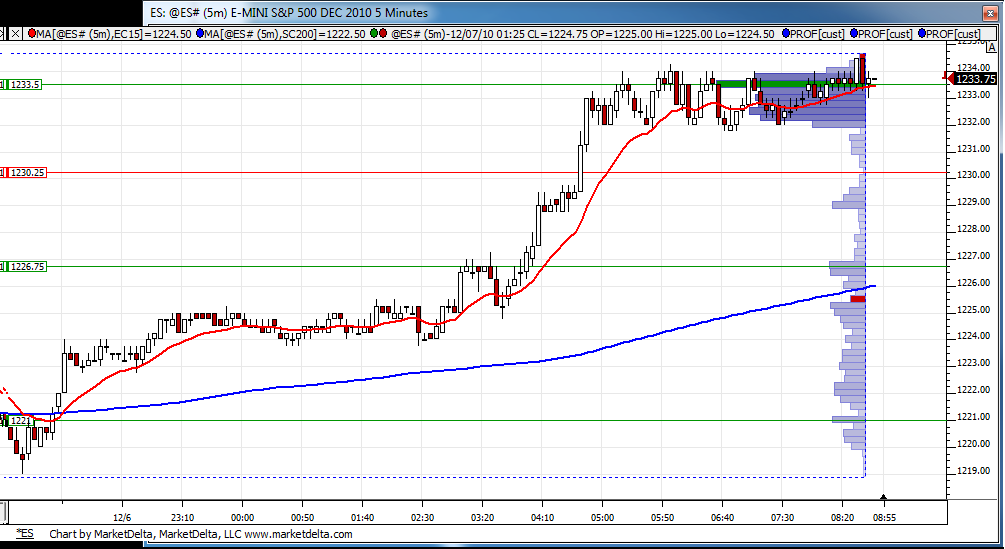

ES Short term 12/07/10

I'm looking for 1231.00 as the objective and possibly higher.

So far, tonight, the ES moved down to 1219.00. The MdP is at 1219.25, ES found support and bounced back.

ES now trading at 1223.25

I think that it will need to open gap up and above the 1226.00 resistance. 1226/1227 is a strong resistance, add R1 at 1227.00 and we have a nice SR to play from.

Moving below 1216.00 will void the above.

Will see, and as always; the market has the last word and in due time will show me the way.

So far, tonight, the ES moved down to 1219.00. The MdP is at 1219.25, ES found support and bounced back.

ES now trading at 1223.25

I think that it will need to open gap up and above the 1226.00 resistance. 1226/1227 is a strong resistance, add R1 at 1227.00 and we have a nice SR to play from.

Moving below 1216.00 will void the above.

Will see, and as always; the market has the last word and in due time will show me the way.

Nice call Ihunter...I had 31.25 on the radar as it is a Rat number but more important will be the 37.50 ...the split and Pauls double of Mondays range has hit too....

with no reports today it will be interesting to watch volume to see if our Fade mentality will serve us today

That volume spike in the O/N session created a gap at 1230.50 so any initial fades up here will need to watch that area first

with no reports today it will be interesting to watch volume to see if our Fade mentality will serve us today

That volume spike in the O/N session created a gap at 1230.50 so any initial fades up here will need to watch that area first

looking to start shorts above 33.75 in O/N session now...assuming lots of stops under 31.75 ...ON ledge and then the 30.50 gap...

now on 34.50 and very light.....short.....the overnight session is tricky for me.....Ideal short in RTH willbe closer to 37.50.....if it prints.....

we will need to put in a high to low day soon...not sure if that will be today.....no reports to goof me up today but news is out so lets see if RTH buyers enter at open

we will need to put in a high to low day soon...not sure if that will be today.....no reports to goof me up today but news is out so lets see if RTH buyers enter at open

one off at r2 -- 32.50...trying for that 30.50 if support fails here

gotta drive now...don't want ANOTHER open test !

took 30.50...last contract trying for 1/2 gap fill ...obvious concern is that voume that enetered at 30.50 area in ON

28.25 is final....out of ammo...otherwise I'd try to hold a bit more...we may still get complete gap fill if they resolve 25 - 27 area

