TradeQueen Daily Journal

I've gotten myself into something much deeper than I could of ever imagined.

While I've lost a ton, still I have no regrets for trying.

My goal set from this point forward is to slowly recoup my losses and continue to learn the tactics to gain advantages and become a successful day player.

The positive here is everyday I learn a wealth of information that can put me on track.

The immediate goal for tomorrow, Monday 5/9/11, is to minimize the surprises and find the better gains. Until then...

While I've lost a ton, still I have no regrets for trying.

My goal set from this point forward is to slowly recoup my losses and continue to learn the tactics to gain advantages and become a successful day player.

The positive here is everyday I learn a wealth of information that can put me on track.

The immediate goal for tomorrow, Monday 5/9/11, is to minimize the surprises and find the better gains. Until then...

Originally posted by TradeQueen

Another fantastic learning day! 100% on 5 trades. Little ones... have to take baby steps!

Good, short swings....see the ball....make contact....build confidence......

I hope I don't get in trouble for this but this PUG guy may help you.

He draws the charts, sometimes kindof an eyechart, but you can view in real time. He's an Elliot Wave guy, but he's not a perma bear....anyway...its a data point.

He uses Pivots too! Service is cheap......$50 per Q....but I think $ well spent. Its the only service I subscribe to because he spends a lot of time trying to "sort it out".

I think its free to look on a weekly basis.

http://pugsma.wordpress.com/

air pocket... another example of a magnet.

Have not been posting here as much the last couple days, because I've actually had a pretty good week. Felt like a real player, for a short time anyway.

Really started understanding some of the regular terminology (then some new stuff comes along. It's all good though.). It was nice.

Then... I took a real bad turn yesterday... after doing so well all day... uh.. I had met one of my first goals. should of quit early. shoulda shoulda...

Then came out ok today, but took a smaller bad turn again in the end of the day. I'm about dead in the water now.

If I disappear... Yeah whatever... I'll be back... You can't shake me.

Lot of real smart people... very nice smart people. Great website.

Really started understanding some of the regular terminology (then some new stuff comes along. It's all good though.). It was nice.

Then... I took a real bad turn yesterday... after doing so well all day... uh.. I had met one of my first goals. should of quit early. shoulda shoulda...

Then came out ok today, but took a smaller bad turn again in the end of the day. I'm about dead in the water now.

If I disappear... Yeah whatever... I'll be back... You can't shake me.

Lot of real smart people... very nice smart people. Great website.

Got a call for a couple days work. I've got to take it. Long hours so I probably wont be able to catch up until next week. That hurts more than anything. I know the market will be there when I get back... It's just I pick up and retain a little more every day. I don't want to loose that. So please keep posting!

The broken bank may have had an upside to it. Helped me step back and reflect on what I'm been doing wrong.

The biggest thing is I was looking too closely at the market. Because of this, last Thursday was brutal to me. Looking back I should of just taken a small loss and the rest of the day off.

Had I of just held firmly, or even better, got out and waited until things calmed down... I would of road it out and came out a head by the end of the day. Trouble is you can't know that until the end of the day.

A day like today for example.. down all day and did not look back. Frustrating thing is... I had my sites on a down trend (should of said a correction, but who knew that this morning?). I had no idea it was going to stay down... but I'm sure I'd of had more money in the end than I started the day with.

Regardless... I got my demo account up and going. I should have some more funds by next week. It will have to be my last go at it. Got to face reality, at least for a while. But I gotta give it one more shot.

For those who stop by and take the time to read all this stuff... hope it's somewhat helpful. It's not a lot of technical information, but there a lot of that in the real forums from people who know what their doing.

anywhoo.. till next week I guess.

The broken bank may have had an upside to it. Helped me step back and reflect on what I'm been doing wrong.

The biggest thing is I was looking too closely at the market. Because of this, last Thursday was brutal to me. Looking back I should of just taken a small loss and the rest of the day off.

Had I of just held firmly, or even better, got out and waited until things calmed down... I would of road it out and came out a head by the end of the day. Trouble is you can't know that until the end of the day.

A day like today for example.. down all day and did not look back. Frustrating thing is... I had my sites on a down trend (should of said a correction, but who knew that this morning?). I had no idea it was going to stay down... but I'm sure I'd of had more money in the end than I started the day with.

Regardless... I got my demo account up and going. I should have some more funds by next week. It will have to be my last go at it. Got to face reality, at least for a while. But I gotta give it one more shot.

