Dom's notes

Despite having been hammered for posting my sincere feedback re. ATW in the appropriate thread (or may-be, because of ...) I am starting this thread for the benefit of all waanabee traders.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

...making a new P&L peak in my account at +17,840. Then it got caught short until Thursday evening, erasing -1415 in 1 loss. Overnight & Friday was hit & miss (3 win / 3 loss ; net +850 ; unrealized P&L -300).

Current drawdown from P&L peak: -545 (realized P&L only).

Dom, is this real money or simulated P&L?

Originally posted by day trading

...making a new P&L peak in my account at +17,840. Then it got caught short until Thursday evening, erasing -1415 in 1 loss. Overnight & Friday was hit & miss (3 win / 3 loss ; net +850 ; unrealized P&L -300).

Current drawdown from P&L peak: -545 (realized P&L only).

Dom, is this real money or simulated P&L?

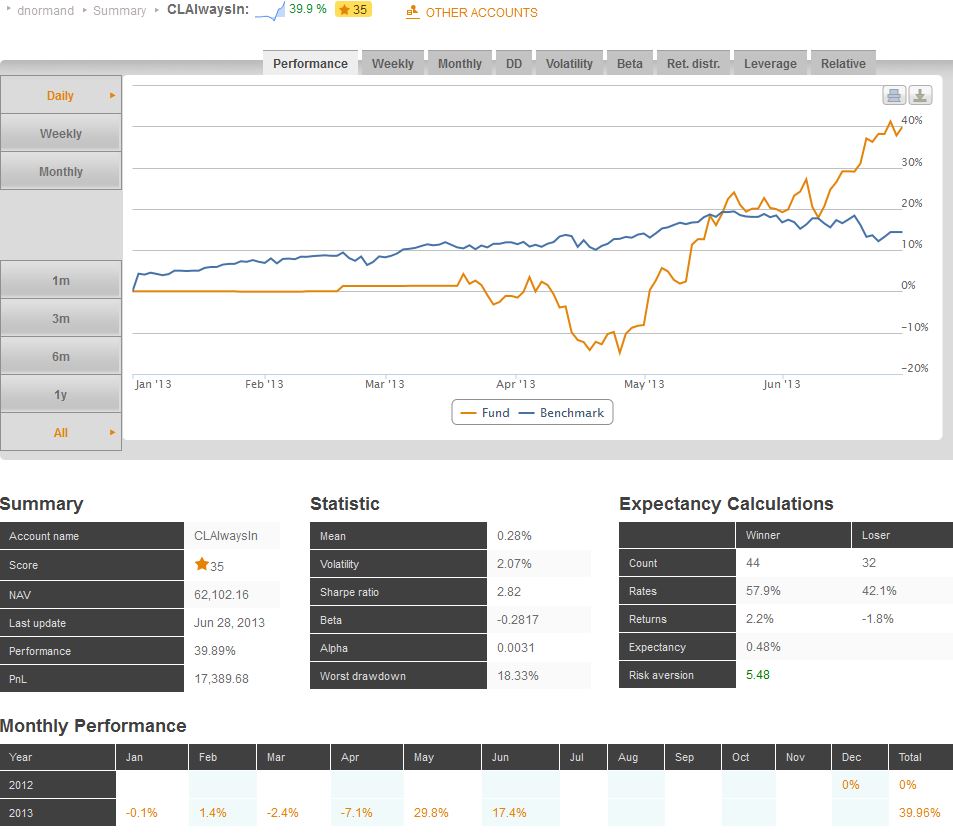

Real account - real money. Tracked on the RAPACapIntro website:

http://rapacapintro.com/account/accounts?acc=CLAlwaysIn

Awesome results Dom! I've copied them below so others can see what your progress is to date.

Happy Independence-Day !!!

CL always-in: 9 wins ; 7 losses ; net +2210

The system made a series of new equity peaks, reaching +21,130 in my account, before giving some back from Wednesday 10:30am. The current drawdown (on closed trades) is -1,625, and the system is long as of the close tonight (after being short almost all day). It is worth noting that the 1st win of the week (coming after 2 losses) banked +3,805 (making it the largest trade since March-19, instead of the -3,225 loss from April-11).

