Long-term and Short-term Setups

Hello Traders,

I’m a pro with 7+ years of experience in the market. I want to help out retail traders. So, here I post some of my long-term and short-term setups and crisp points of the reasoning and my conclusion. Hope it benefits you.

AUD/USD Technical Analysis

~~ The counter has formed a gramophone pattern.

~~ It has hit the upper trendline and is coming down with strong momentum.

~~ We advise traders to go short when the pair breaks the support level of 0.71745 and expect a sell-off to lower trendline.

I’m a pro with 7+ years of experience in the market. I want to help out retail traders. So, here I post some of my long-term and short-term setups and crisp points of the reasoning and my conclusion. Hope it benefits you.

AUD/USD Technical Analysis

~~ The counter has formed a gramophone pattern.

~~ It has hit the upper trendline and is coming down with strong momentum.

~~ We advise traders to go short when the pair breaks the support level of 0.71745 and expect a sell-off to lower trendline.

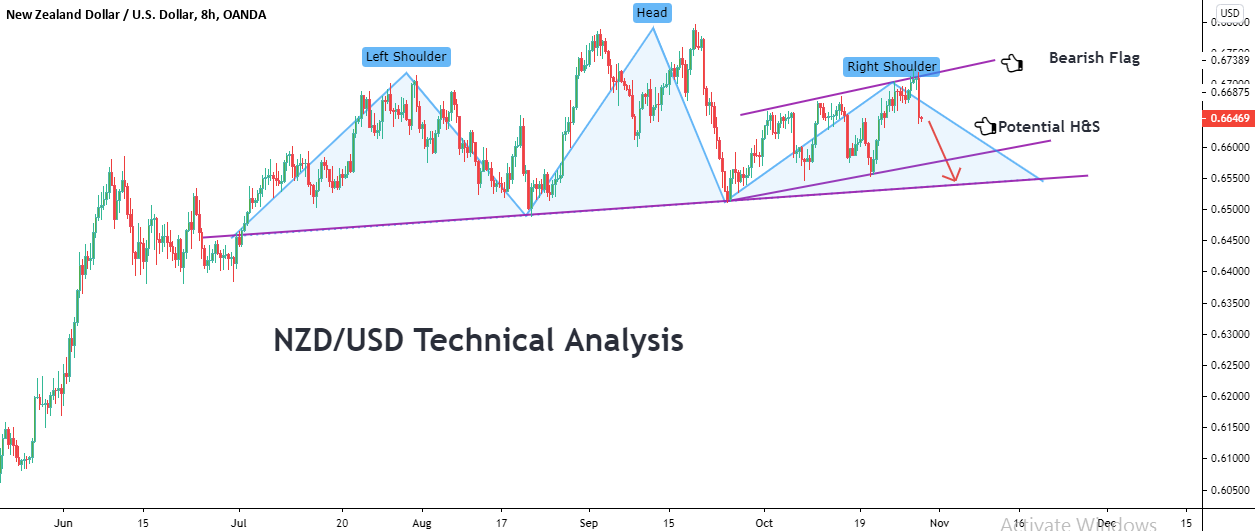

NZD/USD Technical Analysis

~~The counter was in a consolidation phase after a solid down move.

~~ The consolidation resembles a bearish flag pattern.

~~ Further, the entire setup could be interpreted as a head and shoulder pattern.

~~ Hence, we expect the pair to be bearish in the near-term.

~~The counter was in a consolidation phase after a solid down move.

~~ The consolidation resembles a bearish flag pattern.

~~ Further, the entire setup could be interpreted as a head and shoulder pattern.

~~ Hence, we expect the pair to be bearish in the near-term.

