ES numbers for 3-29-11

Numbers generated from todays trade based on volume

1312.50 volume spikes ****

1310.25 Volume spikes ****

1307 Volume spikes

Old ones you should have on your radar from previous days:

1300 - 1301

1295.50

1291 - minor

1287.50 ****** major number

1282.25 ******

1312.50 volume spikes ****

1310.25 Volume spikes ****

1307 Volume spikes

Old ones you should have on your radar from previous days:

1300 - 1301

1295.50

1291 - minor

1287.50 ****** major number

1282.25 ******

Poc flipped higher and Value moved higher....I went flat at 11.25..just not liking it

Here is the 5 min projection up off the low which challenged O/N low and YD RTH low. That 1312.75-1313 number coincides with your numbers bruce. Notice how prices found resistance at O/N high which was spot on with 2.618 projection.

i'm out at 10.50 should never have gone into the trade just before lunch

Currently they are trying to put in a double high on the 30 minute chart....don't like those...as they get run out too often....

So we have trended quite a bit...so time for some pausing action and lunchtime

1310.75 is the obvious key price now...so we may just form a new distribution around that price......in other words, I wouldn't expect too much trend in either direction now..

smart money will try to sell above that ledge from yesterday above 1312.50 if given the opportunity...

Lisa, I'm only posting delta to make sure I understand it...I'd like you to explain your charts more and would be glad to step aside from posting delta charts...I know it's tough while trading...

So we have trended quite a bit...so time for some pausing action and lunchtime

1310.75 is the obvious key price now...so we may just form a new distribution around that price......in other words, I wouldn't expect too much trend in either direction now..

smart money will try to sell above that ledge from yesterday above 1312.50 if given the opportunity...

Lisa, I'm only posting delta to make sure I understand it...I'd like you to explain your charts more and would be glad to step aside from posting delta charts...I know it's tough while trading...

Yea Lisa. Delta readings are very dependent on the data feed.

Even though you and Bruce both get data from the same place, the fact that data is packeted will cause different readings with even the smallest software changes.

Even though you and Bruce both get data from the same place, the fact that data is packeted will cause different readings with even the smallest software changes.

Originally posted by Lisa P

I find the difference in Delta reading from different posters very confusing. Bruce and I should have similar numbers, considering we both use IB, but that is not the case. Maybe our charts set up differently. Would be good to discuss .

Originally posted by BruceM

cool to watch how the volume is trying to build at 10.75...Lisa I'm showing 07.50 as POC from TOdays trade only but 1310.25 is POC from Yesterday....and we both have IB data...interesting

The 5 yesr note auction at the top of the hour may wake the market a little.