For those who stop by and take the time to read all this stuff... hope it's somewhat helpful. It's not a lot of technical information, but there a lot of that in the real forums from people who know what their doing.

anywhoo.. till next week I guess.

Been trading on a demo account for the last two days. Frustrating because I've been nailing some beautiful long trades and have met daily goals... On a demo account!

This shows I'm starting to practice what I've been learning, but it also goes back to basics and the mindset you need to be a good trader. I've woken up late... Both days, with a, you know what to do, do it!, kind of attitude. And it's been working! Although I know I can't base success on only two days. It's just been so darn easy though. Today is another day.

If you are new like me, the information in the pages of these forums are invaluable. While I've not yet donated to this website, I really need to do so soon. There's this overwhelming urge to give back and an actual desire to do so as well. If you have a sincere desire to learn trading, this is a great place to be. Just be prepared to lose. Even though what is written here daily is based on years of experience, the market will always get you when your most confident.

I've been in and out of the house all day and it's taken all day to write this. I've bragged about my last two days... Well... Today was not one of those days. Thank goodness it was only a demo. Had it been a real account, I would not of left it today the way I did. Still, the day did not go as I had planned. Got an hour to go though. Well see.

I started the day with confidence. The market will always get you when your most confident. The big lesson learned, AGAIN, is to get out with minimal loss and start over.

It's important to know and REMEMBER, that everyone goes against the ups and downs from time to time. It's the nature of this business. Any business for that matter.

Read and learn. Most of it is difficult to understand until a particular situation actually happens to you. Then it hits you like a brick! O-Yeah! Darn... Now I get it!

Other times you'll see a perfect setup... You jump in... And... The market will always get you when your most confident. Everyday I look back and see how much money that could have been made.

I just read a post from LORN which talks about the game. It's how you play it! I believe this is truly how you push yourself ahead. It's what I tell young athletes. I totally get it! Fulfills that sense of accomplishment. Unfortunately for myself, the financial side is equally as important at this time. And that's a bummer.

Enough with the daily rant. I haven't been here in a while... I remember I said I wouldn't do this anymore. Sorry. It's a great place to vent.

I've kept my mind off the (fake)losses long enough to rebound (nearly anyway). Currently at break even, but still looking for my daily plan to take heed. Well see. Break even is better than a loss. To bad it took all day to get here. It's ok... I've learned a little more today. g'night!

This shows I'm starting to practice what I've been learning, but it also goes back to basics and the mindset you need to be a good trader. I've woken up late... Both days, with a, you know what to do, do it!, kind of attitude. And it's been working! Although I know I can't base success on only two days. It's just been so darn easy though. Today is another day.

If you are new like me, the information in the pages of these forums are invaluable. While I've not yet donated to this website, I really need to do so soon. There's this overwhelming urge to give back and an actual desire to do so as well. If you have a sincere desire to learn trading, this is a great place to be. Just be prepared to lose. Even though what is written here daily is based on years of experience, the market will always get you when your most confident.

I've been in and out of the house all day and it's taken all day to write this. I've bragged about my last two days... Well... Today was not one of those days. Thank goodness it was only a demo. Had it been a real account, I would not of left it today the way I did. Still, the day did not go as I had planned. Got an hour to go though. Well see.

I started the day with confidence. The market will always get you when your most confident. The big lesson learned, AGAIN, is to get out with minimal loss and start over.

It's important to know and REMEMBER, that everyone goes against the ups and downs from time to time. It's the nature of this business. Any business for that matter.

Read and learn. Most of it is difficult to understand until a particular situation actually happens to you. Then it hits you like a brick! O-Yeah! Darn... Now I get it!

Other times you'll see a perfect setup... You jump in... And... The market will always get you when your most confident. Everyday I look back and see how much money that could have been made.

I just read a post from LORN which talks about the game. It's how you play it! I believe this is truly how you push yourself ahead. It's what I tell young athletes. I totally get it! Fulfills that sense of accomplishment. Unfortunately for myself, the financial side is equally as important at this time. And that's a bummer.

Enough with the daily rant. I haven't been here in a while... I remember I said I wouldn't do this anymore. Sorry. It's a great place to vent.

I've kept my mind off the (fake)losses long enough to rebound (nearly anyway). Currently at break even, but still looking for my daily plan to take heed. Well see. Break even is better than a loss. To bad it took all day to get here. It's ok... I've learned a little more today. g'night!

