Day Trading with TTT and other tools

Welcome to this new thread, where we can share trading ideas and our thoughts on the Taylor Trading Technique.

Anyone with questions on TTT, this is the place.

Anyone with questions on TTT, this is the place.

- Page(s):

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

rich's ttt did it again ! es day made it to its possible high

fantastic job rich !!!

fantastic job rich !!!

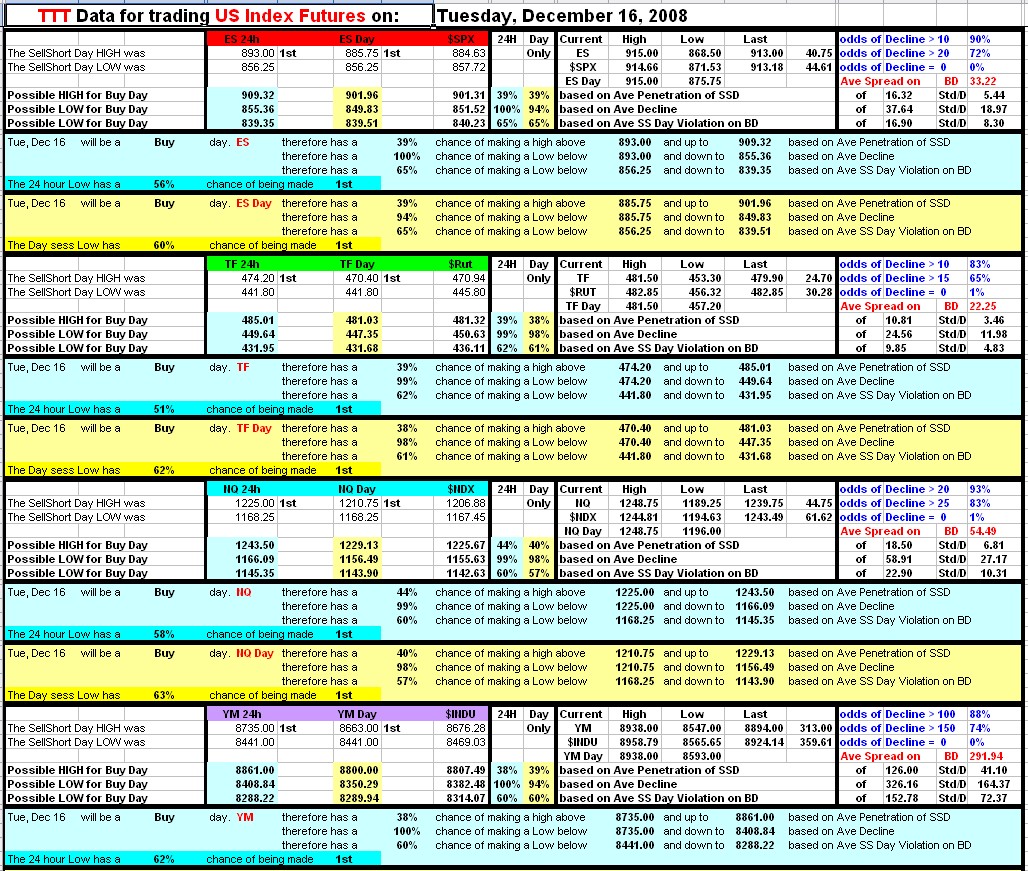

Today was a Buy day. Again today we had a shallow Decline. We did have 60% of the low made first, We gapped up, TVGR took effect and we reached the projected highs.

