ES Wednesday 2-8-12

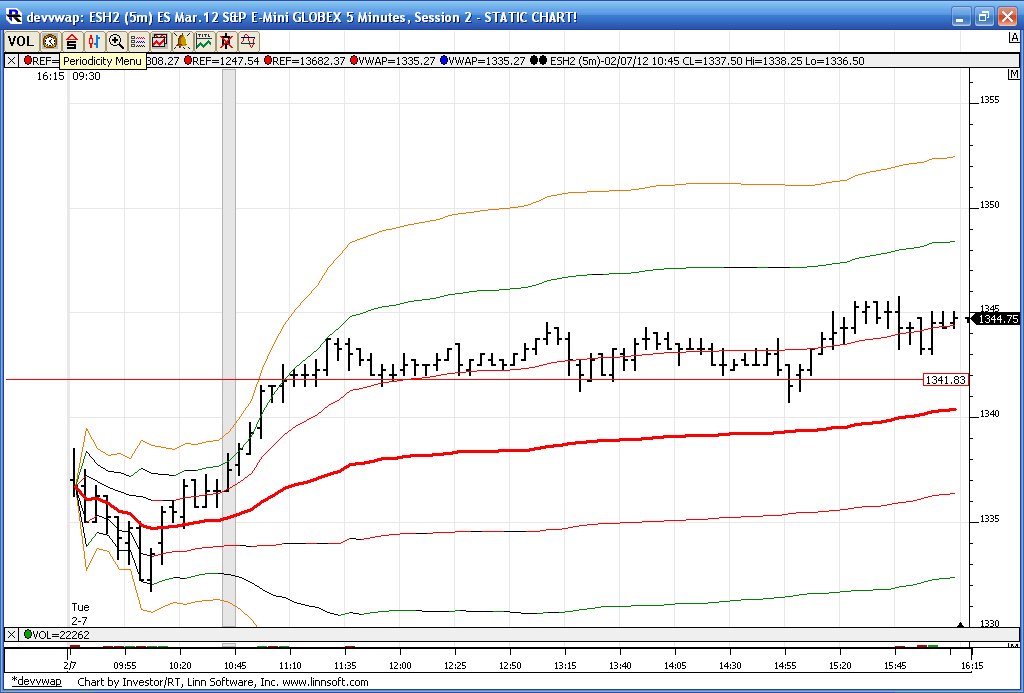

Here is a look at yesterdays trade with the vwap bands and Video. I decided that in many ways video is becoming faster than typing for me...The current Overnight high of 48.25 now has come in right at a vwap band so that confirms that band.

other areas....

