ES Thursday 3-5-15

this is excatly what i am about to watch...the Folks from Dough linked me to those yesterday...it's like u r a mind reader

Originally posted by Big Mike

Bruce,

All of these segments are about defending trades gone bad. maybe something there for you.

https://www.tastytrade.com/tt/shows/anatomy-of-a-trade?locale=en-US

If you are spread, typically no defending. Risk XX to make X that's it. Short strike beyond the market maker move and give it a shot. I do not adjust my Bittman trade at all, they go or not.

I will anxiously watch your progression. I never could wrap my head around the poor risk/reward ratio and lack of positive expectancy on these types trades.

I will anxiously watch your progression. I never could wrap my head around the poor risk/reward ratio and lack of positive expectancy on these types trades.

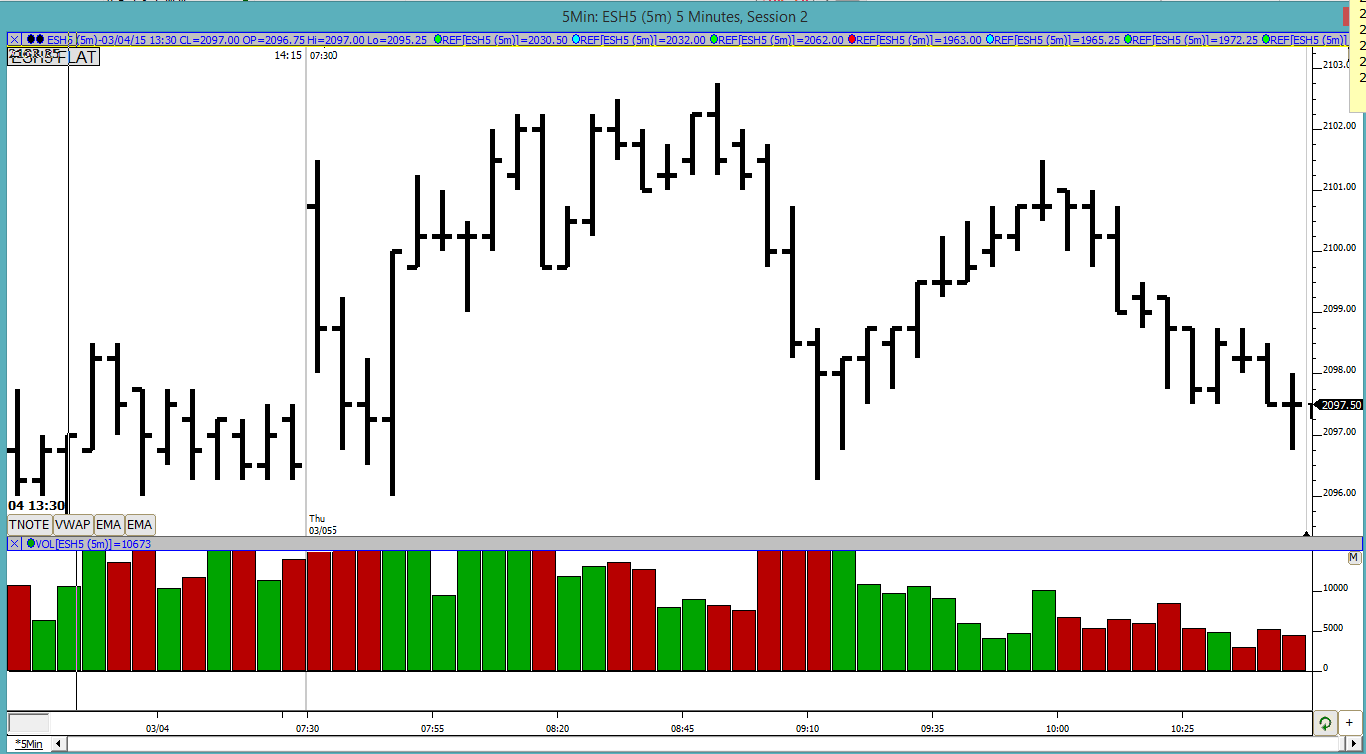

I was looking at the 5-min chart and made the following observation. I did not take the trade and only "mentally" made a paper trade. We were making higher highs. We had just made a sixth higher high on the day with range contracting on each 5-min bar and so far it has been a relatively low volume slow moving day. So I am sitting here thinking, if I were trading this, I would take a short at 2101 targeting around 99.75 as a target and let runners run. Looks like it would have been a good scalp and then some. Thanks for the idea Joe. This is a nice and easy way to read the market. Now if it was a trending day with good pace and large ranges on the 5-min bars, I might have traded it differently but today it was worth a shot I think.

Good eye Newkid...I was watching the move down for the same thing...Not sure if it counts as the candles down were so large, didn't really know where a good entry would have been. Your example was much better with the "range contracting on each 5-min bar"

Thanks for sharing this idea Joe.

Thanks for sharing this idea Joe.

In a trend day market new kid, say its been going down against trend Higher highs look like beautiful long entries but will most often not go a tick or two higher so I will look to fade. I also look to fade LL or HH near the open the further we travel away from the open print. But todays 3rd and 4th LL I went long, because we opened inside of y/d range.

Best trades are like the one later in the a.m. it made 6HH if you are bearish the LL L1 at 2100 was a perfect entry.at 12:00 but I was at zaxbys haha

I have done this for years by hand only real time this a.m. looked like this

9:30 LL

9:35 LL L1 -80%

9:40 LL L2-60%

9:45 LL L3 +100 o.b.

9:50 HH H1 +20%

9:55 ib inside bar

10:00 LL L1 strong close +90%

9:30 LL

9:35 LL L1 -80%

9:40 LL L2-60%

9:45 LL L3 +100 o.b.

9:50 HH H1 +20%

9:55 ib inside bar

10:00 LL L1 strong close +90%

The % is based on my discretion where we closed in relation to where it has moved in its bars range

i would say the 96.5 greenie again would have been a good place to enter a long

Originally posted by pants

Good eye Newkid...I was watching the move down for the same thing...Not sure if it counts as the candles down were so large, didn't really know where a good entry would have been. Your example was much better with the "range contracting on each 5-min bar"

Thanks for sharing this idea Joe.

yup, that was exactly the one I was referring to in my earlier post. i was bearish at that time and thought of taking that short. cool stuff

Originally posted by CharterJoe

Best trades are like the one later in the a.m. it made 6HH if you are bearish the LL L1 at 2100 was a perfect entry.at 12:00 but I was at zaxbys haha

Joe, when you have a minute, can you explain again how you calculated those percentages and what does o.b mean (opening balance? 1-min, 5-min?)?

i know you said you used discretion on where the bar closes with respect its range but i did not quite understand the L1-80%, etc.. thanks

i know you said you used discretion on where the bar closes with respect its range but i did not quite understand the L1-80%, etc.. thanks

Originally posted by CharterJoe

I have done this for years by hand only real time this a.m. looked like this

9:30 LL

9:35 LL L1 -80%

9:40 LL L2-60%

9:45 LL L3 +100 o.b.

9:50 HH H1 +20%

9:55 ib inside bar

10:00 LL L1 strong close +90%

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.