No R&D this week, I am still sick despite taking antibiotics.

After yet another refusal to help from the Ninja support, about the historical data download bug for multi-timeframe charts and strategies, I decided to write a letter to NinjaTrader CEO, Raymond Deux ... the guy probably didn't even read it, I received an almost immediate response confirming that I am out of luck, they are not fixing NT7 and not going to help me either getting a workaround for that issue, and "possible resolutions are being explored for a future release of NinjaTrader" (NT8, hopefully). That response ended by "Thank you and have a nice day", which got me real mad - how can I have a nice day when they are screwing me up? So I decided to publish that letter and the response on 2 forums, EliteTrader & LinkedIn. To my disgust, I found out last night that the EliteTrader thread has been removed by Baron, upon Raymond Deux's request. Needless to say, I have decided to walk-away from that site.

Have a great week-end!

The system made a series of new equity peaks, reaching +21,130 in my account, before giving some back from Wednesday 10:30am. The current drawdown (on closed trades) is -1,625, and the system is long as of the close tonight (after being short almost all day). It is worth noting that the 1st win of the week (coming after 2 losses) banked +3,805 (making it the largest trade since March-19, instead of the -3,225 loss from April-11).

No R&D this week, I am still sick despite taking antibiotics.

After yet another refusal to help from the Ninja support, about the historical data download bug for multi-timeframe charts and strategies, I decided to write a letter to NinjaTrader CEO, Raymond Deux ... the guy probably didn't even read it, I received an almost immediate response confirming that I am out of luck, they are not fixing NT7 and not going to help me either getting a workaround for that issue, and "possible resolutions are being explored for a future release of NinjaTrader" (NT8, hopefully). That response ended by "Thank you and have a nice day", which got me real mad - how can I have a nice day when they are screwing me up? So I decided to publish that letter and the response on 2 forums, EliteTrader & LinkedIn. To my disgust, I found out last night that the EliteTrader thread has been removed by Baron, upon Raymond Deux's request. Needless to say, I have decided to walk-away from that site.

Have a great week-end!

The letter:

Date: July 3rd, 2013

Attn: Mr Raymond Deux, CEO NinjaTrader

Mr Deux,

It is not without love for your company’s flahship product, NinjaTrader 7, that I am writing you. I have been a customer of your company for just over a year, starting with a single broker licence in June 2012, which I expanded to a multi-broker licence in December 2012.

I was in high-tech/telecom R&D and Product Management for 20 years, in various (senior) management positions, and I always kept in touch with technology, both hardware & software. That passion for, and experience with, technology has certainly been an asset for me since I decided 7 years ago to tackle a major career change – from high-tech/telecom to trading.

You’ll find further information re. my career on my LinkedIn profile:

http://ca.linkedin.com/pub/dominique-normand/1/510/90a

I have been focusing on automated trading systems (developing & trading my own systems) for over 4 years now – prior to using NinjaTrader, I had developed an ad-hoc infrastructure around Ensign-Windows to support my trading systems. Migrating to a C# based platform was a real treat for me – I was an early adopter & advocate of object-oriented technologies, and C++ expert, from 1990.

Where I am getting to with all this, is that I am far from a novice when it comes to business management, product management, R&D management, software engineering at large, including C# programming.

The very reason for this letter, is to raise your visibility onto an issue tracked by your customer-service desk under the reference 867206. In a nutshell, the problem at hand is that NinjaTrader does *not* handle correctly a chart reload all historical data command (CTRL+SHIFT+R), *nor* the more general Historical Data Manager / ReloadAll command, when a chart or strategy uses 2 or more timeframes. This problem is easily reproducible, 100% of the time, and has been acknowledge (although, reluctantly) by your customer-service team. This is indeed a pretty severe issue, just think about what happens after a loss of internet connectivity … once the connectivity is restored, Ninja obviously is missing data, but using either of those 2 commands does *not* get the job entirely done, although leading the user to believe it was done correctly – as a result, any trading decision after that is actually based on a chart missing data, with dear consequences for the trader.

