Dom's notes

Despite having been hammered for posting my sincere feedback re. ATW in the appropriate thread (or may-be, because of ...) I am starting this thread for the benefit of all waanabee traders.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

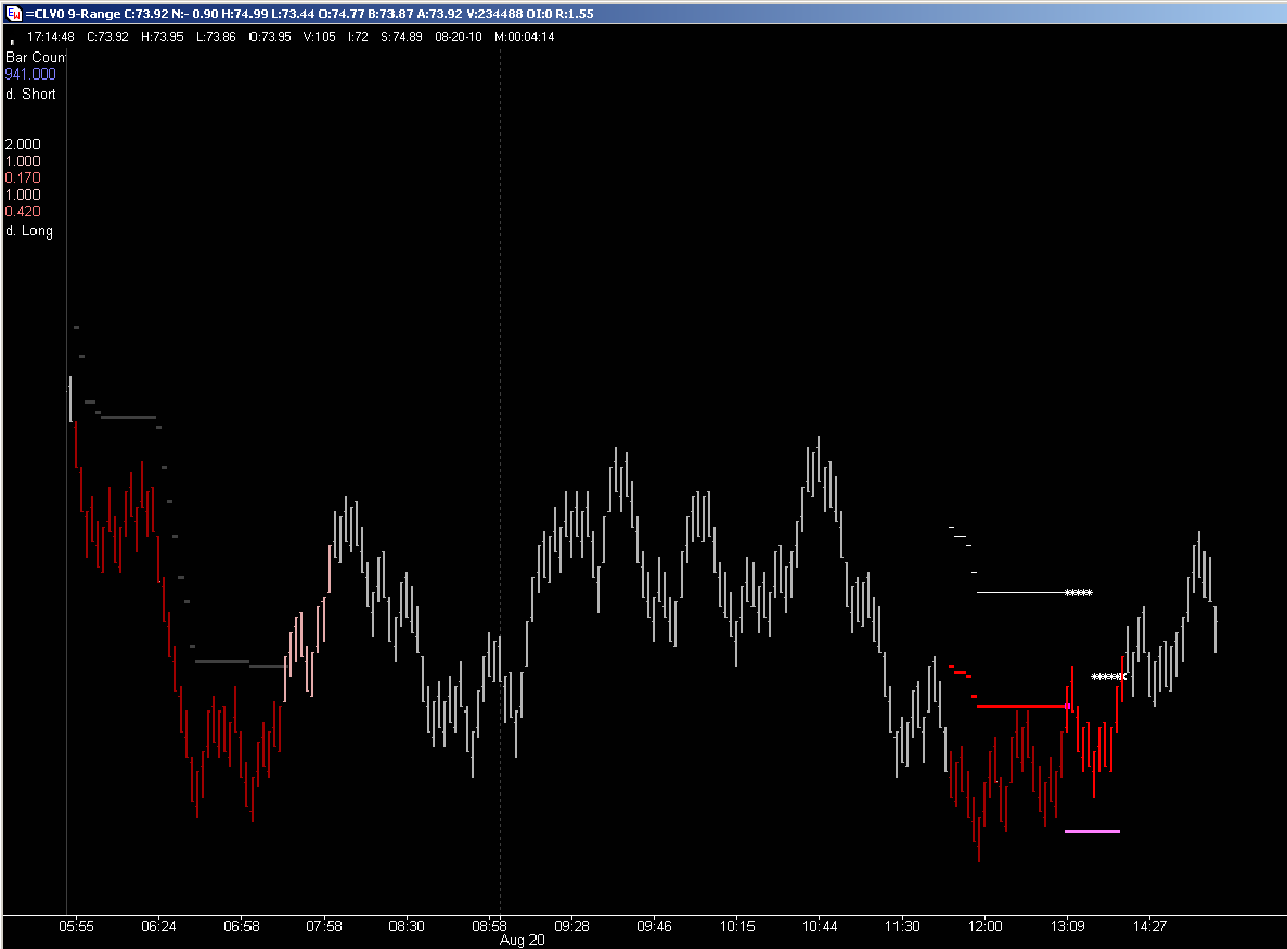

Day's summary

CL new system : 1 win (+25t)

Today is my 1st ERROR using this system : I forgot to move to the new front-month contract last night … My entry order was rejected by IB, when I realized what was happening I scrambled to load the new contract data, and managed that trade very manually, looking at the old contract for reference points as I had no real-time data yet available for the new contract (for whatever reason, TransAct refresh don't work for me, so I have to use an alternate source for refresh which is delayed 10min). The old contract triggered a tight trailing-stop, I followed that and got stopped with +25-t. But when the dust settled, it appeared that the new contract would not have triggered that tight trailing-stop, and would have been a full win (50-t).

On top of that, TWS did not report the fills timely, adding to the confusion as I had to call several time the IB trade-desk to check what was the account situation. Looks like my 1.5-month old version of TWS could be the culprit, so I updated to the current one.

