Long-term and Short-term Setups

Hello Traders,

I’m a pro with 7+ years of experience in the market. I want to help out retail traders. So, here I post some of my long-term and short-term setups and crisp points of the reasoning and my conclusion. Hope it benefits you.

AUD/USD Technical Analysis

~~ The counter has formed a gramophone pattern.

~~ It has hit the upper trendline and is coming down with strong momentum.

~~ We advise traders to go short when the pair breaks the support level of 0.71745 and expect a sell-off to lower trendline.

I’m a pro with 7+ years of experience in the market. I want to help out retail traders. So, here I post some of my long-term and short-term setups and crisp points of the reasoning and my conclusion. Hope it benefits you.

AUD/USD Technical Analysis

~~ The counter has formed a gramophone pattern.

~~ It has hit the upper trendline and is coming down with strong momentum.

~~ We advise traders to go short when the pair breaks the support level of 0.71745 and expect a sell-off to lower trendline.

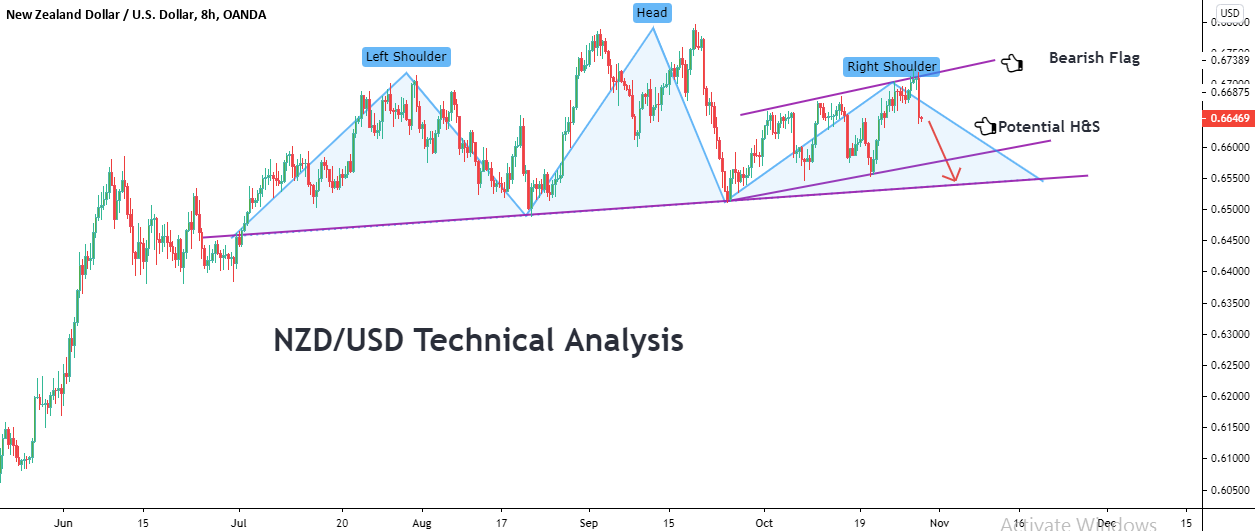

NZD/USD Technical Analysis

~~The counter was in a consolidation phase after a solid down move.

~~ The consolidation resembles a bearish flag pattern.

~~ Further, the entire setup could be interpreted as a head and shoulder pattern.

~~ Hence, we expect the pair to be bearish in the near-term.

~~The counter was in a consolidation phase after a solid down move.

~~ The consolidation resembles a bearish flag pattern.

~~ Further, the entire setup could be interpreted as a head and shoulder pattern.

~~ Hence, we expect the pair to be bearish in the near-term.

