Dom's notes

Despite having been hammered for posting my sincere feedback re. ATW in the appropriate thread (or may-be, because of ...) I am starting this thread for the benefit of all waanabee traders.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

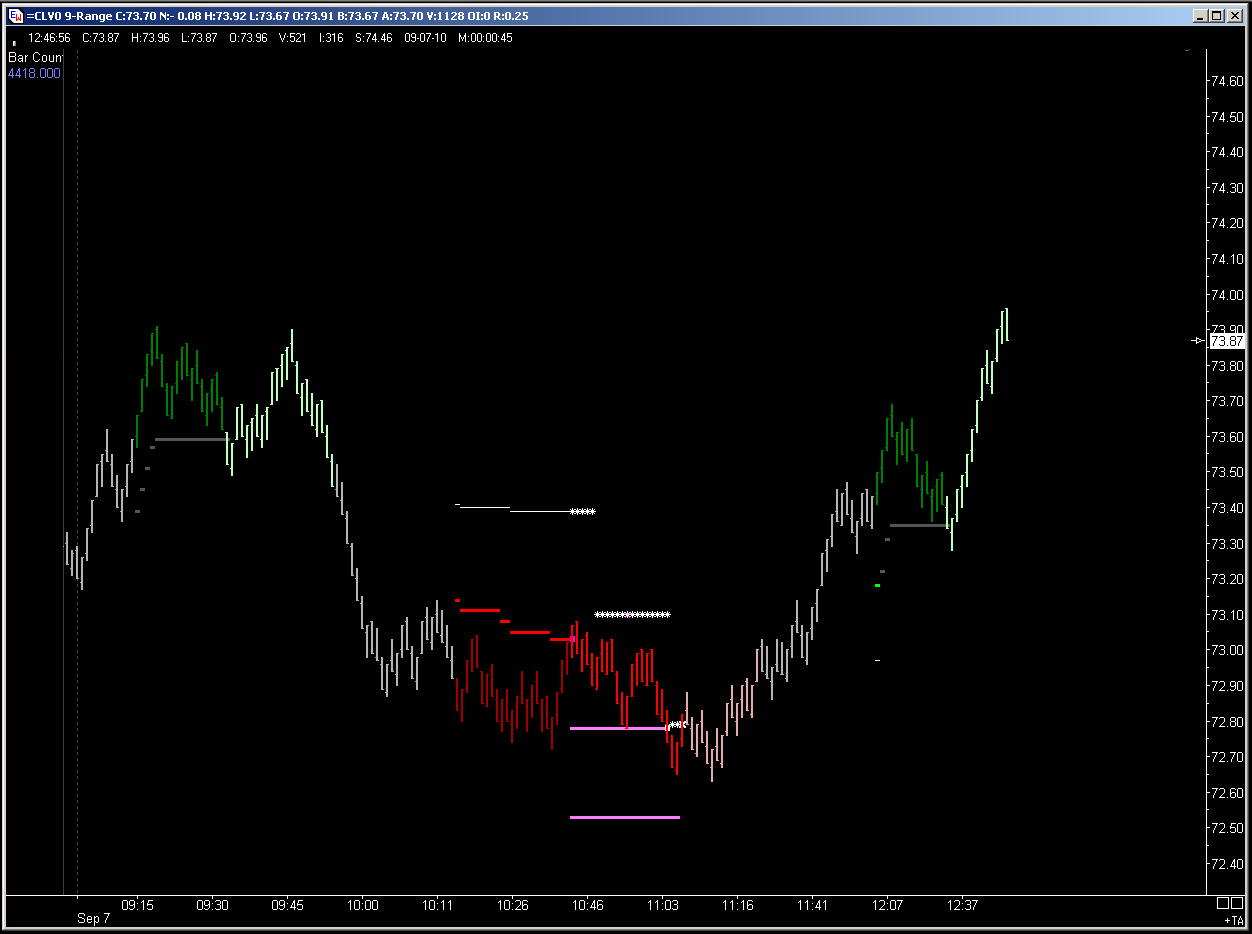

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

