Dom's notes

Despite having been hammered for posting my sincere feedback re. ATW in the appropriate thread (or may-be, because of ...) I am starting this thread for the benefit of all waanabee traders.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

And another positive week to start December:

- Reversal system: 2 wins / 1 BE / 1 small loss : net +1500

- Other system: 1 win / 1 BE / 1 loss ; net : +245

Finally making new P&L peaks on both systems ... although really a marginal one for my other system (+45 vs May-8th), the reversal system is in a better shape (+880 vs Aug-17).

A lot of work and some small progress on the R&D front. A huge frustration also, as the results of the 10 year backtest on CL/ES/6E are all negative, even more than I would expect from random entries & exits. Of course, a number of bugs contributed to that, but in the end, I finally realized that this "system" that I spent over a month just writing specs about, is in its current form nothing more than a very sophisticated entry-signal ... missing the definition of a pre-requisite setup in which to use that signal. Now that this big hole is identified, the next logical step is to define one or more setups (set of conditions under which the signal is valid). I already have identified 2 uncorrelated, plus another 2 correlated to either of those, and there are many other candidates. But uncorrelated setups don't necessarily mean distinct trades. Anyway, these setups are currently purely defined using metrics (representative of scenarios), and one innovation there (for me, anyway) has been to make those metrics parameters self-adjusting.

Have a great week-end!

Oops, take the new P&L peak for my other system back :( ... as I was running a backtest of that system after upgrading Ninja, I got surprised that the Ninja P&L curve was not at its peak ... I checked the detailed trade log against my live trading records, and found one missing losing trade (June-28) in my own live records. So that system is still -$755 from its peak on May-8th.

The last couple of weeks have not been too good for my systems:

- reversal system: 1 small win / 1 loss ; net -450

- other system: 1 small win / 2 large losses ; net -995

Not much R&D per say over those 2 weeks, instead I have been building, testing, and migrating to a new very-high-end PC for my R&D ... it is an i7-3930K (6-core) on an Asus P9X79 motherboard, on which I installed 64GB RAM, an Intel 520 SSD for Windows (I did hesitate quite some time with the Samsung 840 Pro, but even though the 840 Pro is the fastest on the market, it is also just introduced, so I did play it safe going with Intel), a couple 2TB HDs (Raid-1) for my data and Windows 7/64-bit.

The i7-3930K at stock settings benchmarks almost twice as fast as my old Q6600 overclocked at 3GHz for SuperPi (mono-thread), and I get 12 pseudo-cores vs 4 before. The 64GB RAM is intended to allow me using the NinjaTrader optimization feature - I have one underway for the reversal system on CL, on 2007-2012 Ninja's memory usage peaks to 40GB with all 12 (pseudo)-cores used for optimization. It has been running for a day & half, and according to Ninja there remains 7h before completion (this is just to explore the impact of the Pivots parameters, I am testing 4 parameters with 6, 9, 11 and 11 possible values ... total 6534 combinations, and I did very much limit the scope of that run!). I did set Ninja's priority 1 notch under Normal, and I can keep using this PC just as if it wasn't doing anything :) I love it.

My #1 goal in the near future is to assess how much can be gained on CL by playing on the numerous parameters of this system, and use that to increase my position size sometime in January. My #2 goal is to find suitable parameters for ES & 6E for that system (if any !).

But for now, I am just about to leave for an extended week-end & Christmas celebration, so I wish you all a Merry Christmas & Happy New Year!

Nice end to the week, my other system got a +425 win while I was shopping today, 700km away from home ... moving my live trading to a datacenter-based VM was definitively a great decision.

I wish you all a Merry Christmas !

