Es short term trading 7-19 -10

Numbers I'm watching on the upside

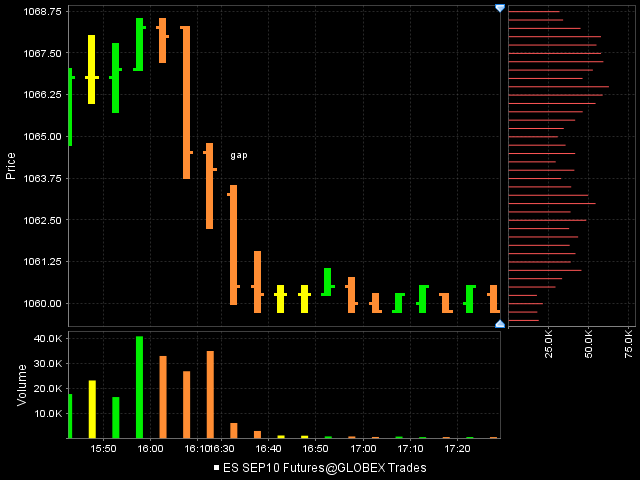

1069 Low Volume as per histogram

1073 - 1075 Pivot, High volume key number

1081 volume spike and 15 minute air pocket

downside numbers

I'm hoping to sell rallies with high $ ticks in the am..that's the plan if we open above Fridays close...but trade down into key numbers BELOW 1061 will be buys for me on low $ tick readings

61 - 62 lots of volume

47 - 50 key number previous volume

39 - 41 key breakout point

Hoping to revise these after I fire up my IRT charts

1069 Low Volume as per histogram

1073 - 1075 Pivot, High volume key number

1081 volume spike and 15 minute air pocket

downside numbers

I'm hoping to sell rallies with high $ ticks in the am..that's the plan if we open above Fridays close...but trade down into key numbers BELOW 1061 will be buys for me on low $ tick readings

61 - 62 lots of volume

47 - 50 key number previous volume

39 - 41 key breakout point

Hoping to revise these after I fire up my IRT charts

small 2 contract short at 67.25...my thinking is if they go back up to run out 69's in RTH then that is better short......otherwise these two will come off at 65 even

Morning Bruce.

67.25 short based on the 67 number being high volume so far?

67.25 short based on the 67 number being high volume so far?

Originally posted by BruceM

small 2 contract short at 67.25...my thinking is if they go back up to run out 69's in RTH then that is better short......otherwise these two will come off at 65 even

Range Based Support and Resistance numbers:

S1 = 1050

S2 = 1041.25

R1 = 1103.75

R2 = 1112.75

I'd say the S's have the edge in terms of seeing prices before the R's.

S1 = 1050

S2 = 1041.25

R1 = 1103.75

R2 = 1112.75

I'd say the S's have the edge in terms of seeing prices before the R's.

MATD oscillation points for today's morning session:

1072.5 - 1074: Friday's AM consolidation lo + today's daily PP + weeklyPP + Fri. VPOC + Fri.avg. VWAP

1063: gap fill + prior support lvl + Fri. late afternoon resistance.

1059: Fri. lo

Odds of gap fill increases after prior unfilled gap + trend day.

1072.5 - 1074: Friday's AM consolidation lo + today's daily PP + weeklyPP + Fri. VPOC + Fri.avg. VWAP

1063: gap fill + prior support lvl + Fri. late afternoon resistance.

1059: Fri. lo

Odds of gap fill increases after prior unfilled gap + trend day.

starting rth shorts at 66.75...

will add above 69 if it prints

hoping O/N high is run out still for better shorts and retest of open print

runners will be trying for 62.75...that was high volume, gap fill etc...

runners stopped and new shorts at 67.75....fade the rallies folks.....65 was POC per time...still would like higher ticks

report in 9 minutes......hopefully the pop above 69 with some air pockets to SHORT,,,,,,I'm like an obsessed fan !!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.