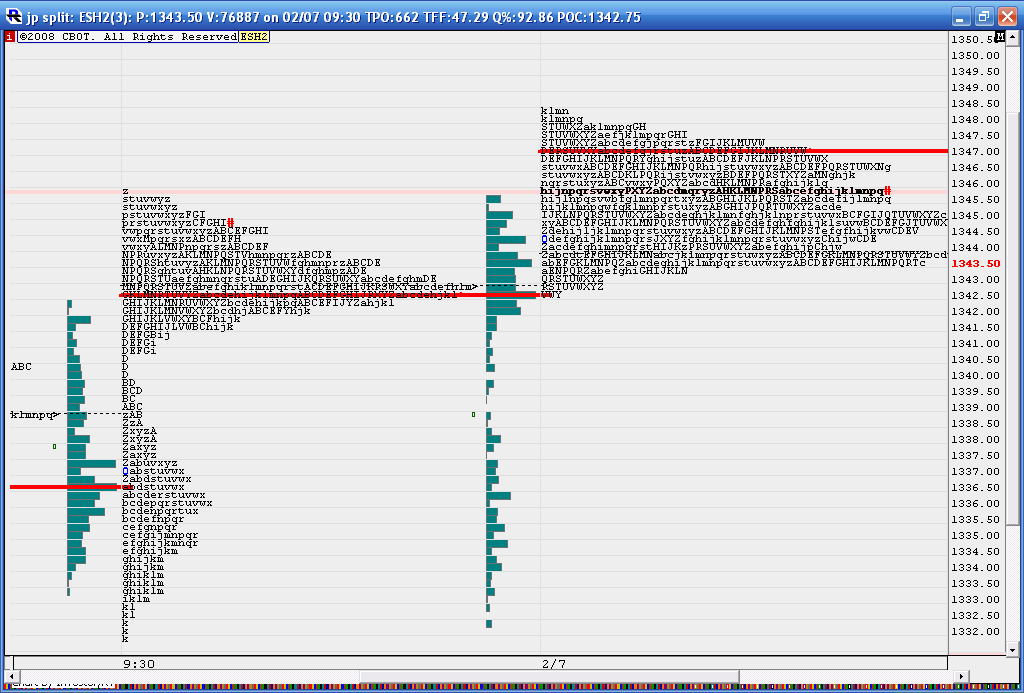

Overnight VPOC at 47.....so 47 - 48.25 becomes key resistance

Time is being spent in the 45 area ...so that is attracting price but I will not use that to initiate from unless some pitbull number matches up...would prefer to use that as a target..then we have the evil 42.50 from yesterday which matches the Overnight low and then we have low volume beginning at 1340 which goes well with closing vwap....

below there I will not buy unless we get below 1336

some charts for reference:

Closing Vwap

Overnight against yesterdays day session

Video explanation:

other areas....

Overnight VPOC at 47.....so 47 - 48.25 becomes key resistance

Time is being spent in the 45 area ...so that is attracting price but I will not use that to initiate from unless some pitbull number matches up...would prefer to use that as a target..then we have the evil 42.50 from yesterday which matches the Overnight low and then we have low volume beginning at 1340 which goes well with closing vwap....

below there I will not buy unless we get below 1336

some charts for reference:

Closing Vwap

Overnight against yesterdays day session

Video explanation:

I took all out @46.50. The 1346 is very strong support because the pit bull numbers.

for those that look at nyse a/d, see how it failed 3 times at the 1300 level and collapsed...that is in general a critical level to watch out for

ok, too many posts from me this morning...too much caffeine i guess, i'll shut up now

ok, too many posts from me this morning...too much caffeine i guess, i'll shut up now

Originally posted by NickP

a/d very strong, almost at the trend level (generally anything above 1300) but ticks have not broken above +500 consistently...so mixed signals thus far from those indicators

trying to be patient and adapt here nick...that's 5 lows there....they may make us suffer....still ideal campaign needs to come in above O/N highs at plus4 area but no luck so far

no, no , no..please ramble on...

Paul I need to digest your post some more too

Paul I need to digest your post some more too

Originally posted by NickP

for those that look at nyse a/d, see how it failed 3 times at the 1300 level and collapsed...that is in general a critical level to watch out for

ok, too many posts from me this morning...too much caffeine i guess, i'll shut up now

Originally posted by NickP

a/d very strong, almost at the trend level (generally anything above 1300) but ticks have not broken above +500 consistently...so mixed signals thus far from those indicators

took all but two runners off at 44.75....that might be the only real trade for me today....will try to hold for new lows into 42.50 but I see no reason we should actually trend

trade back to 46.75 will take these runners from me....will tighten if I see 1343.50 print

trade back to 46.75 will take these runners from me....will tighten if I see 1343.50 print

Nice trades today John !!

took last two off at 43.50...close enough and open range is here...no need to be greedy or stupid...especially if we only have one good campaign in the first 90 minutes

being very selective and small as we enter near 1340 area...we have air pockets above so at least that is another good sign to attempt longs down here

trying from 39.25...keeping it small and tight as we get into an area below I don't want to trade from...unless I see 36 or less

has potential but I went flat at 39.50

Ill try to show later , probably tomorrow why i think timewise the ideal time for a price peak would likely be next week between the 14th and 16th. Im expecting bullish behavior untill then ,so caution is advised on all short sales

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.