A lot of stress for an otherwise easy trade, the entry was well calculated as it took only 3-t heat in the seconds after the entry, and was in the green after that for the entire duration of the trade (short entry 75.07 @ 10:19).

CL new system : 1 win (+25t)

Today is my 1st ERROR using this system : I forgot to move to the new front-month contract last night … My entry order was rejected by IB, when I realized what was happening I scrambled to load the new contract data, and managed that trade very manually, looking at the old contract for reference points as I had no real-time data yet available for the new contract (for whatever reason, TransAct refresh don't work for me, so I have to use an alternate source for refresh which is delayed 10min). The old contract triggered a tight trailing-stop, I followed that and got stopped with +25-t. But when the dust settled, it appeared that the new contract would not have triggered that tight trailing-stop, and would have been a full win (50-t).

On top of that, TWS did not report the fills timely, adding to the confusion as I had to call several time the IB trade-desk to check what was the account situation. Looks like my 1.5-month old version of TWS could be the culprit, so I updated to the current one.

A lot of stress for an otherwise easy trade, the entry was well calculated as it took only 3-t heat in the seconds after the entry, and was in the green after that for the entire duration of the trade (short entry 75.07 @ 10:19).

Day's summary

CL new system : 1 setup manually canceled

This is borderline to a behavior error, or anticipating a needed change in the system - Here is the story :

- price missed twice the entry level by 1-tick, then bounced 23-t, missing by a couple ticks the retest level where the system would currently void the setup.

- given that, at that point, we had a large DB at overnight low, plus a couple of failed retests, I was anticipating that when price would finally come back to fill my short LMT entry, it would not look back, especially on an uneventful Friday afternoon in August

- I was right on the idea, but not on all the details ... price indeed made one last attempt after giving the system a fill, however that retest was only good enough to reduce the initial stop, but that trade eventually ended-up a loser.

CL new system : 1 setup manually canceled

This is borderline to a behavior error, or anticipating a needed change in the system - Here is the story :

- price missed twice the entry level by 1-tick, then bounced 23-t, missing by a couple ticks the retest level where the system would currently void the setup.

- given that, at that point, we had a large DB at overnight low, plus a couple of failed retests, I was anticipating that when price would finally come back to fill my short LMT entry, it would not look back, especially on an uneventful Friday afternoon in August

- I was right on the idea, but not on all the details ... price indeed made one last attempt after giving the system a fill, however that retest was only good enough to reduce the initial stop, but that trade eventually ended-up a loser.

Yesterday's summary

A lot of work over the week-end to complete testing of 2nd version of new trading system ... really, didn't finish before 9am Monday morning, but it went live Monday morning ... and didn't catch any trade Monday.