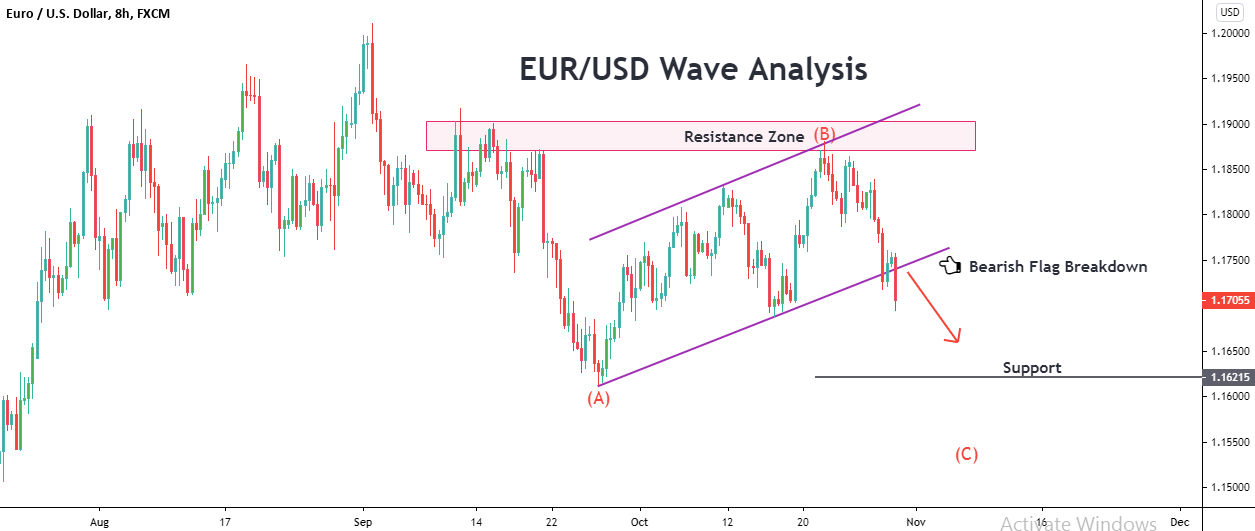

EUR/USD Technical Analysis

~~ As we suggested earlier the counter is in an ABC correction and pushed down at the resistance zone.

~~Now, the bearish flag formation has also broken down, validating the wave C.

~~ Hence, we expect the pair to be bearish in the short-term.

~~ As we suggested earlier the counter is in an ABC correction and pushed down at the resistance zone.

~~Now, the bearish flag formation has also broken down, validating the wave C.

~~ Hence, we expect the pair to be bearish in the short-term.

AUD/JPY Wave Analysis

~~The counter is currently in a long-term corrective ABC structure.

~~ It has completed wave A and is consolidating in a box structure at the low.

~~ We expect it to break upside and move to form wave B.

~~The counter is currently in a long-term corrective ABC structure.

~~ It has completed wave A and is consolidating in a box structure at the low.

~~ We expect it to break upside and move to form wave B.

EUR/GBP Technical Analysis

~~ The upside movement of the pair is capped by a bearish trendline.

~~ It attempted a breakout but fizzled out and the price action has formed an H&S pattern instead.

~~ Hence, we expect the pair to be bearish in the near-term.

~~ The upside movement of the pair is capped by a bearish trendline.

~~ It attempted a breakout but fizzled out and the price action has formed an H&S pattern instead.

~~ Hence, we expect the pair to be bearish in the near-term.

EUR/USD Wave Analysis

~~ The counter had completed its long-term wave 4 with an ABC correction.

~~ It had bounced off from the lows strongly by crossing the resistance at 1.1706.

~~ Further, if the price sustains at a higher level for the day, it could be interpreted as a morning star formation.

~~ We expect the pair to race away to highs and complete the wave 5.

~~ The counter had completed its long-term wave 4 with an ABC correction.

~~ It had bounced off from the lows strongly by crossing the resistance at 1.1706.

~~ Further, if the price sustains at a higher level for the day, it could be interpreted as a morning star formation.

~~ We expect the pair to race away to highs and complete the wave 5.

I had pleasure to learn that. Thanks.

Thank you for the interesting information

When it comes to long-term and short-term setups in forex trading, each has its own strategy and approach depending on your goals and risk tolerance. Understanding the differences and how to execute these setups effectively can make a significant difference in your trading success. Traders offer some insightful perspectives that might help you choose the right approach for your trading style.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.