Dom's notes

Despite having been hammered for posting my sincere feedback re. ATW in the appropriate thread (or may-be, because of ...) I am starting this thread for the benefit of all waanabee traders.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

- Reversal system: 2 wins / 1 loss ; net -80 ... to bad that loss incurred a total of 8 ticks slippage on the stop (3-t & 5-t), else the week would be really break-even (not that it is that good either)

- Other system : 1 win / 1 loss ; net +350

I got a number of datafeed disconnect specific to my Kinetick datafeed during that 1 win of the other system, all was behaving well (reversal chart did reload each time while the other chart was patiently waiting), then all of a sudden the strategy disappears ... WTF ??? It turns out that Ninja disabled the strategy after 4 connection-loss in 5 minutes ... I changed those params to 60 / 60 & finished managing the trade manually through TWS (really manually ... I restarted the strategy but it immediately cancelled the exit OCO pair, which I had to manually re-input in TWS).

Pretty frustrating week on the R&D front ... 1st, I discovered that RTH trading volume only moved to CL Globex (electronic) starting late 2006 (I'd say from Jan-2007, as it pretty much doubled from Oct-Dec 2006 to January 2007) ... which means any intraday volume-based strategy can only be backtested from Jan-2007. Then, the backtesting of my other system (1-min based) did show the market inefficiency it is based upon started July-2007. 5 years is pretty long for a market inefficiency to remain, certainly this year is showing signs of vanishing.

Finally, the backtesting of the reversal system on the period July-2007 to October-2009 does show that in its current implementation, the system is unable to cope with the high volatility experienced from March-2008 to March-2009 (ATR was ranging from 3pt to 6p during that period). There is a lot for me to analyze, approx. 600 trades ...

- Other system : 1 win / 1 loss ; net +350

I got a number of datafeed disconnect specific to my Kinetick datafeed during that 1 win of the other system, all was behaving well (reversal chart did reload each time while the other chart was patiently waiting), then all of a sudden the strategy disappears ... WTF ??? It turns out that Ninja disabled the strategy after 4 connection-loss in 5 minutes ... I changed those params to 60 / 60 & finished managing the trade manually through TWS (really manually ... I restarted the strategy but it immediately cancelled the exit OCO pair, which I had to manually re-input in TWS).

Pretty frustrating week on the R&D front ... 1st, I discovered that RTH trading volume only moved to CL Globex (electronic) starting late 2006 (I'd say from Jan-2007, as it pretty much doubled from Oct-Dec 2006 to January 2007) ... which means any intraday volume-based strategy can only be backtested from Jan-2007. Then, the backtesting of my other system (1-min based) did show the market inefficiency it is based upon started July-2007. 5 years is pretty long for a market inefficiency to remain, certainly this year is showing signs of vanishing.

Finally, the backtesting of the reversal system on the period July-2007 to October-2009 does show that in its current implementation, the system is unable to cope with the high volatility experienced from March-2008 to March-2009 (ATR was ranging from 3pt to 6p during that period). There is a lot for me to analyze, approx. 600 trades ...

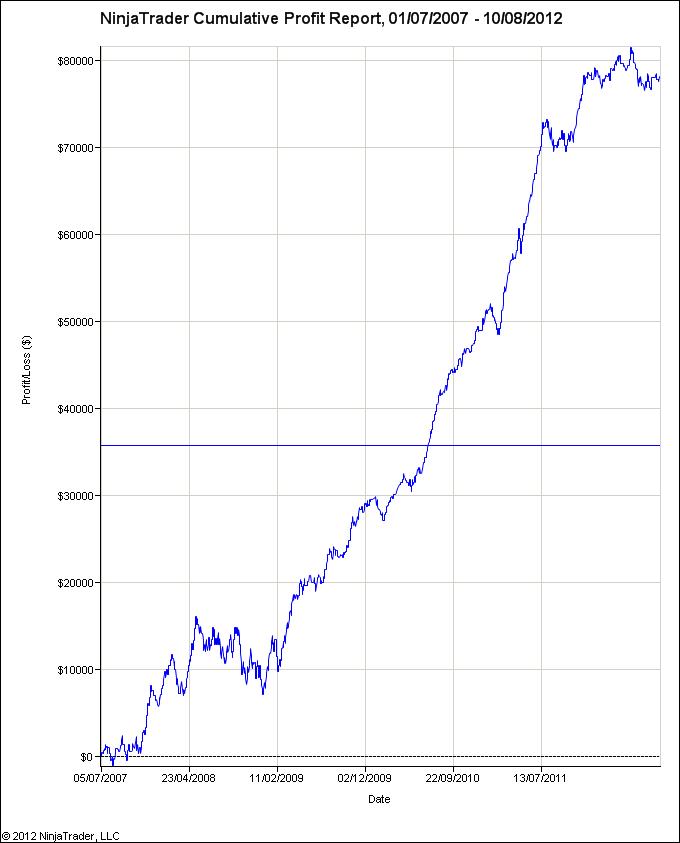

My other system backtesting P&L graph, July-2007 to today (821 trades)

Looks pretty good for a P/F of only 1.49, doesn't it ?

