ES Tuesday 5-10-16

Confluent numbers

Daily R2 and Monthly pivot at 2064, On POC at 65.50

Overnight high, Weekly SITYS number and daily one SD band at 69 - 70.25...so short fades need to be cautious as they may push it up to the SITYS weekly number today

Yesterdays highs and R1 at 58 - 59.50...also Aprils close is 58.75

1/2 SD up today is at 2062 so aggressive traders could sell that in overnight with expectation that the 64 - 65 will slow down price IF it keeps pushing up in O/N...59.75 should be initial target on shorts if doing so

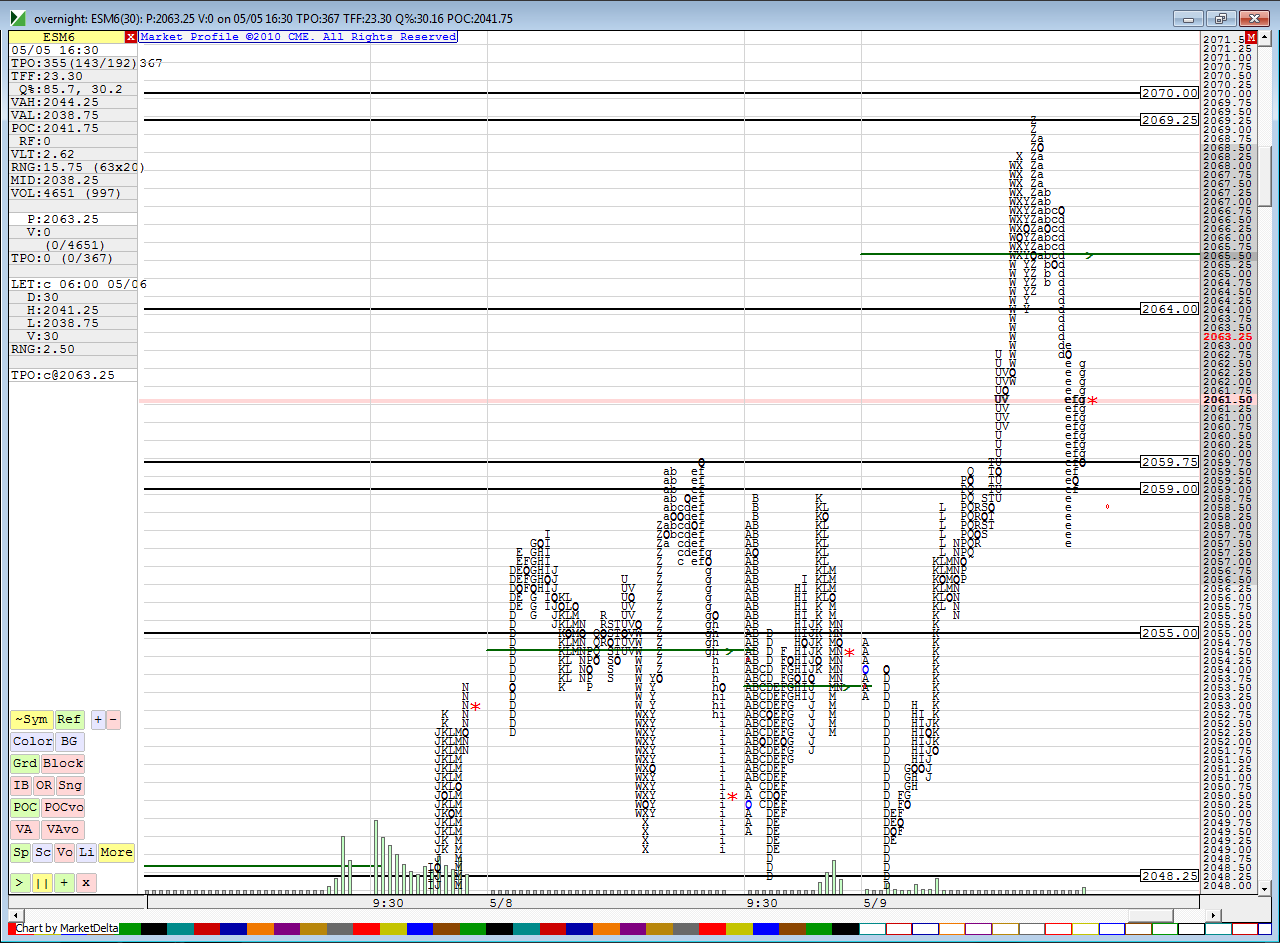

here is current Overnight against Yesterday...I will edit this to include a few other price action charts to further confirm areas

