ES Short Term Trading for 3-28-11

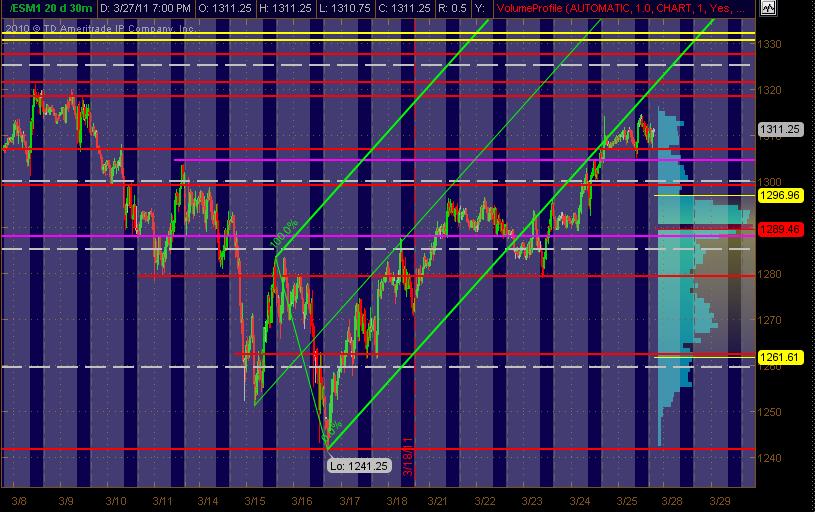

Figgered I'd post my ES trading MAP for Monday and this week. It's the June ES contract 30min chart of 20 days, all hours trading, with RTH sessions of blue background and gray being the "overnight" activity.

Red lines are potential significant PASR levels with Magenta being semi-significant. The Whitish dashed lines are the Weekly Pivots. The Red lines that are roughly 1319-1321 should be considered a ZONE. The Yellow lines also should be considered a potential zone of Fib Clusters around the 1331-1332ish area.

I've left the Green Andrew's Pitchfork that I drew in last week ... as price, after it broke below the lower line, has ridden up against it to some extent. The Volume at Price is displayed on the right vertical in Blue. Hope this is helpful to some as a MAP!

Red lines are potential significant PASR levels with Magenta being semi-significant. The Whitish dashed lines are the Weekly Pivots. The Red lines that are roughly 1319-1321 should be considered a ZONE. The Yellow lines also should be considered a potential zone of Fib Clusters around the 1331-1332ish area.

I've left the Green Andrew's Pitchfork that I drew in last week ... as price, after it broke below the lower line, has ridden up against it to some extent. The Volume at Price is displayed on the right vertical in Blue. Hope this is helpful to some as a MAP!

And if you haven't hit KOOLIO'S Weekly Preview with all his goodies ... then ya need to hit it here:

http://www.mypivots.com/board/topic/6562/-1/es-weekend-preview-3-27-11

Great stuff!

MM

http://www.mypivots.com/board/topic/6562/-1/es-weekend-preview-3-27-11

Great stuff!

MM

What I see as most significant levels as of Sunday evening:

1330 zone

1319-1321

1304-1306 (minor)

1299-1300

1292 HVN

1330 zone

1319-1321

1304-1306 (minor)

1299-1300

1292 HVN

Doesn't seem like much has changed on the downside....and these ranges are tight.....

I like the 1312.50 - 1314.50 as a resistance zone....it also has a volume spike and is a VPOC...R1 is up there too...good selling happened up there especially at the 1312.50 number on Friday..

Volume spike at 1306.25 happened into the same key support from Fridays numbers....

1301 will be critical if we can break fridays low as that is a previous Volume spike and S1...

Small ranges and Internals seem to be week so I'd expect more downside..we'll see what the On brings us

I like the 1312.50 - 1314.50 as a resistance zone....it also has a volume spike and is a VPOC...R1 is up there too...good selling happened up there especially at the 1312.50 number on Friday..

Volume spike at 1306.25 happened into the same key support from Fridays numbers....

1301 will be critical if we can break fridays low as that is a previous Volume spike and S1...

Small ranges and Internals seem to be week so I'd expect more downside..we'll see what the On brings us

It is a helpful chart MM. I see the same zones, but I had not added weekly pivots...those are helpful!

The pitchfork bottom line is roughly the same as the upward RTH on the 15 and 5. Pierced in AH, but if touched again would be a breakout above the res at 12-14.

Thanks for the chart.

The pitchfork bottom line is roughly the same as the upward RTH on the 15 and 5. Pierced in AH, but if touched again would be a breakout above the res at 12-14.

Thanks for the chart.

starting shorts up at 1312.25 for gap fill... O/N profile is symmetric and sellers still seem to like the 1312.50 number....will add on trade above 1314.75 in RTH only

targeting 10.25

selling up above 13.25...reports at 10 .....

failures on these shorts will project way up into MM's 20 number so I'm watching volume and Fridays high closely

Placed a sale order @ 1315

stop loss 4 pts

stop loss 4 pts

I agree Lorn..a potentially very powerful combination

Originally posted by Lorn

There is a certain aspect of delta in showing what the chasers are doing...imo.

That's why I prefer to look at delta on a cumulative basis in bar form so that I can see where the previous levels (pivots) came in relation to price. I use those levels (pivots) of CD as a way of marking where traders initiated there buying or selling. So it becomes a further area of support/resistance to use along with price action support/resistance.

Now combining that with your way of looking at volume Bruce I think is another step forward. The 1 min nodes of volume you follow, if they come in relation to a CD level of initiated buying/selling could give added weight to that levels effective support/resistance.

Ok. My brain hurts now.

Originally posted by BruceM

Yes, thanks Lorn...I guess I'm always looking to see things as they happen, or that repetitive pattern over time...

so right now I see all these orders that went off at the bid at 1310 - 1310.25...it's the peak volume price of the day now.....even overtook that 12.50 but this is based on repeated visits that price....

so if price rallies...the MD people would say "Hey , all those sell orders couldn't break down price so we rallied"

and if we decline they will say .." wow, look at all those sell orders...of course we dropped lower"

my statements are not directed at anyone in our forum...I'm just searching for ways to use this MD thing that is somewhat consistent ....if it even has any value...tons of youtube videos but that also is after the fact.....

I do like it for seeing the buildup of volume but I can see that on my Volume MP charts...the histogram shows that..

just babbling now...

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.