Still on demo account.

I know I'm suppose to post BEFORE a trade, but time didn't allow me this morning and this is only a journal. Will make every attempt to post before, in the future.

Attempting to learn Pitbull strategy.

open 1271.75

37min high 1275.75

+4

entered:

2.5 @ 1274.25

1.5points 1272.75

out: 1272.75

Trouble is that in the first minute, there was a bounce from 71.75open to 69.25 the coverd the -2.5 window.

I didn't know if this counted? As mentioned the market rose +4, got in at +2.5 and got out at +1.5.

Also notice whats called a COMPLETED WINDOW RUN, so by rules of the pitbull... Just to note... Trading should be completed for the day.

If anyone actually reads this and can elaborate or congratulate... Please do so. Thanks

I know I'm suppose to post BEFORE a trade, but time didn't allow me this morning and this is only a journal. Will make every attempt to post before, in the future.

Attempting to learn Pitbull strategy.

open 1271.75

37min high 1275.75

+4

entered:

2.5 @ 1274.25

1.5points 1272.75

out: 1272.75

Trouble is that in the first minute, there was a bounce from 71.75open to 69.25 the coverd the -2.5 window.

I didn't know if this counted? As mentioned the market rose +4, got in at +2.5 and got out at +1.5.

Also notice whats called a COMPLETED WINDOW RUN, so by rules of the pitbull... Just to note... Trading should be completed for the day.

If anyone actually reads this and can elaborate or congratulate... Please do so. Thanks

Original post:

long at 63 to close the air pocket. set target at

*****************

Edited Post:

added 2 @ 62. now in 4 @ 62.50. Still long hopin for 69.00

*****************

Edited Post #2

Obviously this is an extreme and aggressive move. I tried this because I've seen the market move like this before or even more so... listened to it on the radio.

The scenario is... I'm too chicken to try this with a real account. I want to learn to start calling my trades before they happen... But the main reason for this aggression is I'd just like to see this happen.

currently 2:48 eastern and the market has make a single minute jump from 57 to 62. Watching the next minute as it falls back to 59. Crazy... The market is 25 points down and I have just over an hour to watch to see if it will recover. I think we will end the day 10 to 15 points down. Not based on indicators other than that air pocket and that the emini dow is down 200 points. I believe it will recoup some of that loss. going fast here. hope this makes sense.

***********

Edited #3

While the air pocket never filled at 69, I feel the concept is still a good one. As we've seen for a few weeks now, things don't seem to work as well this late in the day. It was a long shot. Something I've got to quit doing. Yet I stand still somewhat surprised things don't go as projected.

I've got a lot to learn still. Yet there's a learning lesson here somewhere.

Happy Trading.

long at 63 to close the air pocket. set target at

*****************

Edited Post:

added 2 @ 62. now in 4 @ 62.50. Still long hopin for 69.00

*****************

Edited Post #2

Obviously this is an extreme and aggressive move. I tried this because I've seen the market move like this before or even more so... listened to it on the radio.

The scenario is... I'm too chicken to try this with a real account. I want to learn to start calling my trades before they happen... But the main reason for this aggression is I'd just like to see this happen.

currently 2:48 eastern and the market has make a single minute jump from 57 to 62. Watching the next minute as it falls back to 59. Crazy... The market is 25 points down and I have just over an hour to watch to see if it will recover. I think we will end the day 10 to 15 points down. Not based on indicators other than that air pocket and that the emini dow is down 200 points. I believe it will recoup some of that loss. going fast here. hope this makes sense.

***********

Edited #3

While the air pocket never filled at 69, I feel the concept is still a good one. As we've seen for a few weeks now, things don't seem to work as well this late in the day. It was a long shot. Something I've got to quit doing. Yet I stand still somewhat surprised things don't go as projected.

I've got a lot to learn still. Yet there's a learning lesson here somewhere.

Happy Trading.

original post

well my dang demo expired... why are they so tight with that? You get 14 days. 4 of those days are weekends. useless. and I went to work of 6 days of that. uh... only 4 demo trading days. darn.

While I am upset (my timing)... i should mention that the company I trade through was nice enough to use the demo for the 14 days, considering the company policy and agreement.

I just don't know why they are so tight with it? But it's a decent company.

