ES Tuesday 5-10-16

Confluent numbers

Daily R2 and Monthly pivot at 2064, On POC at 65.50

Overnight high, Weekly SITYS number and daily one SD band at 69 - 70.25...so short fades need to be cautious as they may push it up to the SITYS weekly number today

Yesterdays highs and R1 at 58 - 59.50...also Aprils close is 58.75

1/2 SD up today is at 2062 so aggressive traders could sell that in overnight with expectation that the 64 - 65 will slow down price IF it keeps pushing up in O/N...59.75 should be initial target on shorts if doing so

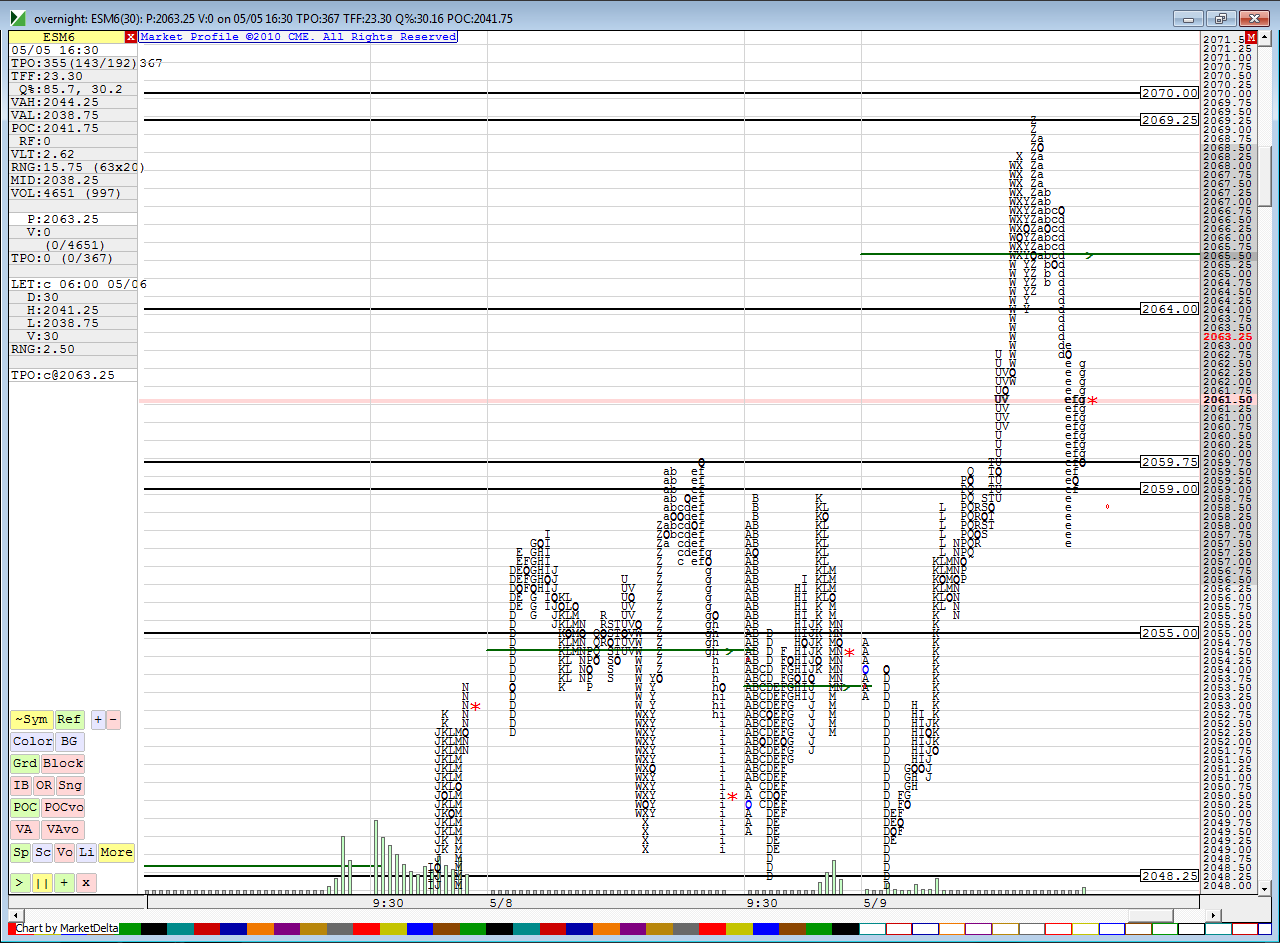

here is current Overnight against Yesterday...I will edit this to include a few other price action charts to further confirm areas

