CME Euro FX Futures 6E

Red, sorry ,i was already asleep when you posted!.. I haven't had much time to look at it, but the daily chart indicates 1.3826 coming. Cycles are not very clear.... here's a real short term peak (10 min chart).. id be buying anywhere around the lower prc band...

Red / Joe or other... just curious how you break up the trading hours for 6e, between Globex session, Europe and US session. and Open / Close...

Curious, as I have spent most of my time following ES, so just interested in feedback on session times...

Thanks..

Curious, as I have spent most of my time following ES, so just interested in feedback on session times...

Thanks..

Originally posted by Lorn

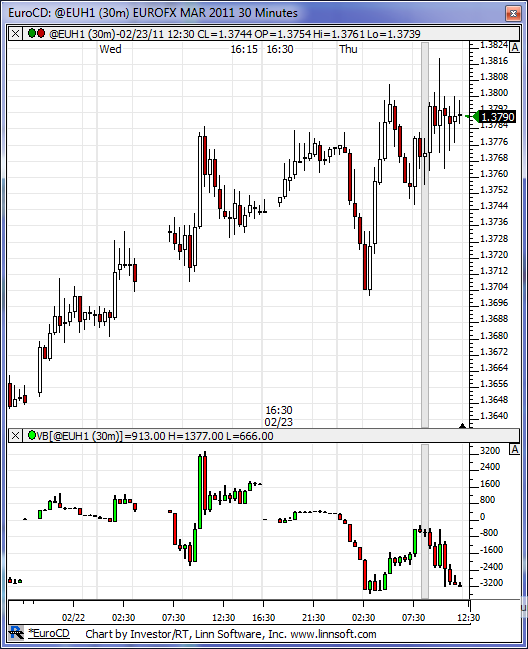

Red, here is a cumulative delta chart on the 6E set to 30 min time frame. Definitely showing selling pressure but prices not budging.

==================================================================

Thanks for the chart Lorn .. that 1.3781 is a tough nut

to crack .. 6e is in between a rock and a hard place

right now .. LOL ..

Originally posted by chrisp

Red / Joe or other... just curious how you break up the trading hours for 6e, between Globex session, Europe and US session. and Open / Close...

Curious, as I have spent most of my time following ES, so just interested in feedback on session times...

Thanks..

======================================================================

This should help:

http://www.cmegroup.com/trading/fx/g10/euro-fx_contract_specifications.html

Here's the sessions for FX...

Sydney 5:00pm-2:00am

Tokyo 7:00pm-4:00am

London 3:00am-11:00am

New York 8:00-5:00

Sydney 5:00pm-2:00am

Tokyo 7:00pm-4:00am

London 3:00am-11:00am

New York 8:00-5:00

Red

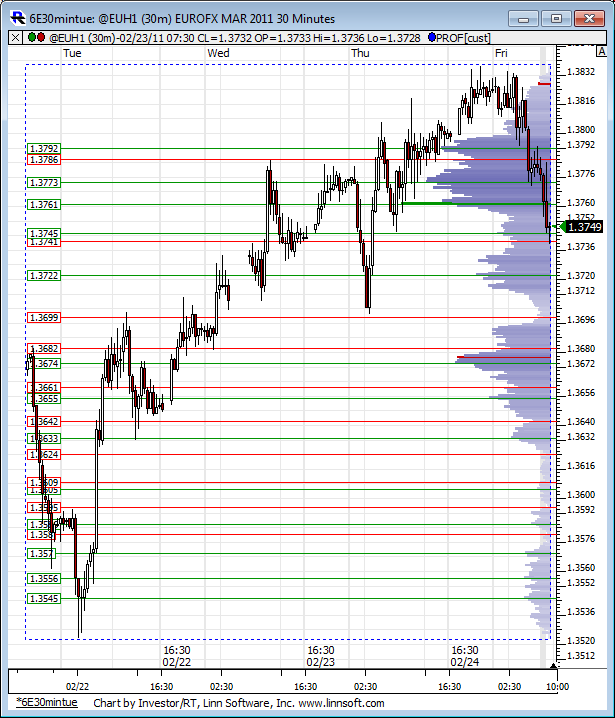

Don't know where the 6e bounced, but the spot bounced 3775 thats exact PP. A bit of hind sight never hurt fwiw

Don't know where the 6e bounced, but the spot bounced 3775 thats exact PP. A bit of hind sight never hurt fwiw

3730 is S1 should provide a couple low risk scalps

We are below yesterdays 50% mark, so 3765 should be a good short scalp.

A little resistance at the 1min mid line bollinger bands knocking it back down.

- Page(s):

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

At $85 billion/month, it cost Bernanke a little over $1 million for each job created last month. Well done, professor. -Tim Knight

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.