I develop & trade 100% automated systems. A year ago, I started what turns out to be an endless quest towards solving the basic issue of updating the chart with missing data after a loss of connectivity. I was told there is no API offered to that effect, and suggested using a workaround with CTRL+SHIFT+R through SendKeys(). I developed along those lines, and got to a workaround which turned-out a waste of time, as SendKeys() requires an open desktop session (which cannot be maintained during a loss of connectivity, for any remote server or VPS). Upon the total lack of cooperation from your teams, I turned my efforts towards using Reflection, initially using CTRL+SHIFT+R through Reflection, later doing a better job and using the underlying API to get those reload data done (I am talking of NinjaTrader.Data.HistoricalDataManager.RequestBarsFromProvider.DoReloadFromProvider()). I was pretty happy of that solution, until discovering 2 weeks ago the issue mentioned earlier (tracked as 867206).

A lot of investigation on my part, led to narrowing the issue pretty well – I even identified that the Historical Data Manager / Download function works correctly in the context of multi-timeframes charts or strategies. Since then, I have been, kindly & politely, asking for some form of help, either in fixing the user-facing features CTRL+SHIFT+R & HDM / ReloadAll, or in helping me to get my own software to work just as well as the HDM / “Download” feature.

But, I have been told *NO*, in the following terms (which I realize are not your employee position, but your management chain position, so please don’t get mad at him, because he has nothing to do with it):

“NinjaTrader was not designed to be a black box, all in system that is completely managed by custom code. While I can understand that this is a priority for you, we simply did not design the product to operate in this way. It is expected for a user to be in front of the machine to monitor their positions, strategies, data, etc. With that said, we are exploring options to help improve in this area as we know, but as it stands there is nothing I can recommend to you to have NinjaTrader 7 function in this manner.

I cannot make any additional comments in this area and our development team is not going to be able to provide you with our propriety methods to get this to work. The reason for this is simply as these methods are not documented, not guaranteed to work form a user script and are subject to change between releases at any time. You can use these methods of course at your own risk, but once again they were not designed to be used in this manner.”

And from a follow-up email:

“We are aware of limitations when reloading with an additional series on the list. Development is aware and are addressing in the next major release. We have you added on the NT8 beta list and we would look forward to your feedback at the time you are able to test on that release.

We will not be making any changes to NinjaTrader 7. Development does not have any additional recommendations for you in this scenario.”

To which I can only respond that the excuse that “NinjaTrader was not designed to be a black box, all in system that is completely managed by custom code. (…) It is expected for a user to be in front of the machine to monitor their positions, strategies, data, etc.” is just that, an excuse, since CTRL+SHIFT+R doesn’t work any better with a user in front of the machine, and neither does ReloadAll. Furthermore, Ninja provides a mode in Options / Strategies / NinjaScript / On connection loss to automatically restart the strategy when the connection is re-established (“recalculate”), which it does without even taking care of downloading the missing data (due to the connection drop).

I realize this is a long & technical mail … in summary, 2 customer-facing features do *not* work in NinjaTrader 7, those features are essential to properly recover from any loss of connectivity, I am being told that those features won’t be fixed and that your company won’t help me get a workaround to address that situation.

FWIW, I have always been a public supporter of NinjaTrader (search dom993 posts on EliteTrader), as I have so far been able to achieve with it what my trading business requires (although, not necessarily in a straightforward, documented manner, and I could share with you a number of issues that your teams are aware of, and unwilling to address, which I had to spend days or weeks of R&D to get myself acceptable workaround for). It turns out that I cannot wait for NT8 to fix that particular issue, I have a pretty successful trading system to operate 24/7/365 (you can check its performance here: http://rapacapintro.com/account/accounts?acc=CLAlwaysIn).

I am looking forward to your comments & decision on that matter.

Regards,

Dominique Normand

Date: July 3rd, 2013

Attn: Mr Raymond Deux, CEO NinjaTrader

Mr Deux,

It is not without love for your company’s flahship product, NinjaTrader 7, that I am writing you. I have been a customer of your company for just over a year, starting with a single broker licence in June 2012, which I expanded to a multi-broker licence in December 2012.

