ES Short term 12/07/10

I'm looking for 1231.00 as the objective and possibly higher.

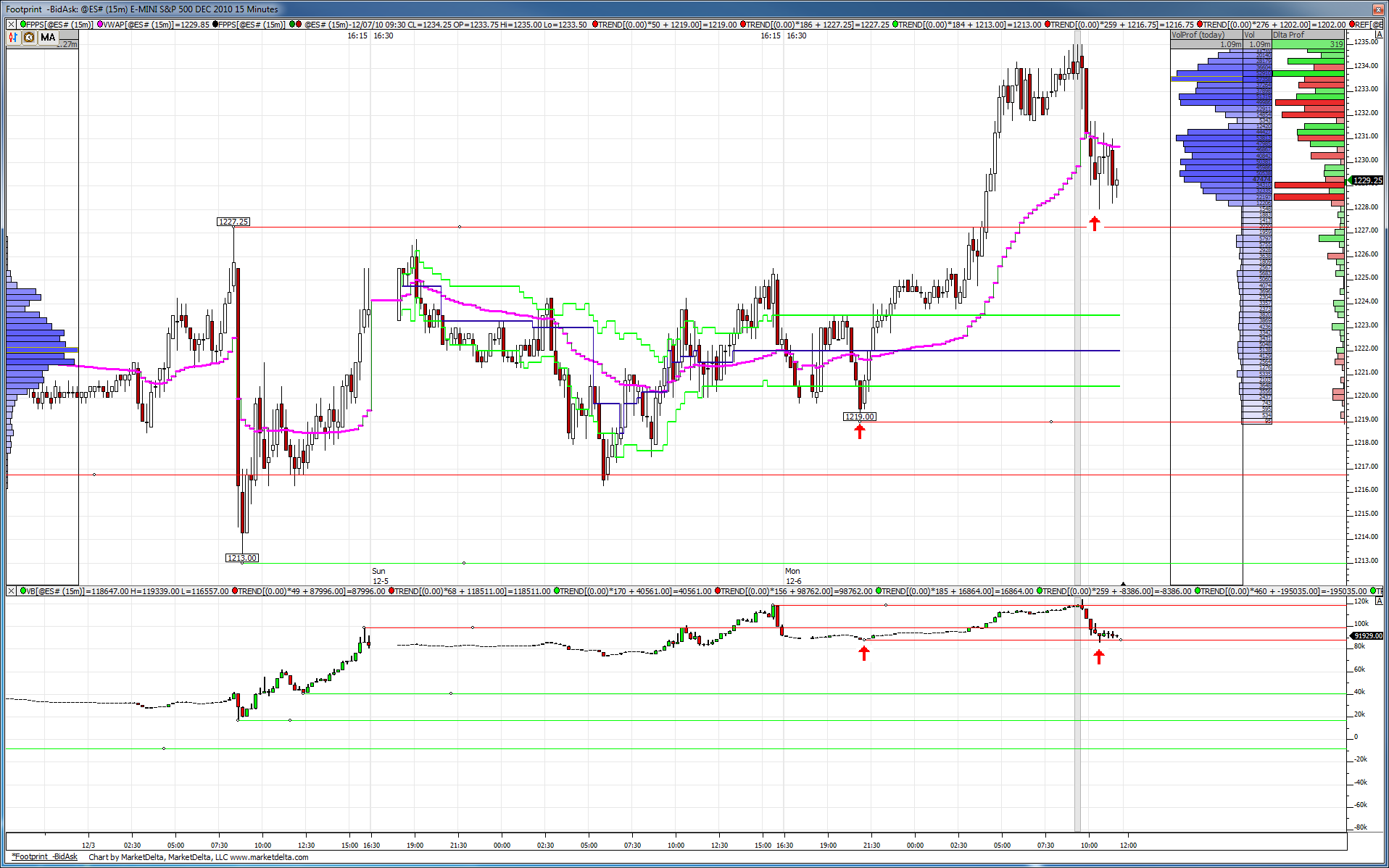

So far, tonight, the ES moved down to 1219.00. The MdP is at 1219.25, ES found support and bounced back.

