ES short term trading 7-7-10 5921

Just a giant range between 1039 and 1006

key zones

1037 - 1039

1025 - 1028

1014.50

1006

key zones

1037 - 1039

1025 - 1028

1014.50

1006

nice process. if high does't break this could slide fast. Wed midday

so we are consolidating above yesterdays VA high and yesterdays highs... we owe it to ourselves to be much more selective on fades and even look for possible breakout buys at new highs if they come

When u have time please remind me of how you thought tons of buyers stepped in on that low $tick....Thanks

Originally posted by phileo

Originally posted by BruceM

added at 41.25...interesting to see if volume comes in off the 39 breakout...still keeping it small..I have the 37.25's too..new air at 37.75

Nice one bruce, your 37.75 got filled in.

However, tons of buyers stepping in right after that -ve TICK extreme at 1036.5

I think we are setting up for an afternoon rally, something which has not happened since last friday.

Looking for a pullback to the low end of the lunchtime range (1036-1037) to enter long.

Looking for a pullback to the low end of the lunchtime range (1036-1037) to enter long.

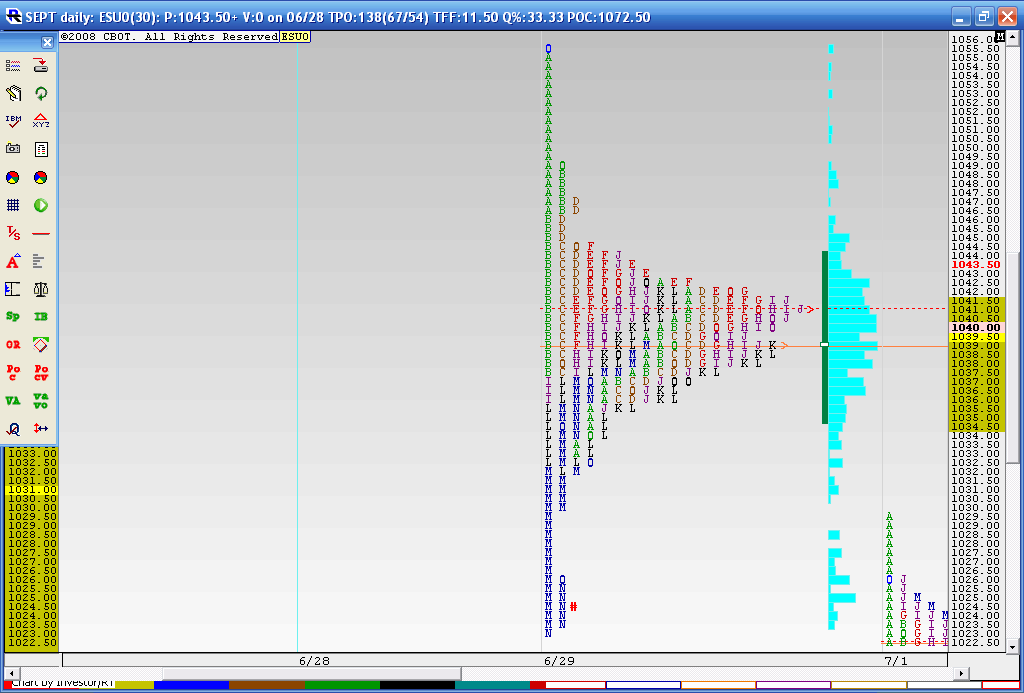

49 - 50 begins a selling tail from the 6-29 trade...also a major Rat...here is the 6-29 and 6-30 profiles combined...look at all the volume in the 39 - 41.50 area...we need also be weary at 44 if the run it there and then turn it back down...

Originally posted by BruceM

When u have time please remind me of how you thought tons of buyers stepped in on that low $tick....ThanksOriginally posted by phileo

Originally posted by BruceM

added at 41.25...interesting to see if volume comes in off the 39 breakout...still keeping it small..I have the 37.25's too..new air at 37.75

Nice one bruce, your 37.75 got filled in.

However, tons of buyers stepping in right after that -ve TICK extreme at 1036.5

Perhaps tons of buyers was not the right wording... I think very agressive buying is more accurate.

The -ve TICK extreme occured around 819am PST, and it pushed price down to 1036.5.

However, it did not stay at 1036.5. In fact, it never touched 1036.5 again, as right after that, we had a range contraction (1036.75 - 1037.25), followed by a range expansion (1.75pts). It led to a +ve tick sequence culminating in two +ve TICK extremes at 1041.5

So, you have a 3.5pt drop followed by a responsive 4pt run-up.

Therefore, Buyers were more aggressive.

I missed it but anyone who traded for that triple run caught a fairly good move

Originally posted by phileo

I think we are setting up for an afternoon rally, something which has not happened since last friday.

Looking for a pullback to the low end of the lunchtime range (1036-1037) to enter long.

Got the direction correct, but can't find the level to enter.

Frustrating.

1041.75 new "naked" air pocket

1036 ledge - less likely to be re-visited today

1031.25 "naked" air pocket - very unlikely to be filled to day.

Thanks Phileo..I need to study that later...I thought you were able to see buyers EXACTLY at 36.25 print...but you are looking at a range of buying....gotch ya

Good volume is keeping me from fading but if they can push into the 49 area I may try it

air at the breakout of 41.75...that would be maximum fill in if anyone is agressive up here and short

Good volume is keeping me from fading but if they can push into the 49 area I may try it

air at the breakout of 41.75...that would be maximum fill in if anyone is agressive up here and short

Broke up now trying to close a bar above that previous high. And the fibs,target,etc

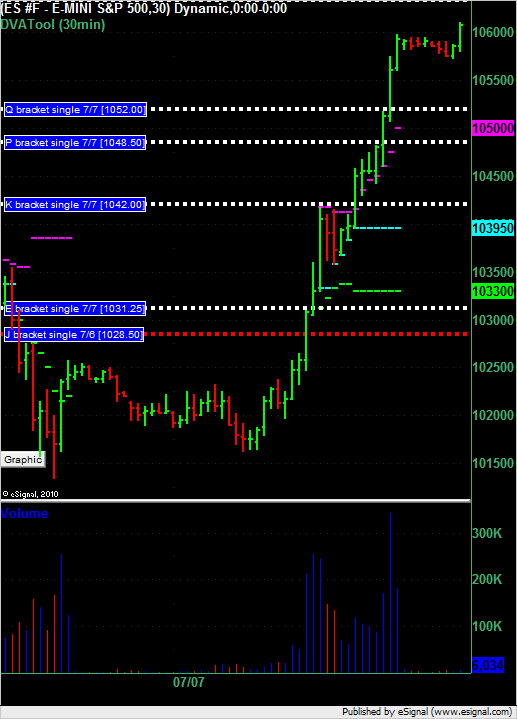

Here's a 30 minute chart of the ES with the DVATool on it showing 1 filled in single print from Tuesday (red horizontal dotted line) and 4 single prints left from today's trading (white horizontal dotted lines).

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.