ES 09-28-16

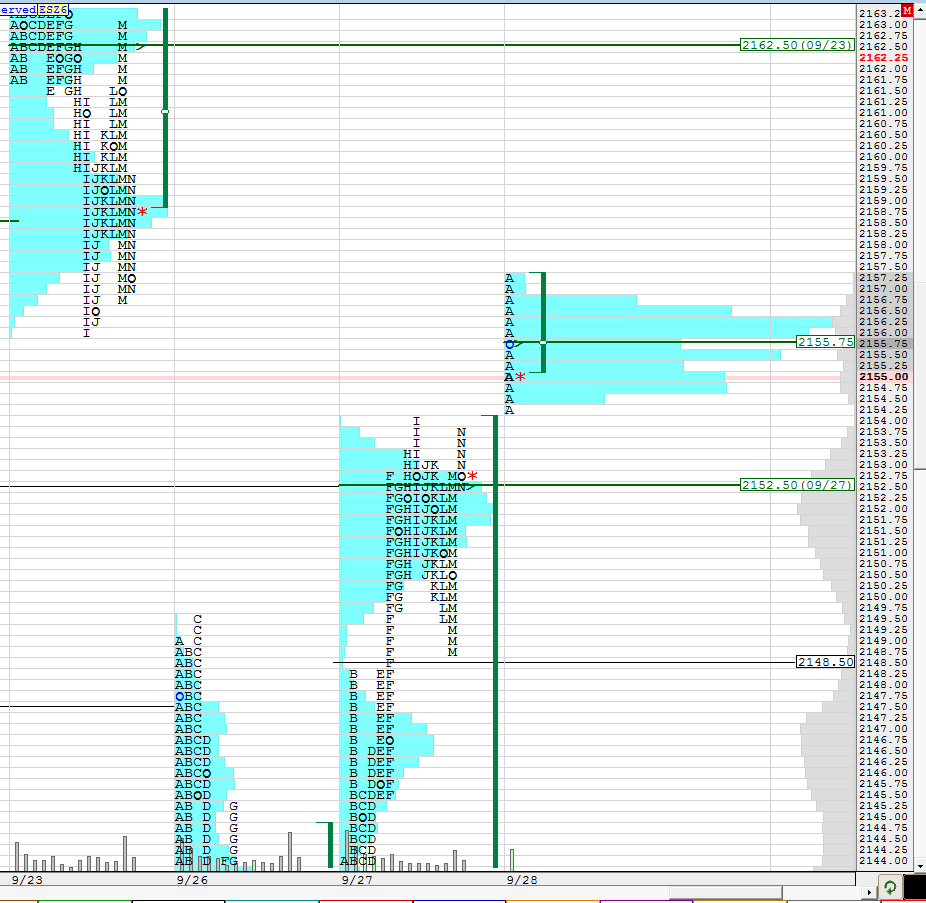

Daily R1 at 60 and PP at 46.5. Coincidentally, those are also the locations of the 0.5 SD volatility bands (60 and 44.5), or the numbers that Bruce says are virtually guaranteed to hit during the day. Also both those numbers are just outside the current ONH and ONL too. I have started waiting until RTH open to being trading. I will post a bit once the market opens.

How I see it... that 52 - 53 becomes very important because it divides the R1 and the Pivot number and we know there is a 96 % chance that at least one of those will print today

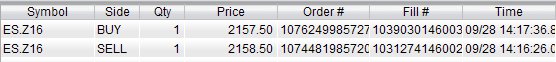

starting a small aggressive short at 55.25 print....56 is the swing low from 9-23....so I am probably early

edit: target will be 52.75

edit: target will be 52.75

over night mid point lines up with your 52-53..lets have up movement to 57 in OR..then short the OR is my plan

Yellen testifying at 10 EST as well as OPEC meeting at same time. Market probably tentative before that

