ES Short Term Trading 6-1-10

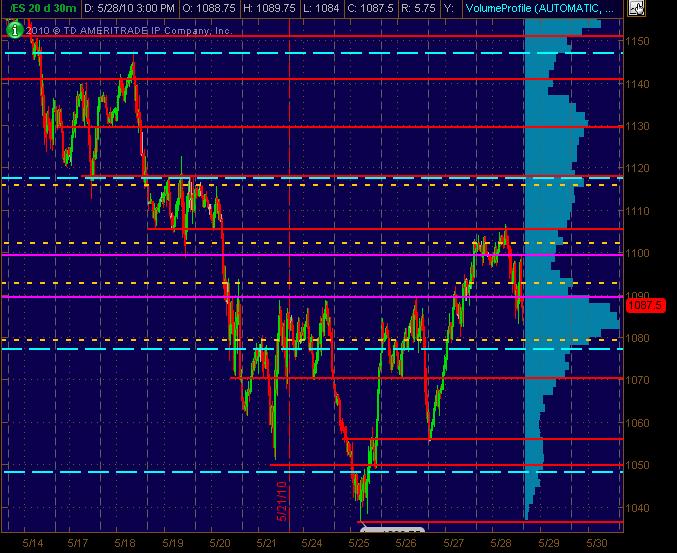

Tossing out two 30m (20 day) charts here with the Red lines as potential significant S/R price action levels with the Magenta lines "semi-significant." The dashed Cyan lines are the Weekly Pivot levels. Also, there's a Volume Profile on the right vertical side of the charts that can be useful.

The 2nd chart adds the Daily Pivots in dashed Yellow. Yeah, yeah, yea ... I know, tons of lines so that any will "work." That's not the point. It's a MAP. And it's also about clusters of lines that are in the same price "zone" give or take a few ticks or points (depending on the volatility).

Hope y'all find this at least semi-useful and look forward to postings of everyone elses analysis of drawn-charts and significant numbers!

The 2nd chart adds the Daily Pivots in dashed Yellow. Yeah, yeah, yea ... I know, tons of lines so that any will "work." That's not the point. It's a MAP. And it's also about clusters of lines that are in the same price "zone" give or take a few ticks or points (depending on the volatility).

Hope y'all find this at least semi-useful and look forward to postings of everyone elses analysis of drawn-charts and significant numbers!

Originally posted by BruceM

so Feng as long as we can add and subtract we can make money...87.50 plus 6.25 is 93.75.....lots of other numbers there too...it all fits together

Nice fade ak1 and PT!!!

Thanks Bruce, looking for 87.50 to 88.25 zone for my exit target, depending on how long it takes to get there...

single print MP players will try and test the buying strength now that the 11 am bar has closed but we already had air before them...lol

filled at 88.00 even ...

Luv it...well done PT...smart as we can't trust the folks who watch for single prints

so feng, just looking at today you would have made your two pints on fading trade above 15 minute and 60 minute from RTH...just pointing it out as a possible idea for you to look at again

you will find that fading those will not work when there is a lot of consolidation and a narrow range as the market is telling you that it is coiling and looking to break out.....just an FYI

seems like 90.50 is attracting lots of volume now...a test up and failure will go back to that unfilled air at 83.75...

you will find that fading those will not work when there is a lot of consolidation and a narrow range as the market is telling you that it is coiling and looking to break out.....just an FYI

seems like 90.50 is attracting lots of volume now...a test up and failure will go back to that unfilled air at 83.75...

anyone know of any current studies that show how often we close above the previous day's close when we open gap down below it....?

some of my worst trades come when stuck inside the 60 minute range and it's lunchtime...two no-no's!!sure seems like they want to fill in that 83.75 though....

so this 83.75 is stuck between a ratchet.....obviously they will get one or both the 87.50 or that 81.25 again...just pointing out a simple truth and how my brain is trying to look at these ratchets in order to form some useful trading ideas.....

my guess is the 81.25 but am staying flat now

my guess is the 81.25 but am staying flat now

ledge at 84.25...interesting...we bust through three ratchets and then retrace two... if that ledge wasn't there I'd be trading for new highs today and then highs above fridays highs..

and a gap in data at our old friend 87.50...will keep me leaning short

and a gap in data at our old friend 87.50...will keep me leaning short

AK1,

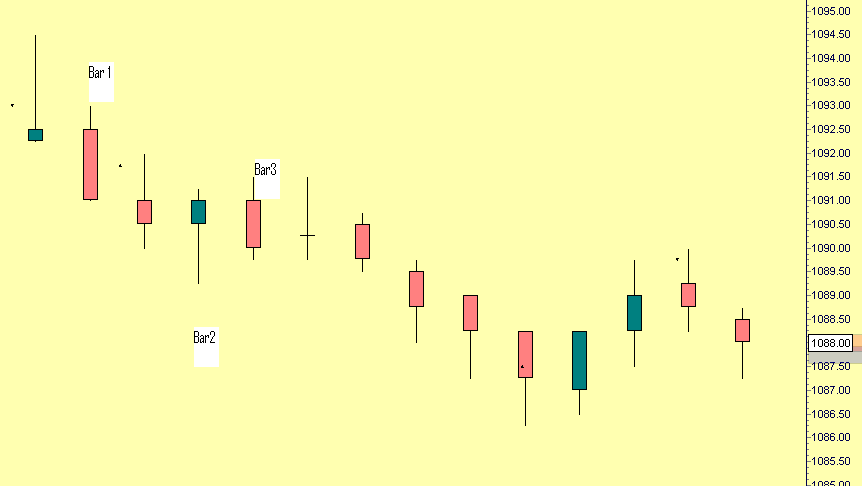

I can't get the context of your first set of numbers so I will be starting with the second ones you have labeled at that swing low..

The key is that you need to expecting a swing low based on your work so lets assume that.

You get the up close which comes right before bar 2. Then bar 2 attempts to test the swing low so you go long on the break of the bar two high which was bar 3. The great thing is that it would take and outside bar down on bar 3 to stop you out on the same bar as your entry.

the next swing low you have labeled does the same thing. the one before bar two gives you the up close, then you getthe test down with bar two, so you go long on the break of bar two's high at bar three..

The two swing highs in between these lows could have been trade in the same way...At those swing highs you get a down close, followed by an upwards test, so you would go short on the break of the low of the up close bar.....hope you see those...it's a simple pattern once you start looking for them...they can work on all time frames

I can't get the context of your first set of numbers so I will be starting with the second ones you have labeled at that swing low..

The key is that you need to expecting a swing low based on your work so lets assume that.

You get the up close which comes right before bar 2. Then bar 2 attempts to test the swing low so you go long on the break of the bar two high which was bar 3. The great thing is that it would take and outside bar down on bar 3 to stop you out on the same bar as your entry.

the next swing low you have labeled does the same thing. the one before bar two gives you the up close, then you getthe test down with bar two, so you go long on the break of bar two's high at bar three..

The two swing highs in between these lows could have been trade in the same way...At those swing highs you get a down close, followed by an upwards test, so you would go short on the break of the low of the up close bar.....hope you see those...it's a simple pattern once you start looking for them...they can work on all time frames

Originally posted by ak1

DT please help so that Bruce's concept can be shared

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.