ES Short Term Trading 7-16-10

A Monkey’s Ramblings on a map to somewhere

*Red Lines are Price Action Support/Resistance lines

*Cyan Dashed Lines are Weekly Pivot lines

*Fib Retracement of 786 is shown with Green line(s)

*Yellow(ish) lines are a Pattern showing both a small ascending triangle BUT more importantly, some range contraction of sideways trading for a few days

*Volume bars are displayed as lighter Blue across the horizontal axis (overlapping some of the other components of the chart)

So, that’s the layout.

Yeppers, it’s option expiry Friday, which always can toss a monkey wrench into “normal” expectations.

1080-1100 seems to be a current significant range boundary. What’s more important to my view is, after a decent magnitude run up during the past week and a half or so, the market’s challenged and still challenging the 1100 price with daily bars of market contraction. This 1100 zone/level coincides not only with a PASR level I’ve got, but also with a 786 Fib retracement for those that follow fibs, and this Weekly R1 @ 1097. Daily R1 is 1101 for Friday fwiw.

After reviewing a bunch of individual stock charts, most of them are over extended to the long side or have a messy bullish pattern setup at best. Three that I ran across that looked only semi-decent were: AZO, NFLX and BIDU. The Russell-2000 was weaker than the other major indices for what it’s worth. As for volume, the rally’s been anemic as every dog and his brother has been intimating on their website and blogs. Don’t forget that we’re entering the Summer slow down though.

ES price is trading between the 50 and 200 sma and slightly above a down trend line (none of which are on the chart … it’s got more than enough lines and pretty colors to confuse me). So those “indicators” are mixed and messy.

Anyway, look to Bruce and Kool and others for intraday MP mapping etc. And hope this is helpful to some extent. Depending upon the overnight trading and the open, I'm looking at a potential straddle or strangle on the SPY.

*Red Lines are Price Action Support/Resistance lines

*Cyan Dashed Lines are Weekly Pivot lines

*Fib Retracement of 786 is shown with Green line(s)

*Yellow(ish) lines are a Pattern showing both a small ascending triangle BUT more importantly, some range contraction of sideways trading for a few days

*Volume bars are displayed as lighter Blue across the horizontal axis (overlapping some of the other components of the chart)

So, that’s the layout.

Yeppers, it’s option expiry Friday, which always can toss a monkey wrench into “normal” expectations.

1080-1100 seems to be a current significant range boundary. What’s more important to my view is, after a decent magnitude run up during the past week and a half or so, the market’s challenged and still challenging the 1100 price with daily bars of market contraction. This 1100 zone/level coincides not only with a PASR level I’ve got, but also with a 786 Fib retracement for those that follow fibs, and this Weekly R1 @ 1097. Daily R1 is 1101 for Friday fwiw.

After reviewing a bunch of individual stock charts, most of them are over extended to the long side or have a messy bullish pattern setup at best. Three that I ran across that looked only semi-decent were: AZO, NFLX and BIDU. The Russell-2000 was weaker than the other major indices for what it’s worth. As for volume, the rally’s been anemic as every dog and his brother has been intimating on their website and blogs. Don’t forget that we’re entering the Summer slow down though.

ES price is trading between the 50 and 200 sma and slightly above a down trend line (none of which are on the chart … it’s got more than enough lines and pretty colors to confuse me). So those “indicators” are mixed and messy.

Anyway, look to Bruce and Kool and others for intraday MP mapping etc. And hope this is helpful to some extent. Depending upon the overnight trading and the open, I'm looking at a potential straddle or strangle on the SPY.

Phileo,

What a great trade you had!. Amazing! I have to say this is the best forum I ever found. I am a newbie and I am learned so much from you guys. Please keep posting. All of you guys are so smart!

What a great trade you had!. Amazing! I have to say this is the best forum I ever found. I am a newbie and I am learned so much from you guys. Please keep posting. All of you guys are so smart!

Originally posted by phileo

Originally posted by phileo

unless price can get above YDay's Lows, I'm going to call this a trend day down now.

NQ new lows

No long setups for me.

I shorted as soon as the econ numbers came out. shorted 1077.75.

stop 1075, target 1064

Originally posted by Piker

Originally posted by BruceM

hey Paul...that would be range air but not price overlap air as I define it....That 61 - 62 is a biggie but more important should be when we tradeback to 1039 - 1041.....that is thee key breakout for this upleg...