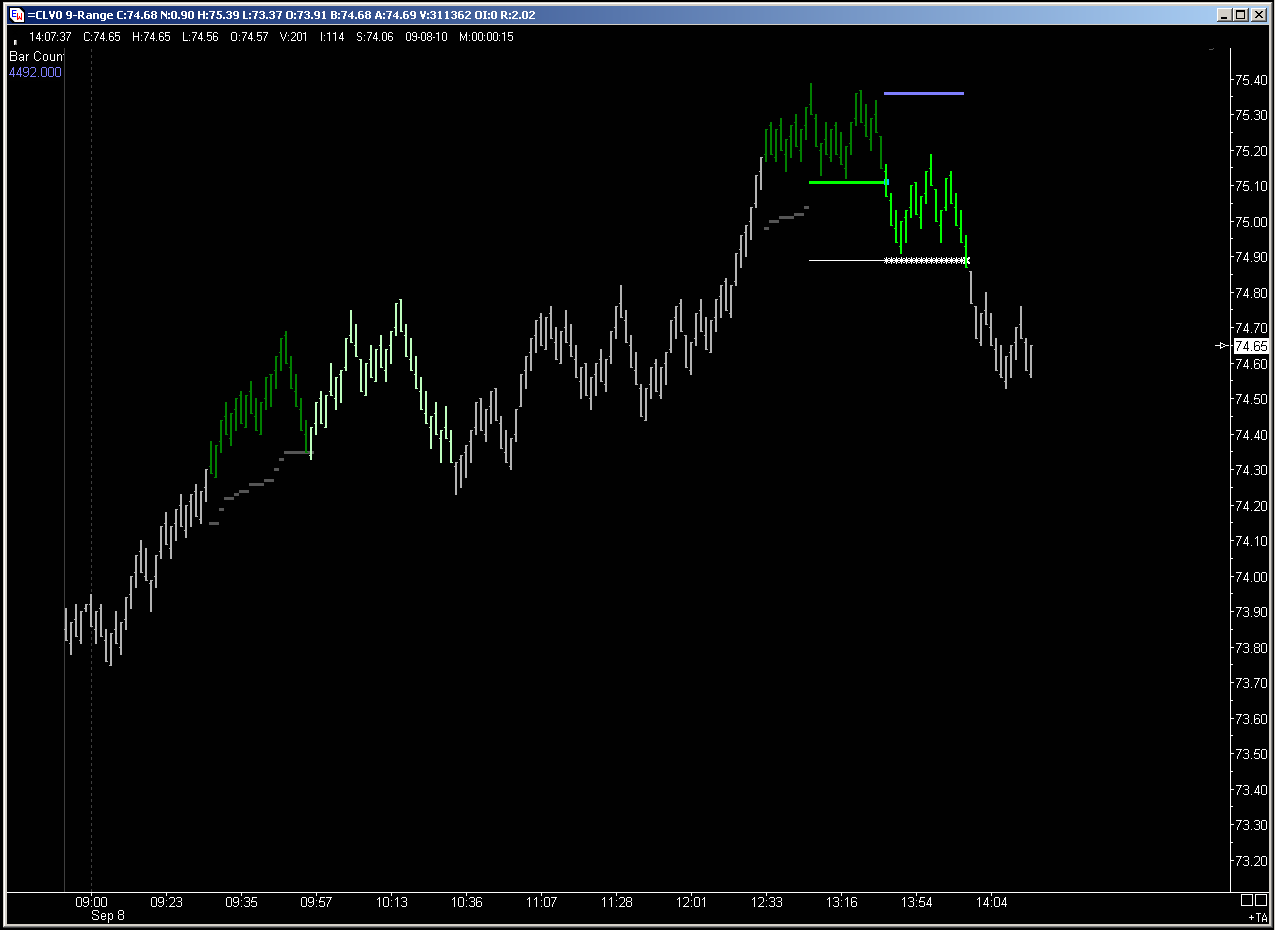

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

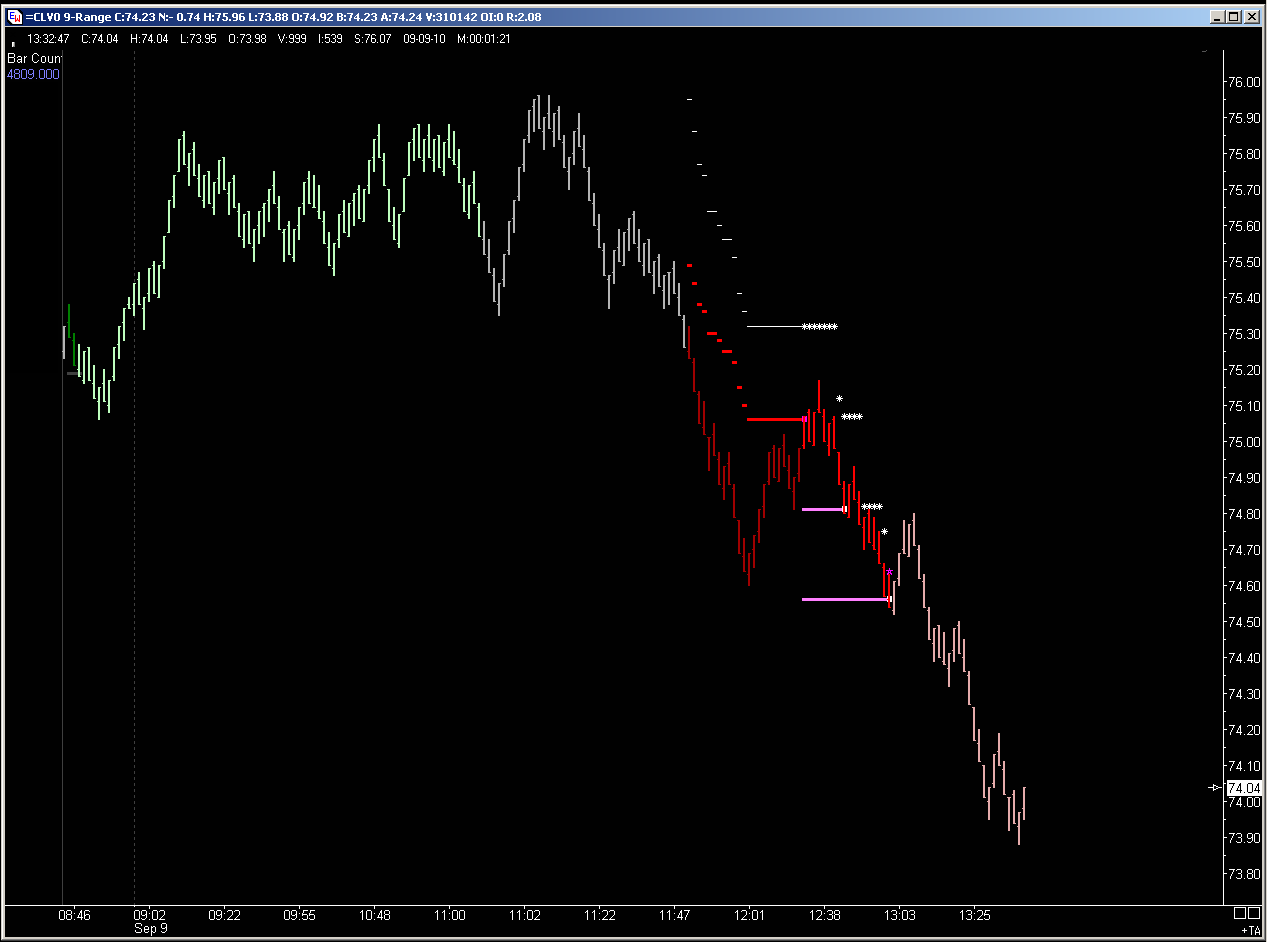