Looks pretty good for a P/F of only 1.49, doesn't it ?

- Reversal system: 1 win ; net +280

- Other system: 2 (small) wins / 1 loss ; net -15

I generated 30 CRs (change request) for the reversal system, going through most of the "dark hours" of that system from 2007 to 2009. Only addressed 1 so far, which I closed / discard. To be honest, I am sick of it, and I get easily distracted into doing other things.

Have a good week-end!

- Reversal system : 1 BE ; net -10 (loss on 2nd contract = win on 1st contract)

- Other system : 1 (small) win / 2 losses ; net -725. This system is struggling since beginning of May.

I did work a few CRs on the reversal system this week, in Trade Management & Entry Filters. One improvement in the algo for initial stop did yield a significant improvement in the 2007-2009 period, and a couple hundred bucks more (!) on 2010-2012. One "whipsaw" filter on Wednesdays 10:30am Inventories Report did also yield a significant improvement in the 2007-2009 period, although it has a small impact on 2010-2012. I did ran out of "easy" CRs, the next 3 are in the pivots subsystem, which is a much more complex piece of code, then I have a couple dozen in the reversal pattern subsystem...

Have a great week-end!

- Reversal system: missed 3 trades by a 1 or 2 ticks early in the week :(

- Other system: 2 wins / 1 BE ; net +665

1 of the Pivots CRs turned out to be a bad idea, the other one, although making sense, only produces a marginal improvement under very restrictive conditions (the idea was, that a new pivot cannot be made in a 1min inside-bar that immediately follows the 1min bar which created the most recent pivot). I left alone the 3rd CR, and decided to work on something that I saw a couple days ago re. the reversal pattern. My 1st task was to get a static view of the system performance for a particular parameter (total volume on the reversal leg), and it appears that there is a better setting for that parameter, which I couldn't see really on 2010-2012 because on that period there is a clear performance plateau, and I had chosen the value corresponding to max. number of trades - but on 2008-2009, the right side of the plateau makes a lot of difference, so this is the new reference value for that parameter. But that didn't address at all what I had seen, which will have to wait until next week because I have a busy long week-end filled with non-trading stuff!

Happy labor-day week-end to all!

- Reversal system: no trade this week; missed 2 big wins on Thursday for similar reasons (ABC pullback, the system cancels after confirmed A).

- Other system: 3 losses ; net -1205 for the week.

On the R&D front, no major progress, a couple minor improvements, a lot of frustration.

- Reversal system: 1 (small) win / 1 loss : net -360 ... quite upset there were 6 setups with no-entry this week.

- Other system: 3 wins ; net +1215

Out of last week's frustration + some time off over the week-end came a better analysis and a very nice improvement on the reversal system's performance on 2007-2009, followed by 2 others decent performance improvements on the same period (it is almost scary, as it clearly shows price-action changed a lot between 2007-2009 & 2010-2012, and how easily this system (any system ?) can be defeated when markets change).

