ES Monday 2-24-14

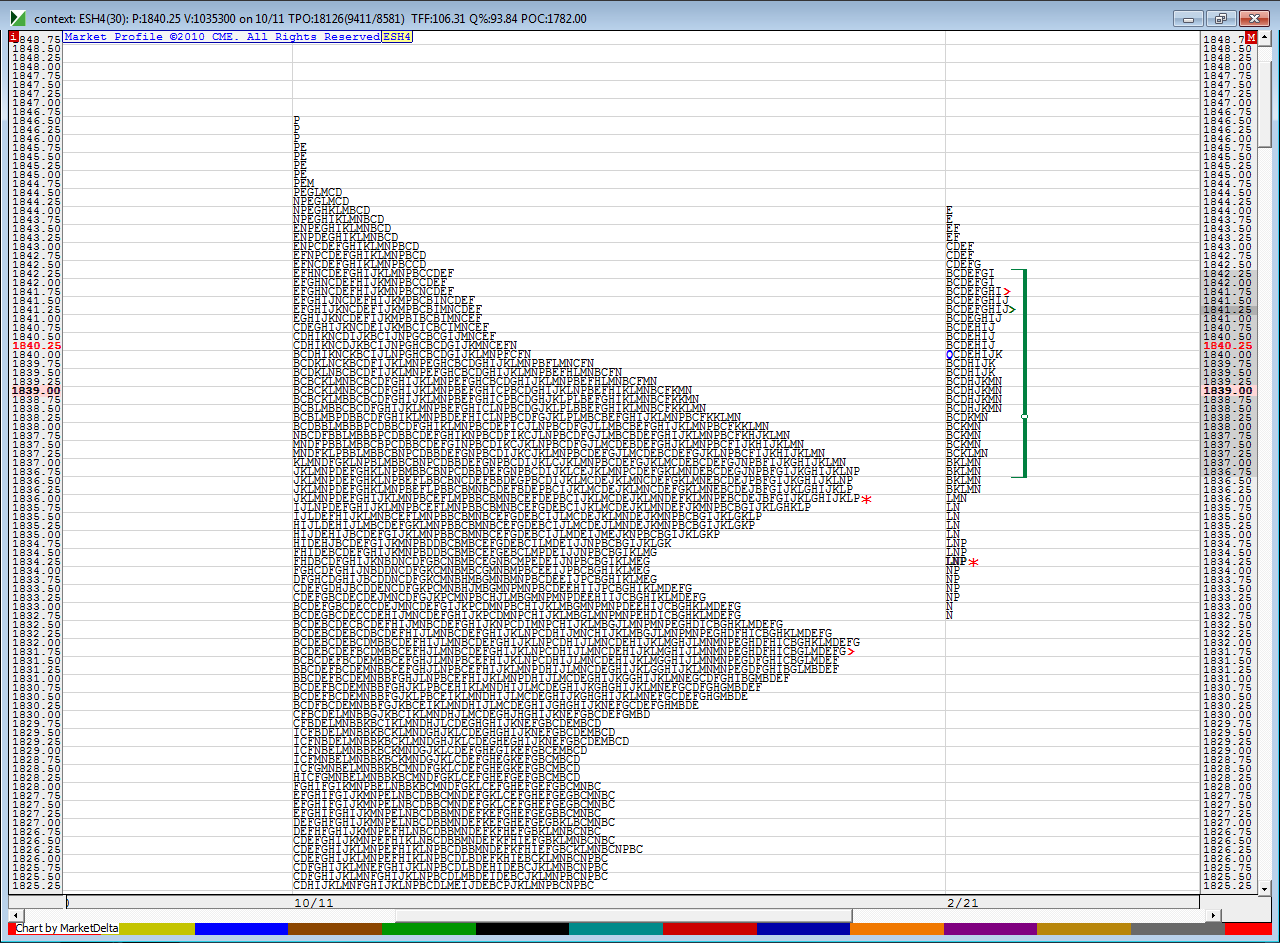

Much of this may be useless by the time we open as we have seen moves happening a bit past 9 a.m but here is context chart...this is Friday's trade against the bigger picture...note how the VA low goes well with a big hump in prices from the composite