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

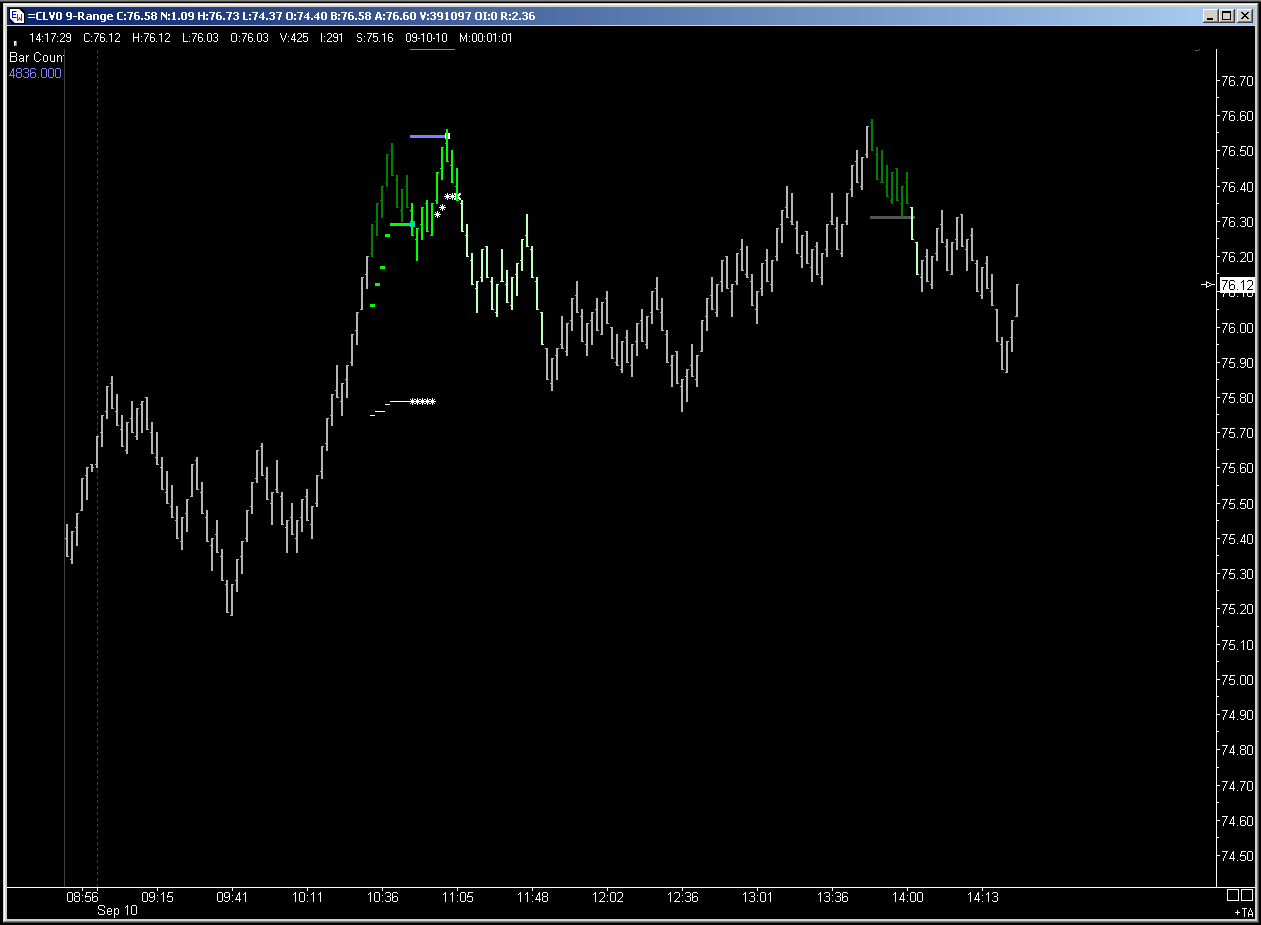

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

