ES Monday 2-24-14

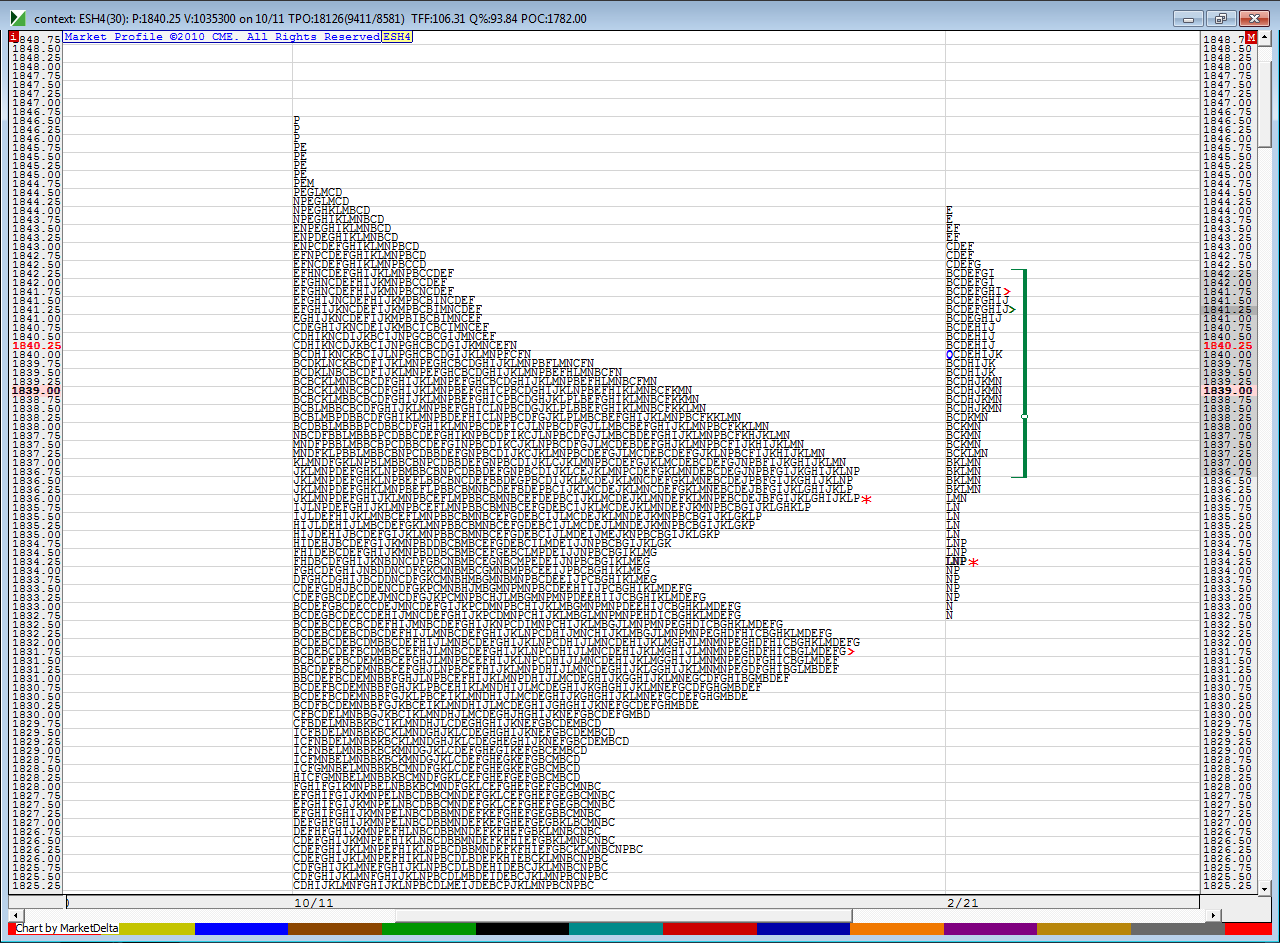

Much of this may be useless by the time we open as we have seen moves happening a bit past 9 a.m but here is context chart...this is Friday's trade against the bigger picture...note how the VA low goes well with a big hump in prices from the composite