ES now trading at 1223.25

I think that it will need to open gap up and above the 1226.00 resistance. 1226/1227 is a strong resistance, add R1 at 1227.00 and we have a nice SR to play from.

Moving below 1216.00 will void the above.

Will see, and as always; the market has the last word and in due time will show me the way.

So far, tonight, the ES moved down to 1219.00. The MdP is at 1219.25, ES found support and bounced back.

ES now trading at 1223.25

I think that it will need to open gap up and above the 1226.00 resistance. 1226/1227 is a strong resistance, add R1 at 1227.00 and we have a nice SR to play from.

Moving below 1216.00 will void the above.

Will see, and as always; the market has the last word and in due time will show me the way.

In terms of cumulative delta I've marked with red arrows showing how the buying from the 1219 O/N low has been completely wiped out in terms of CD.

What could this be suggesting? Selling pressure from the open neutralized the buying pressure of O/N so where we go from here will signify potential new volume...

What could this be suggesting? Selling pressure from the open neutralized the buying pressure of O/N so where we go from here will signify potential new volume...

so price is higher with lower delta readings and this seems to imply that buyers aren't here...so we need this thing to crack....down and now....!!

from a sructural standpoint all fades to take long are harder for two main reasons....we have an open drive ( open got tested and held) and we broke the IB low....best to find a way to get on board short as the only good targets are really 30.50 and 31.50 IF you are agressive to try longs...we also haven't had any 50% test of developing range yet today....

so last weeks highs and Friday O/N high is critical for bears to snap otherwsie we just chop between these curret lows and the volume at 30.50

so last weeks highs and Friday O/N high is critical for bears to snap otherwsie we just chop between these curret lows and the volume at 30.50

Lorn..what would u need to see per CD that would make you think new highs for the day are coming...? I know we can see volume on a regular chart but what might be the tip off on a CD chart if any...

I know u haven't said new highs are coming but lets just suppose for a minute....

I know u haven't said new highs are coming but lets just suppose for a minute....