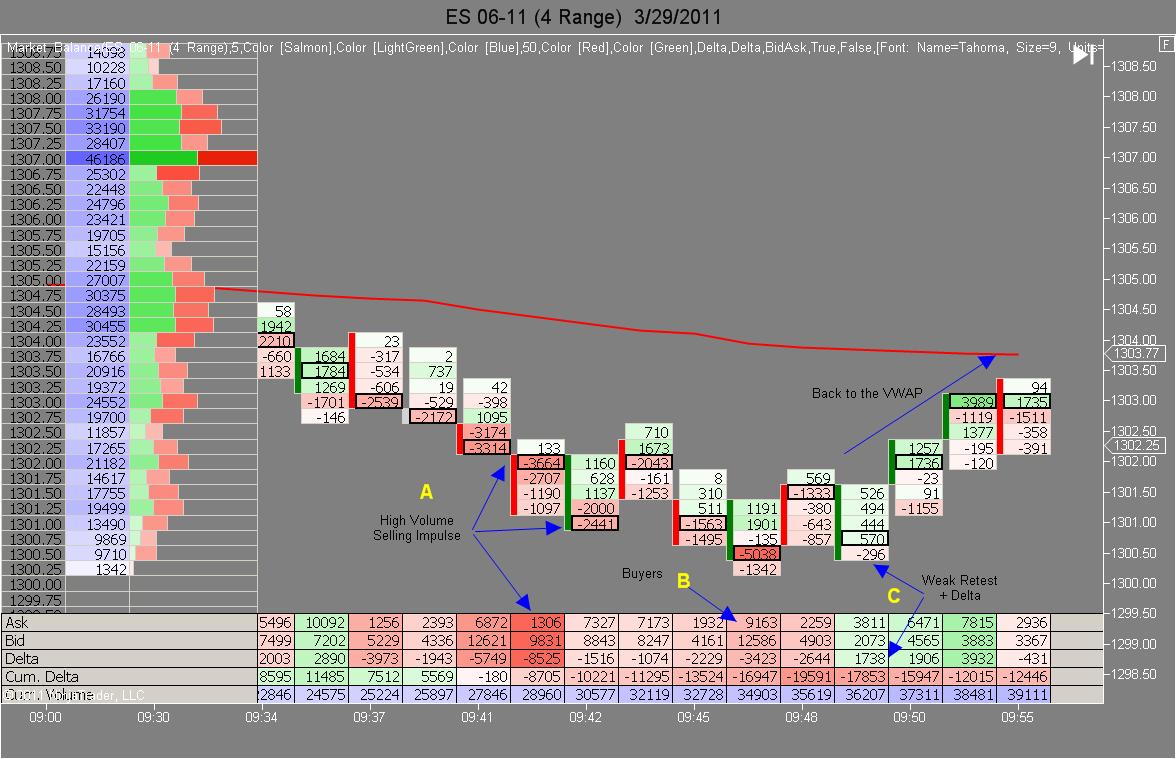

Here is my Balance chart with some notations...

Point A: Bruce's high volume 9:42 bar, Negative delta peak -8525. What happened here was, the CME floor traders were steadily selling from 1305, then when price broke below 1302 all of a sudden the primary Goldman Sachs floor trader shifted to the buy side and bought all the contracts being offered in the SP pit, which of course immediately caught my full attention.

Point B: Price bounced back to 1302.50 then drifted back to point B on reasonably high red delta volume (-5038), but note the heavy Ask (buy side) volume ( + 9163 ) that came in.

Point C: Price bounces from point B and forms a lower high at 1301.75 then drifts back to that point B high red delta vol level, note the very weak sell volume (-296) and positive Delta ( + 1738 ) on the retest forming point C.

It wasn't until point C had formed and buy side volume surged in that I felt confident enough to enter the long side trade, (my entry was at 1302.00). This is a good example of a couple of things. First as Bruce pointed out, how volume dries up as a trend change turning point forms. Second, in the ES it often takes a good bit of time for the turn to lock in and the trend to reverse.

A point of clarification: these delta charts (and my market balance charts) are a graphical representation of the Time and Sales data stream. The delta charts collect up each contract transaction (price and volume) at the bid and ask prices, then depicts that bid/ask volume information in this unique graphical form. The term "delta" is used to describe the difference between bid volume and ask volume. Positive delta values indicate more contracts were bought than sold at a given price level, negative delta indicates more sellers than buyers at that price.

Point A: Bruce's high volume 9:42 bar, Negative delta peak -8525. What happened here was, the CME floor traders were steadily selling from 1305, then when price broke below 1302 all of a sudden the primary Goldman Sachs floor trader shifted to the buy side and bought all the contracts being offered in the SP pit, which of course immediately caught my full attention.

Point B: Price bounced back to 1302.50 then drifted back to point B on reasonably high red delta volume (-5038), but note the heavy Ask (buy side) volume ( + 9163 ) that came in.

Point C: Price bounces from point B and forms a lower high at 1301.75 then drifts back to that point B high red delta vol level, note the very weak sell volume (-296) and positive Delta ( + 1738 ) on the retest forming point C.

It wasn't until point C had formed and buy side volume surged in that I felt confident enough to enter the long side trade, (my entry was at 1302.00). This is a good example of a couple of things. First as Bruce pointed out, how volume dries up as a trend change turning point forms. Second, in the ES it often takes a good bit of time for the turn to lock in and the trend to reverse.