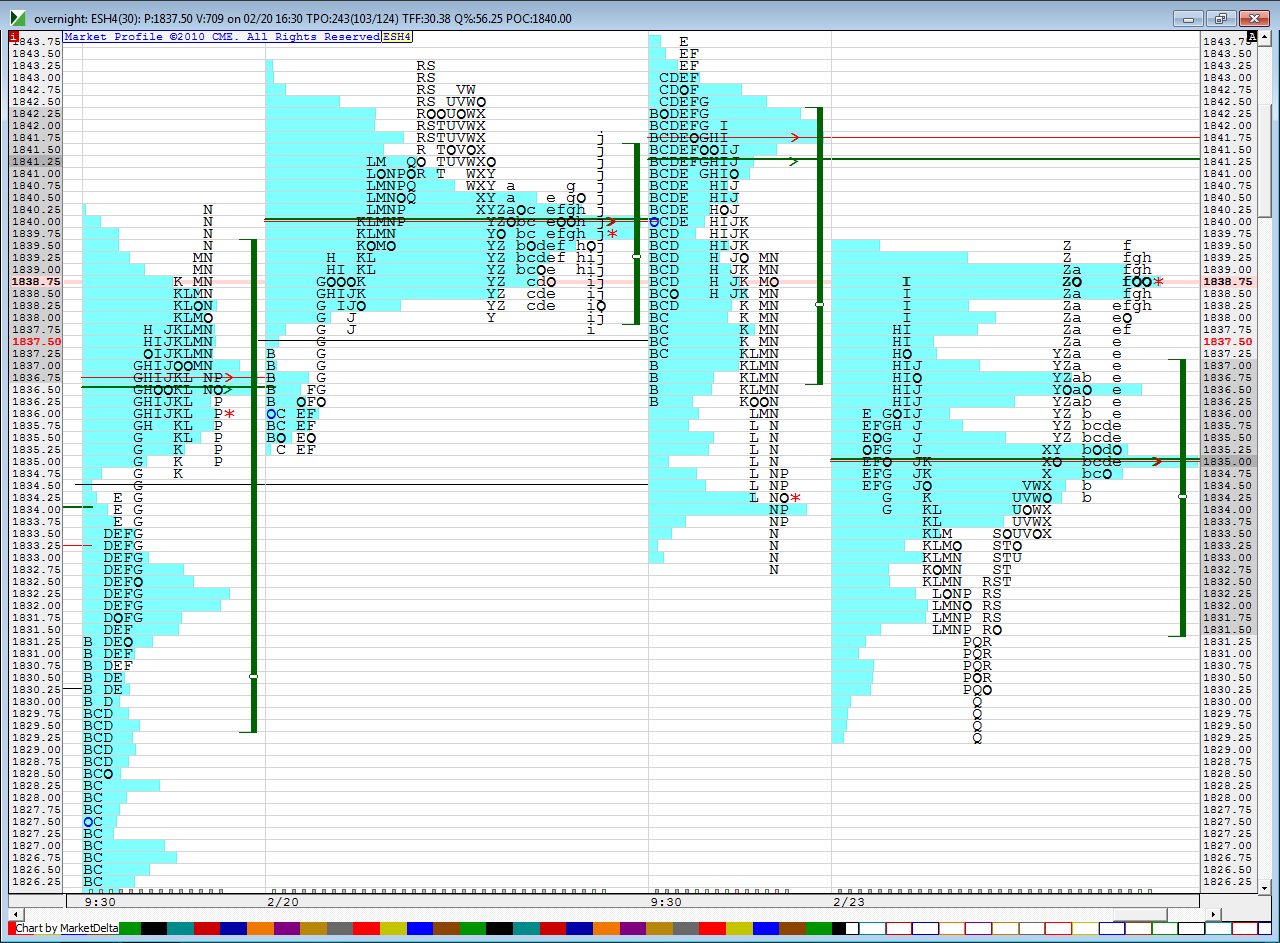

next we have what has happened in the overnight....we had a selloff at the after noon pull back high but have come back to it as I type...on this chart when you see "9:30" it is a day session and when u see the date it is the overnight...note also how the current O/N low stopped at VA low from a few days back at the 29 area...an important reference for the future..note also how the On POC and VPOC formed at a LVN spot from friday ("P" period highs).....so if we open in Value today we may need to use two different buy spots...the VA low from Friday but also the 1835 number ..so I'm making 35 - 36.50 a zone to look at whenever we get back to that

