Es short term trading 7-19 -10

Numbers I'm watching on the upside

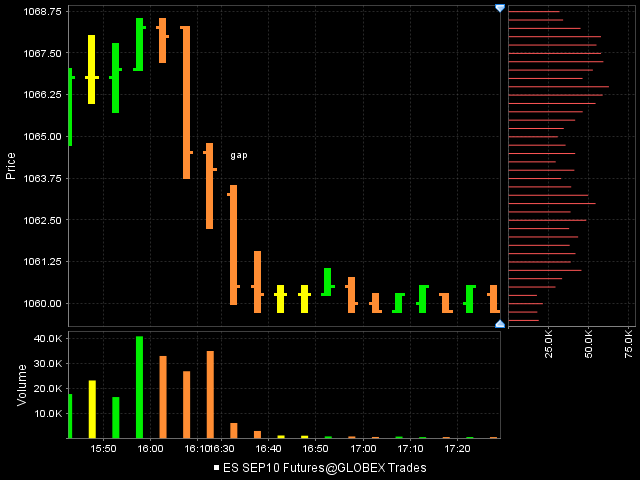

1069 Low Volume as per histogram

1073 - 1075 Pivot, High volume key number

1081 volume spike and 15 minute air pocket

downside numbers

I'm hoping to sell rallies with high $ ticks in the am..that's the plan if we open above Fridays close...but trade down into key numbers BELOW 1061 will be buys for me on low $ tick readings

61 - 62 lots of volume

47 - 50 key number previous volume

39 - 41 key breakout point

Hoping to revise these after I fire up my IRT charts

1069 Low Volume as per histogram

1073 - 1075 Pivot, High volume key number

1081 volume spike and 15 minute air pocket

downside numbers

I'm hoping to sell rallies with high $ ticks in the am..that's the plan if we open above Fridays close...but trade down into key numbers BELOW 1061 will be buys for me on low $ tick readings

61 - 62 lots of volume

47 - 50 key number previous volume

39 - 41 key breakout point

Hoping to revise these after I fire up my IRT charts

Understanding more as we go. Thanks to both of you for the great posts and charts.!

Originally posted by BruceM

anyone getting any of this or is it only me and koolio now....and nice hold for that 65 target kool...!! Rockin!!

Enjoying every post. Thank you much.

Hi Bruce,

Yeah, now I see 1058. I was wondering why it reversed at 1057-58 this morning. The reason I didn't see that was because I didn't do enough homework going that far back.

Yeah, now I see 1058. I was wondering why it reversed at 1057-58 this morning. The reason I didn't see that was because I didn't do enough homework going that far back.

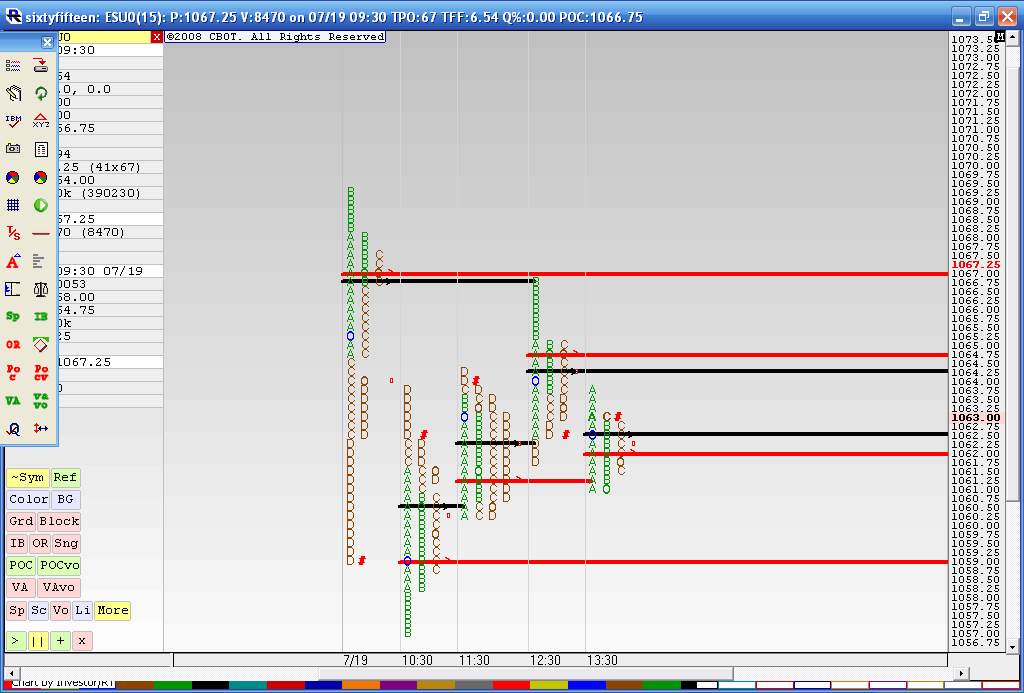

Ok, I've cleaned this up a bit....this is 60 minute periods and each letter (A, B, C, D) represents 15 minutes of that period. I also removed the actual volume display and the Va areas..we are currently bouncing off the 61 line and they may try for that 64 - 65 area as that is another untouched point.