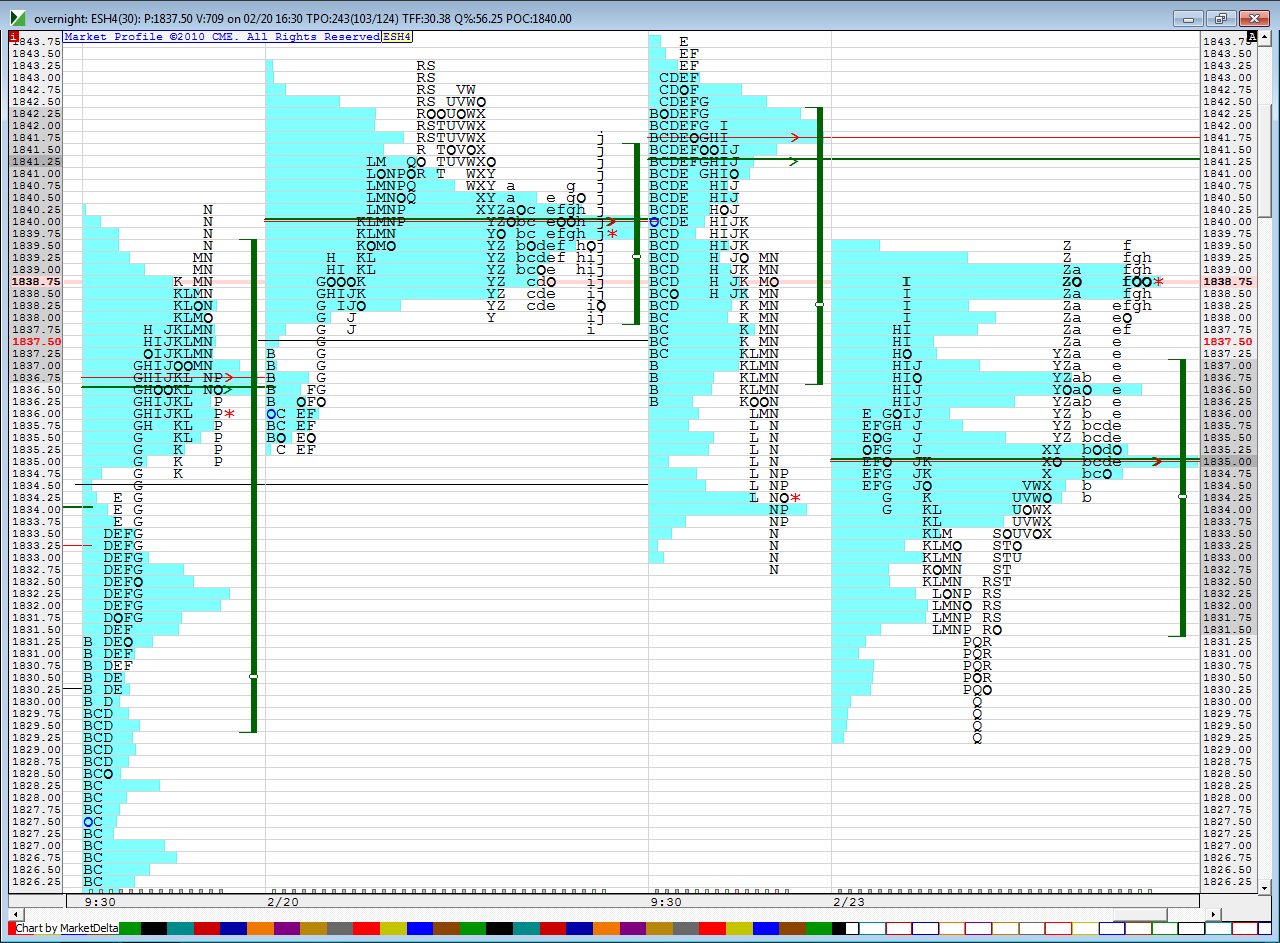

next we have what has happened in the overnight....we had a selloff at the after noon pull back high but have come back to it as I type...on this chart when you see "9:30" it is a day session and when u see the date it is the overnight...note also how the current O/N low stopped at VA low from a few days back at the 29 area...an important reference for the future..note also how the On POC and VPOC formed at a LVN spot from friday ("P" period highs).....so if we open in Value today we may need to use two different buy spots...the VA low from Friday but also the 1835 number ..so I'm making 35 - 36.50 a zone to look at whenever we get back to that

