Sept 24 NQ.

I have been away from this site for years. I have had an interesting experience since then, trading as a CTA other people's money not worth the stress in futures Forex. selling my trades via copy trading actually my favorite only con was the non-stop questions and whining from "clients" who are never satisfied. Trading small multiple personal accounts amassing a small fortune and retiring at 38 which started 6 months pre covid and moving deep into the forest of SC with my wife and 6 kids, took 4years off to live my dream of going completely self-sufficient off grid homesteading. My 2 oldest daughters are nearly adults, and I have coached and taught them to trade for themselves not there yet but making progress good progress. my goal for them is to give them something they can fall back on in whatever field they choose. I struggled for years should I teach them trading due to my addiction to trade 24hr sessions in FX I decided early summer to come out of Retirment and teach them how to trade and start my 4th trading campaign of my life. with an emphasis on NQ, ES, and GC (the best currency) rth >with as little overnight< as I can. when I say I took 4 yrs. off I literally took 4 years off....I didn't check the markets maybe 2x since mid 2019-june 2024. the longest break and rest from trading I have had since I started at 16. Took about a month to get back into the swing of things, but it did come back to me as I started really small trading 1-20 MNQs good thing I keep detailed notes from past yrs. NQ was 6-7k back then. but same approach still works. Thought it would be fun to work thru sept on here.

Chart on left is 4hr NQ with 1% envelopes to identify extreme moves away from hi vol.

Aug POC 19,630ish

last weeks Hi vol POC 19,570ish

areas of interest:

Hi vol

Lo vol

VAH

VAL

POC (aug, july, last weeks and 2 weeks ago)

last weeks Hi Lo

last months Hi Lo

Chart on right is MNQ 30 min profiles.

Overnight vol profile

rth vol profile

areas of interest;

last untouched POC both above and below current market

yesterday VAH

yesterday VAL

overnight POC

price channels (more of an art than science)

Fridays open returned rather quickly to prev days POC 19,625, then to the over nights POC 19,529, then to take out overnight lows before targeting its developing POC and then back to the last untouched POC of 19,625.

tues opening looks like be around its last month's POC 19,649. and watching for thrusts away from augs high vol.

Welcome back buddy! I think that it's been more than 8 years since you last posted? A reply on this one?

https://www.mypivots.com/board/topic/8646/-1/basics-of-forex-trading-demo-accounts

https://www.mypivots.com/board/topic/8646/-1/basics-of-forex-trading-demo-accounts

ES 4hr on left. 30 min on right.

ES 2 months of High vol POC at 5639. Fridays untouched POC at 5613. cyan line is major ceiling at the moment.

are the markets going to melt up into oblivion due to inflation 1930s German style? going to be exciting.

MNQ furiously rejected the high vol area of Aug. and is less than 120pts from striking price target untouched overnight POC 18,751 and as i type is in Lo Vol area of Aug. with in value. Caught some good shorts late in the day, but to be honest this sell off blindsided me outta nowhere after the weak ISM numbers {47.2}

sitting all nice and tight on the bottom of my trend channels 30min.

18,600ish would-be last month's VAL. watch those EMAs

Aug 3 both the ES and NQ didn't hit its overnight POC, I'm not sure how rare that is but I hadn't seen it since the overnight session on Aug. 7-8 18 @ 17,985. and a large run occurred.

neither the MNQ of MES hit its overnight POC last night.

neither the MNQ of MES hit its overnight POC last night.

