ES Short Term Trading 6-1-10

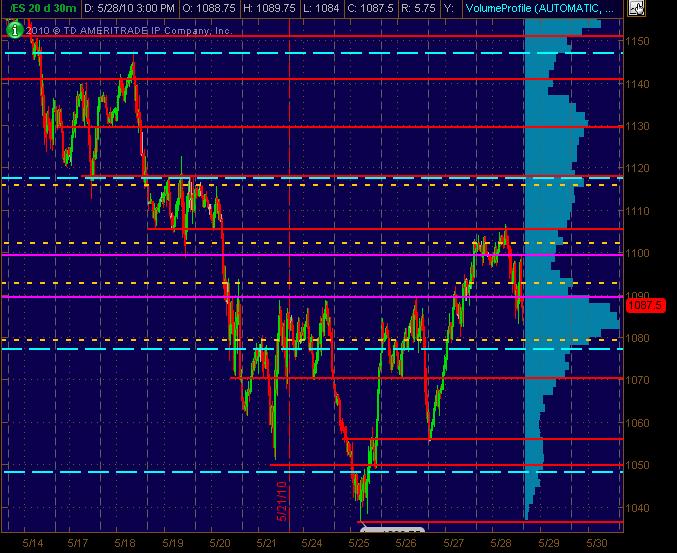

Tossing out two 30m (20 day) charts here with the Red lines as potential significant S/R price action levels with the Magenta lines "semi-significant." The dashed Cyan lines are the Weekly Pivot levels. Also, there's a Volume Profile on the right vertical side of the charts that can be useful.

The 2nd chart adds the Daily Pivots in dashed Yellow. Yeah, yeah, yea ... I know, tons of lines so that any will "work." That's not the point. It's a MAP. And it's also about clusters of lines that are in the same price "zone" give or take a few ticks or points (depending on the volatility).

Hope y'all find this at least semi-useful and look forward to postings of everyone elses analysis of drawn-charts and significant numbers!

The 2nd chart adds the Daily Pivots in dashed Yellow. Yeah, yeah, yea ... I know, tons of lines so that any will "work." That's not the point. It's a MAP. And it's also about clusters of lines that are in the same price "zone" give or take a few ticks or points (depending on the volatility).

Hope y'all find this at least semi-useful and look forward to postings of everyone elses analysis of drawn-charts and significant numbers!

And fwiw, here's a 3 year Daily chart with higher level S/R price levels drawn in RED. Also, have a 50 and 200 SMA as well ... just for a bigger picture look.

Bruce, correct me if I'm wrong as I am still learning, but I think there is an air pocket at 79 ya? and 88?

thanks MM..here's where I'm at today

1062.50 - 1061 gap and Rat **** I don't like shorts below that today if it prints

1068.75 - 1069 Rat, daily S2, O/N inflection Point

1077 - 1075 Rat and weekly PV ****

1081.25 - 1082.50 Rat and Friday low

1087.50 - 1088 Rat and Fri close

93 - 95 lots of volume there the past two RTH sessions. Rat there of course.

We are building Volume at the 75 this mornng so that seems to be the most important number as I type....we know they will take at least Two ratchets today. Se we can project which ones after the first one trades in RTH. Mondays are fairly bullish so we need to watch open print closely today.

Low volume sits slightly above weekly PV in O/N so a good long should target that this a.M

1062.50 - 1061 gap and Rat **** I don't like shorts below that today if it prints

1068.75 - 1069 Rat, daily S2, O/N inflection Point

1077 - 1075 Rat and weekly PV ****

1081.25 - 1082.50 Rat and Friday low

1087.50 - 1088 Rat and Fri close

93 - 95 lots of volume there the past two RTH sessions. Rat there of course.

We are building Volume at the 75 this mornng so that seems to be the most important number as I type....we know they will take at least Two ratchets today. Se we can project which ones after the first one trades in RTH. Mondays are fairly bullish so we need to watch open print closely today.

Low volume sits slightly above weekly PV in O/N so a good long should target that this a.M

what do you mean when you say "Rat"?

Originally posted by feng456

what do you mean when you say "Rat"?

He's referring to the ratchet levels... the split of the split between the 00, 25, 50, 75 levels

25 / 2 = 12.50 split

12.50 / 2 = 6.25 split of split

50 + 6.25 = 56.25

............56.25 + 6.25 = 62.50

...........................62.50 + 6.25 = 68.75

..........................................68.75 + 6.25 = 75.00

wash rinse repeat

yes the 79 is from O/N session as that was a new low price too that didn't get traded back to.....

I prefer longs if we can get the trade down first today.....below the 75 after RTH opens...we will have fib players come in under there too from last Tuesday low to Friday's high...below 50 % retrace

I prefer longs if we can get the trade down first today.....below the 75 after RTH opens...we will have fib players come in under there too from last Tuesday low to Friday's high...below 50 % retrace

Feng..in general I prefer the air that forms in RTH session

if they keep going they gonna fill that air @ 79

I'm going long at open.

well in and out in 10 seconds. i wish it was like this all the time...sigh.

AK1,

I can't get the context of your first set of numbers so I will be starting with the second ones you have labeled at that swing low..

The key is that you need to expecting a swing low based on your work so lets assume that.

You get the up close which comes right before bar 2. Then bar 2 attempts to test the swing low so you go long on the break of the bar two high which was bar 3. The great thing is that it would take and outside bar down on bar 3 to stop you out on the same bar as your entry.

the next swing low you have labeled does the same thing. the one before bar two gives you the up close, then you getthe test down with bar two, so you go long on the break of bar two's high at bar three..

The two swing highs in between these lows could have been trade in the same way...At those swing highs you get a down close, followed by an upwards test, so you would go short on the break of the low of the up close bar.....hope you see those...it's a simple pattern once you start looking for them...they can work on all time frames

I can't get the context of your first set of numbers so I will be starting with the second ones you have labeled at that swing low..

The key is that you need to expecting a swing low based on your work so lets assume that.

You get the up close which comes right before bar 2. Then bar 2 attempts to test the swing low so you go long on the break of the bar two high which was bar 3. The great thing is that it would take and outside bar down on bar 3 to stop you out on the same bar as your entry.

the next swing low you have labeled does the same thing. the one before bar two gives you the up close, then you getthe test down with bar two, so you go long on the break of bar two's high at bar three..

The two swing highs in between these lows could have been trade in the same way...At those swing highs you get a down close, followed by an upwards test, so you would go short on the break of the low of the up close bar.....hope you see those...it's a simple pattern once you start looking for them...they can work on all time frames

Originally posted by ak1

DT please help so that Bruce's concept can be shared

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.