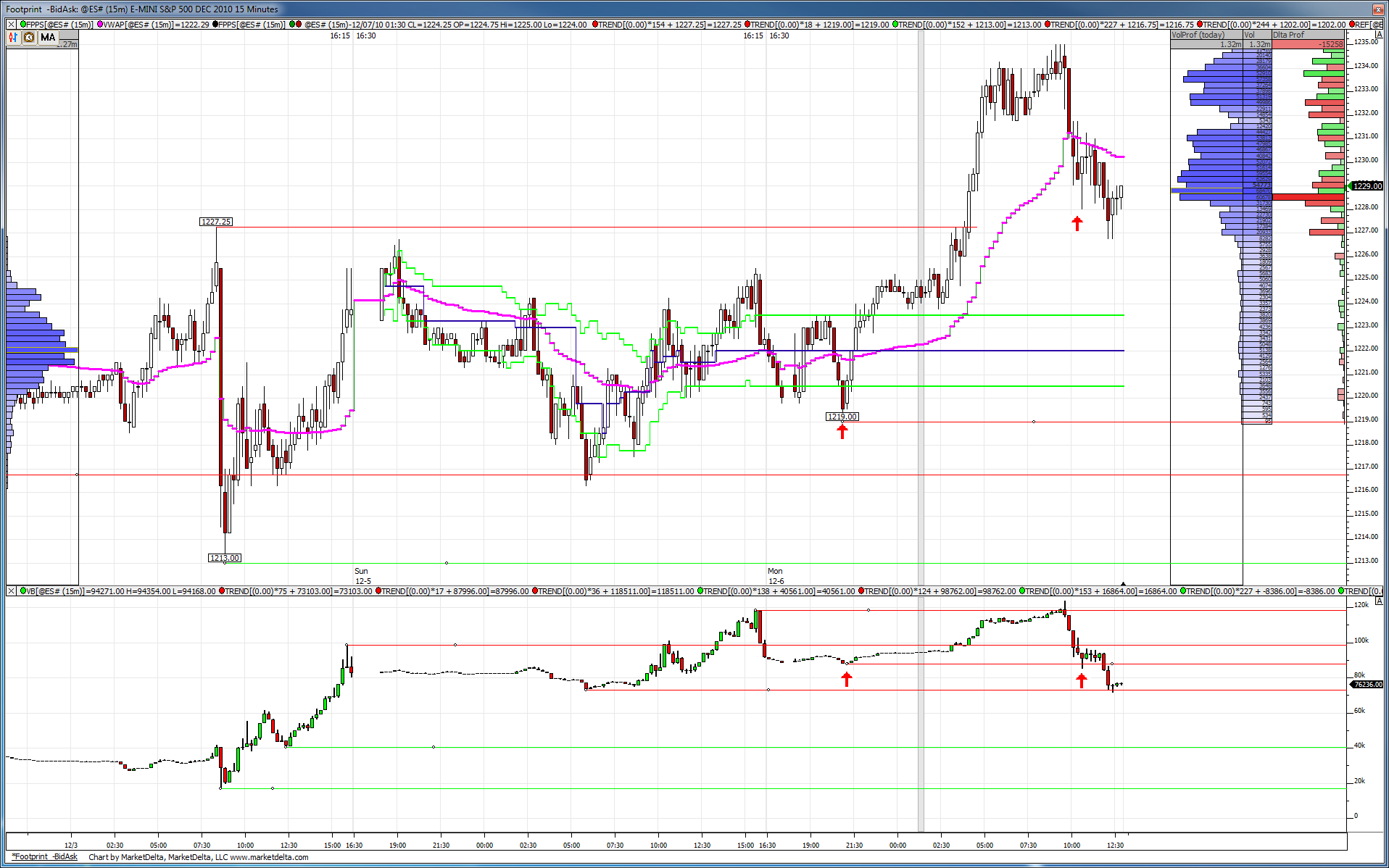

Great question. CD would need to get back above the level it set at the O/N low of 1219 and also price would need to get back above VWAP to show volume is coming in on the buy side.

Originally posted by BruceM

Lorn..what would u need to see per CD that would make you think new highs for the day are coming...? I know we can see volume on a regular chart but what might be the tip off on a CD chart if any...

I know u haven't said new highs are coming but lets just suppose for a minute....

Interesting we have trips right on 1226.75 which I show as a HVN from the O/N session.

Whats your take on that Bruce?

Whats your take on that Bruce?

So you can see here where I put the down arrow, cum delta wasn't able to get back up over that morning bottom zone as prices rallied. This shows the sellers who sold at 34-35 were still holding and not covering.

Sorry Lorn, I left for the day so missed all this but here is a chart and some thoughts of what I think I would have done. Without actually trading it , it's hard to actually say what I would have been thinking in the line of fire of daytrading but I think this is it.

In general I donot like to trade for triples near the lows or highs of the day but yesterday I think I would have taken a shot at those on the lows as long as we didn't get too far above that 30.50 number I was watching. It would have made sense given the context of opening at the highs and then testing that open print with that Green up bar on my chart and then we rolled over down. We also broke the hour low and we gapped higher. So with that context I would have taken a shot at the short and would have lost when we got above 30.50 and consolidated up there.

The better trade was obviously going for those second set of triples that formed inside the hour range later in the day at about 2:15 as long as we didn't trade back above the open print. Runners would have probably gotten the new lows too....and broke the triples you mentioned......but if ya aint here to trade then this is all speculation of what I think I would have done... hope that helps as that would have been my thought process..

In general I donot like to trade for triples near the lows or highs of the day but yesterday I think I would have taken a shot at those on the lows as long as we didn't get too far above that 30.50 number I was watching. It would have made sense given the context of opening at the highs and then testing that open print with that Green up bar on my chart and then we rolled over down. We also broke the hour low and we gapped higher. So with that context I would have taken a shot at the short and would have lost when we got above 30.50 and consolidated up there.

The better trade was obviously going for those second set of triples that formed inside the hour range later in the day at about 2:15 as long as we didn't trade back above the open print. Runners would have probably gotten the new lows too....and broke the triples you mentioned......but if ya aint here to trade then this is all speculation of what I think I would have done... hope that helps as that would have been my thought process..

Originally posted by Lorn

Interesting we have trips right on 1226.75 which I show as a HVN from the O/N session.

Whats your take on that Bruce?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.