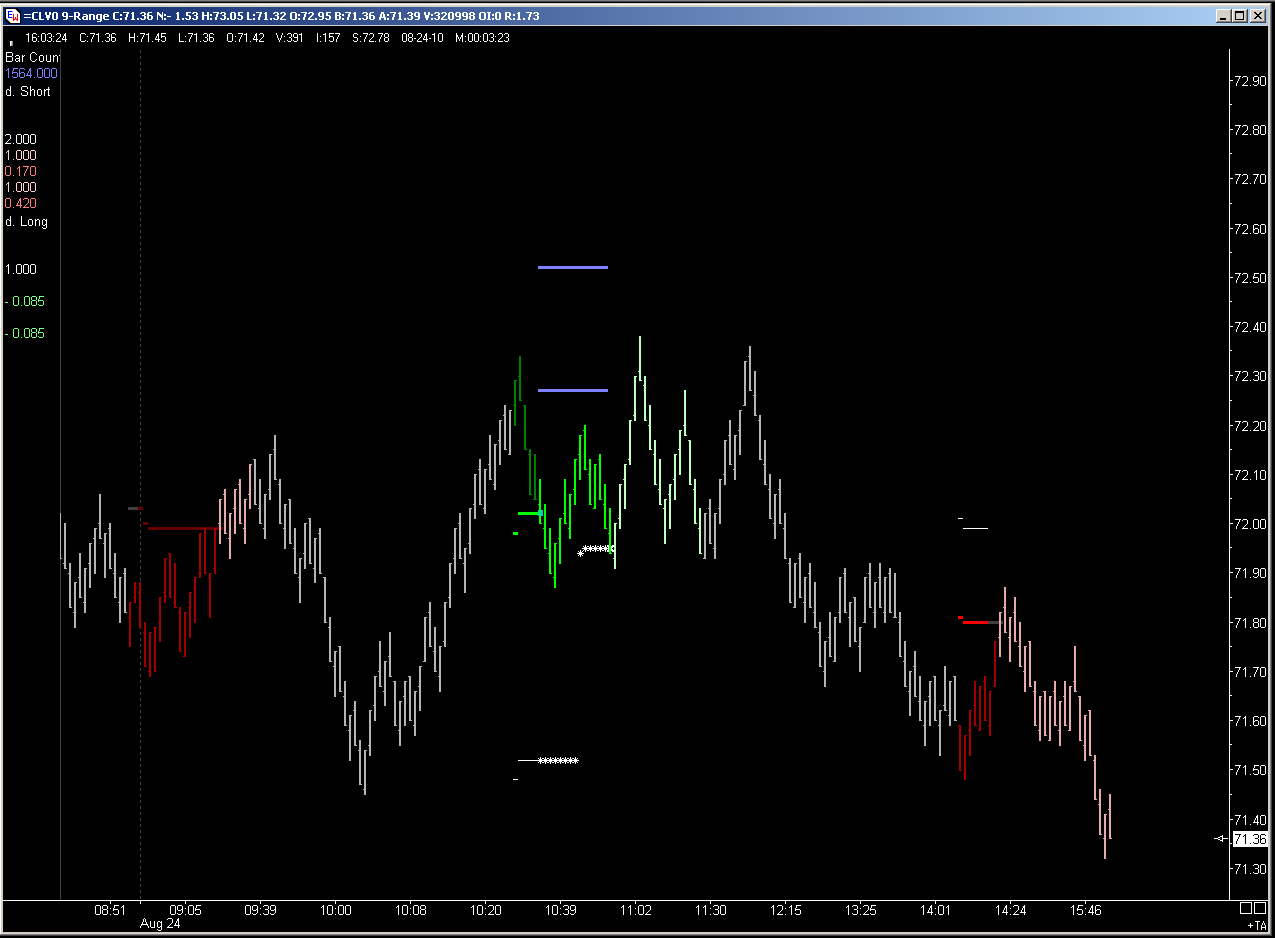

Today's summary

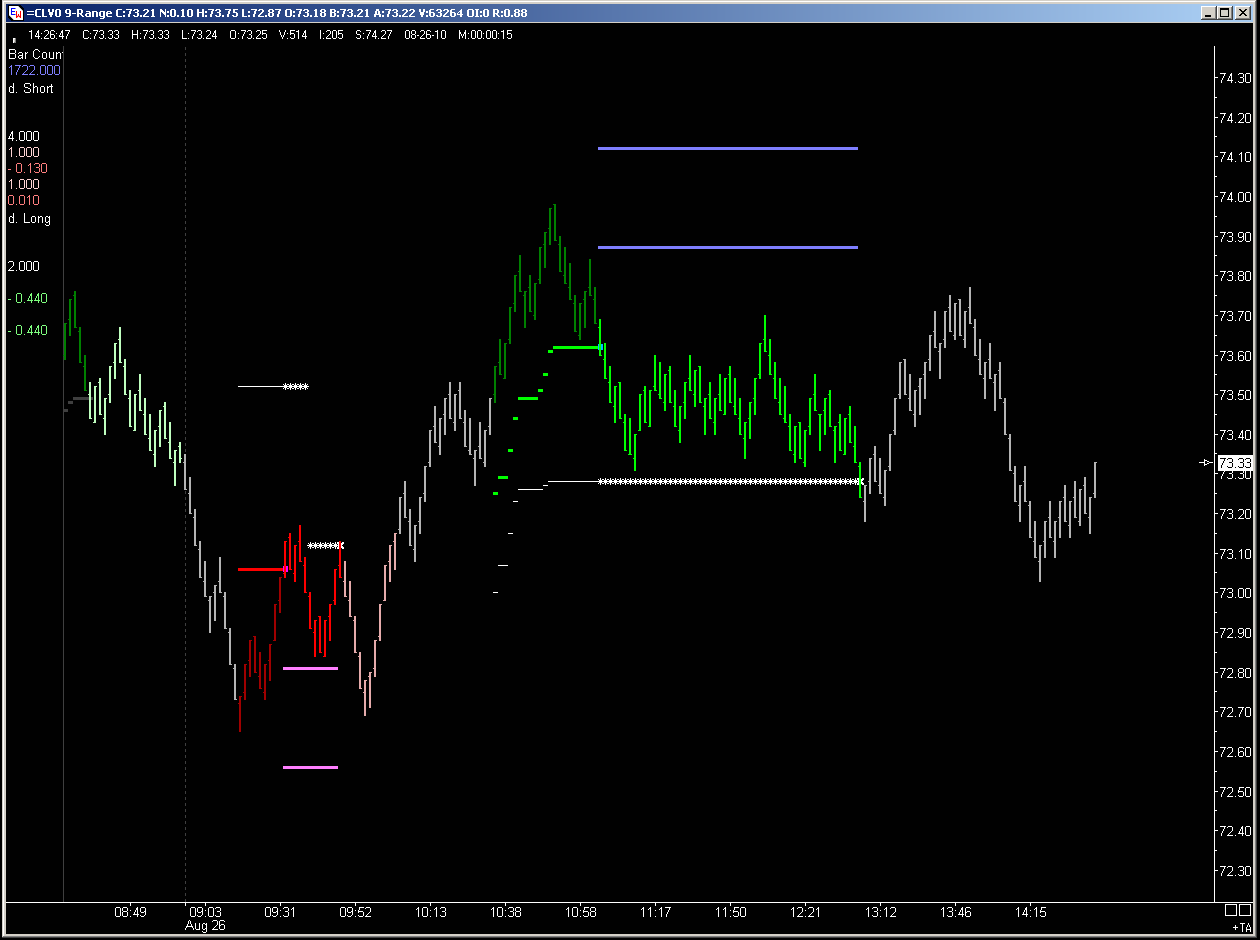

CL new system v2 : 1 loss (-7t).

I suppose this loss (and many other of same kind) would be frustrating for many ... -7t after being up +18t - but this is what this system needs to catch many of the 50-ticks target it is going after.

The early morning short was actually filtered out (dark-red line, although in most cases filtered entries will be dark gray), and so was the afternoon one (cut-over time for entries : 2:20pm).

A lot of work over the week-end to complete testing of 2nd version of new trading system ... really, didn't finish before 9am Monday morning, but it went live Monday morning ... and didn't catch any trade Monday.

Today's summary

CL new system v2 : 1 loss (-7t).

I suppose this loss (and many other of same kind) would be frustrating for many ... -7t after being up +18t - but this is what this system needs to catch many of the 50-ticks target it is going after.

The early morning short was actually filtered out (dark-red line, although in most cases filtered entries will be dark gray), and so was the afternoon one (cut-over time for entries : 2:20pm).