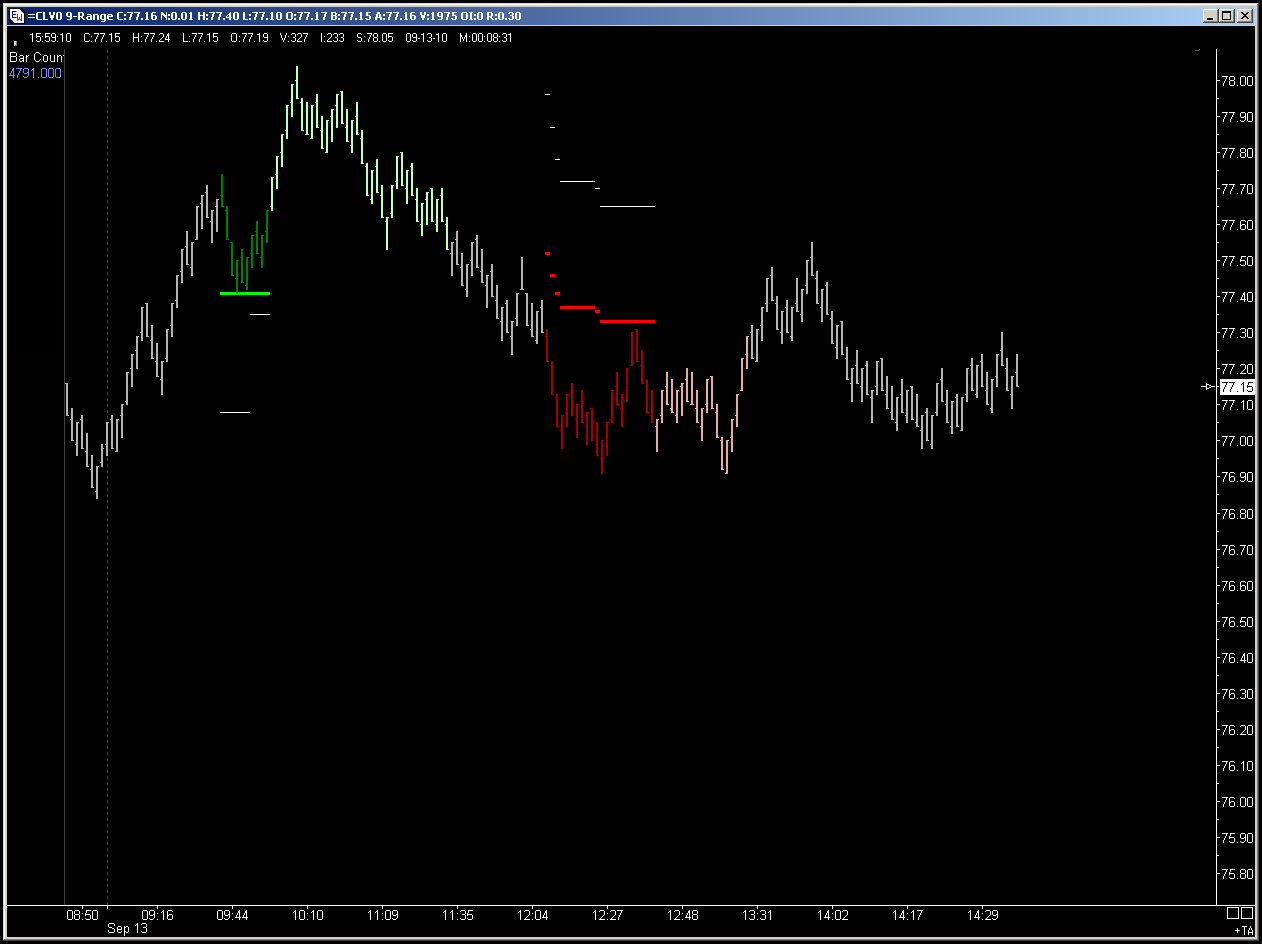

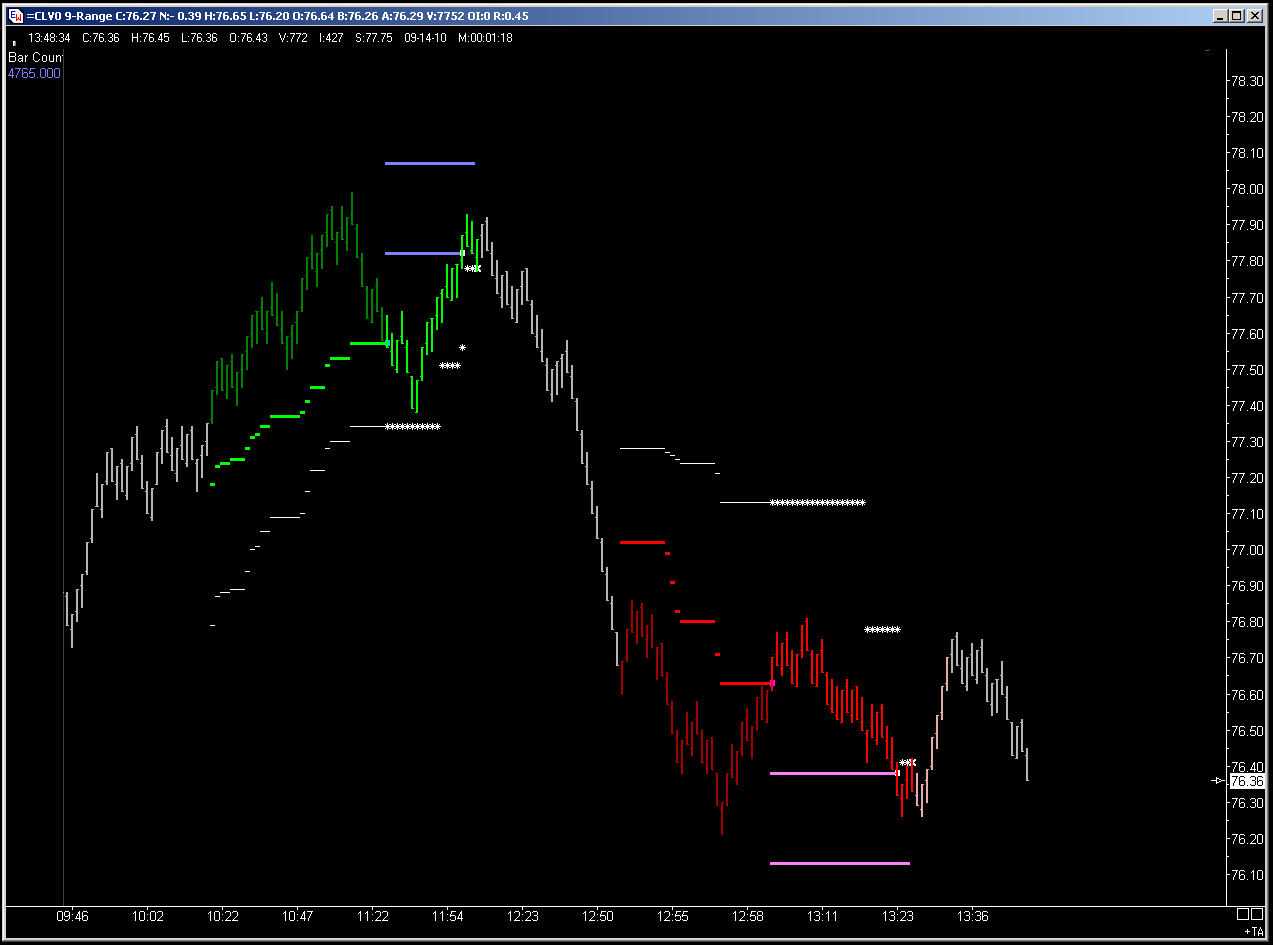

Day's summary

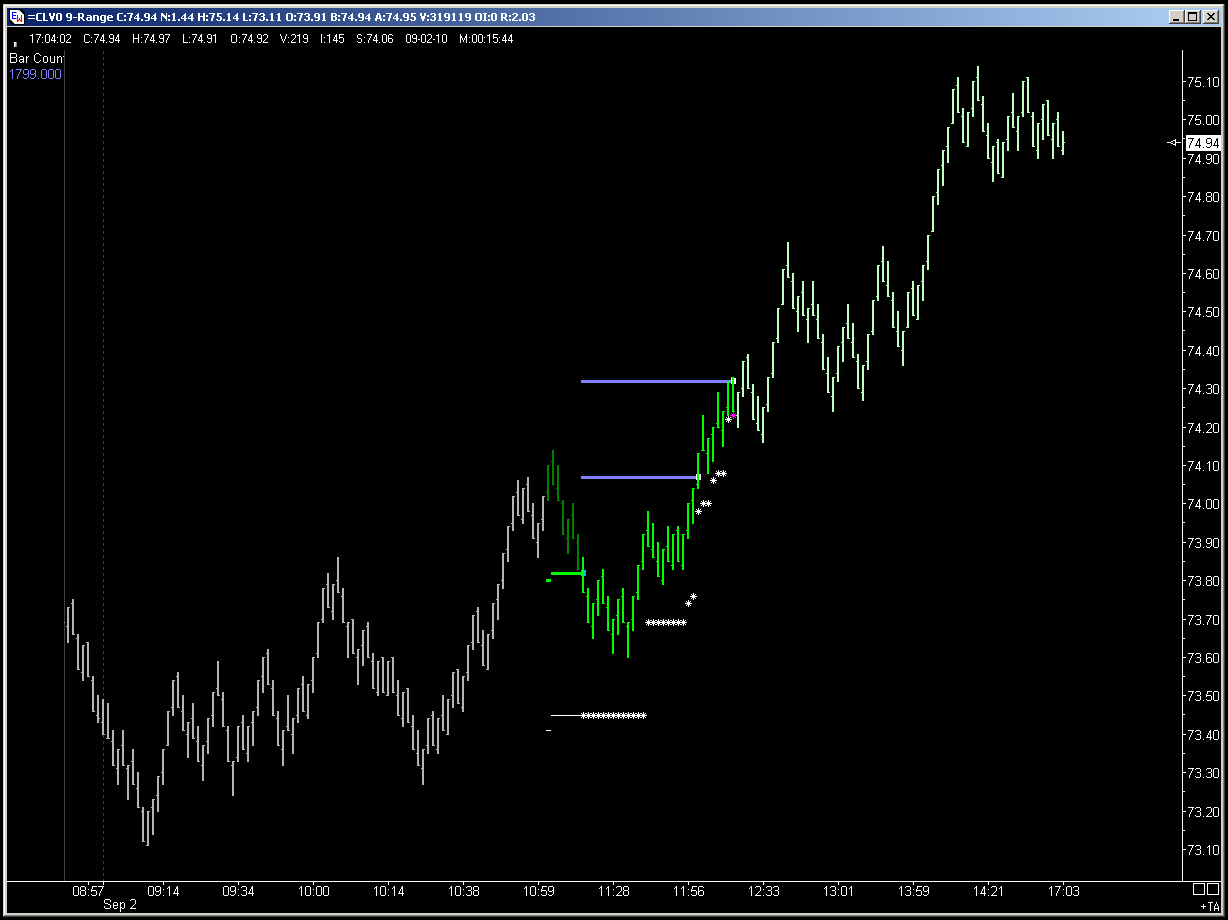

CL new system : 1 win (+50-ticks)