Hey BruceM or DayTrader,

The chart below was posted by DayTrader about a week ago, showing all the single prints that got left behind during the run up. According to the rules of MP, those are still valid correct?

Yes, they still are valid but after a "long period of time" their validity apparently wanes. I've never had "long period of time" defined for me and have never time tested this.

Long-term those get filled if I understand MP correctly.

Based on the empirical evidence that we have so far markets will always move upwards over the long-term. This will mean that the singles above us will always fill in over the long term. However, it is possible that there singles below us that will never be filled in again, at least not in our lifetimes.

Lorn,

Here is todays chart broken up into 60 minute market profile segments. The dotted black dashed line is the point of control and the red line is the peak volume price...you will note that both lines went lower with each next 60 minute time period...price was getting accepted at lower levels...the rare time the market popped up it stopped at a previous peak volume /poc line..

This is a well chosen example..but clearly we can see all the volume at the 73 - 74 area and those lines did not get challenged so that is a key Resitance price going forward....a work in progress..

Here is todays chart broken up into 60 minute market profile segments. The dotted black dashed line is the point of control and the red line is the peak volume price...you will note that both lines went lower with each next 60 minute time period...price was getting accepted at lower levels...the rare time the market popped up it stopped at a previous peak volume /poc line..

This is a well chosen example..but clearly we can see all the volume at the 73 - 74 area and those lines did not get challenged so that is a key Resitance price going forward....a work in progress..

Originally posted by Lorn

Bruce,

Can you explain what you mean by high volume nodes? Or is there somewhere on the site that goes over this? Or is this something you are in the early stages of developing?

Originally posted by BruceM

this was suppose to read 59 - 61 butthe point being that there may be something to the hour bars and the high volume nodes that go untouched...hopefully I'll have some time to investigate....where is BeyondMP ? He liked 30 minute untouched in O/N if I recall!!Originally posted by BruceM

triple at 72.25.....trickier on trend days....I'd like to see that 67.75 print first....other volume line way down at 61 - 61...so risk is not well defined for longs

Thanks Bruce!

Makes a lot of sense to me. I like your phrase "price was getting accepted at lower numbers". I learned that from Dr. Brett as a way to determine if we are having a trend day. He put it "accepting volume at higher/lower prices from VWAP".

I'll post a chart to show you what I mean.

Makes a lot of sense to me. I like your phrase "price was getting accepted at lower numbers". I learned that from Dr. Brett as a way to determine if we are having a trend day. He put it "accepting volume at higher/lower prices from VWAP".

I'll post a chart to show you what I mean.

I stole that phrase from Dr.B...he has great ideas...the only one that really still alludes me is his use of the $tick...I just cannot find too many meaningful ways to interpret that thing...

And please post charts on Vwap or anything etc....this guy Jerry at traders Laboratory did some good work on VWAP...let me know if you can't find it////you've probably already watched his videos ..

And please post charts on Vwap or anything etc....this guy Jerry at traders Laboratory did some good work on VWAP...let me know if you can't find it////you've probably already watched his videos ..

Originally posted by Lorn

Thanks Bruce!

Makes a lot of sense to me. I like your phrase "price was getting accepted at lower numbers". I learned that from Dr. Brett as a way to determine if we are having a trend day. He put it "accepting volume at higher/lower prices from VWAP".

I'll post a chart to show you what I mean.