I was in high-tech/telecom R&D and Product Management for 20 years, in various (senior) management positions, and I always kept in touch with technology, both hardware & software. That passion for, and experience with, technology has certainly been an asset for me since I decided 7 years ago to tackle a major career change – from high-tech/telecom to trading.

You’ll find further information re. my career on my LinkedIn profile:

http://ca.linkedin.com/pub/dominique-normand/1/510/90a

I have been focusing on automated trading systems (developing & trading my own systems) for over 4 years now – prior to using NinjaTrader, I had developed an ad-hoc infrastructure around Ensign-Windows to support my trading systems. Migrating to a C# based platform was a real treat for me – I was an early adopter & advocate of object-oriented technologies, and C++ expert, from 1990.

Where I am getting to with all this, is that I am far from a novice when it comes to business management, product management, R&D management, software engineering at large, including C# programming.

The very reason for this letter, is to raise your visibility onto an issue tracked by your customer-service desk under the reference 867206. In a nutshell, the problem at hand is that NinjaTrader does *not* handle correctly a chart reload all historical data command (CTRL+SHIFT+R), *nor* the more general Historical Data Manager / ReloadAll command, when a chart or strategy uses 2 or more timeframes. This problem is easily reproducible, 100% of the time, and has been acknowledge (although, reluctantly) by your customer-service team. This is indeed a pretty severe issue, just think about what happens after a loss of internet connectivity … once the connectivity is restored, Ninja obviously is missing data, but using either of those 2 commands does *not* get the job entirely done, although leading the user to believe it was done correctly – as a result, any trading decision after that is actually based on a chart missing data, with dear consequences for the trader.

I develop & trade 100% automated systems. A year ago, I started what turns out to be an endless quest towards solving the basic issue of updating the chart with missing data after a loss of connectivity. I was told there is no API offered to that effect, and suggested using a workaround with CTRL+SHIFT+R through SendKeys(). I developed along those lines, and got to a workaround which turned-out a waste of time, as SendKeys() requires an open desktop session (which cannot be maintained during a loss of connectivity, for any remote server or VPS). Upon the total lack of cooperation from your teams, I turned my efforts towards using Reflection, initially using CTRL+SHIFT+R through Reflection, later doing a better job and using the underlying API to get those reload data done (I am talking of NinjaTrader.Data.HistoricalDataManager.RequestBarsFromProvider.DoReloadFromProvider()). I was pretty happy of that solution, until discovering 2 weeks ago the issue mentioned earlier (tracked as 867206).

A lot of investigation on my part, led to narrowing the issue pretty well – I even identified that the Historical Data Manager / Download function works correctly in the context of multi-timeframes charts or strategies. Since then, I have been, kindly & politely, asking for some form of help, either in fixing the user-facing features CTRL+SHIFT+R & HDM / ReloadAll, or in helping me to get my own software to work just as well as the HDM / “Download” feature.

But, I have been told *NO*, in the following terms (which I realize are not your employee position, but your management chain position, so please don’t get mad at him, because he has nothing to do with it):

“NinjaTrader was not designed to be a black box, all in system that is completely managed by custom code. While I can understand that this is a priority for you, we simply did not design the product to operate in this way. It is expected for a user to be in front of the machine to monitor their positions, strategies, data, etc. With that said, we are exploring options to help improve in this area as we know, but as it stands there is nothing I can recommend to you to have NinjaTrader 7 function in this manner.

I cannot make any additional comments in this area and our development team is not going to be able to provide you with our propriety methods to get this to work. The reason for this is simply as these methods are not documented, not guaranteed to work form a user script and are subject to change between releases at any time. You can use these methods of course at your own risk, but once again they were not designed to be used in this manner.”

And from a follow-up email:

“We are aware of limitations when reloading with an additional series on the list. Development is aware and are addressing in the next major release. We have you added on the NT8 beta list and we would look forward to your feedback at the time you are able to test on that release.

We will not be making any changes to NinjaTrader 7. Development does not have any additional recommendations for you in this scenario.”