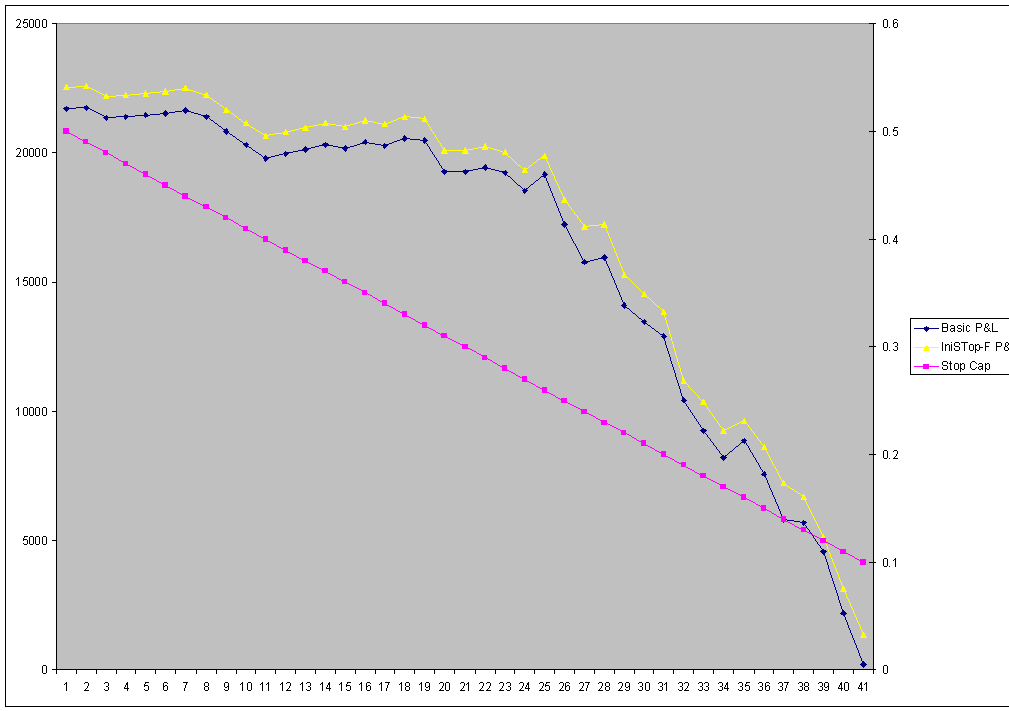

I have been looking at the impact of capping the initial stop size to a value smaller than current cap (which is 50-ticks) ... I initially looked at it from a reduced target point of view, as I don't like risking 50-t to make only 25-t ; I then extended it to the full target as well. Looks like impact is pretty similar regardless of target size.

Impact of Initial Stop cap on Target 1 :

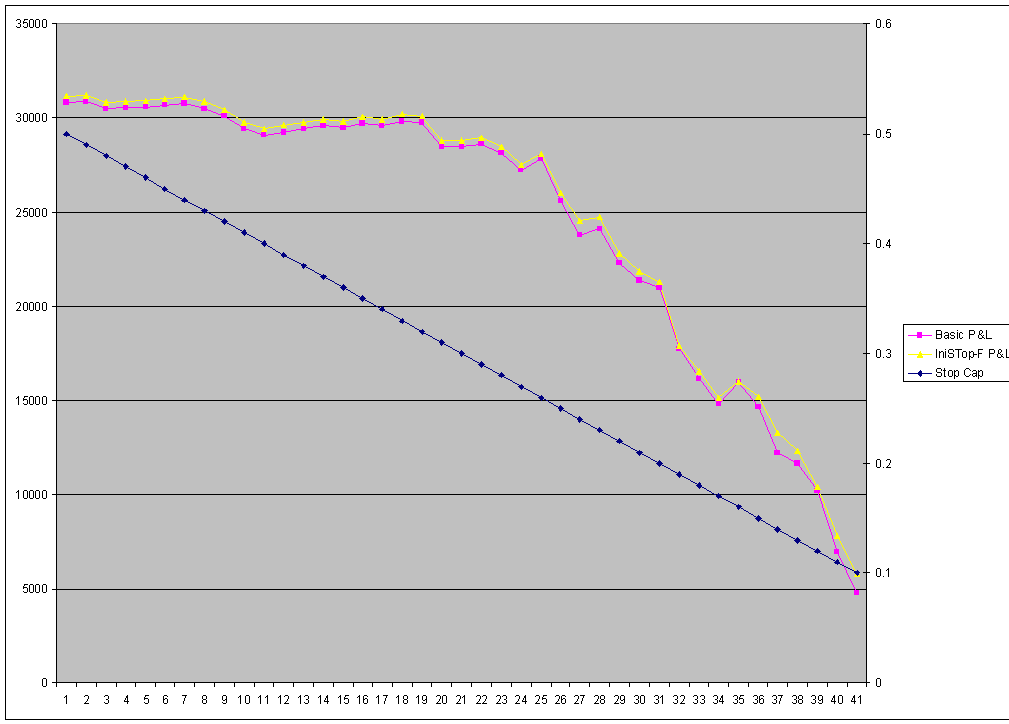

Impact of Initial Stop cap on Target 2 :

These chart are a bit misleading, as the impact really varies from month to month, and the chart only reflect the 10-months performance. But I think this is another good way of diversification when trading multiple contracts on this system (several targets, several initial stop cap, and 3 filters all based on price-action but with little to no correlation).

