ES key numbers for 3-9-11

1331.25 volume spike from 3-03-11

1325 - 1327.50 - zone of previous highs and volume spike in the 1326 area

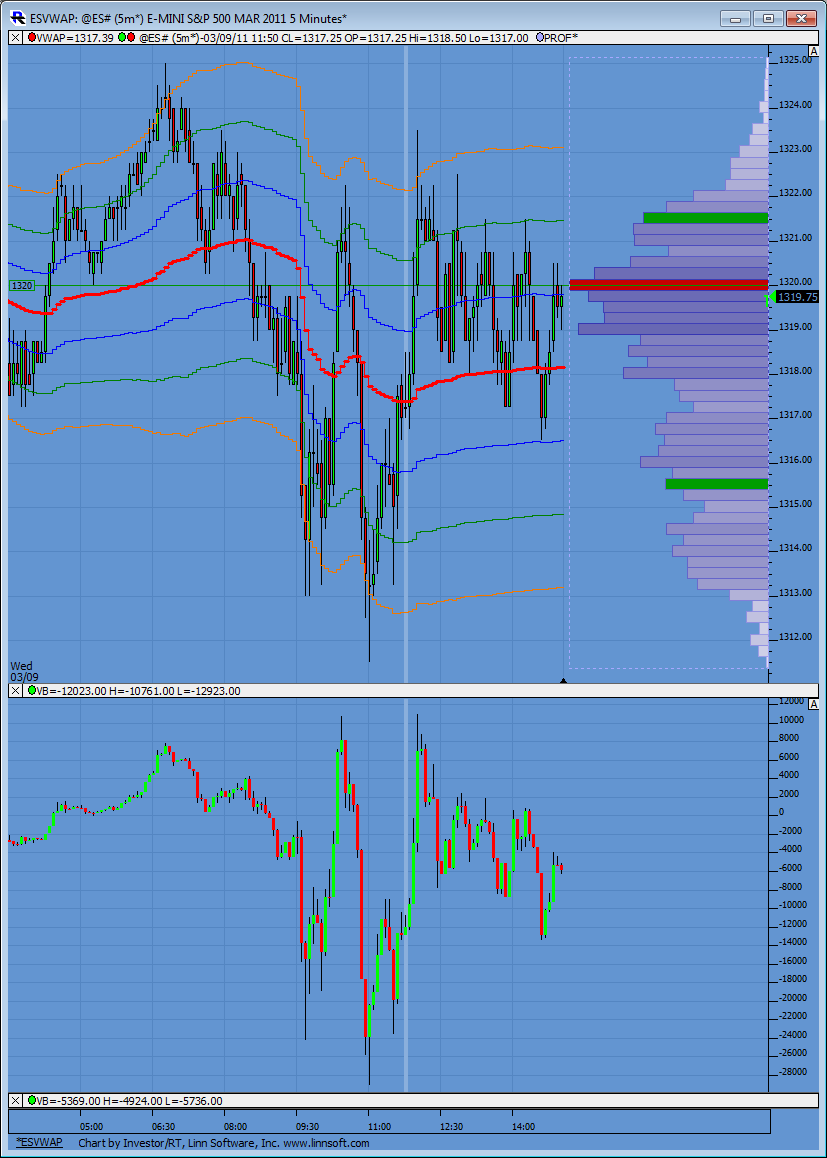

1318.50- 1319.75- this will be the critical zone as all the huge volume came in there yesterday. Folks will be watching to see if price is accepted above or below that price zone

1313.25 - volume spike from Tuesday that held price up

1306.50 - 1308.50 strong support and volume spike once again .

Current plan is to sell into a weak rally and target 1319.75 on the way back down.....Tuesday was an inside day so we need to be careful in case the breakout traders enter above Tuesdays highs with volume. That could mess up our fading plans and bring the 31 number into play

1325 - 1327.50 - zone of previous highs and volume spike in the 1326 area

1318.50- 1319.75- this will be the critical zone as all the huge volume came in there yesterday. Folks will be watching to see if price is accepted above or below that price zone

1313.25 - volume spike from Tuesday that held price up

1306.50 - 1308.50 strong support and volume spike once again .