To which I can only respond that the excuse that “NinjaTrader was not designed to be a black box, all in system that is completely managed by custom code. (…) It is expected for a user to be in front of the machine to monitor their positions, strategies, data, etc.” is just that, an excuse, since CTRL+SHIFT+R doesn’t work any better with a user in front of the machine, and neither does ReloadAll. Furthermore, Ninja provides a mode in Options / Strategies / NinjaScript / On connection loss to automatically restart the strategy when the connection is re-established (“recalculate”), which it does without even taking care of downloading the missing data (due to the connection drop).

I realize this is a long & technical mail … in summary, 2 customer-facing features do *not* work in NinjaTrader 7, those features are essential to properly recover from any loss of connectivity, I am being told that those features won’t be fixed and that your company won’t help me get a workaround to address that situation.

FWIW, I have always been a public supporter of NinjaTrader (search dom993 posts on EliteTrader), as I have so far been able to achieve with it what my trading business requires (although, not necessarily in a straightforward, documented manner, and I could share with you a number of issues that your teams are aware of, and unwilling to address, which I had to spend days or weeks of R&D to get myself acceptable workaround for). It turns out that I cannot wait for NT8 to fix that particular issue, I have a pretty successful trading system to operate 24/7/365 (you can check its performance here: http://rapacapintro.com/account/accounts?acc=CLAlwaysIn).

I am looking forward to your comments & decision on that matter.

Regards,

Dominique Normand

The 1st response, received from support@NinjaTrader.com:

"Hello Dominique,

Thank you for taking your time to write me this note.

I agree with teams assessment and acknowledge that, while this is not preferable for you, it is a current limitation of NinjaTrader. The functionality of the reload of downloaded data is the ultimate issue at hand and any other methods cannot be offered. Our development team is aware of this limitation and possible resolutions are being explored for a future release of NinjaTrader.

Thanks and have a nice day.

Sincerely,

Raymond

NinjaTrader Customer Service"

"Hello Dominique,

Thank you for taking your time to write me this note.

I agree with teams assessment and acknowledge that, while this is not preferable for you, it is a current limitation of NinjaTrader. The functionality of the reload of downloaded data is the ultimate issue at hand and any other methods cannot be offered. Our development team is aware of this limitation and possible resolutions are being explored for a future release of NinjaTrader.

Thanks and have a nice day.

Sincerely,

Raymond

NinjaTrader Customer Service"

The 2nd response, after I published on ET, wondering about the 1st response:

"Dominique,

The reply is from me, Raymond Deux. To confirm, this is being addressed in NinjaTrader 8. We are not making any changes to NinjaTrader 7.

Sincerely,

Raymond

NinjaTrader Customer Service"

"Dominique,

The reply is from me, Raymond Deux. To confirm, this is being addressed in NinjaTrader 8. We are not making any changes to NinjaTrader 7.

Sincerely,

Raymond

NinjaTrader Customer Service"

It is pretty clear NinjaTrader is focusing on revenue generation, not on fixing their product's issues to allow their customers to use it for trading.

I do not think NT8 will be of better quality than NT7 ... it will likely take a couple of years just to get it even with NT7 from a quality / outstanding issues point of view.

I am going to investigate MultiChart .NET ... I certainly don't like the idea of switching platform again, but on the other hand there is no hope for me with NT7/8.

CL always-in: 9 win / 6 losses ; net -345.

Not the greatest week ... Wednesday was pretty bad, with a net for the day of -2820 ... Thursday / Friday early morning made most of it back. That being said, the open-trade (short) into the close is down ~ -750, after being up ~ +500 earlier in the day.

I found yet another bug in NT7, which I submitted to Ninja support & could easily be reproduced. Of course, it will only be fixed in NT8.

Really no R&D at all this week, and likely none next week either - I have been fighting all kind of personal issues, no end in sight.

Have a great week-end!

Dom that equity curve looks too good to be true so I'd be scared but hope it trades like that in real time....what became of your trading contest...? how did Chuck Huges do ? He wants me to spend almost 4 k on options recomendations

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.