- Reversal system: 1 win ; net +390

- Other system: halted

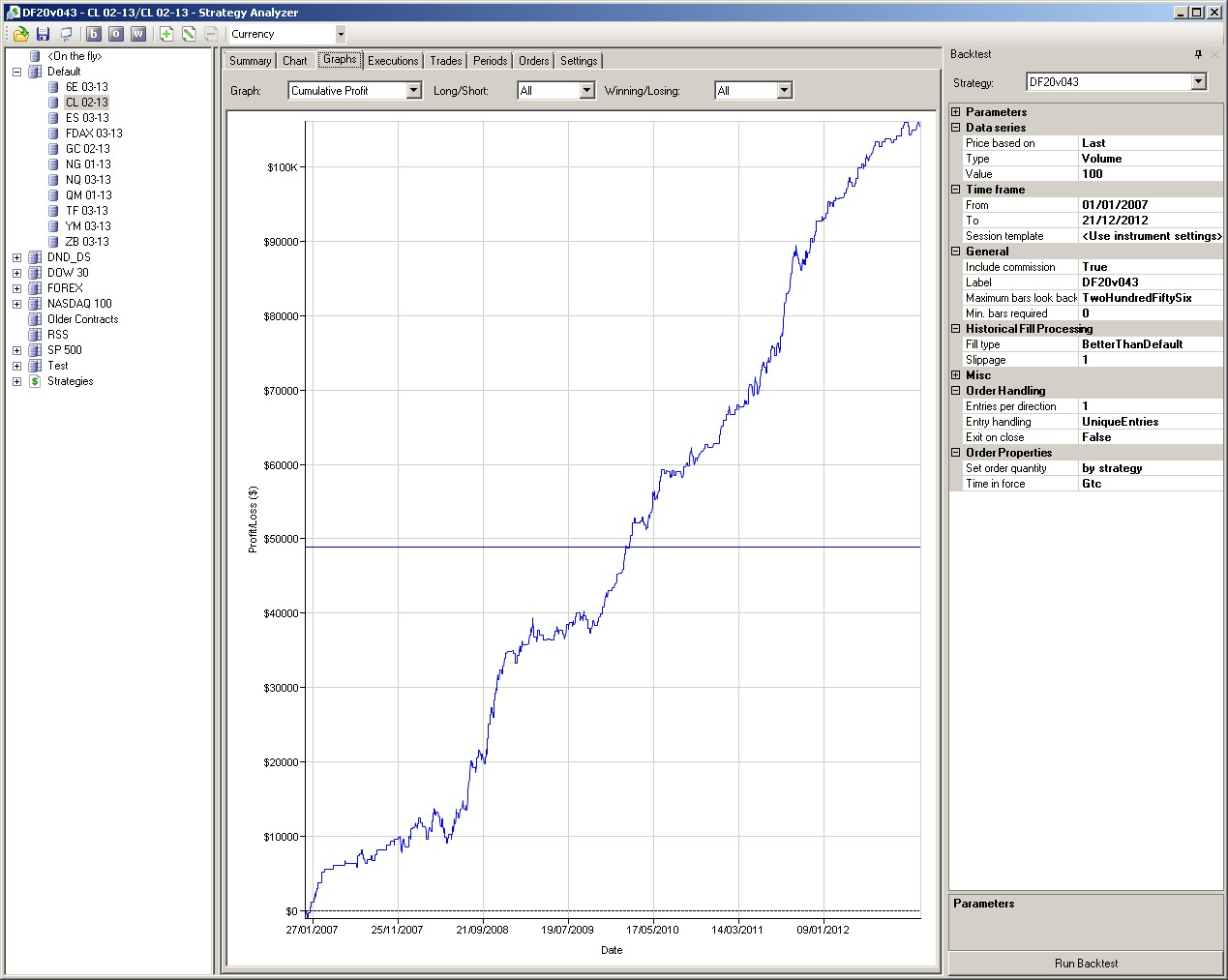

Over the last 10 days I have been evaluating my best course of action for next year, looking at past performance & possible tweaks for both the reversal system & my other system. I made some significant progress on the reversal system, mostly by changing the entry level (which had been set in stone 2 years ago). I actually found 2 better settings: a more aggressive one, allowing to increase both the number of trades (+7%) & the P&L (+9%), improving the average per trade ($171 for 2 contracts) and reducing the historical max drawdown, for a P/F of 1.76 (unchanged) over 1082 trades in 6 years, and a more conservative one, which coupled to reduced trading hours (morning only), cuts the # of trades in half (530) but improves the average per trade ($199 for 2 contracts) and the P/F (2.00), while reducing the historical max drawdown (-4730 vs -7630 for the most aggressive version).