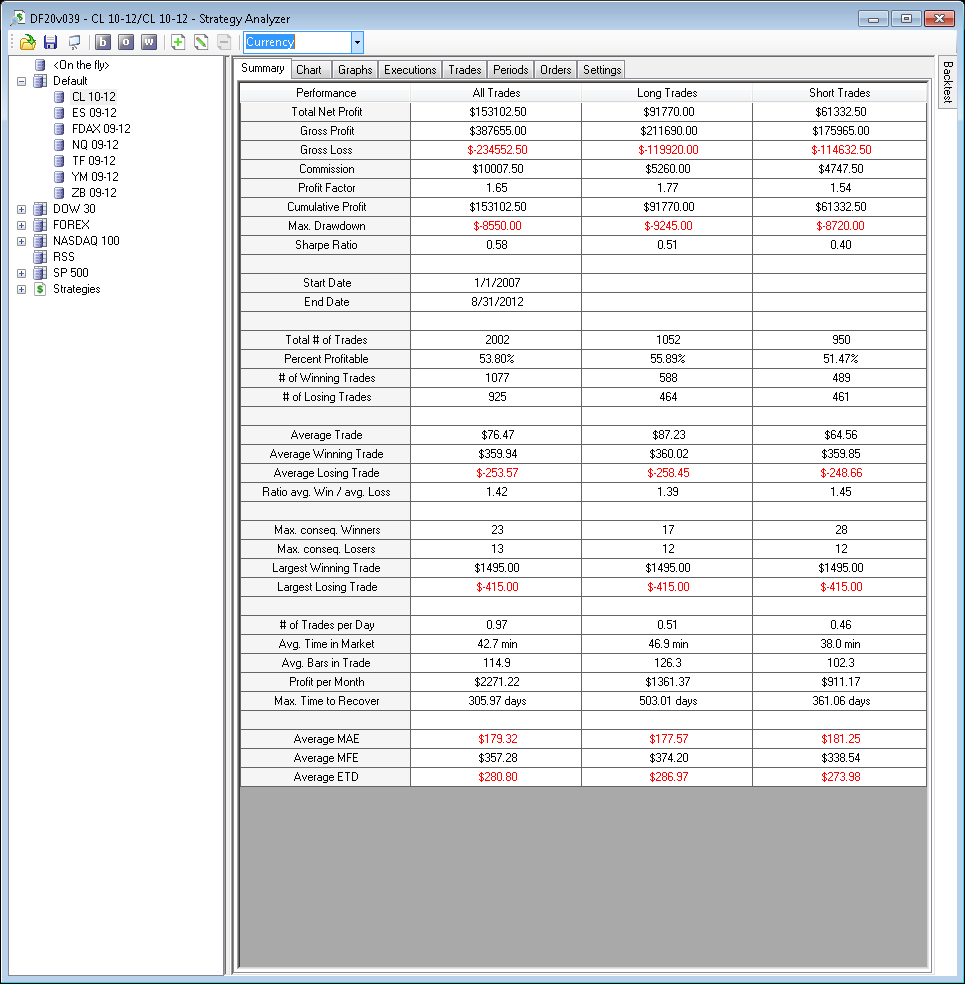

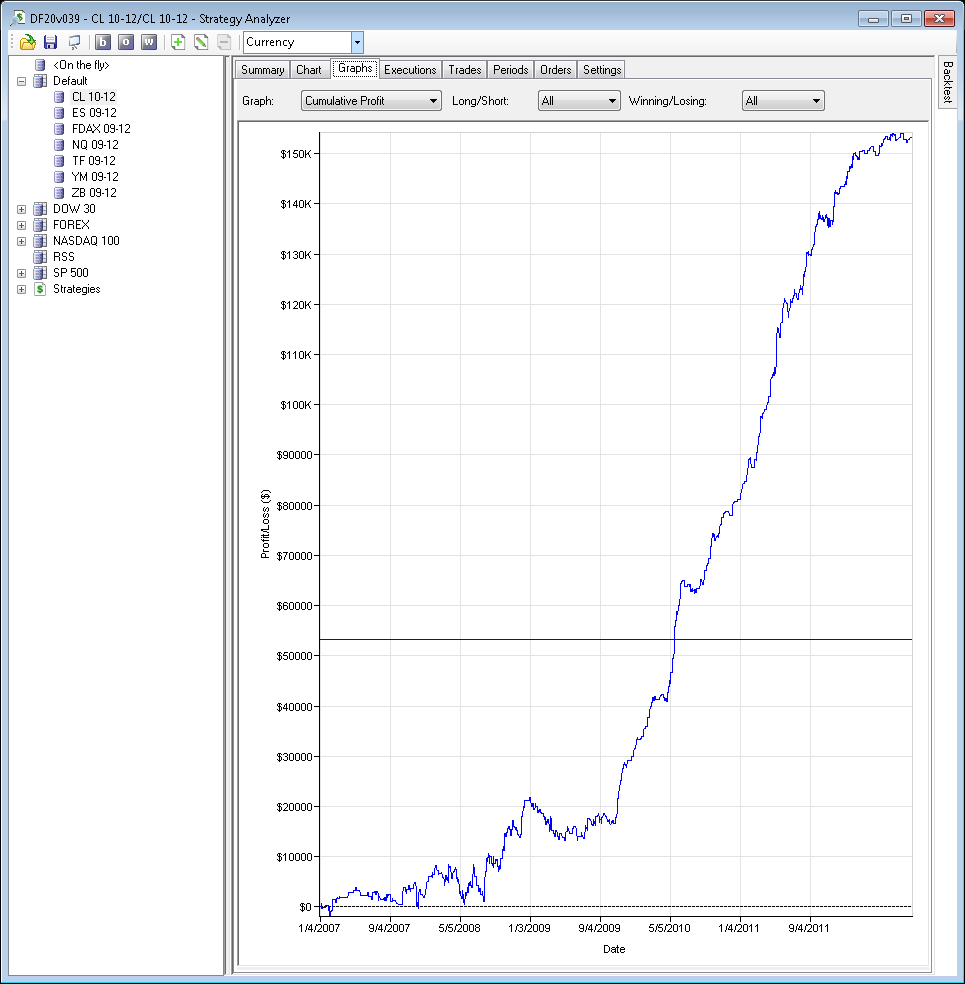

1/1/2007 .. 8/31/2012 current performance view of reversal system:

(divide #trades by 2, as each trade has 2 targets which are counted as separate trades by Ninja)

This week I also started to evaluate using for my live trading a virtual machine hosted in a remote data-center ... passed step #1 (backtesting my systems OK on Windows7/64 & Ninja/64), step #2 planned early next week (quick verification of Ninja/TWS interworking using my IB demo account & a HF test strategy), step#3 hopefully to follow (live trading).

Have a great week-end

- Other system: 3 wins ; net +1215

Out of last week's frustration + some time off over the week-end came a better analysis and a very nice improvement on the reversal system's performance on 2007-2009, followed by 2 others decent performance improvements on the same period (it is almost scary, as it clearly shows price-action changed a lot between 2007-2009 & 2010-2012, and how easily this system (any system ?) can be defeated when markets change).

1/1/2007 .. 8/31/2012 current performance view of reversal system:

(divide #trades by 2, as each trade has 2 targets which are counted as separate trades by Ninja)

This week I also started to evaluate using for my live trading a virtual machine hosted in a remote data-center ... passed step #1 (backtesting my systems OK on Windows7/64 & Ninja/64), step #2 planned early next week (quick verification of Ninja/TWS interworking using my IB demo account & a HF test strategy), step#3 hopefully to follow (live trading).

Have a great week-end

A pretty frustrating week:

- Reversal system : 1 loss (-490) too bad this trade would have been filtered if my latest software version had already been in production, but I had hold-off for whatever reason (really, I was busy doing other things). So I turned the new version to production status the next day.

- Other system: gave it all back & then some: 3 losses / 1 BE ; net -1560

No progress on the evaluation of the hosted virtual machine, was too busy doing other things, too.

Spent the entire week starting development on a new system. Anticipating to spend a few months on this. Since I am doing this in collaboration with another trader, and under NDA, I won't be discussing this moving forward.

Another frustrating week:

- Reversal system: 2 losses ; 1 missed win for technical reasons ; net -1360 (should have been -930 for the week)

- Other system: 2 wins (1 tiny) / 1 loss / 1 BE : net +350

Missed a win for the reversal system on Tuesday morning on the remote VM ... I had it running standalone overnight (no remote access session), and in the morning I ended-up reconnecting at 9:20am ... only to find a short that should have been entered 15min ago, but was filtered because the mechanism I use to reload data + restart strategy on a data/order-feed loss/recovery requires an end-user session to be opened (and so, the system did filter the trade as the chart was still waiting for a reload :(

Of course I contacted Ninja support to re-ask for a software way of triggering the chart reload (currently only available through a keystroke sequence), and of course in the end (that is, after explaining in details to Brett - the lead-support guy - why Ninja's current behavior needs to be supplemented by proper error-handling) there was no solution offered whatsoever.

I HATE NINJA'S LACK OF SUPPORT TO AUTOMATED TRADERS WAY MORE THAN I HATE THE PRODUCT IN ITSELF.

Anyway, after a few hours of investigating possible workarounds, it became clear that the only workaround in that matter is to use 2 (two) VMs ... one for trading, and one to maintain a 24/7 remote session open into the trading VM. The person offering this VM service was of a huge support again here, before the end of the day he had a 2nd VM tailored for that 24/7 remote access function configured and ready to use, since then I have been using that double VM setup and it works perfectly (the response time of the UI is of course degraded a bit, but given I only need to use it once a day to keep alive my TWS connections it doesn't bother me at all).

At this point, I have to be fair and acknowledge that I missed that win because I had not tested that error handling before using it live.

September ended-up just as bad (-3400) as July had been good (+3380) ... It could have been about 900 better than this, but anyway it was a tough month.

R&D ... I only worked on that new system this week ... some nice progress, but all in all I still have a long way to go on this one!

Not a lot of trading action last week:

- Reversal system: no trade

- Other system: 1 win / 1 BE ; net +400 for the week.

The VM real-time "testing" (live trading) has been working perfectly since the double VM config was put in place. I even managed to take a 3 days week-end away for this Canada's Thanksgiving, restarting my systems on Sunday afternoon from my hotel room, and coming back home on Monday evening to find a small win for the other system.

Dom that equity curve looks too good to be true so I'd be scared but hope it trades like that in real time....what became of your trading contest...? how did Chuck Huges do ? He wants me to spend almost 4 k on options recomendations

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.