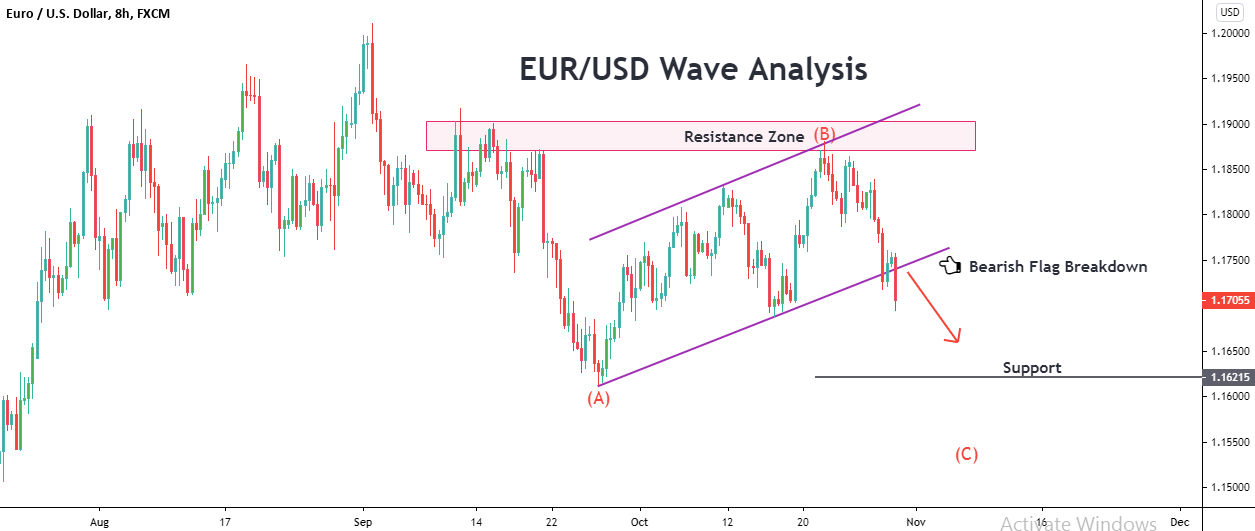

EUR/USD Technical Analysis

~~ As we suggested earlier the counter is in an ABC correction and pushed down at the resistance zone.

~~Now, the bearish flag formation has also broken down, validating the wave C.

~~ Hence, we expect the pair to be bearish in the short-term.

~~ As we suggested earlier the counter is in an ABC correction and pushed down at the resistance zone.

~~Now, the bearish flag formation has also broken down, validating the wave C.

~~ Hence, we expect the pair to be bearish in the short-term.

AUD/JPY Wave Analysis

~~The counter is currently in a long-term corrective ABC structure.

~~ It has completed wave A and is consolidating in a box structure at the low.

~~ We expect it to break upside and move to form wave B.

~~The counter is currently in a long-term corrective ABC structure.

~~ It has completed wave A and is consolidating in a box structure at the low.

~~ We expect it to break upside and move to form wave B.

EUR/GBP Technical Analysis

~~ The upside movement of the pair is capped by a bearish trendline.

~~ It attempted a breakout but fizzled out and the price action has formed an H&S pattern instead.

~~ Hence, we expect the pair to be bearish in the near-term.

~~ The upside movement of the pair is capped by a bearish trendline.

~~ It attempted a breakout but fizzled out and the price action has formed an H&S pattern instead.

~~ Hence, we expect the pair to be bearish in the near-term.

EUR/USD Wave Analysis

~~ The counter had completed its long-term wave 4 with an ABC correction.

~~ It had bounced off from the lows strongly by crossing the resistance at 1.1706.

~~ Further, if the price sustains at a higher level for the day, it could be interpreted as a morning star formation.

~~ We expect the pair to race away to highs and complete the wave 5.

~~ The counter had completed its long-term wave 4 with an ABC correction.

~~ It had bounced off from the lows strongly by crossing the resistance at 1.1706.

~~ Further, if the price sustains at a higher level for the day, it could be interpreted as a morning star formation.

~~ We expect the pair to race away to highs and complete the wave 5.

I had pleasure to learn that. Thanks.

Thank you for the interesting information

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.