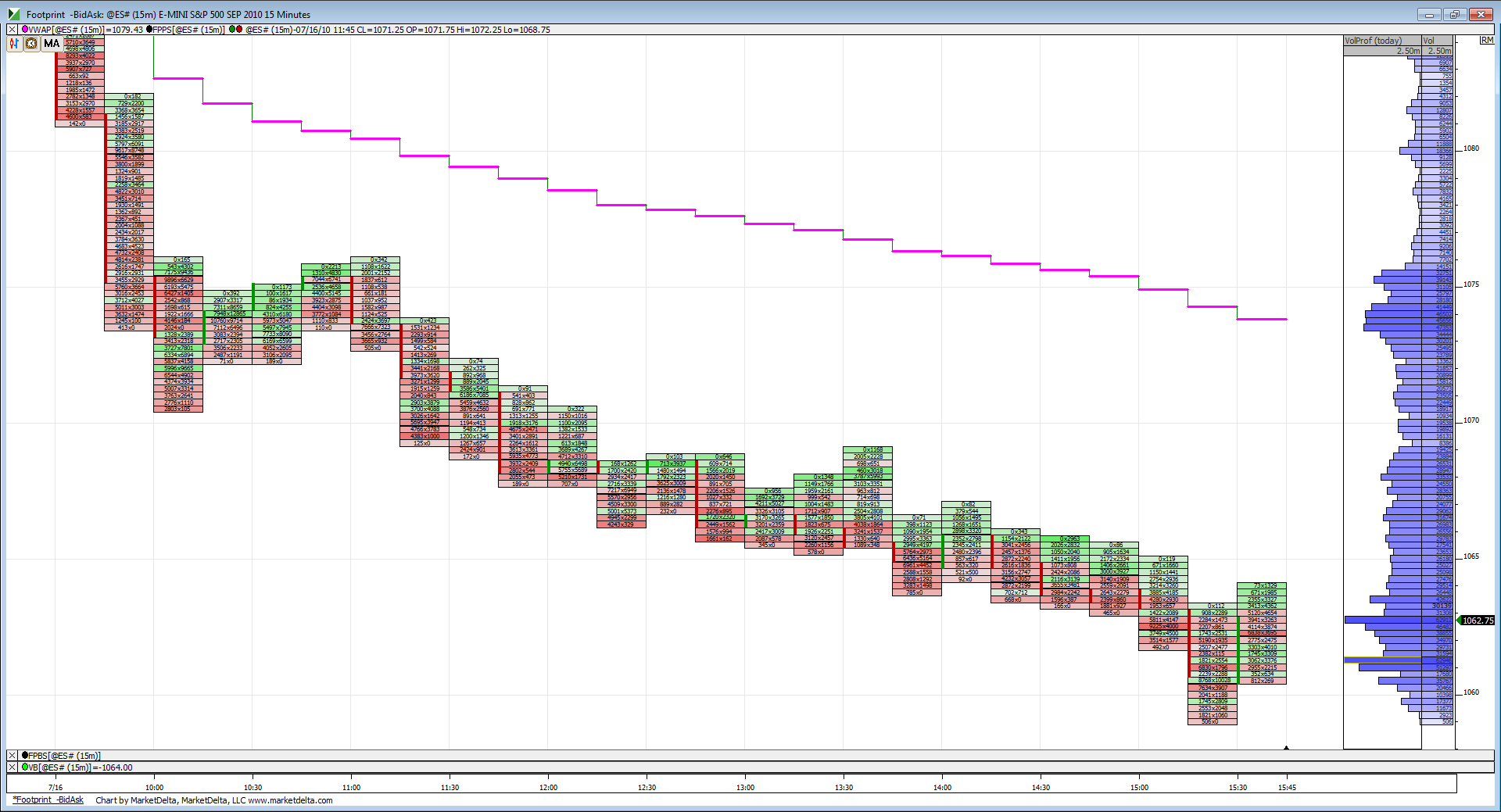

Here is a 15 min chart of Friday's action. VWAP is the pink line across the top. Volume Profile on the right side column and a footprint style price chart. Anyone else use these Market Delta style charts? I love them.

So, some observations. As price plunges we can see VWAP declining right along with price. Also, during the day price never rally's back to VWAP. During range bound days price will almost always either oscillate above and below VWAP or at least come back to VWAP on a regular basis. (I'll post another chart to show this).

Second, we can see volume (right side column) is persistent in size all the way down as price moves down. In a range bound market we would see a clear bulge of volume bunched around a tight price range.

Third, we can see within the footprint bars all the red cells moving down as volume hits bids and drives prices lower. Another interesting thing to point out is all the green cells (volume hitting ask) come in groups at consistently lower prices as well, which going off Dr. Brett's theory, meant buyers were being overwhelmed by sellers.

Hope you can make sense of my ramblings and the chart.

So, some observations. As price plunges we can see VWAP declining right along with price. Also, during the day price never rally's back to VWAP. During range bound days price will almost always either oscillate above and below VWAP or at least come back to VWAP on a regular basis. (I'll post another chart to show this).

Second, we can see volume (right side column) is persistent in size all the way down as price moves down. In a range bound market we would see a clear bulge of volume bunched around a tight price range.

Third, we can see within the footprint bars all the red cells moving down as volume hits bids and drives prices lower. Another interesting thing to point out is all the green cells (volume hitting ask) come in groups at consistently lower prices as well, which going off Dr. Brett's theory, meant buyers were being overwhelmed by sellers.