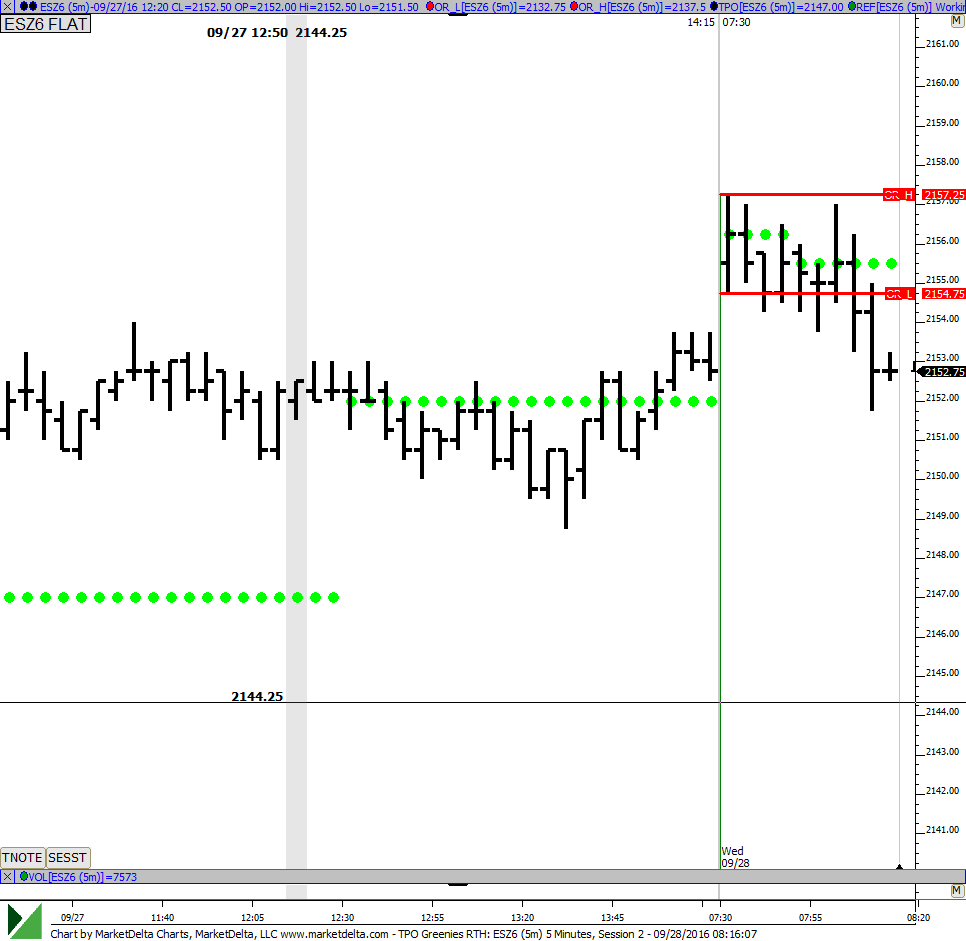

the fact that we can't test in YD range is certainly no good for us shorts so far...my average in is now 56.50 so bringing first target up to 54.50...not liking this so far

on the other hand i see some weak buying 1 tic above YD's highs. house of cards could come tumbling down for the weak longs...

interesting battle now between the range( the low) of 9 - 23 and yesterdays high...and the funny thing is they are only two points apart ..here's a pic for those who are bored like me

moving second target to one tic above close gap fill at at 53...this could be a mistake...watching this test into yesterdays range closely

This is a 5 min chart where the red horizontal lines are the high and low of the first 5-min bar, called the OR. Bruce, I think you use the 1-min bar to define OR, is that right? I am slower and prefer the 5-min chart. Note how we have been unable to break the ORH and made multiple attempts to break ORL before it finally gave away to get to YD's VPOC at 52. The shorts do not want the market to go back above the ORL for too long. Time matters a lot because you dont want to spend too much time above ORL to keep the shorts valid.

yes I use one minute but 5 minute works well too...covering last on new lows at 51.50...gap in data sits up at 53.50 and my concern is they may come back up for that....and if not then those holding will get their 46 pivot......it won't be me

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.