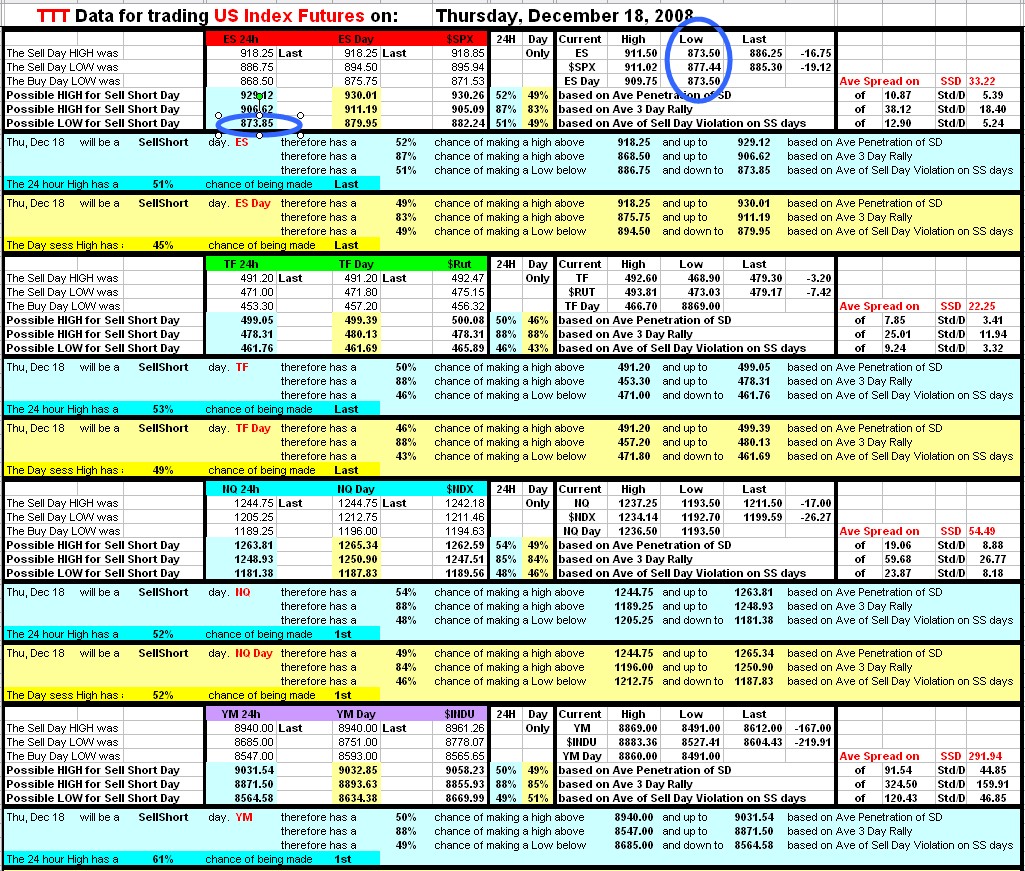

Today was a Sell day. Having reached the average target for a Sell day at the close yesterday, the markets declined overnight and gapped down at the open. TVGR took effect on ES but TF closed the gap at the start. It took half the day to finally close the gap but when ES tried to penetrate the previous day high it ran out of steam and pulled back. TF managed to penetrate and stopped climbing at the projected highs that were sent in the report last night.

Ya hit the numbers good today Rich, too bad I chickened out of my ES on the way there, I didn't think they would be hit so quick.

Thanks and have a happy New Year,

Thanks and have a happy New Year,

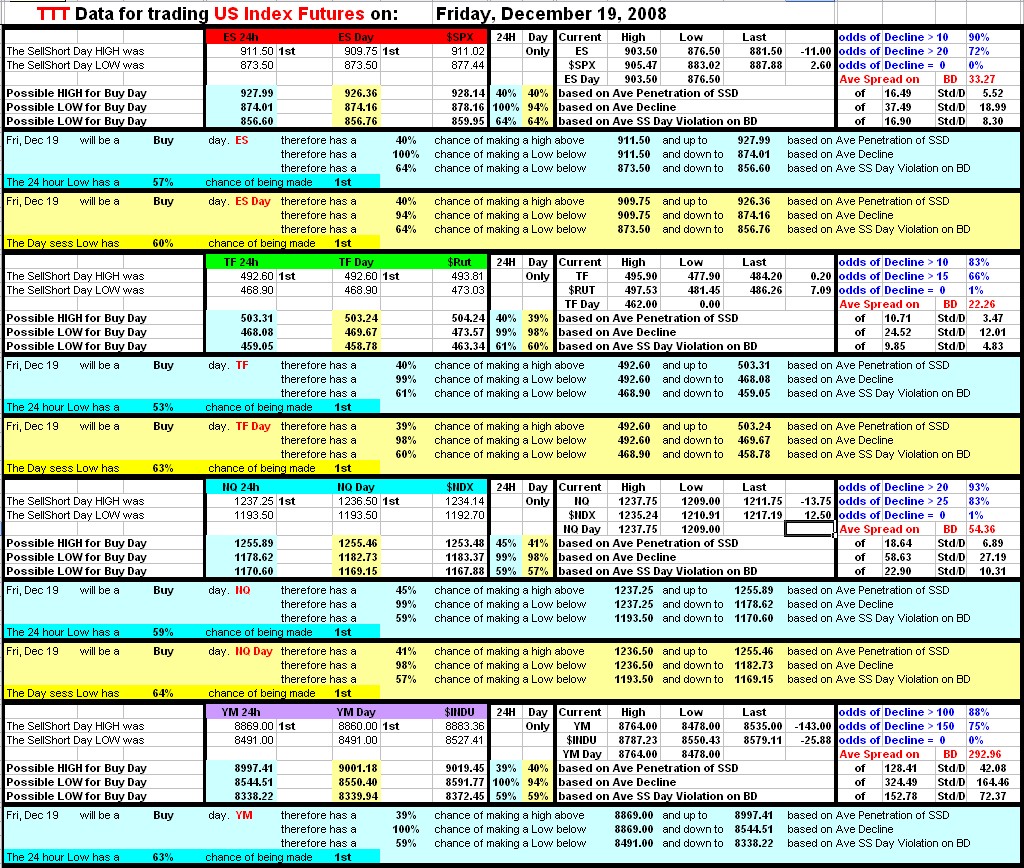

Today was SS day. Only TF managed to make a new high but not by much. Since the others failed to follow then the markets went and tested the lows with ES reaching the precise projected lows.

Today was a Buy Day. Markets were mixed as TF and NQ managed to make higher Highs and YM made a Lower Low. ES and YM achieved their projected average Decline.

Have a great weekend

Have a great weekend

Today was a Sell day. The 60% odds did favor making lower lows and we did. Markets reversed when we got close to the Recap MA numbers

Brilliant enough, if you ask me. Knowing where to exit my shorts saved me a $1k vs waiting for the close.

quote:

Originally posted by mlomker

Brilliant enough, if you ask me. Knowing where to exit my shorts saved me a $1k vs waiting for the close.

You are getting the feel for TTT pretty quick I may say. And like you inferred TTT is not only for entry but for exits also.

Nice job

Today was a SS day. As mentioned in last night's report we had 85% odds of getting back above the Buy day lows. All the Futures except NQ made it however the Indexes didn't.

- Page(s):

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

I hope all you TTT traders had a good 2014 and I wish you all a better 2015

Richard

Richard

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.