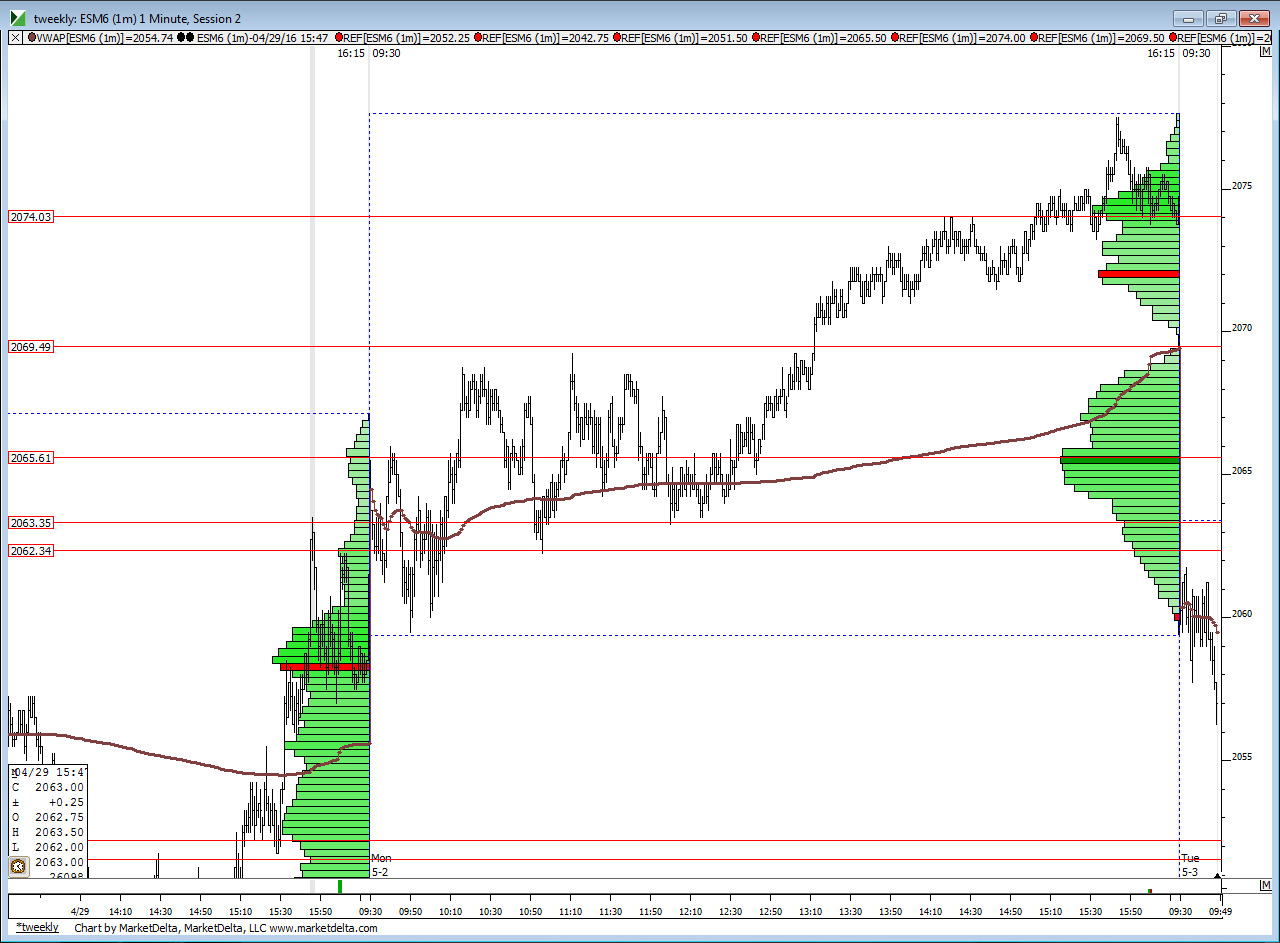

ok, this is last Monday...note the Low time at 2070 and high time at 65.50 ( chart says 65.61)...I also drew lines at the lows in the 62.34 - 63.34 area...this helps confirm overnight prices to me

Daily R2 and Monthly pivot at 2064, On POC at 65.50

Overnight high, Weekly SITYS number and daily one SD band at 69 - 70.25...so short fades need to be cautious as they may push it up to the SITYS weekly number today

Yesterdays highs and R1 at 58 - 59.50...also Aprils close is 58.75

1/2 SD up today is at 2062 so aggressive traders could sell that in overnight with expectation that the 64 - 65 will slow down price IF it keeps pushing up in O/N...59.75 should be initial target on shorts if doing so

here is current Overnight against Yesterday...I will edit this to include a few other price action charts to further confirm areas

ok, this is last Monday...note the Low time at 2070 and high time at 65.50 ( chart says 65.61)...I also drew lines at the lows in the 62.34 - 63.34 area...this helps confirm overnight prices to me

great point... i think FT71 says there is a 95% probability of getting either the ONH or ONL on a given day (I think Paul said the same as well). So YD was definitely an outlier

Originally posted by BruceM

one other thing that sits in the back of my mind is that we didn't get an Overnight low or high yesterday...so I think we will get one today and it sure seems like the high is the easy one...just another factor that will make me go smaller on short fades this morning in general

average price in is now 64.50 for me and I am NOT liking this so far...revising target to 62.50 now...that would be initial short from O/N...bad feel up here

perfect reversal from 65.5 naked VPOC so far.... lets see now

another reason I exited here is that if we hit into the center of a bell... that 65 area then we need to try to get out of lower edge so I use those lower edges as targets...holding up inside lower edge would be good for bulls