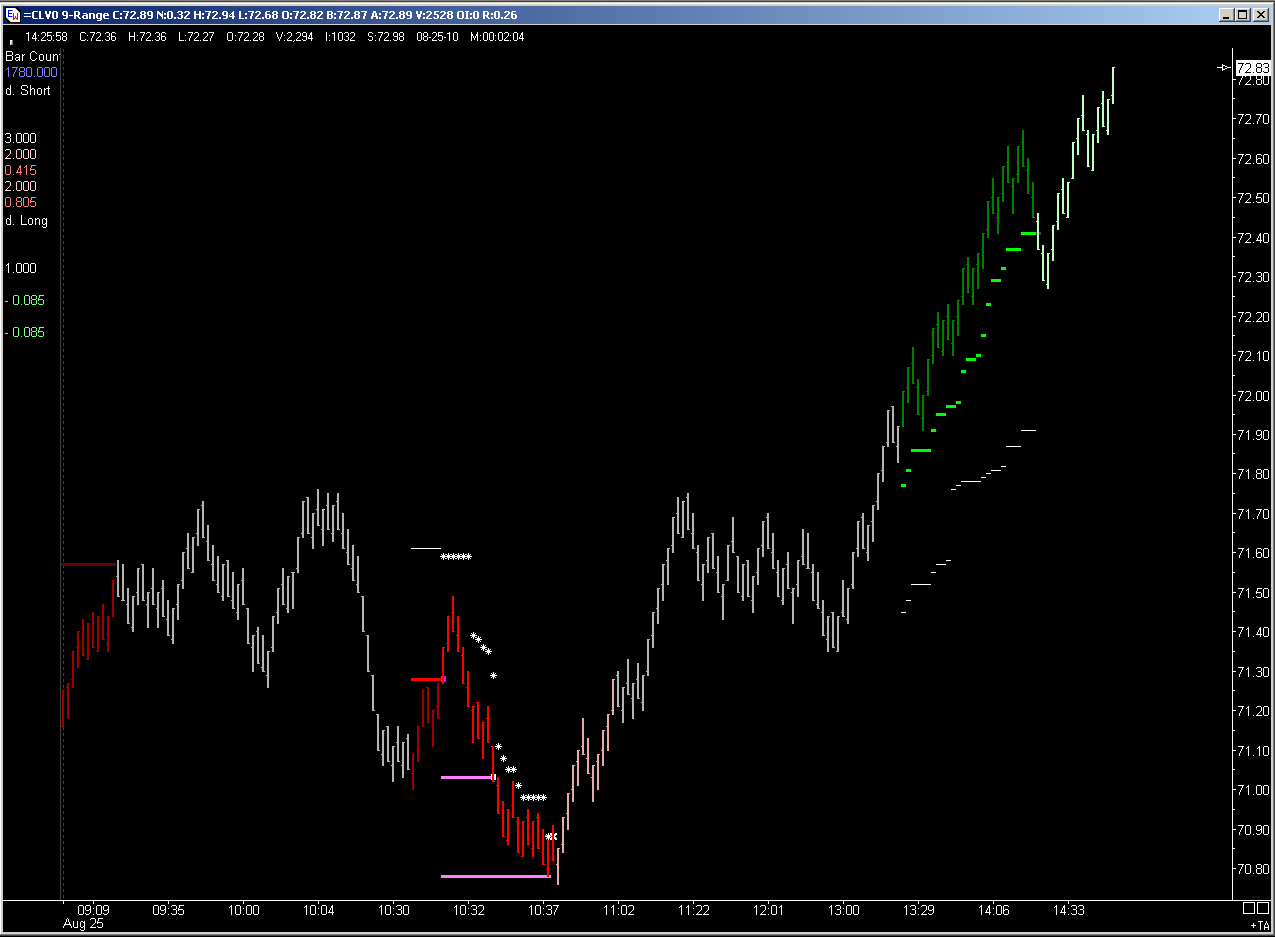

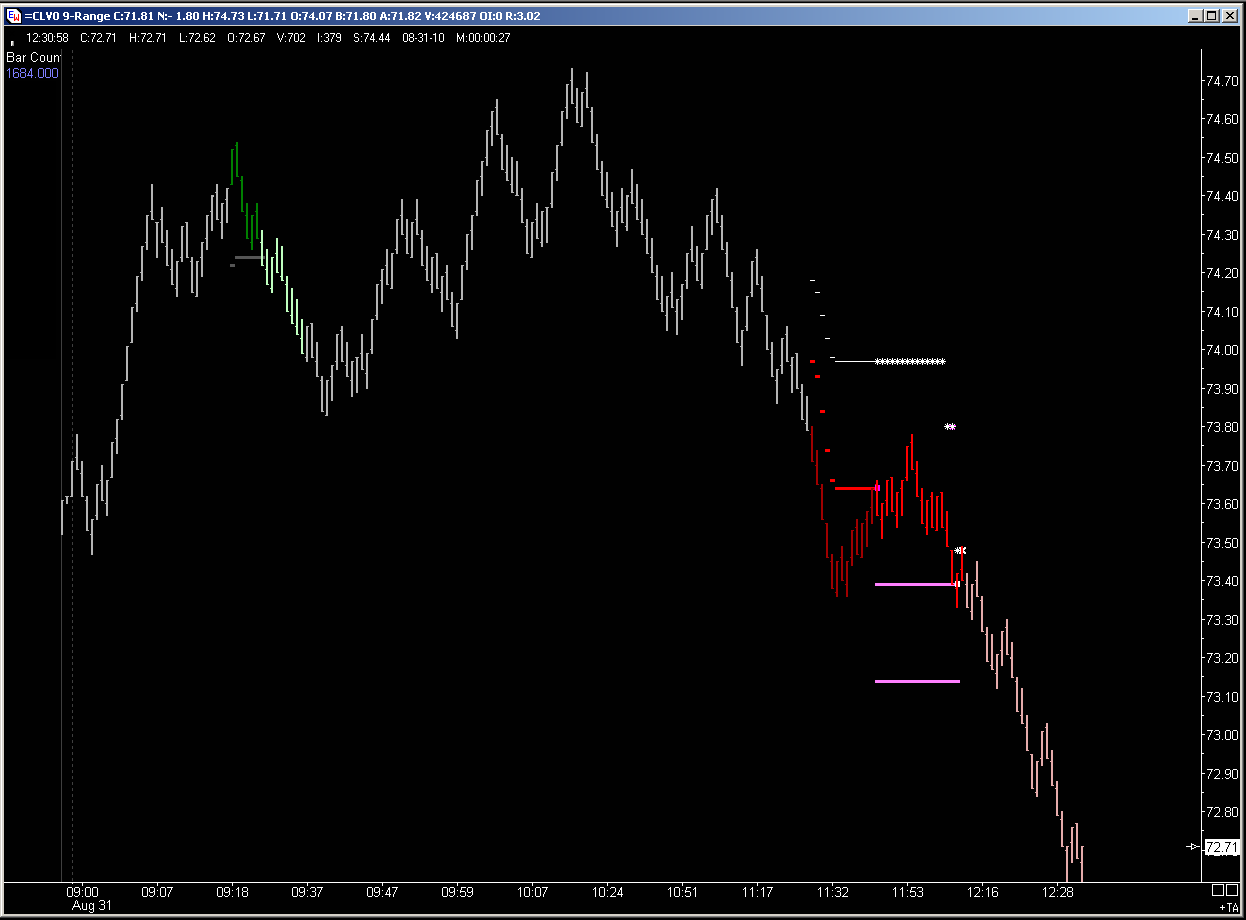

Day's summary

CL new system v2 : 1 win (+50t)

I must be making progress on the behavior front ... I didn't interfere with this trade, even when it was looking like it would not make it to the target, and I could have grabbed 40-t instead of "risking" to be stopped w/ only 30-t less slippage. (I realize more and more that any single trade outcome doesn't matter too much, it is the long-term performance that matters).

Note : despite the chart showing the trade ended stopped-out, I got a fill on the 1st touch of my target price.

