ES Wednesday 1-14-15

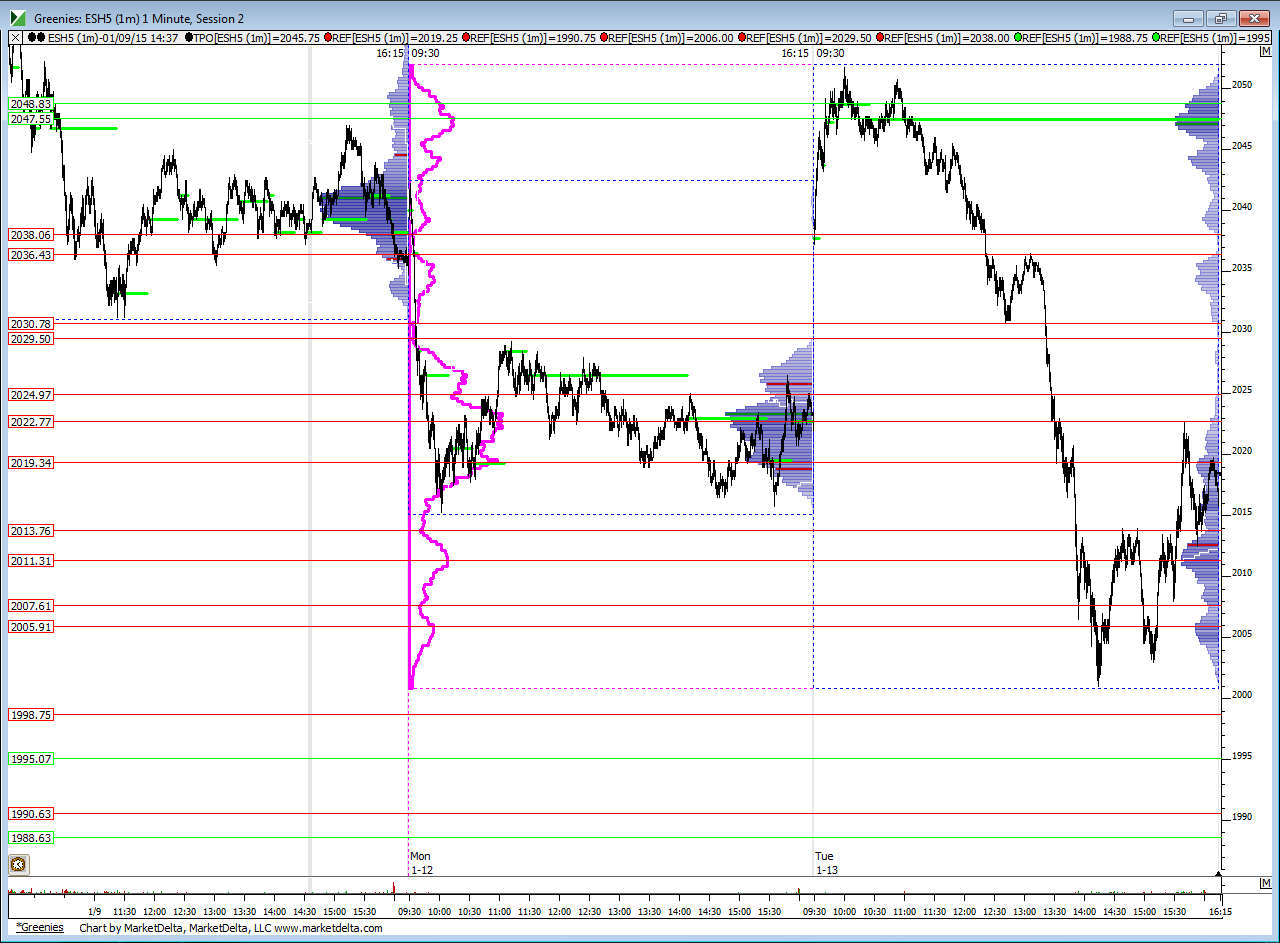

expecting some bullishness coming in towards late in the week. Thursday and Friday are statistically bullish days...but as usual will really only be trading my lines but would like to get some longer term SPY shares put back on....l.had some free time this evening ..this is how my lines look....most important for any bullish cash is getting and closing above Mondays bell curve......On this chart the cyan color is what is currently happening for Monday and Tuesdays trade combined, the developing week.........you can see how we have some lines generated from Tuesdays trading that coincide with levels from Mondays bell curve ...so 2019 - 2025 becomes a big area to watch as we move forward from here regardless of when we get back to those prices...closest greenies are at 1995 area and 1988 area...then one way up at 2047 !!!

official single prints from an Mp chart are at 30.50 and 37.50 but we also spent very little time at 22.75......

here is how the Vix chart seems to be coiling

official single prints from an Mp chart are at 30.50 and 37.50 but we also spent very little time at 22.75......

here is how the Vix chart seems to be coiling

now what would be real nice is if we could go up and tag 95 - 96 then I wouldn't even take an RTH trade today....but that probably won't happen....it seldom does

you are absolutely right. i am afraid of missing a move. i understand where you are coming from and you are 100% right, i need to stay away from O/N. This is it for me. No more O/N trading. Please feel free to yell at me if I do so again..

out at 93. no more O/N trading for me. i am going to wait till the open to see what to do...

market will go find and be attracted back to greenies...at a price of 1991 we have a greenie at 88.50 and 95 ...so if we open in day session in between those we know that they will print at least one....aggressive traders can use break of one minute range to try and get those targets ............an open above 95 should see us return to that........an open below 88.50 will see us return to 88.50........the point here is use Greenies as a magnet if given the opporrtunity today

if we can get a good long then above the 1995 I would try for YD lows near 2001......lets hope the buyers find this attractive down here on the open.....what we don't want to see is Decembers lows get taken out....that confirms an even worse longer term signal for bearishness in the early part of this year....at least that is what the statistics say....today at 8;30 we were at YD lows so they like to return to those report area breakdowns..

S1 is 94 so I'm using 94 - 96 as a key zone...some think if they can't get back up to S1 from an open below in first 45 minutes they you should stay a seller......just an FYI and don't think that will happen today

too quick for me... i missed taking the break of the 1-min bar. it was a text book breakout..

we have bad highs and bad lows on the 5-min bar and we are smack in the middle of it..... which one gets taken out first?

30-min VPOC @ 97. we opened right there

look how the greenie and the LTN ( low time node)on the monthly and weekly became support back to YD lows.....I'm leaving ya with this today...

https://www.youtube.com/watch?v=-WCFUGCOLLU

https://www.youtube.com/watch?v=-WCFUGCOLLU

remember..I would never let myself be blinded by a probability...if we close strong i will be buying spy position...regardless of possible weekly low retest....( it's ahigh probability when we leave the singles at a breakdown anyway)......Thursday and Friday of Jan expiration week has a bullish slant ....

as a short term trader ( except for spy 0 i only trade my lines and everything else is just a bonus

as a short term trader ( except for spy 0 i only trade my lines and everything else is just a bonus

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.