anyone trying shorts??

Up here at 845 ES....S&P is holding back this rally today...where the HECK is my plus or (hopefully) minus 8 - 10 range? has everyone gone to 24 hour trading???

next target is open one minute high.....keeping this tight

filled at 917....I'll try for 909 which is one point above another key volume price......don't have a great feeling for a big selloff though...seems like a chop around session is more likely

revising target to 11.50...that's the poc and minus 4 -5 zone

if we clear this 912.50 we may head on down...imho

nice little scalp there of a couple handles... had to scalp cause higher would not be surprising!

Bruce, always enjoy your insight! If you ever get tired of the spqr"s (jmr's) of the world , your always welcome to join us!

by the way great short and call on that 909 objective!(think we hit 909.75)....great stuff!

My statistic on inside bars is about a year old and needs updating but the point being if something only happens 10 - 12

% OF THE TIME THEN WE SHOULD BE TRADING FOR THE OTHER 90%. So we are to assume that a RTH range will get broken.

I didn't take this particular trade and only point it out for the concepts...

We enter the Value area but get 30 minute closes back OUTSIDE of it....( this is like a reverse 80% rule), we get 30 minute closes above the open....these are some subtle hints that they might try for yesterdays highs.....we also never traded to a minus 8- 10 to the downside so that leaves the possibility open that it may happen on the upside...

These are just some after the fact ideas I like to use

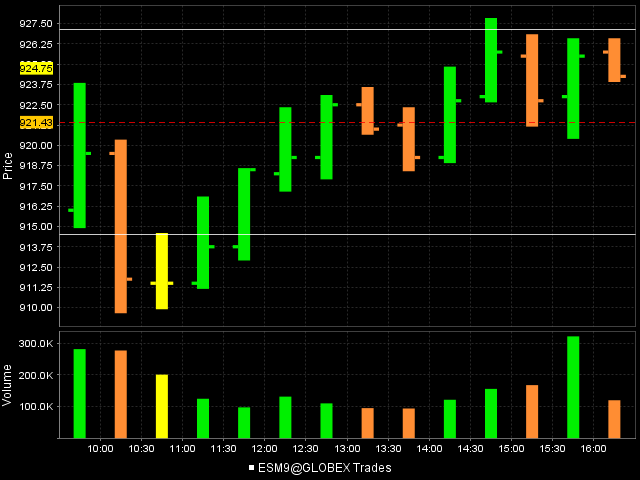

here is Fridays 30 minute chart that has Thursdays high snapped off and the VA high in the 914 area. Also note the inability to get a close above yesterdays high on the 30 minute. We could design a nice trade and reversal signal based on this concept alone.

% OF THE TIME THEN WE SHOULD BE TRADING FOR THE OTHER 90%. So we are to assume that a RTH range will get broken.

I didn't take this particular trade and only point it out for the concepts...

We enter the Value area but get 30 minute closes back OUTSIDE of it....( this is like a reverse 80% rule), we get 30 minute closes above the open....these are some subtle hints that they might try for yesterdays highs.....we also never traded to a minus 8- 10 to the downside so that leaves the possibility open that it may happen on the upside...

These are just some after the fact ideas I like to use

here is Fridays 30 minute chart that has Thursdays high snapped off and the VA high in the 914 area. Also note the inability to get a close above yesterdays high on the 30 minute. We could design a nice trade and reversal signal based on this concept alone.

- Page(s):

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

Just about perfect - perfectly wrong that is!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.