ES Wednesday 1-14-15

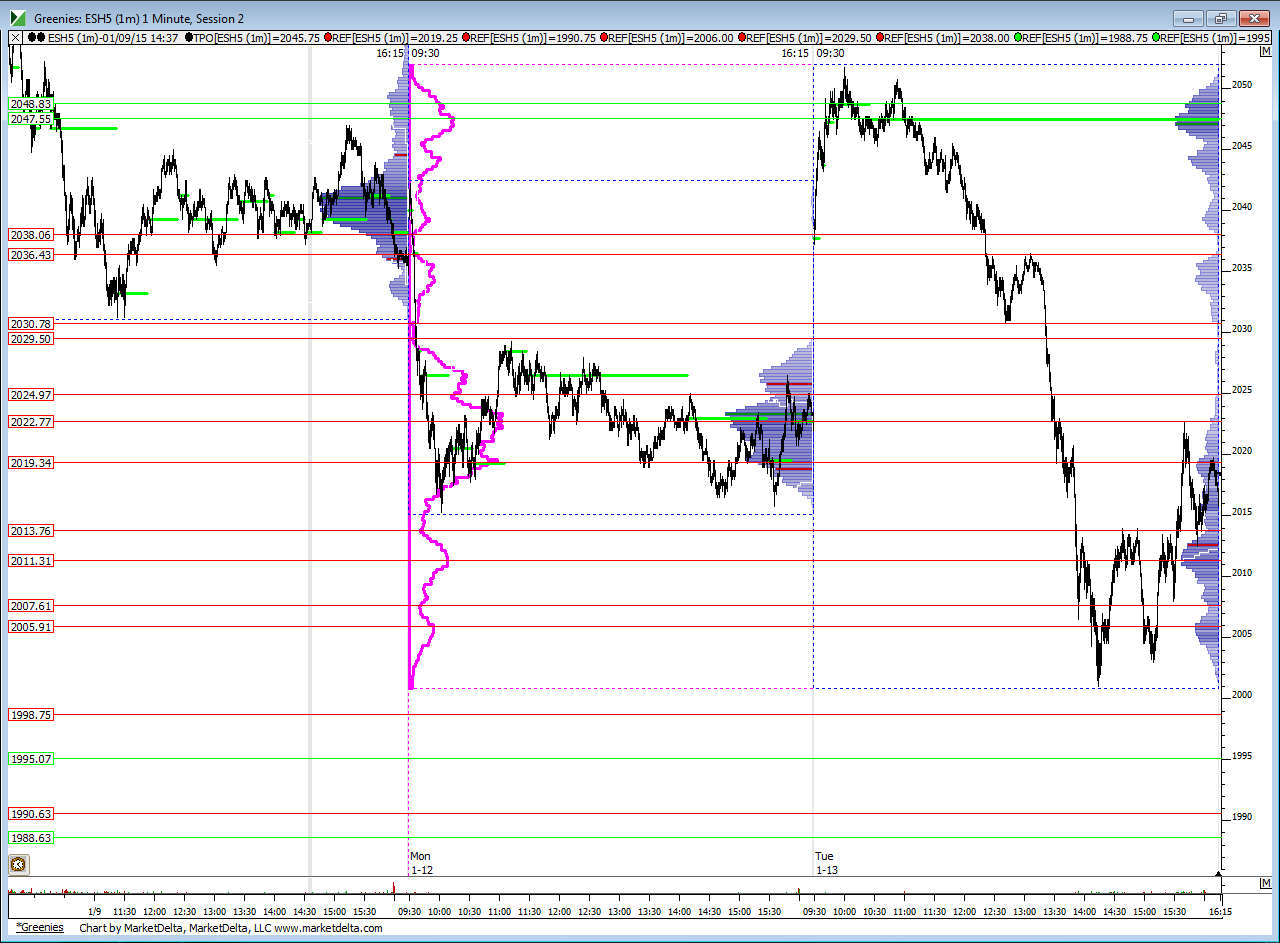

expecting some bullishness coming in towards late in the week. Thursday and Friday are statistically bullish days...but as usual will really only be trading my lines but would like to get some longer term SPY shares put back on....l.had some free time this evening ..this is how my lines look....most important for any bullish cash is getting and closing above Mondays bell curve......On this chart the cyan color is what is currently happening for Monday and Tuesdays trade combined, the developing week.........you can see how we have some lines generated from Tuesdays trading that coincide with levels from Mondays bell curve ...so 2019 - 2025 becomes a big area to watch as we move forward from here regardless of when we get back to those prices...closest greenies are at 1995 area and 1988 area...then one way up at 2047 !!!

official single prints from an Mp chart are at 30.50 and 37.50 but we also spent very little time at 22.75......

here is how the Vix chart seems to be coiling

official single prints from an Mp chart are at 30.50 and 37.50 but we also spent very little time at 22.75......

