ES short term trading 7-7-10 5921

Just a giant range between 1039 and 1006

key zones

1037 - 1039

1025 - 1028

1014.50

1006

key zones

1037 - 1039

1025 - 1028

1014.50

1006

47.25 should be 60 min breakout tgt as well, I am on sideline until momentum dies though

Originally posted by BruceM

nice Paul..here we are !!Originally posted by PAUL9

If you take the 5 day average RTH range (22.65)

and add it to today's RTH Low 1024.74

the sum is 1047.40

anyone out there going to short 1047 ?

yes 47 even..twice the IB up here too...

I can't guess how far down a retracement might go, I don't even know whether there will be a little drift lower, but it sure would be natural, and the OPEN of that "air bar" at 1040.75 seems totally natural if price can roll over.

But with the pattern in place (sure looks like trend buy day to me), if the afternoon retracement is shallow and a retracement finds buying at or above 40-38 handle; lift into the 4:00 close can unfold (usually does not make all the way to 4:00).

I would have to see A-B-C style pattern,

These are not the ideal conditions for the trade, the trade I am talking about is a predatory trade I will make on days when there is a large unfilled

it's as easy as 1-2-3

1) large unfilled gap (preferably open above .5 * 5 day ATR added to previous day's close)

2) Gap remains unfill, price NEVER gets below the Open (sort like today, but gap is not big)

3) trapped shorts who have put off covering all day long are forced to buy in post 3:15 time on any signs of an advance.

ALSO,

Today is a trend day, prepare for tomorrow: because tomorrow would be MATD. In the past 5 or 6 MATD s, early afternoon has put in failure swing and a resumption of price movement in the direction of the trend day.

But with the pattern in place (sure looks like trend buy day to me), if the afternoon retracement is shallow and a retracement finds buying at or above 40-38 handle; lift into the 4:00 close can unfold (usually does not make all the way to 4:00).

I would have to see A-B-C style pattern,

These are not the ideal conditions for the trade, the trade I am talking about is a predatory trade I will make on days when there is a large unfilled

it's as easy as 1-2-3

1) large unfilled gap (preferably open above .5 * 5 day ATR added to previous day's close)

2) Gap remains unfill, price NEVER gets below the Open (sort like today, but gap is not big)

3) trapped shorts who have put off covering all day long are forced to buy in post 3:15 time on any signs of an advance.

ALSO,

Today is a trend day, prepare for tomorrow: because tomorrow would be MATD. In the past 5 or 6 MATD s, early afternoon has put in failure swing and a resumption of price movement in the direction of the trend day.

but this is grinding now...don't like this trade..no good target except the previous 30 minute bar concept but not expecting an outside 30 minute bar down now...

sure wish those 47 folks would start exiting longs..

Originally posted by PAUL9

I can't guess how far down a retracement might go, I don't even know whether there will be a little drift lower, but it sure would be natural, and the OPEN of that "air bar" at 1040.75 seems totally natural if price can roll over.

But with the pattern in place (sure looks like trend buy day to me), if the afternoon retracement is shallow and a retracement finds buying at or above 40-38 handle; lift into the 4:00 close can unfold (usually does not make all the way to 4:00).

I would have to see A-B-C style pattern,

These are not the ideal conditions for the trade, the trade I am talking about is a predatory trade I will make on days when there is a large unfilled

it's as easy as 1-2-3

1) large unfilled gap (preferably open above .5 * 5 day ATR added to previous day's close)

2) Gap remains unfill, price NEVER gets below the Open (sort like today, but gap is not big)

3) trapped shorts who have put off covering all day long are forced to buy in post 3:15 time on any signs of an advance.

ALSO,

Today is a trend day, prepare for tomorrow: because tomorrow would be MATD. In the past 5 or 6 MATD s, early afternoon has put in failure swing and a resumption of price movement in the direction of the trend day.

You know, the funny thing is that opening gap was only 1 stinking point, and it still didn't fill! I should have paid attention to that one - very big hint of what was to come.

VWAP has never been touched all session, another sign of a trend day.

trying to get 45 even..and hold two...hopefull before the\46.50 run out

I'm hoping that this next 30 minute period trades below this periods low

sneaky...where is my 45 print damn it...!!break that low..

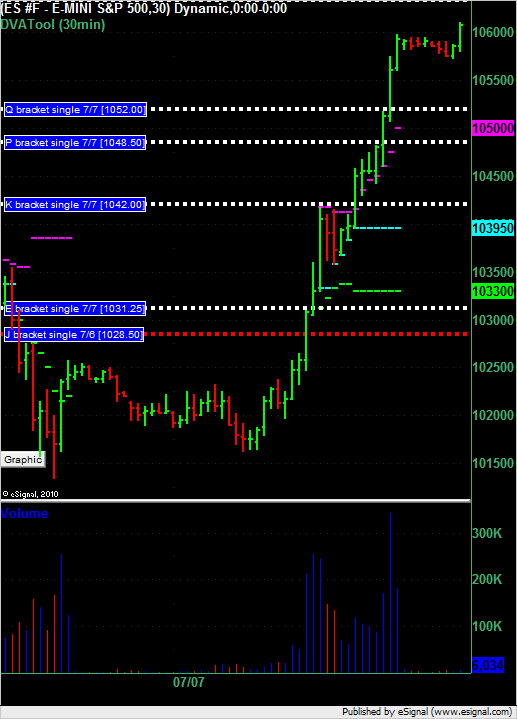

Here's a 30 minute chart of the ES with the DVATool on it showing 1 filled in single print from Tuesday (red horizontal dotted line) and 4 single prints left from today's trading (white horizontal dotted lines).

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.