I have no clue this morning. I'm thinking the market will open dipping to the o/n s2 level. and rally up to yesterdays highs.

based on yesterdays 25 point loss due to Greece economic problems.

****************

edit #1

this morning didn't go as planned, but ultimately reached the same goal. market went up instead of down as suggested. although on the half hour, market fell 6 pts in 1min to near s1 level.

I've been having login problems this morning and missed the whole thing. it may be just as well.

had i entered using my plan, my emotions would of fell apart and who knows where my brain would have been before that 1 min down spike. The market has recovered and has reached new daily high.

market currently level on yesterdays pivot. I thinking it has peaked for the day maybe bumping 68 area. I think this is where we start entering single print area. thats how I'm basing that.

next resistance is at 70.50. o/n s2. and 77 rth r1.

although there is lots of volume still, but is decreasing. so we'll see what happens.

****************

edit #2

it busted through the o/n r1 and rth PP. While it did not reach the resistance mentioned. I believe the o/n r1 and rth PP will now act as support.

Because this is hypothetical, I would be long at 65.5, to 69.5 but don't expect any drastic change til 2:30ish(eastern). naturally, any breaking news would upset this. I don't like stops, but I'd stop out at 2 points at 63.5.

***********

Final Note of the day...

While I probably would not have had a successful day, it's good to know my ranges were very close for the day. That's very comforting. Means I've learned a little this whole time. Was totally on my own today.

I need to work on getting more comfortable with RTH opening direction. Some call this out regularly, but I still sit confused at the beginning of each morning. Which way will it go.

Many here, have given me fantastic documentation and clues to help with this, I just need to go back and re-read some of my old notes again. This leads to remind myself that I still need to focus on exit strategies as well. Get out early, get our early, take a break and get out early! And remember to breath! The last part is just a joke. I'm not that bad, but the way I type sometimes, I imagine it may seem like that.

I FOUND OUT yesterday... With the demo account, you fortunate ones with decent size accounts... got it a little easier when it comes to getting out of a bad trade!

Get yourself into a bad trade? Most likely it'll turn around sometime and you just throw a buttload of contracts down at that moment... BAM!! YOUR IN THE GOOD! Something to look forward to there someday! That was fun.

What else... no trading today, but I made two bad decisions and about 5 good ones.

1. picked the wrong direction on the morning open. Although it ended up being the right direction.

2. picked a resistance point, but had a two point stop. Got close to the resistance point but stopped out with I believe a 3 point rebound. Hope that makes sense.

I think this is all I need to remind myself. Dinners waiting for me, so it's time to say g'night. g'night

well my dang demo expired... why are they so tight with that? You get 14 days. 4 of those days are weekends. useless. and I went to work of 6 days of that. uh... only 4 demo trading days. darn.

While I am upset (my timing)... i should mention that the company I trade through was nice enough to use the demo for the 14 days, considering the company policy and agreement.

I just don't know why they are so tight with it? But it's a decent company.

I have no clue this morning. I'm thinking the market will open dipping to the o/n s2 level. and rally up to yesterdays highs.

based on yesterdays 25 point loss due to Greece economic problems.

****************

edit #1

this morning didn't go as planned, but ultimately reached the same goal. market went up instead of down as suggested. although on the half hour, market fell 6 pts in 1min to near s1 level.

I've been having login problems this morning and missed the whole thing. it may be just as well.

had i entered using my plan, my emotions would of fell apart and who knows where my brain would have been before that 1 min down spike. The market has recovered and has reached new daily high.

market currently level on yesterdays pivot. I thinking it has peaked for the day maybe bumping 68 area. I think this is where we start entering single print area. thats how I'm basing that.

next resistance is at 70.50. o/n s2. and 77 rth r1.

although there is lots of volume still, but is decreasing. so we'll see what happens.

****************

edit #2

it busted through the o/n r1 and rth PP. While it did not reach the resistance mentioned. I believe the o/n r1 and rth PP will now act as support.

Because this is hypothetical, I would be long at 65.5, to 69.5 but don't expect any drastic change til 2:30ish(eastern). naturally, any breaking news would upset this. I don't like stops, but I'd stop out at 2 points at 63.5.

***********

Final Note of the day...

While I probably would not have had a successful day, it's good to know my ranges were very close for the day. That's very comforting. Means I've learned a little this whole time. Was totally on my own today.

I need to work on getting more comfortable with RTH opening direction. Some call this out regularly, but I still sit confused at the beginning of each morning. Which way will it go.