I have decided to triple my trading size on the reversal system, using 3 different parameter configurations (the 2 described above, plus an in-between based on the existing entry level) ... but this will use all of my trading capital, and as a result I decided to stop trading my other system (which performance this year is a big warning sign, even though I have a tweak in store that would make it better - but doesn't compare with the reversal system).

I will post performance summary & P&L graph for the 3 configurations of the reversal system I intend to trade next year - but I have a couple of things to do before that.

Have a great week-end!

Note: each setup has 2 contracts, each contract is counted as an individual trade by Ninja, hence the trade count by Ninja is twice the number of setups.

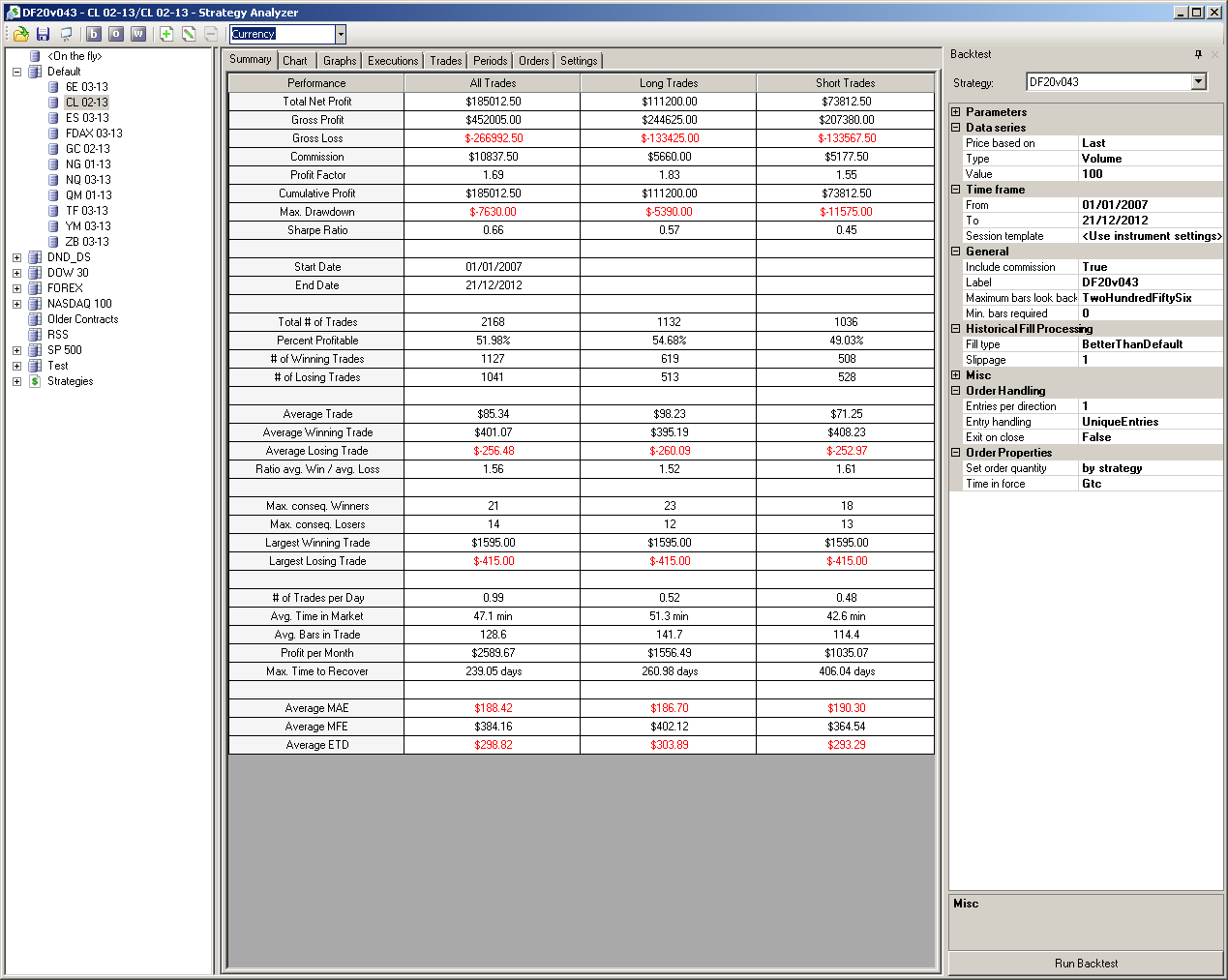

Reversal system, parameters config #1:

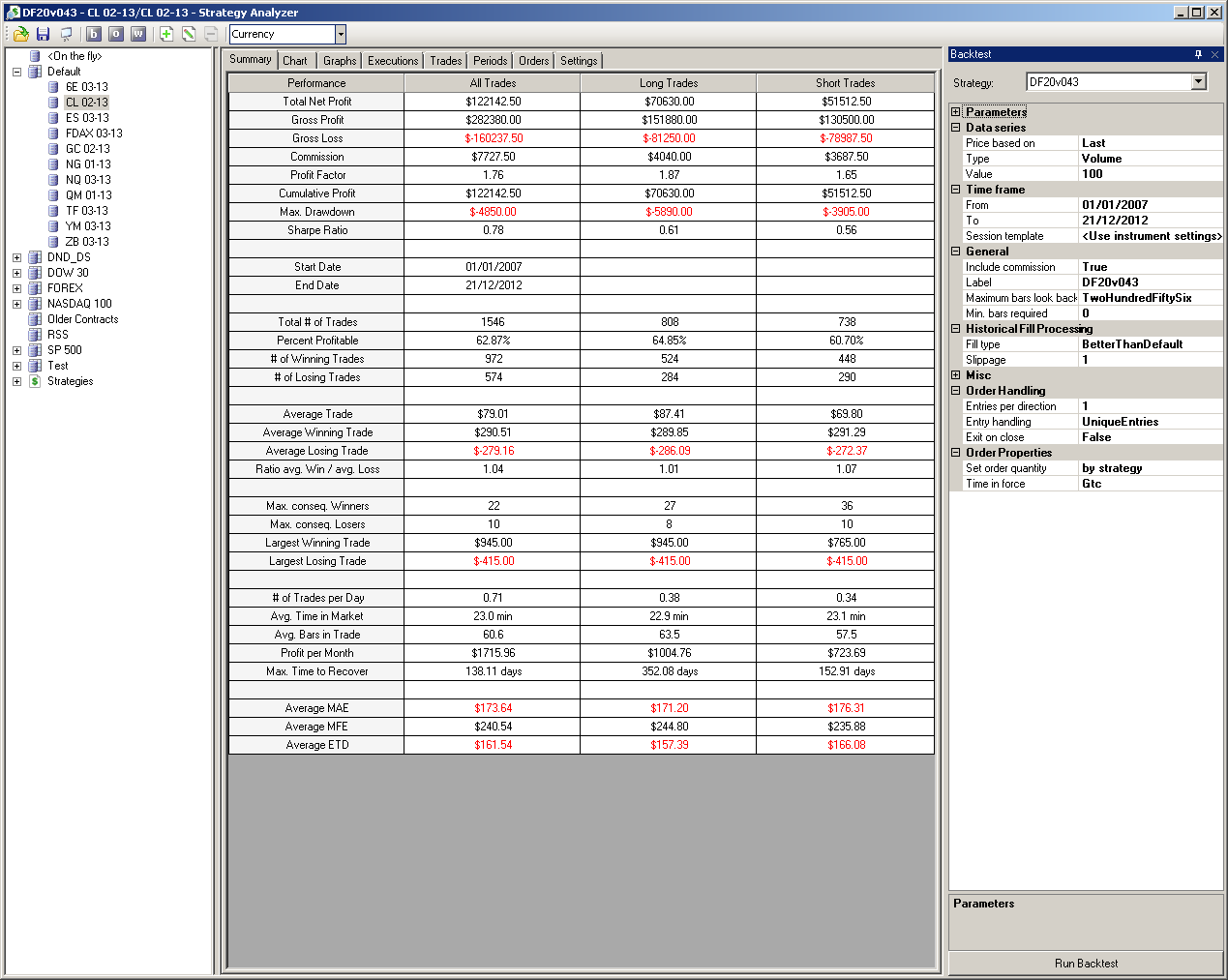

Reversal system, parameters config #2:

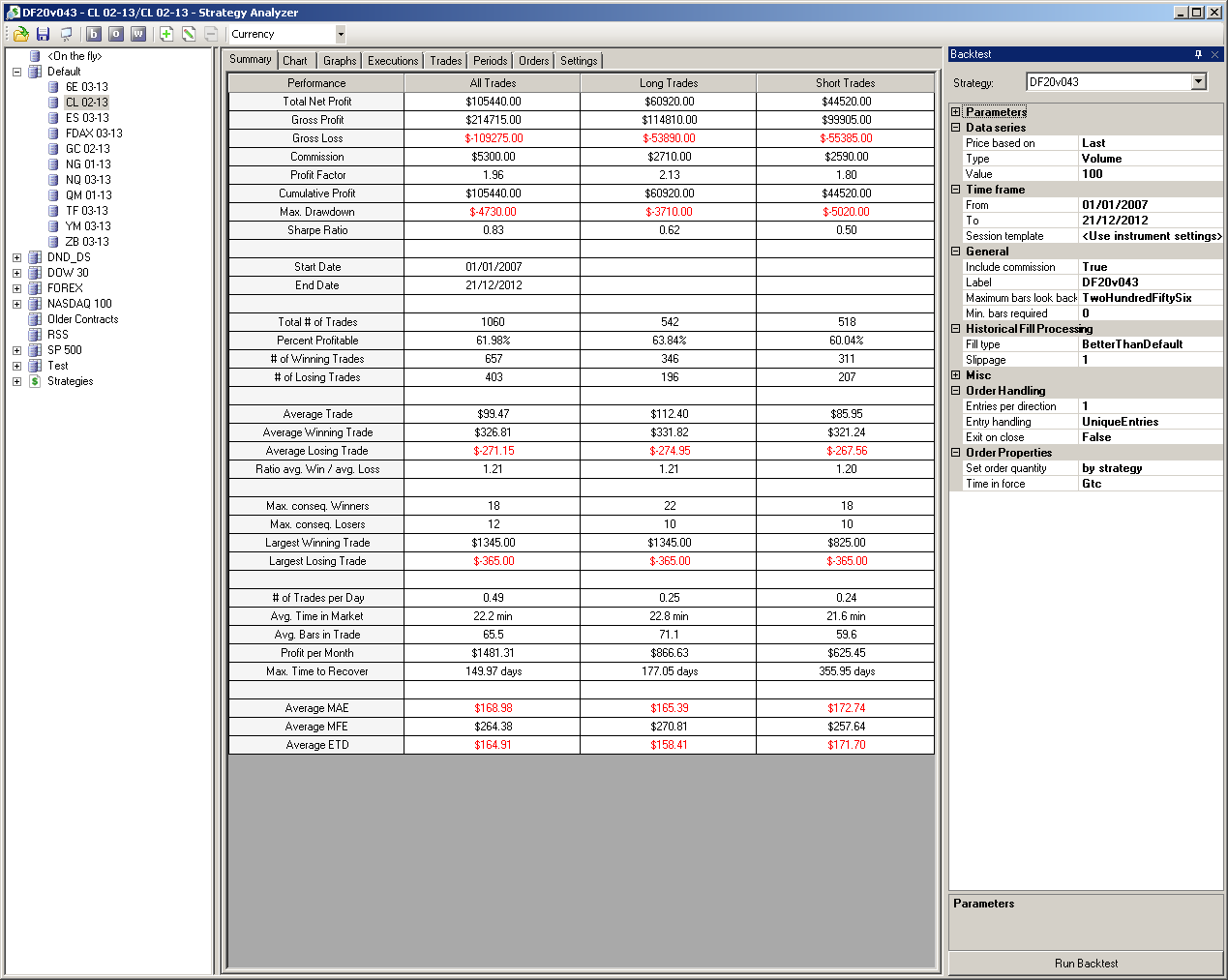

Reversal system, parameters config #3:

Reversal system, parameters config #1:

Reversal system, parameters config #2:

Reversal system, parameters config #3:

Forgot to mention, I am seriously considering leasing this system moving forward - on top of trading it. PM me if interested.

No trade on the last day of 2012, and no trade for the 3 trading days in 2013.

I am still investigating options to lease this system. I did poll 4 different forums (including MyPivots), and really didn't get a lot of answers. On top of that, public feedback re. Collective2 isn't much positive, between the technical issues & limitations, and the fees on both sides of the system - signal-sellers & subscribers.

I took a deep breath, and decided to compete in the 2013 World-Cup championship of trading ; I will use config#1 for that. I am in the final steps of opening the required account - will wire funds tomorrow. If all goes well, I should start trading for the World Cup sometime next week.

No pure R&D this week, but I am working at defining the best configuration for the reversal system on ES ... at this point, I am not at a place I would like to trade it - but I am not done with this just yet (current best P&L on 2004..2012 ~45,000 for ~350 trades - 2 contracts, max DD ~ -6,500, good results in 2007, 2008 & 2011, decent results in 2009, 2010, 1/2 decent in 2005, the other years about BE, P/F ~1.6). The most annoying part for me is the very low number of trades ... the good news is, it is doing very well in the high volatility years, OK in the mid-volatility years, and isn't harmful in the low volatility years.

Next week I will finish with ES, and see what I can do with it on 6E.

Have a great week-end!

Dom, wish you all the best at the World Cup.

When I first read about your intention about the thread on leasing, I was skeptical. But afterwards, I tried to go through most of your posts on this thread (I used to peak at some of these posts once in a while - but after sometime, I lost track about what you were doing) and am impressed with your methodical attempt to automate your strategies.

I did even stumble into your posts on NT support forum (now how did I figure out that those posts were yours?...same username!) and did see your efforts from a coding perspective.

Once again, best wishes and do inform us here about how your performance at the World Cup goes.

When I first read about your intention about the thread on leasing, I was skeptical. But afterwards, I tried to go through most of your posts on this thread (I used to peak at some of these posts once in a while - but after sometime, I lost track about what you were doing) and am impressed with your methodical attempt to automate your strategies.

I did even stumble into your posts on NT support forum (now how did I figure out that those posts were yours?...same username!) and did see your efforts from a coding perspective.

Once again, best wishes and do inform us here about how your performance at the World Cup goes.

Dom that equity curve looks too good to be true so I'd be scared but hope it trades like that in real time....what became of your trading contest...? how did Chuck Huges do ? He wants me to spend almost 4 k on options recomendations

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.