here is how the Vix chart seems to be coiling

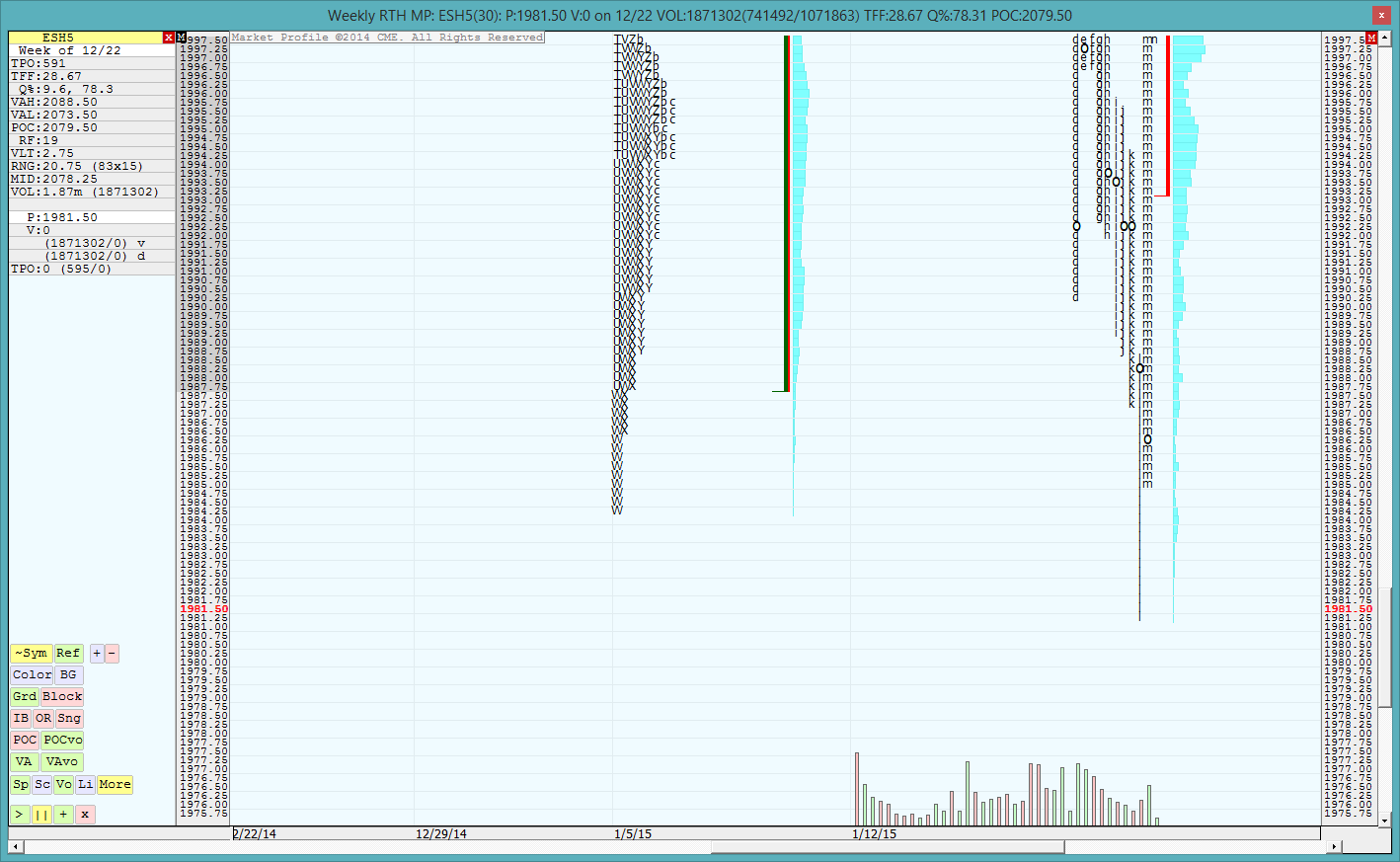

if i am not mistaken, I think what Bruce is trying to say is if that "l' period had close under 84.25, there was a high likelyhood of seeing multiple TPOs there. but since it ended at 86.25, i guess that does hold true?

maybe if it had kept going lower, then there was a high likelyhood of it coming back to tag the "W" singles from last week but since it shot up right away, it was a moot point.

did i get that right, Bruce?

maybe if it had kept going lower, then there was a high likelyhood of it coming back to tag the "W" singles from last week but since it shot up right away, it was a moot point.

did i get that right, Bruce?

correct newkid...they usually donot blow through and leave singles at weekly lows......and often come back to retest those lows.....in fact many times it doesn't matter we usually see multiple tpo's at weekly lows regardless of where we close but closing below on 30 minute seems to increase probability of upside retests...moral of the story is "watch weekly lows and highs for multiple tpo prints with a good signal".....so if u found a good short then we may see 84 reprint today...or tomorrow or friday...once again we are missing the "WHEN" of the equation.

remember..I would never let myself be blinded by a probability...if we close strong i will be buying spy position...regardless of possible weekly low retest....( it's ahigh probability when we leave the singles at a breakdown anyway)......Thursday and Friday of Jan expiration week has a bullish slant ....

as a short term trader ( except for spy 0 i only trade my lines and everything else is just a bonus

as a short term trader ( except for spy 0 i only trade my lines and everything else is just a bonus

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.