A point of clarification: these delta charts (and my market balance charts) are a graphical representation of the Time and Sales data stream. The delta charts collect up each contract transaction (price and volume) at the bid and ask prices, then depicts that bid/ask volume information in this unique graphical form. The term "delta" is used to describe the difference between bid volume and ask volume. Positive delta values indicate more contracts were bought than sold at a given price level, negative delta indicates more sellers than buyers at that price.

Originally posted by BruceM

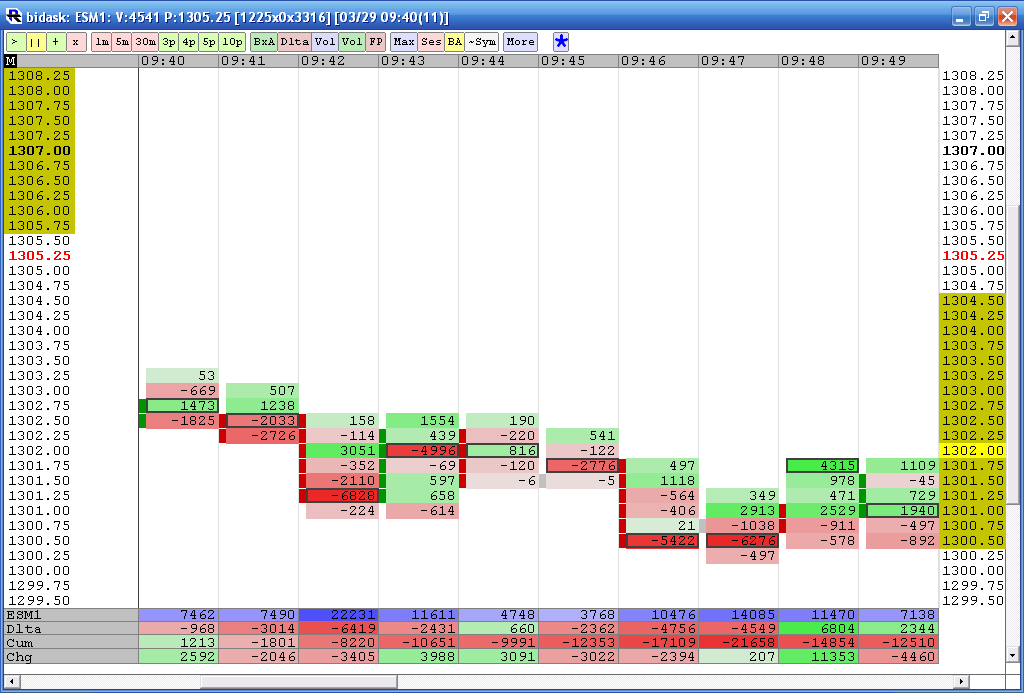

I'm gonna make this quick today......I was buying into the 1300 area as it was a key zone...( 1300- 1301)..Now lorn made an excellent point yesterday about volume and this bid/ask stuff and that is that these footprints are only showing the aggressive buyers or sellers...not TOTAL volume....so Today I watched the 9:42 one minute bar...it had the biggest volume and it was made up of sellers...I watched this on the bar chart...then flipped to delta to see what happened

Look at my chart below at 9:42... it had the biggest area shaded at -6828 sellers at a price of 1301.25.....now this is critical....look what happens at the 9:46 and 9:47 bars....we make new lows on lower volume and higher delta compared to the 9:42 bar...so price is probing lower on less volume and HIGHER net delta....someone is trying to get long....and this is a key zone...so I'm a buyer anyway...so this helped me initiate...

Pt's did some videos which Lorn linked up yesterday....which explains this much better than my post here...I'm just showing how I incorporated the key ideas of having a key area and looking at the High volume bars...in conjunction with the delta ...

I'm appreciative of all the help you folks are giving me and may not have thanked you yesterday......so THANKS

I'll be printing that post out PT ...thanks for taking the effort and explaining that

Originally posted by BruceM

I'll be printing that post out PT ...thanks for taking the effort and explaining that

Anytime Bruce, hope it helps !

Originally posted by prestwickdrive

The 5 year note auction at the top of the hour may wake the market a little.

It needs more No-Doze. Nat Gas (NGK1) is very active though.

closed my short. took 1 pt loss.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.