ES Wed 8-10-11

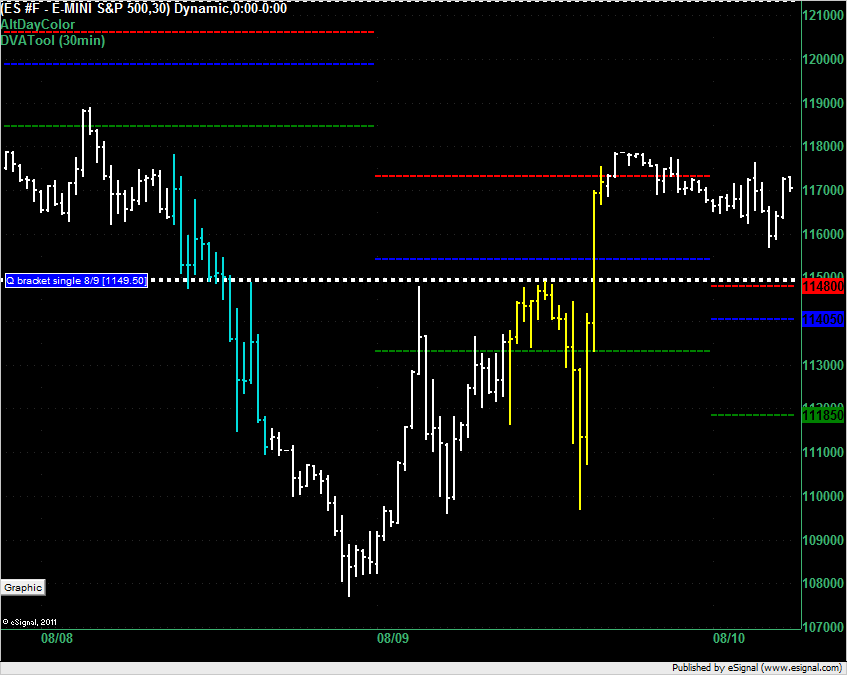

The end of day bounce yesterday (Tuesday) left a single print at 1149.50 and the day's trading created a value area bounded by a VAH of 1148 even, just 2 ticks below the single print. The chart below shows Monday's trading session as cyan (blue) bars and Tuesday's trading session as yellow bars. The white bars show the overnight action. You can see that on Monday there was support (and then resistance) at around 1149 and then the overnight session used that as resistance and then most of Tuesday's session used that as resistance until it was broken at the end of the day. Now with the VAH and single print marking the spot and the market looking like it is set to open above this area my call is a long at 1148 or 1148.50.

dt,

I appreciate your taking the time to explain the MP.

I had a question for you.

Today (as I understand it) if RTH opens ABOVE the VAH, then the normal rule is BUY, but I was wondering, have you ever looked at similar situation (RTH open above VAH) but view a prints at the VAH as a signal bar, saying "pay attention," and then only taking a long position if price can attract enough buyers to push price above the VAH by some nominal noise level like S-10 or half of S-10?

I appreciate your taking the time to explain the MP.

I had a question for you.

Today (as I understand it) if RTH opens ABOVE the VAH, then the normal rule is BUY, but I was wondering, have you ever looked at similar situation (RTH open above VAH) but view a prints at the VAH as a signal bar, saying "pay attention," and then only taking a long position if price can attract enough buyers to push price above the VAH by some nominal noise level like S-10 or half of S-10?

Correct Paul - if we had opened above the VAH then the VAH would have been a buy. Because we opened inside it that negated my earlier call and filled in that single print before the market opened negating it as well.

Your second question: Are you asking if I've looked at that same trade but instead of entering at the VAH to wait for a bounce to confirm that the trade is working first? If so, then no, I have not looked into that or researched it.

Your second question: Are you asking if I've looked at that same trade but instead of entering at the VAH to wait for a bounce to confirm that the trade is working first? If so, then no, I have not looked into that or researched it.

Not a lot of time to post.

1098,1198 1148 key levelsand the fibs in between are the levels to use here imo

1197-8 the 38% retrace of the entire lift from 666

1198 the 23.6

I'm getting a better read of indicators on smaller timeframe charts, but keep an eye on the larger

1098,1198 1148 key levelsand the fibs in between are the levels to use here imo

1197-8 the 38% retrace of the entire lift from 666

1198 the 23.6

I'm getting a better read of indicators on smaller timeframe charts, but keep an eye on the larger

thanks, dt

since my message must be more than 10 characters I wrote this.

since my message must be more than 10 characters I wrote this.

thats david

1123 the 50% of 1098 and 1148

see what happens into europe closing

and lunchtime

not inspiring longs here

see what happens into europe closing

and lunchtime

not inspiring longs here

I have 1135.25 as the level to break and hold for higher, if it can.

DavidS, today it is all news-driven, so tech levels may not be as important

http://www.reuters.com/article/2011/08/10/markets-forex-idUSN1E7790XO20110810

http://www.reuters.com/article/2011/08/10/markets-forex-idUSN1E7790XO20110810

If you are not trading. S&P saga continues.

http://www.reuters.com/article/2011/08/10/us-financial-regulation-sandp-idUSTRE77901S20110810

In unrelated news, France may lose its AAA rating

http://www.reuters.com/article/2011/08/10/us-financial-regulation-sandp-idUSTRE77901S20110810

In unrelated news, France may lose its AAA rating

thanks, don't use it as it's more unreliable than volume to me

note how topped out on good news- death of OBL

and it'll bottom on terrible news, imho

I'm all up for event trading though

note how topped out on good news- death of OBL

and it'll bottom on terrible news, imho

I'm all up for event trading though

Originally posted by Lisa P

DavidS, today it is all news-driven, so tech levels may not be as important

http://www.reuters.com/article/2011/08/10/markets-forex-idUSN1E7790XO20110810

god i had low VOL today at 35.25 it held it for 3 mins

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.