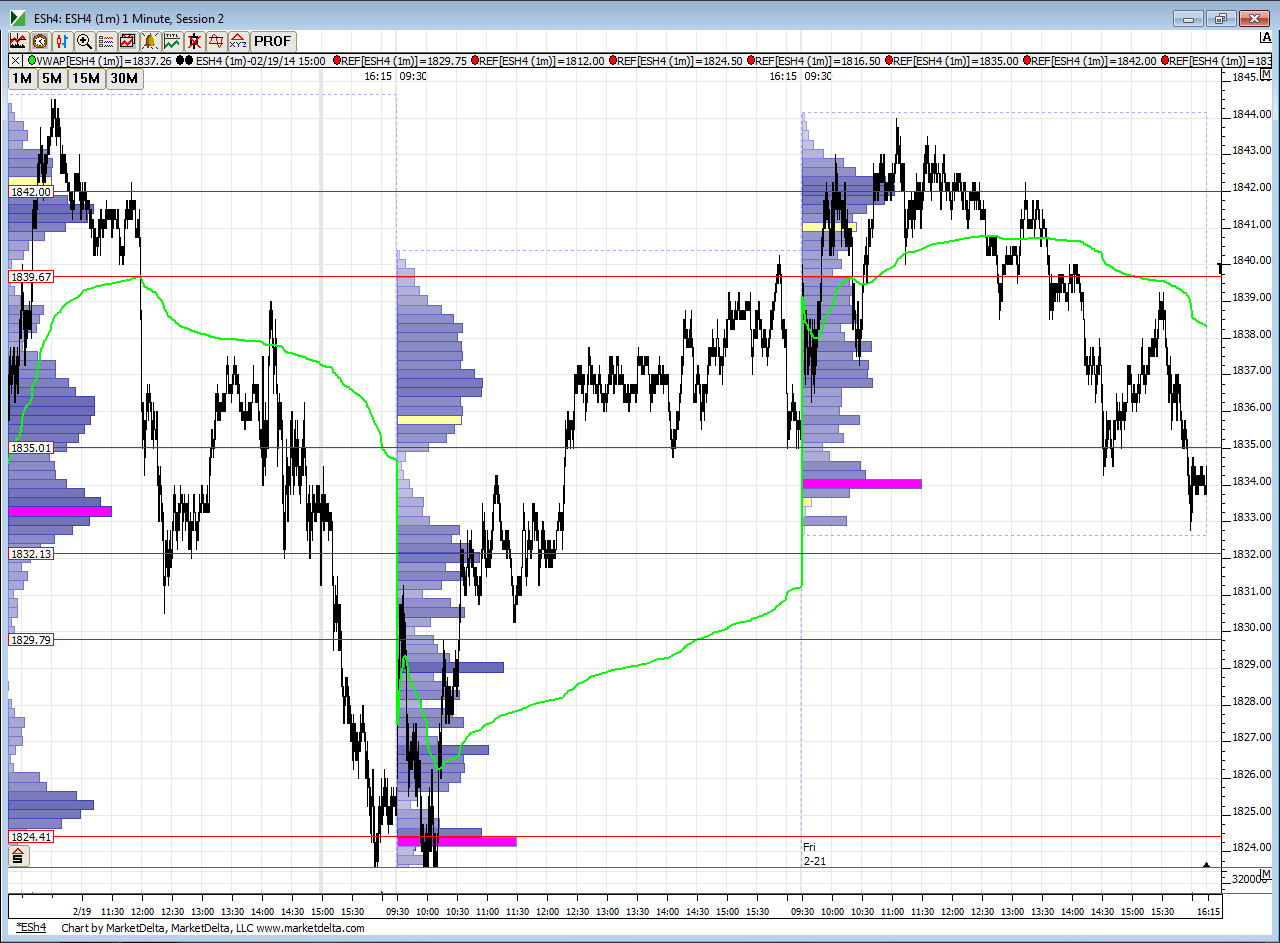

and here is a day session Volume profile...note that 32.13 from a bell curve from Thursday...that goes well with another hump from our CONTEXT chart....so if we open above we not only have the 35 - 36.50 zone but under Fridays lows we bump up into that 32....then the 29 below there ..above is that 42 and then we might as well just wait till we see if they can push new contract highs above...so watch 46 - 47 closely if they push there today ....many short traders would be trapped from longer term shorts but also those who thought they caught a good short trade and have stop outs above Fridays highs.....all that short covering could lead to a trend...just something to be careful of