Many here, have given me fantastic documentation and clues to help with this, I just need to go back and re-read some of my old notes again. This leads to remind myself that I still need to focus on exit strategies as well. Get out early, get our early, take a break and get out early! And remember to breath! The last part is just a joke. I'm not that bad, but the way I type sometimes, I imagine it may seem like that.

I FOUND OUT yesterday... With the demo account, you fortunate ones with decent size accounts... got it a little easier when it comes to getting out of a bad trade!

Get yourself into a bad trade? Most likely it'll turn around sometime and you just throw a buttload of contracts down at that moment... BAM!! YOUR IN THE GOOD! Something to look forward to there someday! That was fun.

What else... no trading today, but I made two bad decisions and about 5 good ones.

1. picked the wrong direction on the morning open. Although it ended up being the right direction.

2. picked a resistance point, but had a two point stop. Got close to the resistance point but stopped out with I believe a 3 point rebound. Hope that makes sense.

I think this is all I need to remind myself. Dinners waiting for me, so it's time to say g'night. g'night

Originally posted by TradeQueen

well my dang demo expired... why are they so tight with that? uh...

Who was the demo with?

ORIGINAL POST

have a double support this Friday morning on the last day of the june contract.

1270 is R1 of the RTH as well as the PP of the O/N.

Morning RTH opened about 10 above the open, but dropped to the support area mentioned. Studying closer the gap fill vs. half gap fill posted by Paul on the stragity pages of this same day.

***********

Followup #1

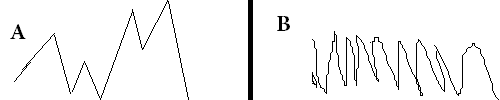

A: the way I see the market on a demo account

B: the way I see the market when I think I'm ready to trade.

Is it my ME?... Or is today just different? Timing timing timing!

Followup #2 1:45 eastern

Got to rebuild the confidence. Back on Real trading. Been doing fib math and starting to understand that a little better. I like it, but it doesn't always work for me.

With that, based on and area of 63.25 and 67.25 I got a fib of 65. Wanted to buy at 65, but I lose at this time of day so I didn't. With the market down to the O/N S1, I want to say today will finish about 1273. Unfilled triples at 1272.25 and 1268.50. But again... I always lose at this time of day so I just don't have the confidence.

hypothetically buy now @1265. Last post... Happy Fathers Day to those and have a great weekend all!

Followup #3 3pm eastern

For my own record.... got the go-nads to buy at 65. Felt strong about it. This would of been the first trade after reinstating my account. I was locked out.

No problem getting unlocked, but missed my window and lost confidence. So I didn't buy. Market hit 1270. Filled one Triple. Missed opportunity. Just over and hour to go to fill the last Triple.

Not this kid... Hopefully next week can be a good week. uh.. someday.

have a double support this Friday morning on the last day of the june contract.

1270 is R1 of the RTH as well as the PP of the O/N.

Morning RTH opened about 10 above the open, but dropped to the support area mentioned. Studying closer the gap fill vs. half gap fill posted by Paul on the stragity pages of this same day.

***********

Followup #1

A: the way I see the market on a demo account

B: the way I see the market when I think I'm ready to trade.

Is it my ME?... Or is today just different? Timing timing timing!

Followup #2 1:45 eastern

Got to rebuild the confidence. Back on Real trading. Been doing fib math and starting to understand that a little better. I like it, but it doesn't always work for me.

With that, based on and area of 63.25 and 67.25 I got a fib of 65. Wanted to buy at 65, but I lose at this time of day so I didn't. With the market down to the O/N S1, I want to say today will finish about 1273. Unfilled triples at 1272.25 and 1268.50. But again... I always lose at this time of day so I just don't have the confidence.

hypothetically buy now @1265. Last post... Happy Fathers Day to those and have a great weekend all!

Followup #3 3pm eastern

For my own record.... got the go-nads to buy at 65. Felt strong about it. This would of been the first trade after reinstating my account. I was locked out.

No problem getting unlocked, but missed my window and lost confidence. So I didn't buy. Market hit 1270. Filled one Triple. Missed opportunity. Just over and hour to go to fill the last Triple.

Not this kid... Hopefully next week can be a good week. uh.. someday.

The surprises will always be there, but the losses can always be minimalized by better risk management and even more prudent money management.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.