Not sure yet how I am going to use this moving forward.

CL new system : 1 win (+50-ticks)

I have been looking at the impact of capping the initial stop size to a value smaller than current cap (which is 50-ticks) ... I initially looked at it from a reduced target point of view, as I don't like risking 50-t to make only 25-t ; I then extended it to the full target as well. Looks like impact is pretty similar regardless of target size.

Impact of Initial Stop cap on Target 1 :

Impact of Initial Stop cap on Target 2 :

These chart are a bit misleading, as the impact really varies from month to month, and the chart only reflect the 10-months performance. But I think this is another good way of diversification when trading multiple contracts on this system (several targets, several initial stop cap, and 3 filters all based on price-action but with little to no correlation).

Not sure yet how I am going to use this moving forward.

Day's summary

CL new system : 1 win (+50-t) / 1 loss (-27-t)

The long/loss is certainly disappointing, and I was certainly tempted to shut the system down after the short/win ... but in the long-run, it was the right decision to let the system take all trades w/o interfering.

CL new system : 1 win (+50-t) / 1 loss (-27-t)

The long/loss is certainly disappointing, and I was certainly tempted to shut the system down after the short/win ... but in the long-run, it was the right decision to let the system take all trades w/o interfering.

Day's summary

CL new system : 1 win (+24-t)

3 setups today, but the 2 longs were both filtered by the "IniStop" filter (based on calculated Initial Stop size). The 1st one, if taken, would be a minor loss (at least from a Tgt2 point of view, Tgt1 being OK), and the 2nd one a very nice full win / no sweat. (even though I am currently only using the "IniStop" filter, I have a model that combines the 3 filters in such a way that trades are taken as long as 2 filters are "go" for a trade, which was the case for both longs).

I was initially planning on adding a 2nd contract w/ 1/2 size target after Labor day (ie., starting today), but I am still looking at various options (I could use a different filter model for this, also a 25-t Tgt1 gives about 73% P&L of 50-t Tgt2 in backtesting, while a 30-t Tgt1 gives about 85% P&L of 50-t Tgt2, with a little more exposure to volatility drops). The choice would have been easy (in favor of the pure 1/2 size target) if it wasn't for the last 4 weeks, on which that very 1/2 size target is losing ~ $300, while the 30-t tgt is a about BE ... this is really just noise in the decision making process, but it shows how one can be influenced by recent results, even though non-significant.

CL new system : 1 win (+24-t)

3 setups today, but the 2 longs were both filtered by the "IniStop" filter (based on calculated Initial Stop size). The 1st one, if taken, would be a minor loss (at least from a Tgt2 point of view, Tgt1 being OK), and the 2nd one a very nice full win / no sweat. (even though I am currently only using the "IniStop" filter, I have a model that combines the 3 filters in such a way that trades are taken as long as 2 filters are "go" for a trade, which was the case for both longs).

I was initially planning on adding a 2nd contract w/ 1/2 size target after Labor day (ie., starting today), but I am still looking at various options (I could use a different filter model for this, also a 25-t Tgt1 gives about 73% P&L of 50-t Tgt2 in backtesting, while a 30-t Tgt1 gives about 85% P&L of 50-t Tgt2, with a little more exposure to volatility drops). The choice would have been easy (in favor of the pure 1/2 size target) if it wasn't for the last 4 weeks, on which that very 1/2 size target is losing ~ $300, while the 30-t tgt is a about BE ... this is really just noise in the decision making process, but it shows how one can be influenced by recent results, even though non-significant.