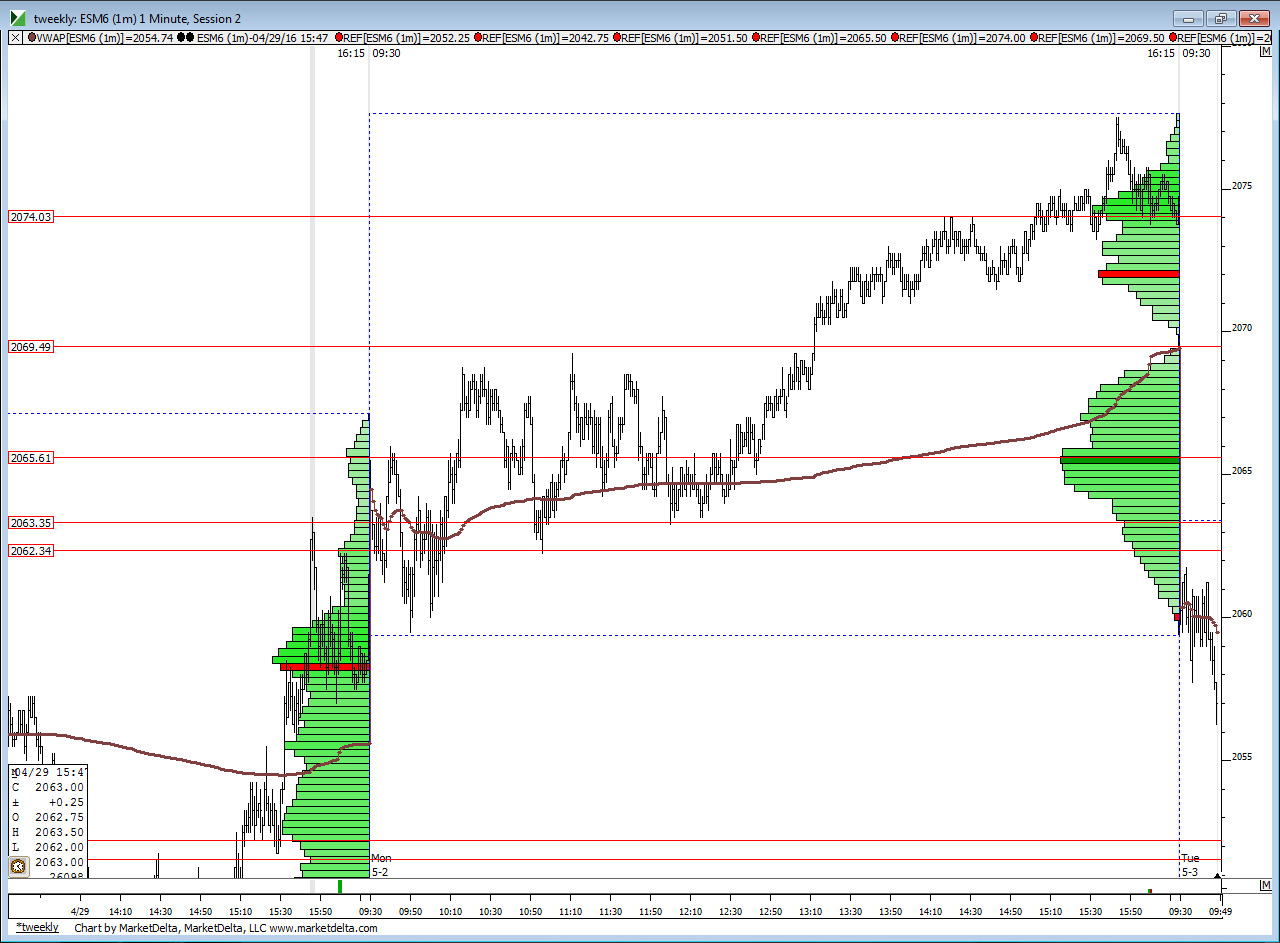

ok, this is last Monday...note the Low time at 2070 and high time at 65.50 ( chart says 65.61)...I also drew lines at the lows in the 62.34 - 63.34 area...this helps confirm overnight prices to me

Daily R2 and Monthly pivot at 2064, On POC at 65.50

Overnight high, Weekly SITYS number and daily one SD band at 69 - 70.25...so short fades need to be cautious as they may push it up to the SITYS weekly number today

Yesterdays highs and R1 at 58 - 59.50...also Aprils close is 58.75

1/2 SD up today is at 2062 so aggressive traders could sell that in overnight with expectation that the 64 - 65 will slow down price IF it keeps pushing up in O/N...59.75 should be initial target on shorts if doing so

here is current Overnight against Yesterday...I will edit this to include a few other price action charts to further confirm areas

ok, this is last Monday...note the Low time at 2070 and high time at 65.50 ( chart says 65.61)...I also drew lines at the lows in the 62.34 - 63.34 area...this helps confirm overnight prices to me

trying for 59.75 retest in Overnight short off first zone show above....the 62.25 - 63.25( this is also 1/2 SD up which is daily SITYS number)

