ES key numbers for 3-9-11

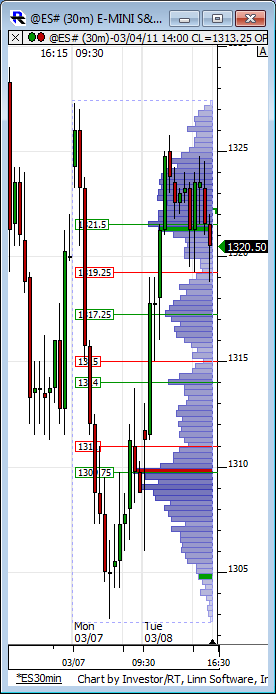

1331.25 volume spike from 3-03-11

1325 - 1327.50 - zone of previous highs and volume spike in the 1326 area

1318.50- 1319.75- this will be the critical zone as all the huge volume came in there yesterday. Folks will be watching to see if price is accepted above or below that price zone

1313.25 - volume spike from Tuesday that held price up

1306.50 - 1308.50 strong support and volume spike once again .

Current plan is to sell into a weak rally and target 1319.75 on the way back down.....Tuesday was an inside day so we need to be careful in case the breakout traders enter above Tuesdays highs with volume. That could mess up our fading plans and bring the 31 number into play

1325 - 1327.50 - zone of previous highs and volume spike in the 1326 area

1318.50- 1319.75- this will be the critical zone as all the huge volume came in there yesterday. Folks will be watching to see if price is accepted above or below that price zone

1313.25 - volume spike from Tuesday that held price up

1306.50 - 1308.50 strong support and volume spike once again .

Current plan is to sell into a weak rally and target 1319.75 on the way back down.....Tuesday was an inside day so we need to be careful in case the breakout traders enter above Tuesdays highs with volume. That could mess up our fading plans and bring the 31 number into play

Thought I'd post both the RTH session profile for Monday/Tuesday and the Globex session as well. Rest of the week should be interesting. I'm very curious if prices stay within this two-day range or extend out in one direction or another.

I like those shots lorn...it almost seems like a double distribution and a good chance they will fill in the cleavage in the center......assuming they don't break out of the highs with volume this morning...

So a secondary target down near 1315 - 1313.25 is a good plan on any shorts we happen to get today

So a secondary target down near 1315 - 1313.25 is a good plan on any shorts we happen to get today

My simple and crude battle plan for today is as follows:

The 19 - 20 area is the main magnet area so:

1) an open below and push lower towards the O/N low will have me trying to buy providing Volume and internals are not screeming for shorts......then the target will be back up into the 19 - 20 area

2) An open higher will have me trying to sell as close to the O/N high as possible....watching for volume once again to dry up and mean reversion back to the 19 - 20.

On the flipside is that if we start testing the 19 - 20 and it starts holding then we should try for additional targets....for example..if we opne higher and drop down to it and it becomes support then we need to try and hanng on for the next zone near 25 - 27 and then the 31 area...

the reverse would be true if we open below it and it becomes resistance....then we try to target the 1313.75 area

The 19 - 20 area is the main magnet area so:

1) an open below and push lower towards the O/N low will have me trying to buy providing Volume and internals are not screeming for shorts......then the target will be back up into the 19 - 20 area

2) An open higher will have me trying to sell as close to the O/N high as possible....watching for volume once again to dry up and mean reversion back to the 19 - 20.

On the flipside is that if we start testing the 19 - 20 and it starts holding then we should try for additional targets....for example..if we opne higher and drop down to it and it becomes support then we need to try and hanng on for the next zone near 25 - 27 and then the 31 area...

the reverse would be true if we open below it and it becomes resistance....then we try to target the 1313.75 area

Here is some added weight to your numbers Bruce. Projection down off the O/N high gives both 19 zone and the 15 zone.

Trade on both sides of the IB...neutral days like to try for the center....hopefully someone bought into that 60 minute low....Context:

An inside day......that has trade on both sides of the 60 minute range

An inside day......that has trade on both sides of the 60 minute range

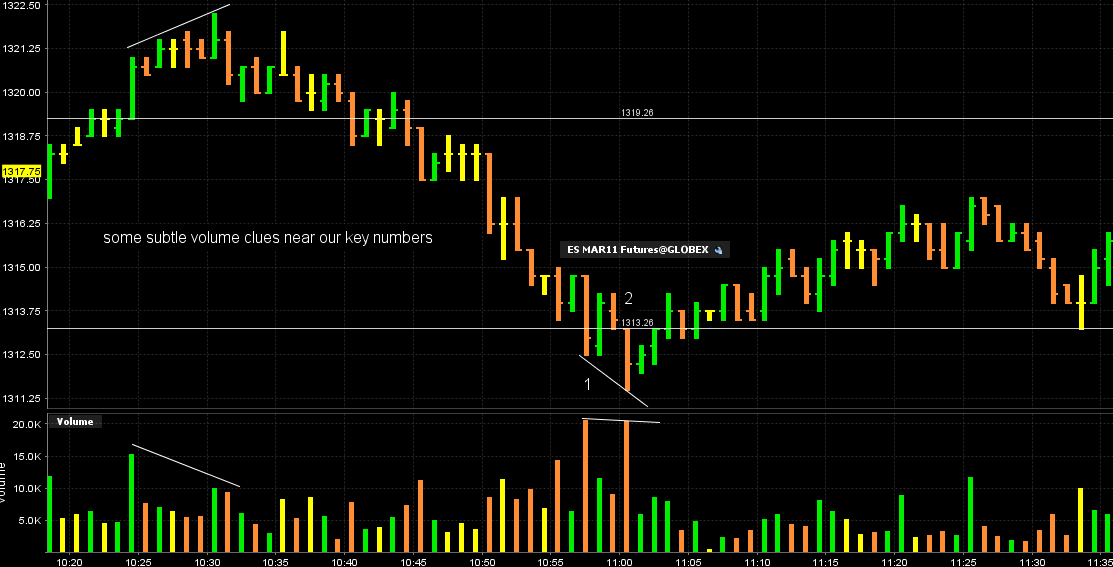

Here is the quick chart of the day with the subtle volume clues...these divergences can be made better with an understanding of Delta and market internals.....but here they are in my world...we don't want to look for them unless we are near the key areas....otherwise we can have divergences at places that mean nothing

Once again we see volume subside a bit as we get above the 19.25 area and then below the 13.25....tells us that folks aren't as interested in trade above and below those points

Once again we see volume subside a bit as we get above the 19.25 area and then below the 13.25....tells us that folks aren't as interested in trade above and below those points

17.50 is the new Middle price now!!!

you donot see this very often,,,,,rarely.....trade above 60 minute high, then trade below 60 minute low and then trade above 60 minute highs to new highs again.....

i still think they want the middle at 17.50

i still think they want the middle at 17.50

are we looking at contract rollover moves or just fighting for the next move out of this range??? difficult to keep a bias today...

Here is a new feature CME has on their site. Called "Pace of the Roll"

http://www.cmegroup.com/trading/equity-index/paceofroll/main.html

http://www.cmegroup.com/trading/equity-index/paceofroll/main.html

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.