MES withing yesterdays value.....targets slightly below 5575

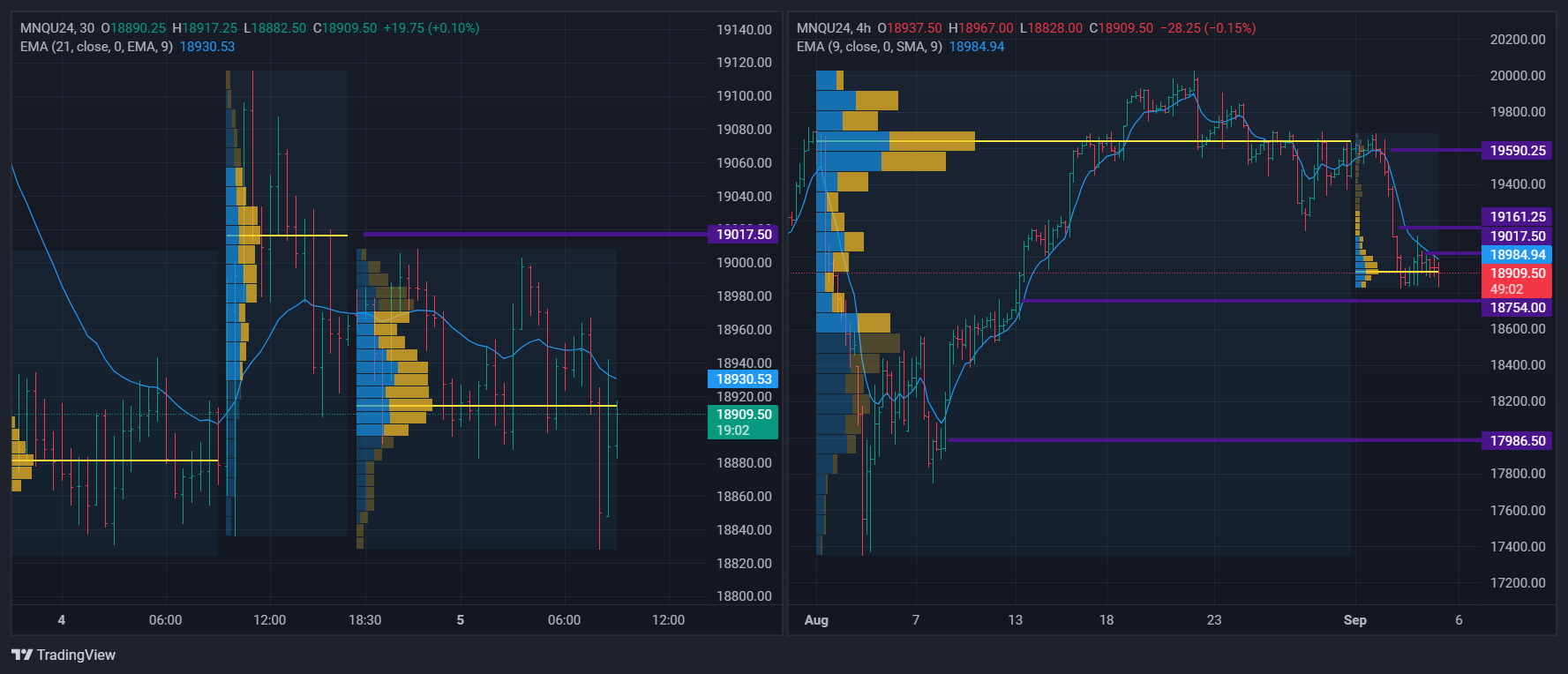

so, I had to switch the 4hr and 30min around due to glare from the changing sun.

30 min MNQ on left areas of interest;

19,017ish yesterdays Vol POC

18,833 seems to be the hill bulls are willing to die on.

4hr MNQ on right market is constricting on Aug. Lo Vol area. waiting for thrusts away from that area. purple lines are price magnets then potential S/R

pretty much same story on MES, markets are currently in Lo VOL 4hr zones. with price magnets in Purple.

MNQ year to date Vol profile. High Vol area 18,190 easly within reach.

NQ has left value are for month of Aug.

Not that I myself have been on here a lot but I am glad you are back CharterJoe. Sounds like you have had some great experiences. Hope your daughters are doing well and find a similar success to yours.

-mrg

-mrg

so here is what i consider a good setup on GC.

trend up long term, and swing term. a test of fridays low the first HL and the next HL trend line break and a retest. Ill put a stop a couple pts below the current EMA price the 2524 lvl.

*a HH (higher hi) not a HL ( Higher lo)

same concept....trend line break and a rejection at a longer term conjunction of Fridays singles. still long gold barely the best looking ones tend to be the days losers....

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.