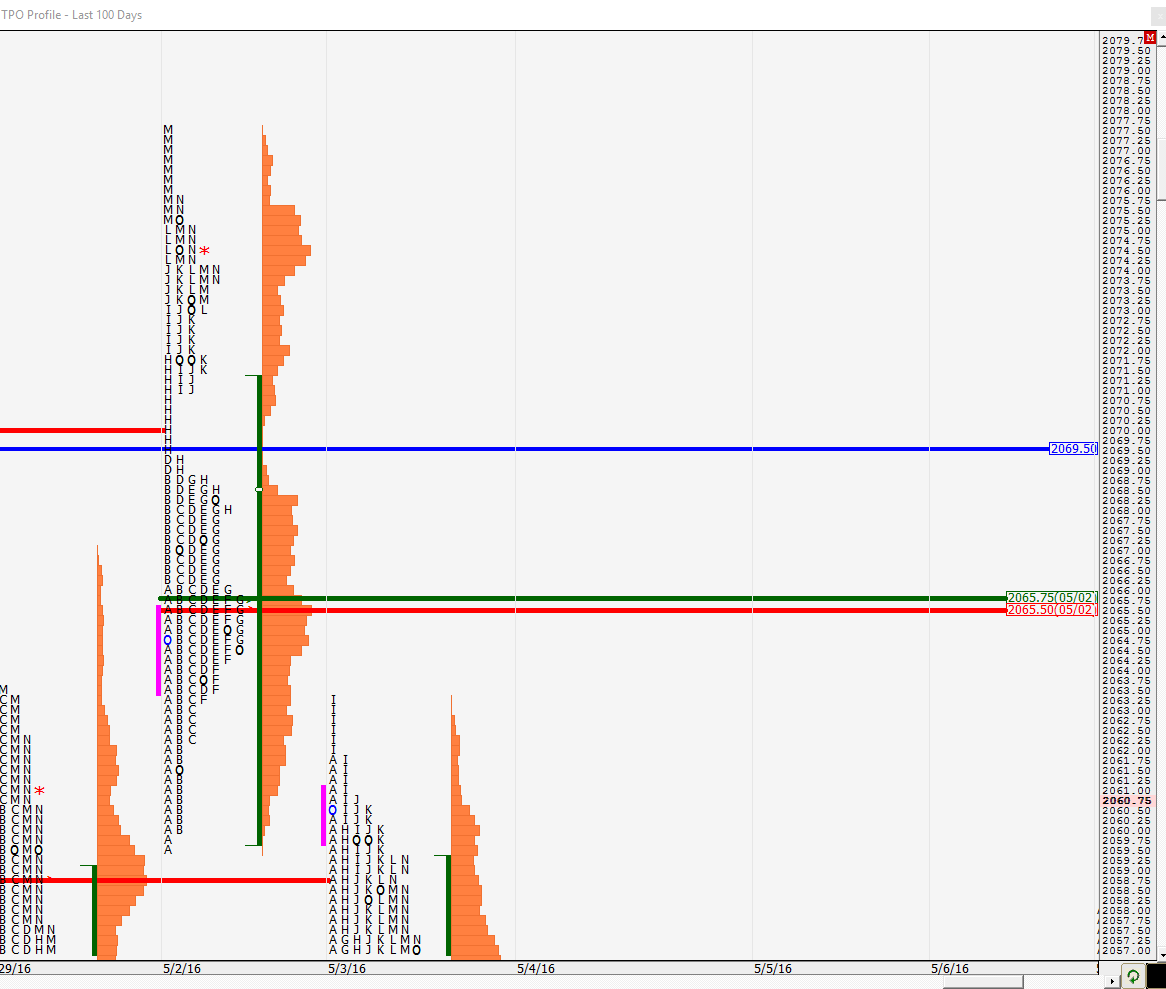

To add on to Bruce's case for the short, there are single prints from 69.5 on 5/2 which means that is a LVN zone. Also 65.5 is a naked VPOC from 5/2 as well. Just a lot going on in that area so I am going to treat it is a relatively wide band. There could be a lot of back and forth.

Bruce, just saw your edited post. Looks like we were writing down the same thing at the same time. Did not mean to duplicate

I am not as adventurous as Bruce so I am going to wait till the 65/66 area before initiating a trade. I am hoping that we get there before YD's high is tested

oh , no problem....u showed it from a pure market profile view which is always great to see

Originally posted by NewKid

Bruce, just saw your edited post. Looks like we were writing down the same thing at the same time. Did not mean to duplicate

so far I missed my exit by one tic....really don't enjoy Overnight trades...also in the back of my mind is that super low range fom yesterday so concern that volatility will expand and don't want to be on the wrong side of the expansion.....I should have mentioned that the 62 area kinda splits up the R1 at 59.25 and the R2 at 64 if we open in between...we know one will hit today...unlike yesterday that failed to have a floor trader number print

Originally posted by NewKid

I am not as adventurous as Bruce so I am going to wait till the 65/66 area before initiating a trade. I am hoping that we get there before YD's high is tested