Hope you can make sense of my ramblings and the chart.

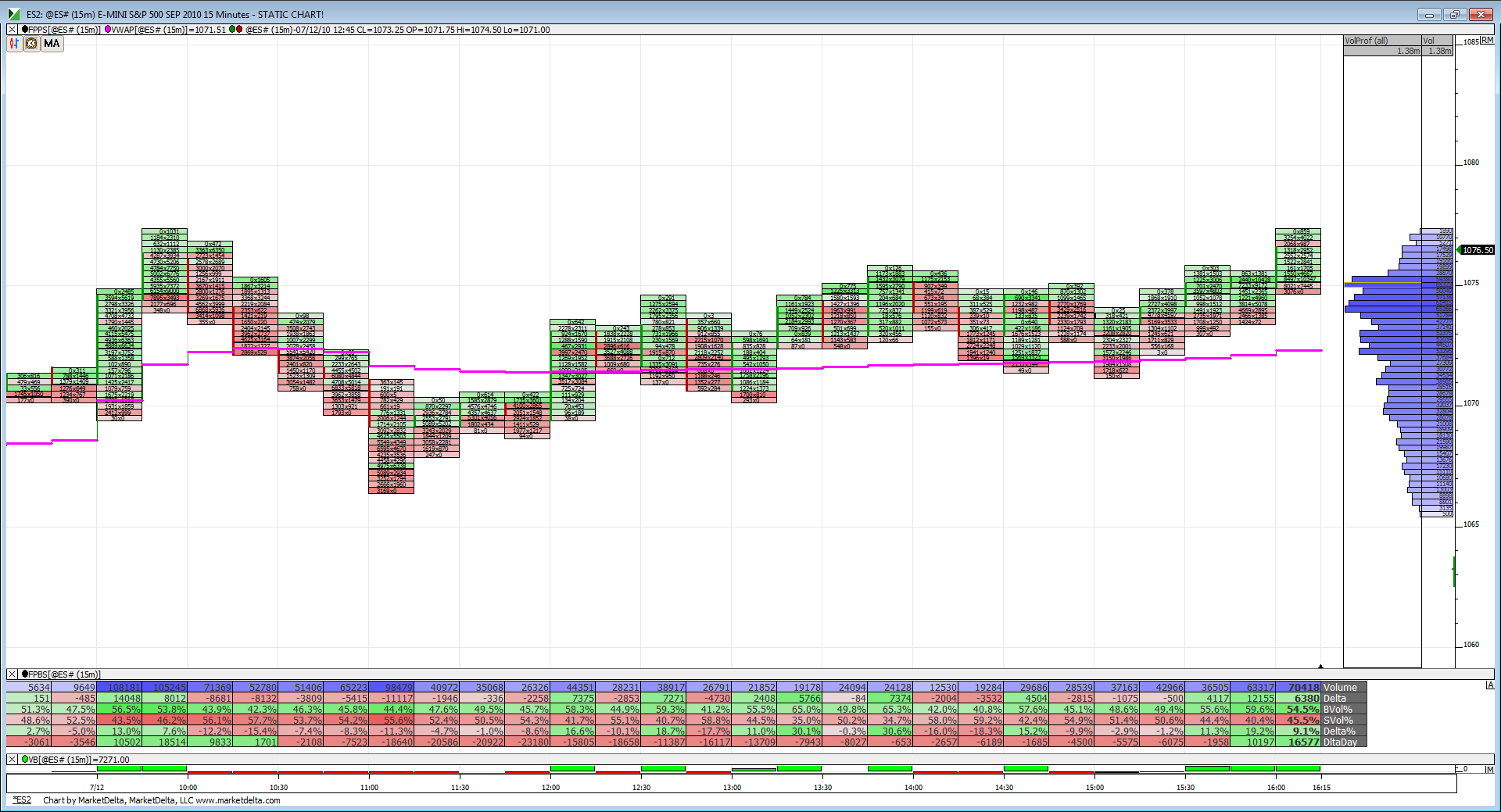

So here is a range bound day. You can see prices coil around the pink VWAP line. Also you can see how volume bulges in the range on the right column.

Thanks for those Lorn...one question...my Vwap band ends the day at 69.25 where I see yours is up near 74...my 1st standard deviation band is up near 74 though...can anyone confirm closing VWAP?

I'm using continuous day trading volume not just RTH volume....fyi.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.