Missed another winning trade which entry would have been just after the cutover time (2:20pm). I also didn't interfere here.

CL new system v2 : 1 win (+50t)

I must be making progress on the behavior front ... I didn't interfere with this trade, even when it was looking like it would not make it to the target, and I could have grabbed 40-t instead of "risking" to be stopped w/ only 30-t less slippage. (I realize more and more that any single trade outcome doesn't matter too much, it is the long-term performance that matters).

Note : despite the chart showing the trade ended stopped-out, I got a fill on the 1st touch of my target price.

Missed another winning trade which entry would have been just after the cutover time (2:20pm). I also didn't interfere here.

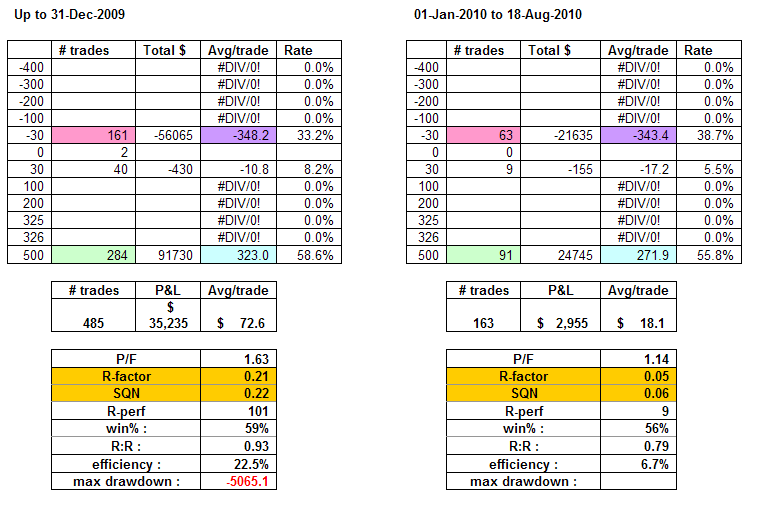

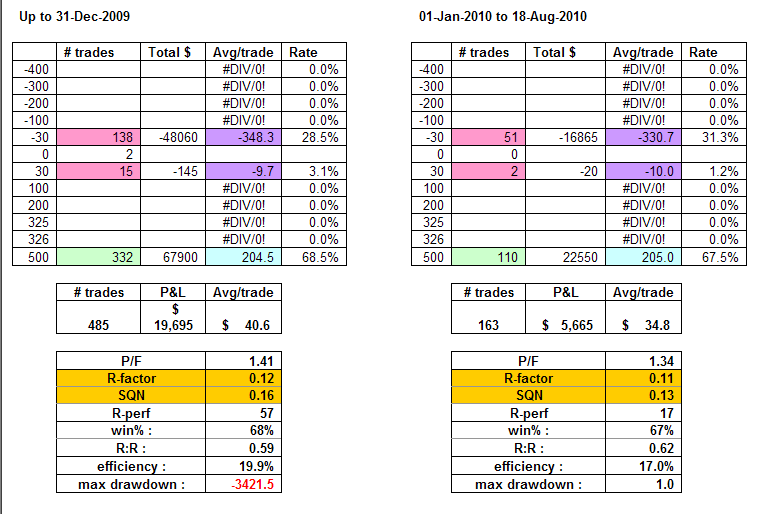

Since I am starting to trade a new system, after the "failure" of previous one, I wanted to analyze what went wrong there. I ran a detailed backtest of the 5W system to get all trades details from Jan-1st to Aug-18th, then compared side by side performance over Oct-2008..Dec-2009 & Jan-2010..Aug-2010.

From Jan to Aug-18th, the system’s performance on its large target (42-ticks) would have been +$2,955 for 163 trades, an average of $18 per trade – far from the prior 15 months, where the average per trade was $73. The win rate was essentially identical (56% since January, vs 59% on prior 15 months). The main & big difference was the split between “big” winners (above $315) and small ones. On the prior 15 months, “big” winners were 40% of the total # trades, and “small” ones 18%. Since January, “big” winners have been only 28% of total # trades, and “small” ones 28%.

Similar comparison of system performance using the ½ size target shows a much better “relative” performance … Average / trade of $35 since January, vs. $41 in the prior 15 months. Win rate 67%, vs. 68% in the prior 15 months. Sure, the ½ size target average performance on prior 15 months was only 56% of the full-size target, but it stayed quite stable under significantly different market conditions when the large target did suffer a lot.

A few lessons (hopefully) learned with this system :

- Over-optimization : no matter how sincere I am when designing a trading strategy, I must acknowledge that there is de-facto over-optimization embedded in any strategy … and I should do a lot more “sensitivity” analysis to understand the impact of small variations of system parameters onto the system’s performance.

- Changes in market volatility : reduction in market volatility leaves big targets exposed to strong variation of win% … I should trade at least 2 contracts, one w/ a large target & one w/ a small (~1/2 size) target.