Current plan is to sell into a weak rally and target 1319.75 on the way back down.....Tuesday was an inside day so we need to be careful in case the breakout traders enter above Tuesdays highs with volume. That could mess up our fading plans and bring the 31 number into play

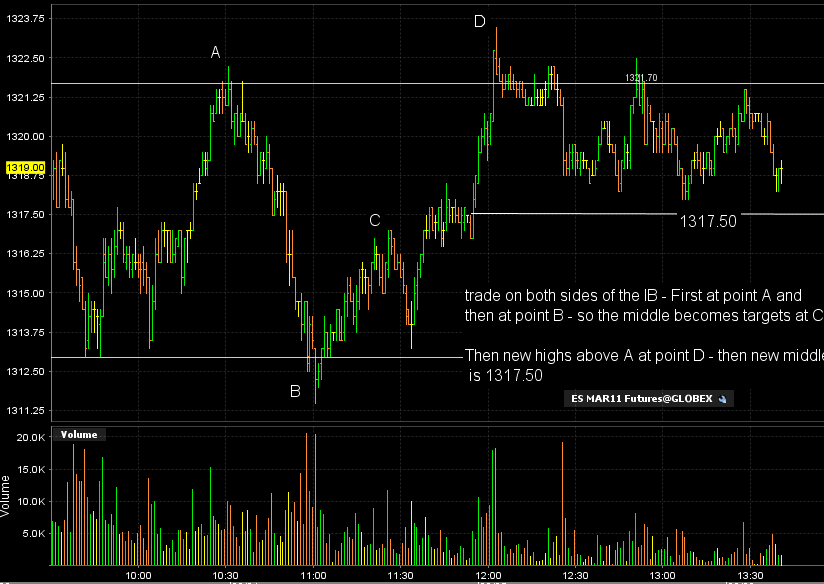

Here is a picture of my last bit of babbling...they still haven't officially tagged 1317.50

Originally posted by BruceM

you donot see this very often,,,,,rarely.....trade above 60 minute high, then trade below 60 minute low and then trade above 60 minute highs to new highs again.....

i still think they want the middle at 17.50

That's close enough for me not gonna be a knucklehead over one measley tick

anyway the point of all this is that we need to know context.....Neutral day so you want to try and buy/sell at extremes and target the middle...eventually the market will grow tired and the band of volatility will snap and you get a break away from the IB....and that usually doesn't happen over the lunch hour time frame.

Good point Chris...we seem to be accepting price under the key areas from yesterday afternoon so if I was trading anymore it would have to be with a downward bias.....good luck to any who are still in this

Originally posted by chrisp

are we looking at contract rollover moves or just fighting for the next move out of this range??? difficult to keep a bias today...

every push above 20 is hit with sellers......so that would need to change for bulls to do any real damage to our bearish bias

Very nice descriptions Bruce. Quite interesting to see the uptick in volatility for the old ES. Almost looked like 6E or CL this morning...lol

Here is a nice visual on what Bruce is describing. Notice the bulging volume in the middle of the days range and how it dries up at the extremes.

Just an aside here. I know the ES daily range and volatility kicked up a couple of weeks ago. And in this bull uptrend on the daily chart, we've got a pennant/wedge type pattern. Yesterday (Tuesday) was an IDNR4. And with less than an hour of the RTH session's close today, this day will be another ID and maybe even an NR7.

Trading hasn't even taken out the highs of the prior overnight session yet. This could be setting up for a reasonable move out of this area. And, it could begin in an overnight session. Just a heads up.

Trading hasn't even taken out the highs of the prior overnight session yet. This could be setting up for a reasonable move out of this area. And, it could begin in an overnight session. Just a heads up.

Seems like moves are beginning in the O/N of late.

Originally posted by MonkeyMeat

Just an aside here. I know the ES daily range and volatility kicked up a couple of weeks ago. And in this bull uptrend on the daily chart, we've got a pennant/wedge type pattern. Yesterday (Tuesday) was an IDNR4. And with less than an hour of the RTH session's close today, this day will be another ID and maybe even an NR7.

Trading hasn't even taken out the highs of the prior overnight session yet. This could be setting up for a reasonable move out of this area. And, it could begin in an overnight session. Just a heads up.

Overnights hitting the 1306 - 1308 zone....Gheesh...how do these people hold for those moves........It just kills me..

Originally posted by BruceM

1331.25 volume spike from 3-03-11

1325 - 1327.50 - zone of previous highs and volume spike in the 1326 area

1318.50- 1319.75- this will be the critical zone as all the huge volume came in there yesterday. Folks will be watching to see if price is accepted above or below that price zone

1313.25 - volume spike from Tuesday that held price up

1306.50 - 1308.50 strong support and volume spike once again .

Current plan is to sell into a weak rally and target 1319.75 on the way back down.....Tuesday was an inside day so we need to be careful in case the breakout traders enter above Tuesdays highs with volume. That could mess up our fading plans and bring the 31 number into play

Here is a new feature CME has on their site. Called "Pace of the Roll"

http://www.cmegroup.com/trading/equity-index/paceofroll/main.html

http://www.cmegroup.com/trading/equity-index/paceofroll/main.html

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.