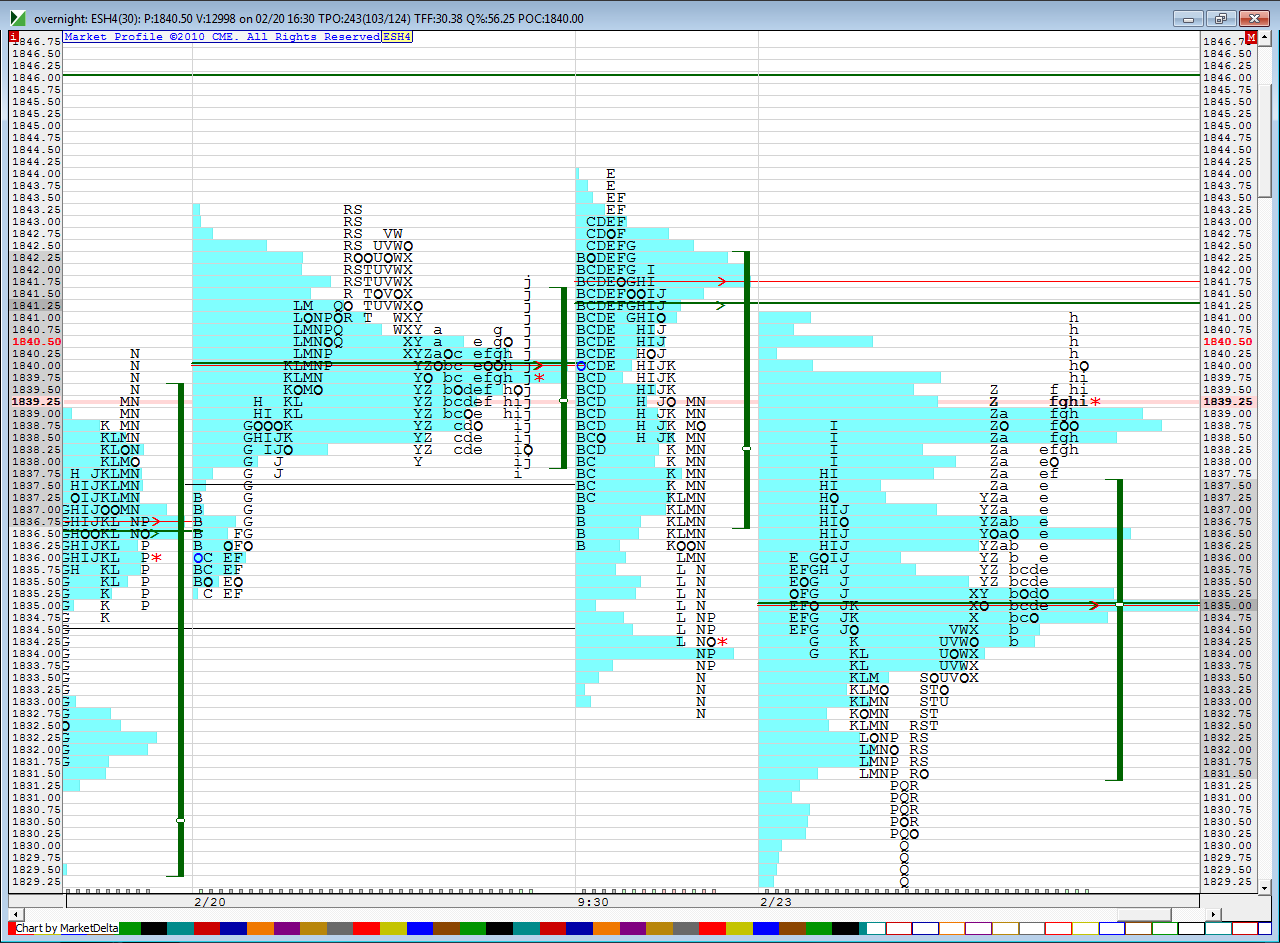

quick update...here is a new O/N chart... as I was making this we rallied higher to the 41- 42 area....it seems the real key to getting this right today is going to be that afternoon pull back high and LVn at 39..