- Anticipated system performance : anticipated forward system performance should be only a fraction of backtesting results … I haven’t come with a formula to that effect yet, but I feel it is a necessary step in system validation.

- System performance in real-life operation : the largest impact on system performance in real-life operation is me ! For various reasons, trading this system exceeded my risk comfort zone, I ended-up interfering on most every trade, and did not make any money for that reason – the system would have by itself, even though not as much as anticipated. I must never loose sight that it is the system long-term outcome which matters, not the result of any single trade.

From Jan to Aug-18th, the system’s performance on its large target (42-ticks) would have been +$2,955 for 163 trades, an average of $18 per trade – far from the prior 15 months, where the average per trade was $73. The win rate was essentially identical (56% since January, vs 59% on prior 15 months). The main & big difference was the split between “big” winners (above $315) and small ones. On the prior 15 months, “big” winners were 40% of the total # trades, and “small” ones 18%. Since January, “big” winners have been only 28% of total # trades, and “small” ones 28%.

Similar comparison of system performance using the ½ size target shows a much better “relative” performance … Average / trade of $35 since January, vs. $41 in the prior 15 months. Win rate 67%, vs. 68% in the prior 15 months. Sure, the ½ size target average performance on prior 15 months was only 56% of the full-size target, but it stayed quite stable under significantly different market conditions when the large target did suffer a lot.

A few lessons (hopefully) learned with this system :

- Over-optimization : no matter how sincere I am when designing a trading strategy, I must acknowledge that there is de-facto over-optimization embedded in any strategy … and I should do a lot more “sensitivity” analysis to understand the impact of small variations of system parameters onto the system’s performance.

- Changes in market volatility : reduction in market volatility leaves big targets exposed to strong variation of win% … I should trade at least 2 contracts, one w/ a large target & one w/ a small (~1/2 size) target.

- Anticipated system performance : anticipated forward system performance should be only a fraction of backtesting results … I haven’t come with a formula to that effect yet, but I feel it is a necessary step in system validation.

- System performance in real-life operation : the largest impact on system performance in real-life operation is me ! For various reasons, trading this system exceeded my risk comfort zone, I ended-up interfering on most every trade, and did not make any money for that reason – the system would have by itself, even though not as much as anticipated. I must never loose sight that it is the system long-term outcome which matters, not the result of any single trade.

Yesterday's summary

CL new system : 2 loss (-7t / -34t)

1st one is a bit frustrating as it got stopped before price moved far enough to trigger the tight trailing stop. Trade management is a trade-off between less whipsaws and smaller losses, whatever one chooses, there will be trades that suffer from it - but again, it is the long-term performance of the system that matters.

2nd one is also a bit frustrating, price bounced 2-t before the entry, the same bounce right off the entry level would have changed the initial stop to a tight one. (I am pretty sure I already tested that it is a better trade-off than allowing the same initial stop reduction in case of a bounce a few ticks before entry level, but I will re-test this today)

CL new system : 2 loss (-7t / -34t)

1st one is a bit frustrating as it got stopped before price moved far enough to trigger the tight trailing stop. Trade management is a trade-off between less whipsaws and smaller losses, whatever one chooses, there will be trades that suffer from it - but again, it is the long-term performance of the system that matters.

2nd one is also a bit frustrating, price bounced 2-t before the entry, the same bounce right off the entry level would have changed the initial stop to a tight one. (I am pretty sure I already tested that it is a better trade-off than allowing the same initial stop reduction in case of a bounce a few ticks before entry level, but I will re-test this today)

Day's summary

CL new system : 1 max loss short (-50-ticks) / 1 long no-fill (missed by 5-ticks)

That makes the week net negative (the 2 prior weeks ended pretty much break-even each).

I re-tested the reduced initial stop on early bounce before entry level, it essentially decreases overall performance, unless making the reduced initial stop significantly larger than what it is right now.

All in all, this is another trade-off with little impact on long-term performance I believe, I am keeping things as they are for the moment.

CL new system : 1 max loss short (-50-ticks) / 1 long no-fill (missed by 5-ticks)

That makes the week net negative (the 2 prior weeks ended pretty much break-even each).

I re-tested the reduced initial stop on early bounce before entry level, it essentially decreases overall performance, unless making the reduced initial stop significantly larger than what it is right now.

All in all, this is another trade-off with little impact on long-term performance I believe, I am keeping things as they are for the moment.

