ES Day Trading 5-25-2011

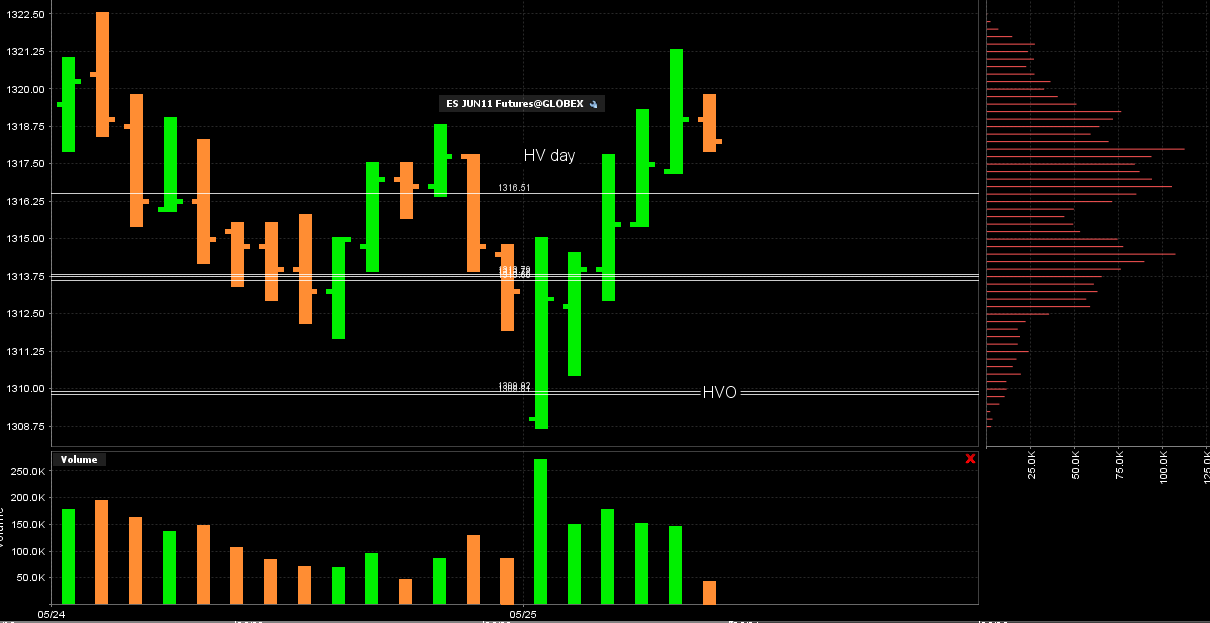

Two vprofiles on this chart. Last weeks and the developing one for this week. Tight range so far this week and the bell curve shaped profile signaling a fight between bulls and bears. Interesting to note VPOC is below last weeks range.

watching for the previous low test,,,good time for that and also consolidations...peak volume is at 16.75 and my major target..

Thank you , Rami... I hope these charts help someone.

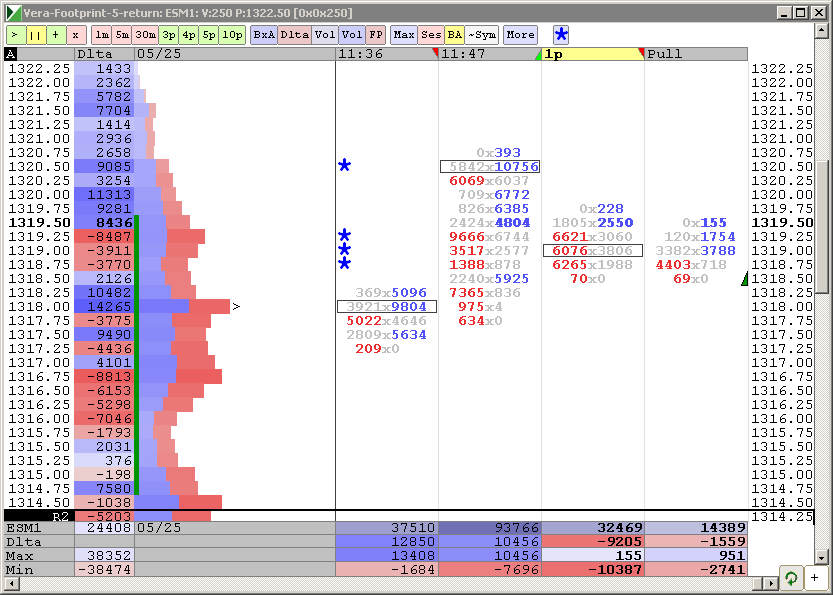

This is not a CQG, however, this is Market Delta software

SHORT FROM 1320.50...

update to the pattern...volume trying to build at 1318 is a concern as that is swing high from yesterday afternoon...need to get a 30 minute close under there

My target on this short is 1316.75 (minimum) but i'll likely exit at 1317.50, taking the money and run!