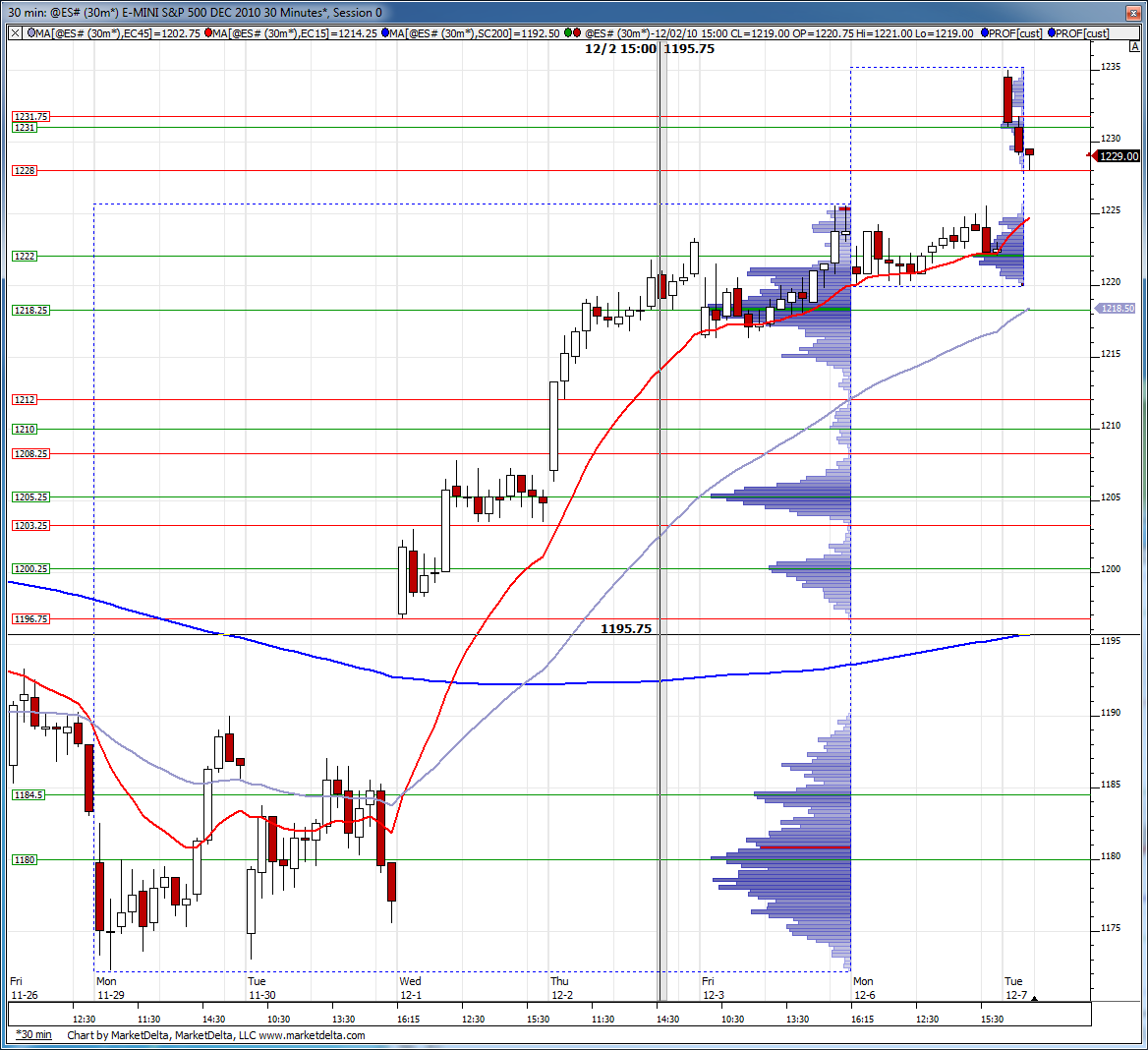

Here is the weekly developing profile and last weeks profile. Interesting how 1231 (HVN) and 1231.75 (LVN) are showing contrasting zones so close together.

Sorry Lorn, I left for the day so missed all this but here is a chart and some thoughts of what I think I would have done. Without actually trading it , it's hard to actually say what I would have been thinking in the line of fire of daytrading but I think this is it.

In general I donot like to trade for triples near the lows or highs of the day but yesterday I think I would have taken a shot at those on the lows as long as we didn't get too far above that 30.50 number I was watching. It would have made sense given the context of opening at the highs and then testing that open print with that Green up bar on my chart and then we rolled over down. We also broke the hour low and we gapped higher. So with that context I would have taken a shot at the short and would have lost when we got above 30.50 and consolidated up there.

The better trade was obviously going for those second set of triples that formed inside the hour range later in the day at about 2:15 as long as we didn't trade back above the open print. Runners would have probably gotten the new lows too....and broke the triples you mentioned......but if ya aint here to trade then this is all speculation of what I think I would have done... hope that helps as that would have been my thought process..

In general I donot like to trade for triples near the lows or highs of the day but yesterday I think I would have taken a shot at those on the lows as long as we didn't get too far above that 30.50 number I was watching. It would have made sense given the context of opening at the highs and then testing that open print with that Green up bar on my chart and then we rolled over down. We also broke the hour low and we gapped higher. So with that context I would have taken a shot at the short and would have lost when we got above 30.50 and consolidated up there.

The better trade was obviously going for those second set of triples that formed inside the hour range later in the day at about 2:15 as long as we didn't trade back above the open print. Runners would have probably gotten the new lows too....and broke the triples you mentioned......but if ya aint here to trade then this is all speculation of what I think I would have done... hope that helps as that would have been my thought process..

Originally posted by Lorn

Interesting we have trips right on 1226.75 which I show as a HVN from the O/N session.

Whats your take on that Bruce?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.