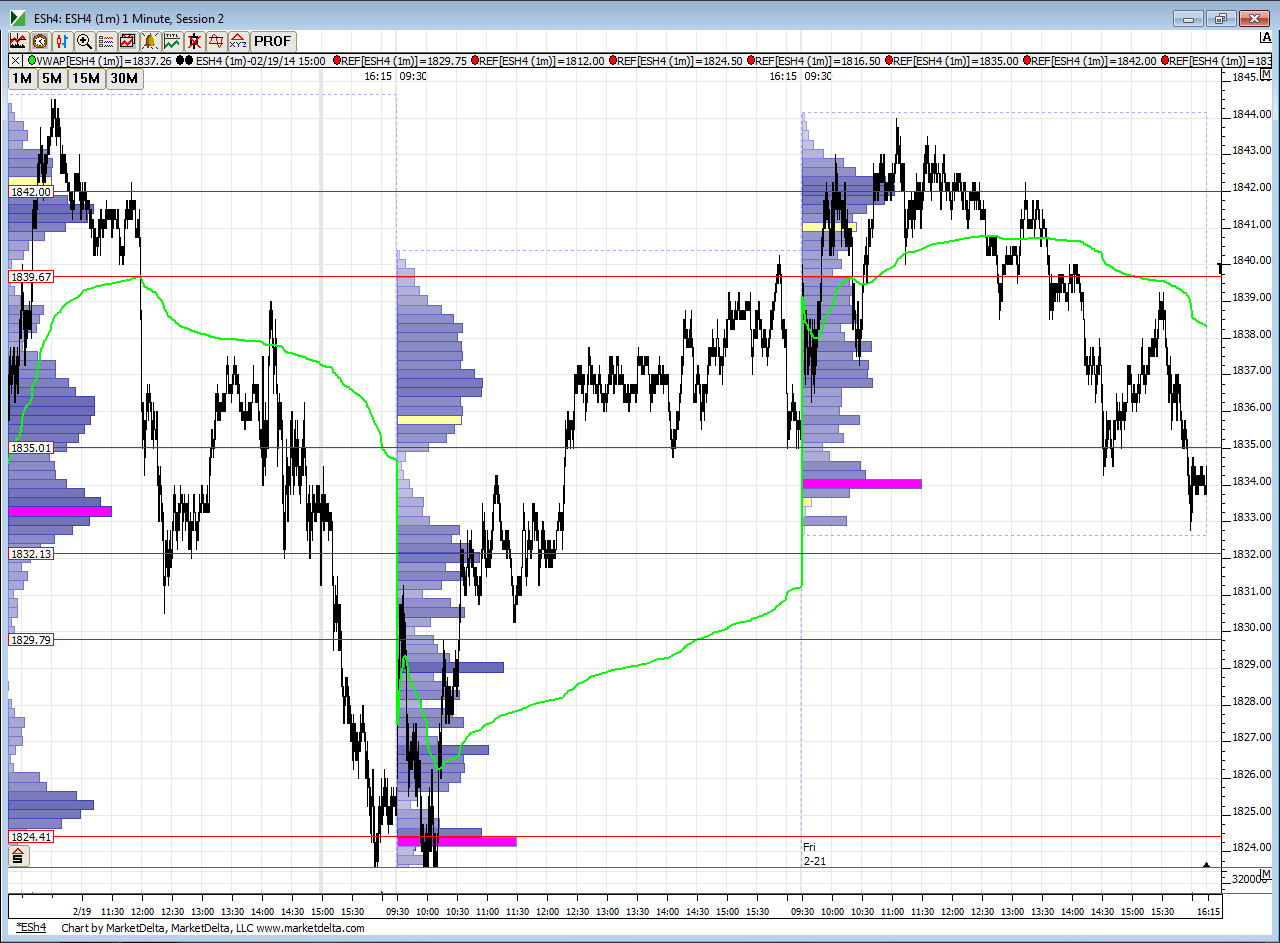

and here is a day session Volume profile...note that 32.13 from a bell curve from Thursday...that goes well with another hump from our CONTEXT chart....so if we open above we not only have the 35 - 36.50 zone but under Fridays lows we bump up into that 32....then the 29 below there ..above is that 42 and then we might as well just wait till we see if they can push new contract highs above...so watch 46 - 47 closely if they push there today ....many short traders would be trapped from longer term shorts but also those who thought they caught a good short trade and have stop outs above Fridays highs.....all that short covering could lead to a trend...just something to be careful of

