ES key numbers 3-11-11

1390.50 all that great volume on Thursday

1394.50 - a peak volume price based on time and VWAP

1301 - 1302 Thursdays highs and a key area

1308 - 1309- adjusted numbers from March contract

1316 - 1317.50 - adjusted numbers from march contract

It seems like we may be overcooked to the downside so Hoping for a gap lower in the morning to set up buys......and will need to use overnight numbers to key off of as I really don't have any good volume numbers below todays lows..

1394.50 - a peak volume price based on time and VWAP

1301 - 1302 Thursdays highs and a key area

1308 - 1309- adjusted numbers from March contract

1316 - 1317.50 - adjusted numbers from march contract

It seems like we may be overcooked to the downside so Hoping for a gap lower in the morning to set up buys......and will need to use overnight numbers to key off of as I really don't have any good volume numbers below todays lows..

Four areas of price zones I've got as significant (potentially for both "attractors" as well as S/R halting/pausing areas) are:

1308

1299-1300

1294-95

1277-79

This is based on PASR and also on Volume Profile on a 30m chart of the ES June contract w/the 77-79 simply a fib cluster

this is just a MAP w/a couple of numbers coinciding with what Bruce has

1308

1299-1300

1294-95

1277-79

This is based on PASR and also on Volume Profile on a 30m chart of the ES June contract w/the 77-79 simply a fib cluster

this is just a MAP w/a couple of numbers coinciding with what Bruce has

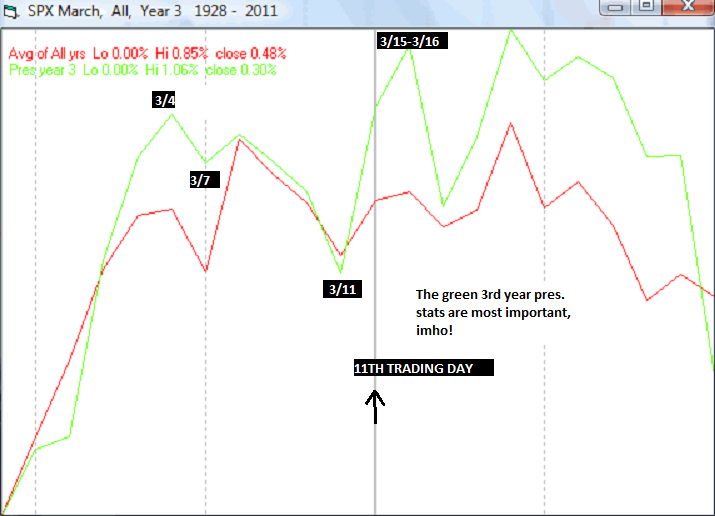

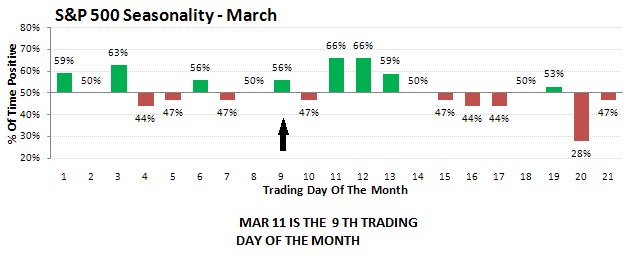

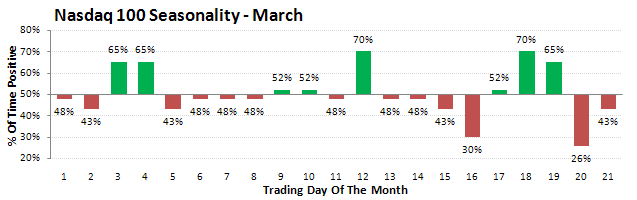

Good morning. Welcome to the Saudi 'day of rage'! Hopefully any effect will be on currencies or oil more than equities. I see weve made new lows tonite, 1278.50 basis the June es contract. Believe it or not ,there is a slight chance of some attempt at a rebound today. First ,we have already had 2 down days , and if you look at the daily chart, 2 or 3 is the norm before a bounce. Also observe the seasonals once again...

...

..Stricly from the historical seasonals it certainly seems as tho at least a temp. bottom could come in around this timeframe (or Mon) and a bounce into Tues-Wed next week.

...

..Stricly from the historical seasonals it certainly seems as tho at least a temp. bottom could come in around this timeframe (or Mon) and a bounce into Tues-Wed next week.

Some numbers to be aware of today might be ...1278.00(30 min 1.618 projection from 1308.00 high yesterday morning.1279.00 is also the c=a point on the daily chart from the June high of 1337.75 with "b" being the 1329 peak. 1276.25 the daily Demark pivot low....1259.50, the 30 MIN 2.618 min projection from yesterdays 1308.00 high.... 1259.00 ,the previous wave 4 of lesser degree and the .236 correction of the entire rally from 1002 to 1337.75.. AND FINALLY 1250.50 (the daily initial move 2.618) the 'line in the sand' for bulls. As for upside numbers , i prefer to wait for projections once we think a low may be in ,tho i tend to agree 1293,or 1302 (projections off of the globex overnite low) could be important.

Hey MM / Mr. Fib Cluster....

nice call on the fib down in 77 - 79...so far the O/N low....great number

nice call on the fib down in 77 - 79...so far the O/N low....great number

Thoughts and prayers to Japan this morning.

and koolio...I think there is a very good chance for the rebound attempt today....or at least a gap fill with a lower open...LOL

Good post and probably the most important one of the thread

Originally posted by Lorn

Thoughts and prayers to Japan this morning.

Ha! I almost didn't include it, but there was such a variety of fibs clustering in that zone that I was gonna pay attention to it. Lots of movement overnight (more and more) these days. Lorn's pointed out the same thing ... question is, how do we take advantage of it in this evolving "global" market.

Originally posted by BruceM

Hey MM / Mr. Fib Cluster....

nice call on the fib down in 77 - 79...so far the O/N low....great number

I have no plan to take advantage of the O/N moves as I like my sleep.....it is frustrating at times but there are still plenty of opportunities in the day session.

The funny thing about us day traders is that we THINK we'd be able to hold for these bigger Overnight moves but I think most wouldn't..

A good example would be someone who was thinking that buying was growing weak at yesterdays close and that further selling was coming.....that was my thought...but what are the real chances of me holding for a move down into 1278 ...? Not very good as most can't even hold for 5 points in the day session....and we have no good internals in the O/N session..

So I think the first step is to get to a "place" where we can hold longer term in the day session and then perhaps move that same concept into the overnight. The only other option is to stay up all night and miss out on sleep...I 'll stick with getting some sleep and dealing with the frustration of missing Overnight trade

The funny thing about us day traders is that we THINK we'd be able to hold for these bigger Overnight moves but I think most wouldn't..

A good example would be someone who was thinking that buying was growing weak at yesterdays close and that further selling was coming.....that was my thought...but what are the real chances of me holding for a move down into 1278 ...? Not very good as most can't even hold for 5 points in the day session....and we have no good internals in the O/N session..

So I think the first step is to get to a "place" where we can hold longer term in the day session and then perhaps move that same concept into the overnight. The only other option is to stay up all night and miss out on sleep...I 'll stick with getting some sleep and dealing with the frustration of missing Overnight trade

long at 85.75 and using 90 as target...small in O/N session

just for reference I have 82 as a magnet price too...

just for reference I have 82 as a magnet price too...

and see where that stopped.......? Right at the Overnight high.....just pointing that out for those who deny the power of the Overnight session..the On high was 93.50!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.