Out conservatively at 1317.50 from 1320.50... having a very good day... Hpefully you remebered that 1320.50 projection from yesterday... Time for lunch... good luck gang!

I mentioned this in a few private emails but most don't know that I use a matrix to determine how agressive or not I am at particular entry points. This is important to me because I can qualify my trades based on OVERALL risk tolerance.

While I'm not planning to share the specifics with the forum it is based on my account size and also how much pain ( how big of a loss ) I can tolerate per trading campaign. I also qualify entries with the key areas as mentioned here on the forum so many times. Previous highs and lows, 60 minute, 90 minute, overnight ranges etc.

For me the dollar amount will usually fall in the $2500 - $3200 range as I know I can still keep my head straight on the days where this maximum loss is hit early in the day. Most losses are very far below this level. This is a maximum and will get hit the most when I add a second or third time. This shows me I am on the wrong side. It protects my fragile trading ego and my account from serious damage.

What I do is that I will work it backwards. I knew today that I would want to try shorts from above the 18.75 so that is my MAIN key area. I also had sub areas like the 1314 - 1316 zone. So I will often start too early and have a good feel that I will need to add to a trade based on my matrix and the particular trade setup. So I will go "light" up front and heavier on the back. Classic Martingale stuff with the key being that I have an uncle point and stick to it

For today, I "KNOW" that we don't often get OVB's to the upside ..I KNOW that single prints in range fill in quite often. I KNOW that they test previous 30 minute bar lows.....but the most important thing that I KNOW is that I REALLY REALLY KNOW HOW TO TAKE A LOSS

Now to lighten up this post....we need to have that "Uncle" point so we can keep it together to take further trades. If LORN decides to keep buying and we get that OUTSIDE VERTICAL BAR ( OVB) to the upside then I need to get out.....and let him sit back and count his money at my expense. He knows I'm just busting on him.....I hope..

I'm lighting up this trade at 1317.25 ..that is what I do at add ons.

Then try to hold a small piece. One of the reasons I don't share my matrix is that it has taken me a lot of hard work and it is really so specific to ones risk tolerance. It wouldn't be much use to most as you don't have my trading personality.

I highly suggest adding to trades unless you have perfect entries and timing. If you don't have discipline than stay far away from trade add on's. It will crush you! I've been crushed like most and it's a horrible feeling.

While I'm not planning to share the specifics with the forum it is based on my account size and also how much pain ( how big of a loss ) I can tolerate per trading campaign. I also qualify entries with the key areas as mentioned here on the forum so many times. Previous highs and lows, 60 minute, 90 minute, overnight ranges etc.

For me the dollar amount will usually fall in the $2500 - $3200 range as I know I can still keep my head straight on the days where this maximum loss is hit early in the day. Most losses are very far below this level. This is a maximum and will get hit the most when I add a second or third time. This shows me I am on the wrong side. It protects my fragile trading ego and my account from serious damage.

What I do is that I will work it backwards. I knew today that I would want to try shorts from above the 18.75 so that is my MAIN key area. I also had sub areas like the 1314 - 1316 zone. So I will often start too early and have a good feel that I will need to add to a trade based on my matrix and the particular trade setup. So I will go "light" up front and heavier on the back. Classic Martingale stuff with the key being that I have an uncle point and stick to it

For today, I "KNOW" that we don't often get OVB's to the upside ..I KNOW that single prints in range fill in quite often. I KNOW that they test previous 30 minute bar lows.....but the most important thing that I KNOW is that I REALLY REALLY KNOW HOW TO TAKE A LOSS

Now to lighten up this post....we need to have that "Uncle" point so we can keep it together to take further trades. If LORN decides to keep buying and we get that OUTSIDE VERTICAL BAR ( OVB) to the upside then I need to get out.....and let him sit back and count his money at my expense. He knows I'm just busting on him.....I hope..

I'm lighting up this trade at 1317.25 ..that is what I do at add ons.

Then try to hold a small piece. One of the reasons I don't share my matrix is that it has taken me a lot of hard work and it is really so specific to ones risk tolerance. It wouldn't be much use to most as you don't have my trading personality.

I highly suggest adding to trades unless you have perfect entries and timing. If you don't have discipline than stay far away from trade add on's. It will crush you! I've been crushed like most and it's a horrible feeling.

Curious if those air pockets at 1315.25 and 1312.75 is still in contention? Plus I just noticed triples at 7:15am not filled.

Am I seeing correctly? Concerns? Or other instance void these?

just a heads up.

Am I seeing correctly? Concerns? Or other instance void these?

just a heads up.

There's divergence in this market. This is a 5 min (daily numbers: 1 SMA, 3 typical SMA, & 8 EMA. The 8's leveling off and the 1 and 3 are trying to drive prices lower. Some heavy chop swings coming down the pike.

Chop I says. 12, 16, 21, 35, 43 I says.

Chop I says. 12, 16, 21, 35, 43 I says.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.