ES Short Term Trading 6-1-10

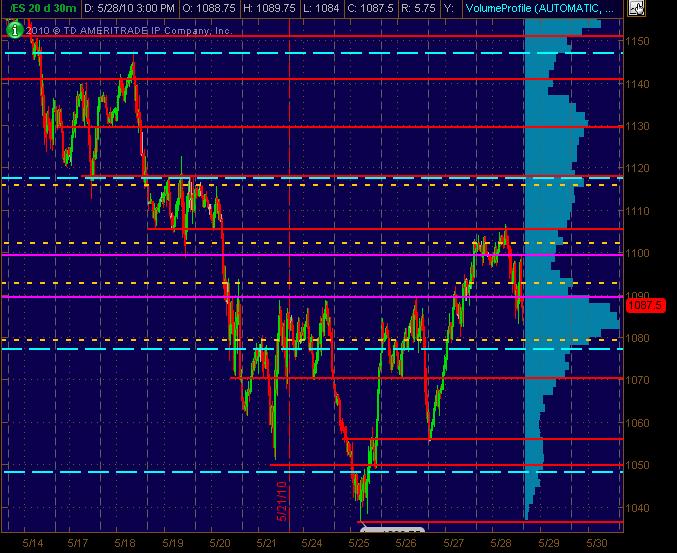

Tossing out two 30m (20 day) charts here with the Red lines as potential significant S/R price action levels with the Magenta lines "semi-significant." The dashed Cyan lines are the Weekly Pivot levels. Also, there's a Volume Profile on the right vertical side of the charts that can be useful.

The 2nd chart adds the Daily Pivots in dashed Yellow. Yeah, yeah, yea ... I know, tons of lines so that any will "work." That's not the point. It's a MAP. And it's also about clusters of lines that are in the same price "zone" give or take a few ticks or points (depending on the volatility).

Hope y'all find this at least semi-useful and look forward to postings of everyone elses analysis of drawn-charts and significant numbers!

The 2nd chart adds the Daily Pivots in dashed Yellow. Yeah, yeah, yea ... I know, tons of lines so that any will "work." That's not the point. It's a MAP. And it's also about clusters of lines that are in the same price "zone" give or take a few ticks or points (depending on the volatility).

Hope y'all find this at least semi-useful and look forward to postings of everyone elses analysis of drawn-charts and significant numbers!

Its just a choppy market trying to correct an error at open

they seem to be slowly chipping away at all that spike volume created at 10 am report this morning

lets not forget fridays low...somebody likes that....

thanks for the credit Ak1....I can't open those .doc extensions either

lots of those entries today.....

lots of those entries today.....

volume cluster between 84 and 87.50 needs to resolve so watch for the possible breakout..not tradeable for me as that would be a breakout trade..but a failed retest after the breakout would be cool

I'd really like to see bulls win with a close above the midrange, the open and above Fridays close

I'd really like to see bulls win with a close above the midrange, the open and above Fridays close

Yes Bruce only DT can help. I am unable to get a good grasp concept of where to enter. Is it the close of the second bar, or is it the open of the 1st bar.....

hopefully someone is picking up on the 3:20 time frame and what happens often.....on Friday they started the final drive for the triples.....today they are trying for the lows..both had neutral volume....so be careful of following this down...

let me look at yoour specific chart when DT gets to it....in general I like to trade the low of the high bar ( That tests upwards)for shorts and the high of the low bar for longs,,,,lots of those today

Originally posted by ak1

Yes Bruce only DT can help. I am unable to get a good grasp concept of where to enter. Is it the close of the second bar, or is it the open of the 1st bar.....

Thanks Bruce. Now the 3.30 guys have opened into a lot of resistance. Can they trade to 1076

AK1,

I can't get the context of your first set of numbers so I will be starting with the second ones you have labeled at that swing low..

The key is that you need to expecting a swing low based on your work so lets assume that.

You get the up close which comes right before bar 2. Then bar 2 attempts to test the swing low so you go long on the break of the bar two high which was bar 3. The great thing is that it would take and outside bar down on bar 3 to stop you out on the same bar as your entry.

the next swing low you have labeled does the same thing. the one before bar two gives you the up close, then you getthe test down with bar two, so you go long on the break of bar two's high at bar three..

The two swing highs in between these lows could have been trade in the same way...At those swing highs you get a down close, followed by an upwards test, so you would go short on the break of the low of the up close bar.....hope you see those...it's a simple pattern once you start looking for them...they can work on all time frames

I can't get the context of your first set of numbers so I will be starting with the second ones you have labeled at that swing low..

The key is that you need to expecting a swing low based on your work so lets assume that.

You get the up close which comes right before bar 2. Then bar 2 attempts to test the swing low so you go long on the break of the bar two high which was bar 3. The great thing is that it would take and outside bar down on bar 3 to stop you out on the same bar as your entry.

the next swing low you have labeled does the same thing. the one before bar two gives you the up close, then you getthe test down with bar two, so you go long on the break of bar two's high at bar three..

The two swing highs in between these lows could have been trade in the same way...At those swing highs you get a down close, followed by an upwards test, so you would go short on the break of the low of the up close bar.....hope you see those...it's a simple pattern once you start looking for them...they can work on all time frames

Originally posted by ak1

DT please help so that Bruce's concept can be shared

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.