it is maddening indeed when you miss an exit by 1 tic... it has happened way too many times for me as well. your logic is sound. i have a concern that all the shorts that were pressing could start getting squeezed very soon and could expand the market to the upside quickly....but since YD's range is so low, all the pivot numbers are relatively close to each other and we are virtually guaranteed to hit at least one of them today..

yeah, this is a much safer trade... for me I'll be using 64 - 65.50 as a zone but in day session...my overnight position is small but will still be working with a loser if they push up that way first....FWIW the O/N midpoint is down at 58.50 and probably won't change before Rth opens

Originally posted by NewKid

I am not as adventurous as Bruce so I am going to wait till the 65/66 area before initiating a trade. I am hoping that we get there before YD's high is tested

i am curious to see how the O/N mid plays out today because YD's range was 10.5 points and the O/N range was 20.5 points. Which means that the O/N range was 2x the RTH range. So how does that spill over to the day session today? Now granted that we are not opening close to the ONH which in my mind should increase the odds of the O/N mid significantly. I would have been more cautious if we were opening closer to the ONH

one other thing that sits in the back of my mind is that we didn't get an Overnight low or high yesterday...so I think we will get one today and it sure seems like the high is the easy one...just another factor that will make me go smaller on short fades this morning in general

confluence 74 - 75.75 if anyone is trading ....only 16 % chance we close OVER 70 and about 6 - 8 % chance we close over 78 today...one time framing can't go on forever

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.