The dilemma comes from wondering " do we use POC's based on time or actual volume"...the best lines will have both near by

The dilemma comes from wondering " do we use POC's based on time or actual volume"...the best lines will have both near by

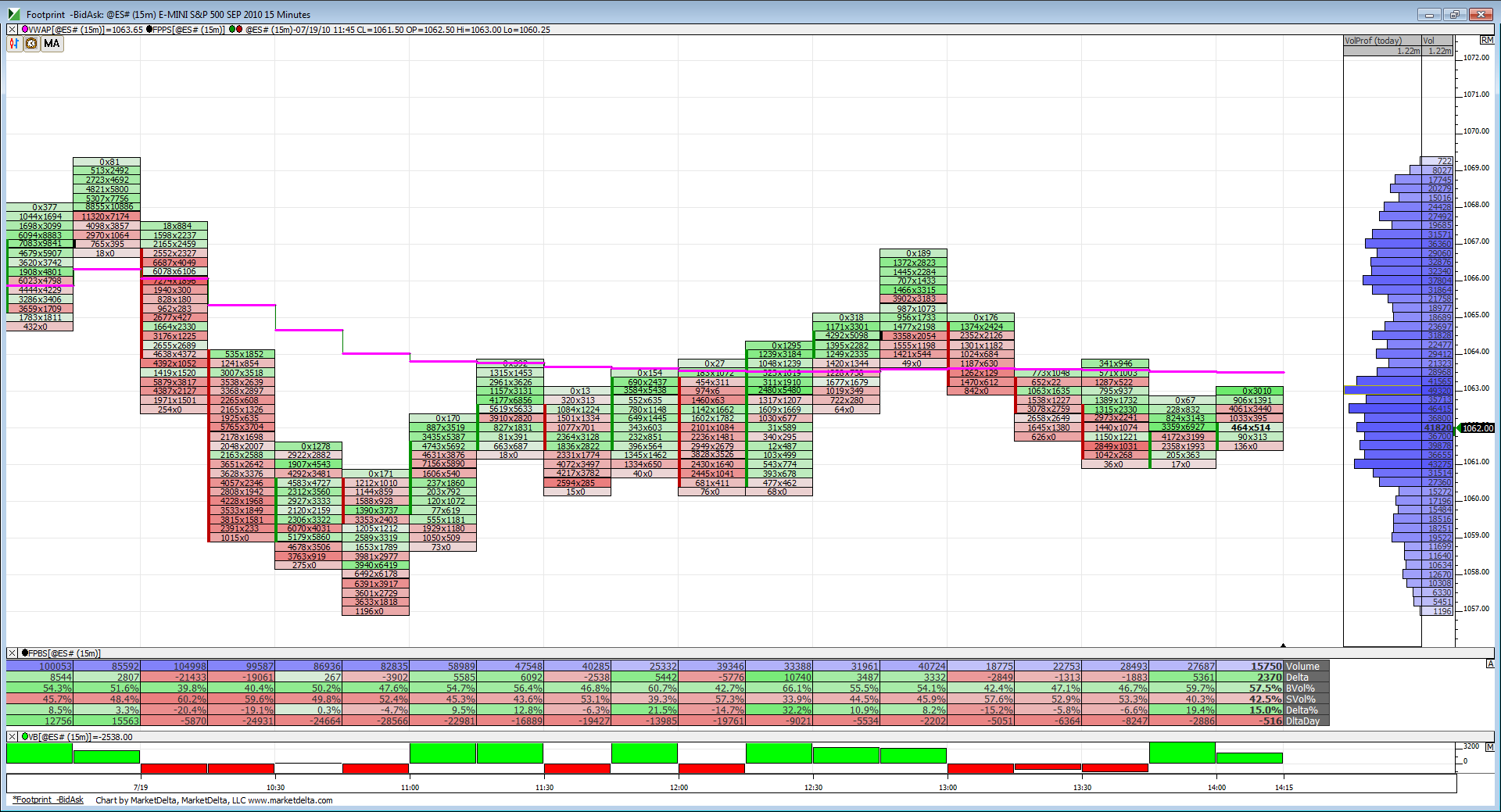

Volume on a 15 minute basis has dropped well below a 5-day running average since 11:15 am.

lots of wicks under 1062, a break above 1063 targets today's open 1065

thanks...I'm not "fishing" for compliments although they are appreciated...I just don't want to be wasting my time either...I know most understand..

I think in many ways it would be cool to retest 64 - 65 and then rollover to go get that double low and the 59..I will be stopped and will need to find a new entry if that happens first..

I think in many ways it would be cool to retest 64 - 65 and then rollover to go get that double low and the 59..I will be stopped and will need to find a new entry if that happens first..

so Lorn that low voluem should be good for us consolidtaion folks as it would take high volume to move it away and hold it away from Vwap...is that how u see it...?

Originally posted by phileo

lots of wicks under 1062, a break above 1063 targets today's open 1065

ABCD move today:

1057-1063 => AB

1060.5 - 1066.5 => CD

so, a potential measured move target for this current up sequence would be 1067.5

Yes sir, spot on interpretation. I see lots of volume building in the 1061-1063 area, as you've been pointing out. 1060 looks like a good place for prices to visit and say hi to a bunch of stops, don't you think?

Originally posted by BruceM

so Lorn that low voluem should be good for us consolidtaion folks as it would take high volume to move it away and hold it away from Vwap...is that how u see it...?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.