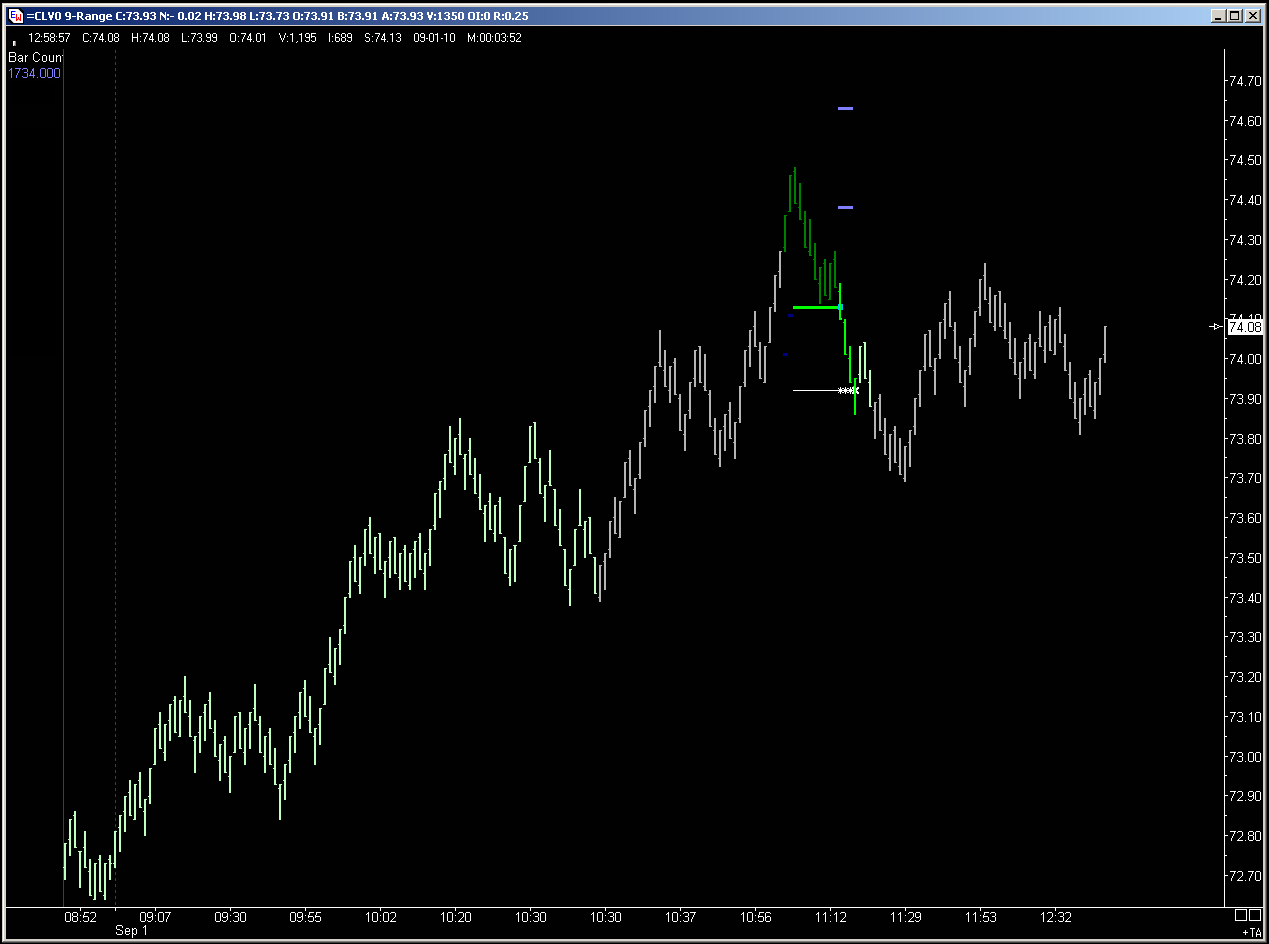

Day's summary

CL new system : no trade today.

The system was trying to get short for most of the 1st 2 hours of the session, but price never even tried to challenge the entry level.

I have been playing with MonteCarlo simulations most of the day, trying to set my expectations for this system correctly (using the 5W system experience) ...

CL new system : no trade today.

The system was trying to get short for most of the 1st 2 hours of the session, but price never even tried to challenge the entry level.

I have been playing with MonteCarlo simulations most of the day, trying to set my expectations for this system correctly (using the 5W system experience) ...

Day's summary

CL new system : 1 win (stopped w/ +15-t)

Pretty sad stop here ... interestingly, the 5th-wave system took the exact same trade (same entry level), but didn't get stopped despite also triggering its tight stop. That makes me want to go back and check if the new system tight stop isn't too tight.

Note how the filter based on "Initial Stop" size avoided a loss on the 9:20am long.

CL new system : 1 win (stopped w/ +15-t)

Pretty sad stop here ... interestingly, the 5th-wave system took the exact same trade (same entry level), but didn't get stopped despite also triggering its tight stop. That makes me want to go back and check if the new system tight stop isn't too tight.

Note how the filter based on "Initial Stop" size avoided a loss on the 9:20am long.

Dom that equity curve looks too good to be true so I'd be scared but hope it trades like that in real time....what became of your trading contest...? how did Chuck Huges do ? He wants me to spend almost 4 k on options recomendations

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.