Originally posted by BruceM

average price in is now 64.50 for me and I am NOT liking this so far...revising target to 62.50 now...that would be initial short from O/N...bad feel up here

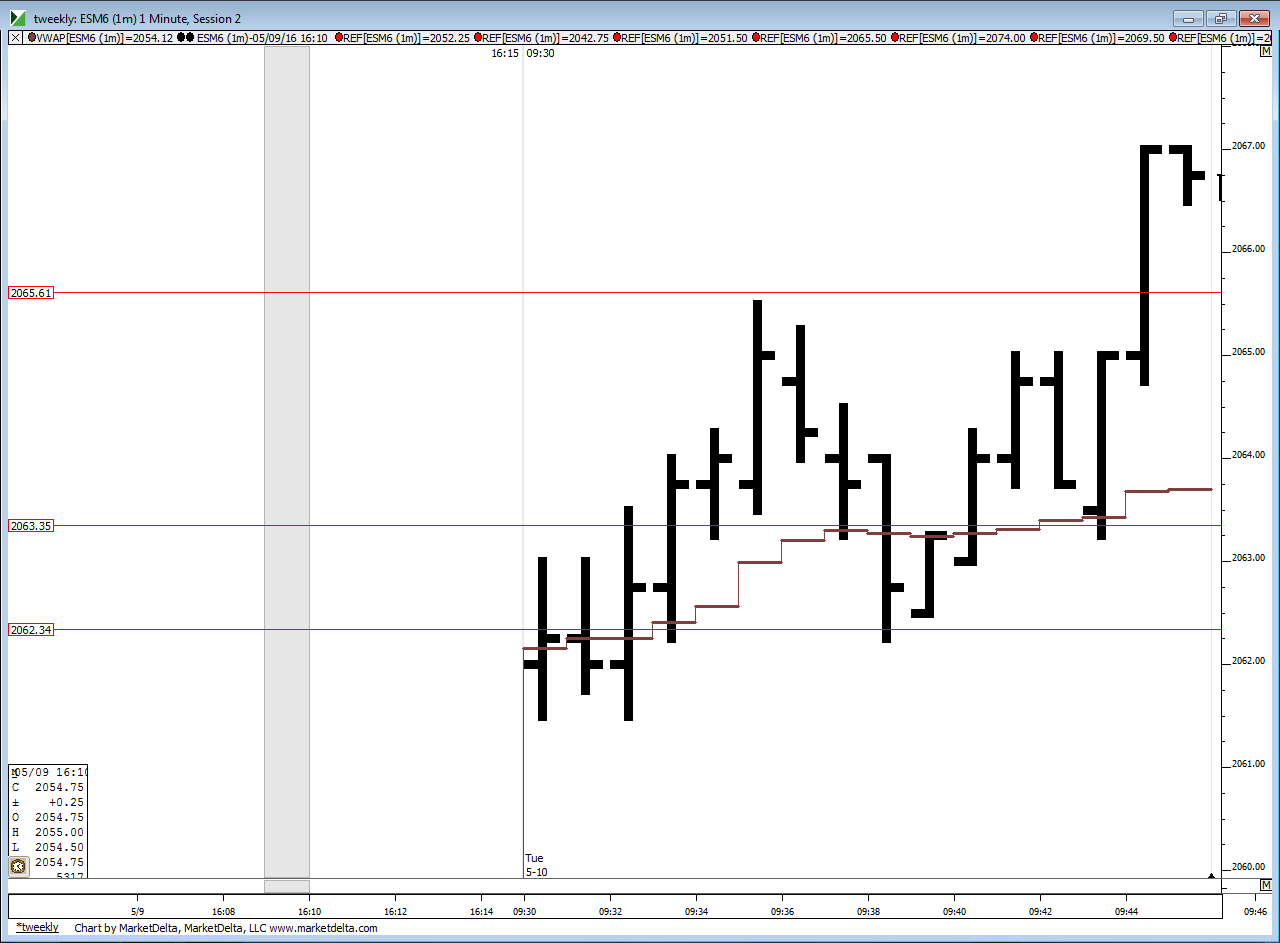

a super sized view of the lines I posted from initial post above...I removed the histogram...but note how lower edge, the 62.25 - 63.25 held prices up ( chart says 2062.34 - 63.35 ..it's jst the way it labels it)....my runners got clipped but a small win and I didn't go long

starting very small shorts at 69.25 with a bigger plan to sell above O/N highs...target will be 66.75

revising target to 67...

currently the VPOC is at 64 and the latest rally came off of the open. So weak buyers likely pushing for the ONH. It still looks like a house of cards that could come tumbling down.. but who knows

plan is to wait to 71 or higher comes in if it does to add.....otherwise will come all out at 67

VPOC just shifted to 67.75

confluence 74 - 75.75 if anyone is trading ....only 16 % chance we close OVER 70 and about 6 - 8 % chance we close over 78 today...one time framing can't go on forever

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.