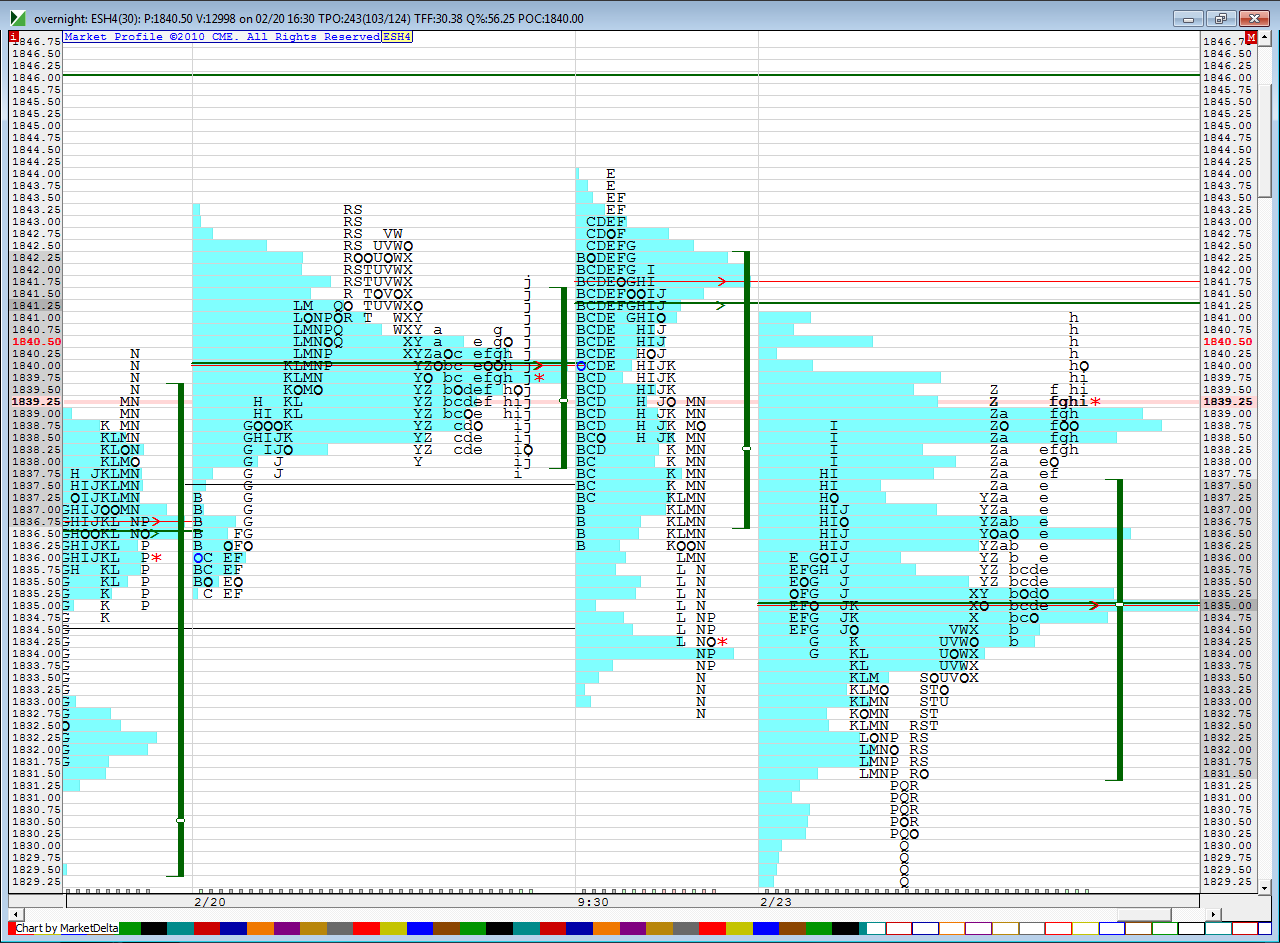

quick update...here is a new O/N chart... as I was making this we rallied higher to the 41- 42 area....it seems the real key to getting this right today is going to be that afternoon pull back high and LVn at 39..

next we have what has happened in the overnight....we had a selloff at the after noon pull back high but have come back to it as I type...on this chart when you see "9:30" it is a day session and when u see the date it is the overnight...note also how the current O/N low stopped at VA low from a few days back at the 29 area...an important reference for the future..note also how the On POC and VPOC formed at a LVN spot from friday ("P" period highs).....so if we open in Value today we may need to use two different buy spots...the VA low from Friday but also the 1835 number ..so I'm making 35 - 36.50 a zone to look at whenever we get back to that

and here is a day session Volume profile...note that 32.13 from a bell curve from Thursday...that goes well with another hump from our CONTEXT chart....so if we open above we not only have the 35 - 36.50 zone but under Fridays lows we bump up into that 32....then the 29 below there ..above is that 42 and then we might as well just wait till we see if they can push new contract highs above...so watch 46 - 47 closely if they push there today ....many short traders would be trapped from longer term shorts but also those who thought they caught a good short trade and have stop outs above Fridays highs.....all that short covering could lead to a trend...just something to be careful of

quick update...here is a new O/N chart... as I was making this we rallied higher to the 41- 42 area....it seems the real key to getting this right today is going to be that afternoon pull back high and LVn at 39..

No good place to get in up there around 5400. Now I need to see if 5200 will work as resistance to get down to that 4650. Looking to get short at 5150.

Got a fill at 5150.

1st target 4950 D period low

Now we'll see if we can get to that 4650

Gotta get over the 50 hump again on the way down

Sometimes trying to get through these numbers is like trying to pass a stone

Didn't quite get to the target looks like the balance wants to stay above 4650 for now

OK I'm flat again at 4925. That's it for me Hopefully will see you tomorrow.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.