readings

61 - 62 lots of volume

47 - 50 key number previous volume

39 - 41 key breakout point

Hoping to revise these after I fire up my IRT charts

1hr left in the session, and price is still making new highs, so I think 1073 is now in the cards.

Looking for a pb to 1069.25 to go long

Looking for a pb to 1069.25 to go long

Thanks for the explanation. Makes sense if its what you are following.

Originally posted by phileo

Originally posted by Lorn

Whats the reason behind 68 target?

and nice trade!

Originally posted by phileo

out 1068, 3.5 min. in that trade, wish they were all that easy

1068 was where my indicator started showing -ve divergence. I've observed that ES usually pulls back ~2pts after reaching new highs, so 1067 was my real target, but I decided to front-run that target because I didn't want to give up any profits nor retraces.....

Plus there was a mini-HVN near 1068.5, I figured a drop below that would cause some buyers to take profits.

runners stopped....on 70.75 short ..looking for 68.50....73 is danger zone on this..they all see it..

68.50 is peak volume this 60 minute...will watch if buyers step up if they retest..

no question a risky time for fades...so going light

73.50 - 74 is leftover volume from Firday...

no question a risky time for fades...so going light

73.50 - 74 is leftover volume from Firday...

Originally posted by phileo

1hr left in the session, and price is still making new highs, so I think 1073 is now in the cards.

Looking for a pb to 1069.25 to go long

breakout air has been filled. Now I'm not so interested in going long, seems like the momo is dying off....

71.75 is stop...if they can get that they should go get 73 and I'm then wrong

2 off at 68.50...holding two..

I think if they can't retake 67 then they will close on highs...if these last two don'tget stopped at 70.50,,,then I'm trying for 64///so obviously I need failure if they hit 67

it will be interesting to see if the 60 minute closing below it's volume POC means anything at 3:30

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.