next we have what has happened in the overnight....we had a selloff at the after noon pull back high but have come back to it as I type...on this chart when you see "9:30" it is a day session and when u see the date it is the overnight...note also how the current O/N low stopped at VA low from a few days back at the 29 area...an important reference for the future..note also how the On POC and VPOC formed at a LVN spot from friday ("P" period highs).....so if we open in Value today we may need to use two different buy spots...the VA low from Friday but also the 1835 number ..so I'm making 35 - 36.50 a zone to look at whenever we get back to that

and here is a day session Volume profile...note that 32.13 from a bell curve from Thursday...that goes well with another hump from our CONTEXT chart....so if we open above we not only have the 35 - 36.50 zone but under Fridays lows we bump up into that 32....then the 29 below there ..above is that 42 and then we might as well just wait till we see if they can push new contract highs above...so watch 46 - 47 closely if they push there today ....many short traders would be trapped from longer term shorts but also those who thought they caught a good short trade and have stop outs above Fridays highs.....all that short covering could lead to a trend...just something to be careful of

quick update...here is a new O/N chart... as I was making this we rallied higher to the 41- 42 area....it seems the real key to getting this right today is going to be that afternoon pull back high and LVn at 39..

my Ib data shows a O/N vpoc shift up to 38.75...with the O/N midpoint and time POC at 35 I'd like to look for a long trade off that ..so the plan is to watch the 35 - 36.50 for a buying opportunity...knowing gap close fill is close buy ...secondary plan is to sell near the current On vpoc and key 39 area...once again knowing if we are wrong they will push to the O/N highs and that 41 - 42 spot...hoping for one of those to play out first today...12 minutes to we open....

opening range is more important when we open right at one of our zones....especially if it is a LVn zone out of value..but still usable inside value ..just prone to more whipsaws then

Overnight vwap is 36.25 !!

opening range is more important when we open right at one of our zones....especially if it is a LVn zone out of value..but still usable inside value ..just prone to more whipsaws then

Overnight vwap is 36.25 !!

Thanks Bruce. I had the 3425-3475 area as a critical zone this morning also. As you said pretty close to the Gap close too.

haven't seen anything until 41.25...so trying small shorts off that...don't like this open

took first loser at 42..

trying again from 43.25 but keeping it all small

trying to get 41.50....gonna be tuff I think

I have gap in data at the highs...out at 41.50 and heavy...this aint gonna work for further selling...it seems that the poc from friday may turn to support and then make new highs and get Fridays highs

Ib data issue..no gap up there....A retest of 43.25 will take runners..otherwise I will try for 39.50...keeping telling myself..."small pieces...just take small pieces"

oopps..too late to post,,,runners stopped

oopps..too late to post,,,runners stopped

can't see a reason not to go take fridays highs now..

anyone who is studying this can see how the O/N high which was also fridays POC turned into support...I wasn't long but at least I knew to get out....so just pointing that out as we all have different ways to trade sometimes....but they blew through a POC so I was trading for the retest back down which came nicely...

I'm going to battle longs between 49 and 50 as I have a gap in data now at 46 area.....and 50 is a key number...see if we can get a 46.50 retest....will try 3 small tries but will be more cautious if they push it over 52.50...nice flush of all the shorts which we thought might happen...now lets see if this is really new buyers or just shorts covering to propel the market higher....if it's just short covering then this rally will fade for us

I'm going to battle longs between 49 and 50 as I have a gap in data now at 46 area.....and 50 is a key number...see if we can get a 46.50 retest....will try 3 small tries but will be more cautious if they push it over 52.50...nice flush of all the shorts which we thought might happen...now lets see if this is really new buyers or just shorts covering to propel the market higher....if it's just short covering then this rally will fade for us

OK I'm flat again at 4925. That's it for me Hopefully will see you tomorrow.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.