Day's summary

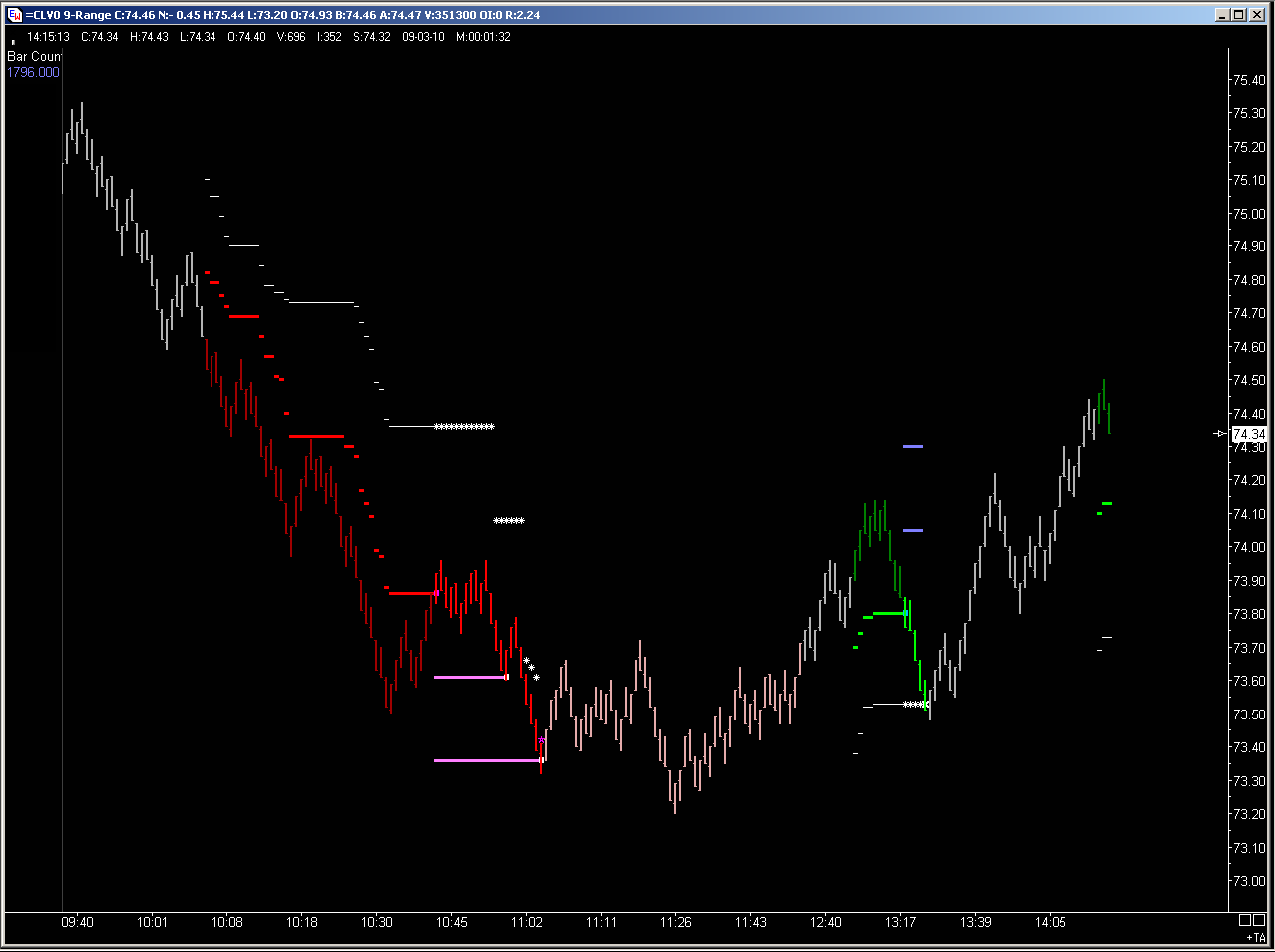

CL new system : 1 loss (-24-t)

A bit of a disappointing day, 1 setup was filtered by the "IniStop" filter, but a win for the "any-2 filters" model (which I currently don't trade :( ), 2nd setup came 1 tick of the entry level before retesting HoD, and because the entry wasn't touched the system kept the initial stop as is (else, that initial stop would we shrinked quite a bit). And yes, that entry looks stupid right there, but I know it makes money over time.

CL new system : 1 loss (-24-t)

A bit of a disappointing day, 1 setup was filtered by the "IniStop" filter, but a win for the "any-2 filters" model (which I currently don't trade :( ), 2nd setup came 1 tick of the entry level before retesting HoD, and because the entry wasn't touched the system kept the initial stop as is (else, that initial stop would we shrinked quite a bit). And yes, that entry looks stupid right there, but I know it makes money over time.

Day's summary

CL new system : 1 win (+50-t)

This one came very close to being prematurely stopped ... anyway, the system makes today a new equity peak, from last equity peak (Aug.25) the drawdown lasted 10 trading days / 10 trades (-$993).

CL new system : 1 win (+50-t)

This one came very close to being prematurely stopped ... anyway, the system makes today a new equity peak, from last equity peak (Aug.25) the drawdown lasted 10 trading days / 10 trades (-$993).

Day's summary

CL new system : 1 win (+8-t)

Performance summary for the week : 3 win / 1 loss ; net +561 for 1 contract.

The "any 2 filters" model performance for the week would have been 5 win / 3 loss ; net +1000 for 1 contract.

CL new system : 1 win (+8-t)

Performance summary for the week : 3 win / 1 loss ; net +561 for 1 contract.

The "any 2 filters" model performance for the week would have been 5 win / 3 loss ; net +1000 for 1 contract.

Day's performance

CL new system : NO trade today :(

1st setup (long): entry touched no-fill. 2nd one (short): missed by 2-t.

CL new system : NO trade today :(

1st setup (long): entry touched no-fill. 2nd one (short): missed by 2-t.

Day's summary

CL new system : 1 BE (-1-t)

A bit disappointed today ... that BE trade went 39-t in the green, but the tight trailing stop didn't kick-in.

A couple of datafeed issues also need to be sorted out.

CL new system : 1 BE (-1-t)

A bit disappointed today ... that BE trade went 39-t in the green, but the tight trailing stop didn't kick-in.

A couple of datafeed issues also need to be sorted out.

Dom that equity curve looks too good to be true so I'd be scared but hope it trades like that in real time....what became of your trading contest...? how did Chuck Huges do ? He wants me to spend almost 4 k on options recomendations

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.