ES Short Term Trading 02-01-2011

I updated a chart in my previous post so you can see what I am babbling about......boring now!!

Took one off at 1303.50 to reduce risk ,holding the runner.

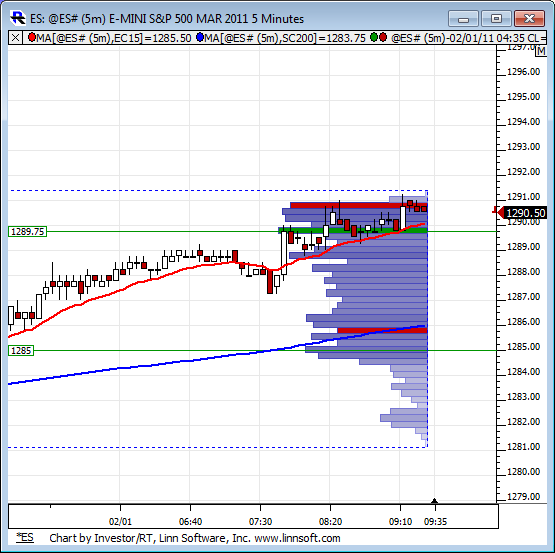

As you can see, this is the first time ALL DAY, that we have broken below the infamous red avg!

that was all that can be expected with the previous low retest and the filling in of the 3rd set...I covered all at 1303...was working the 05 , the 04.25 and the 2.50..

It will be an interesting finish today with all the storms coming to threaten Chicago and New york areas..I wonder if the big players are sticking around...

It will be an interesting finish today with all the storms coming to threaten Chicago and New york areas..I wonder if the big players are sticking around...

Originally posted by BruceMYeah, yet another reason we mish- mash tomorrow

that was all that can be expected with the previous low retest and the filling in of the 3rd set...I covered all at 1303...was working the 05 , the 04.25 and the 2.50..

It will be an interesting finish today with all the storms coming to threaten Chicago and New york areas..I wonder if the big players are sticking around...

what's nice about our little group here is that we don't get a lot of "after the fact" hero's posting....you know the folks who come on and say how they bought the open and held on the trend day....

just ridiculous...but I will admit there are lots of clues with the closes outside of the Overnight high and the closes outside of the 60 minute high...the in ability to get 1/2 a gap fill or trade back to the open print.it's days like this that I burn a whole in my key board typing and marking up charts......in an effort to get better at sidestepping the trends......

A losing day today...it all started with a minor loss in the overnight and being greedy on that 96 area short later on...

volume sucks now....for reference , I always like the concept of 2.5 and 5 points above and below key areas...the problem is that we never know how far they will try and push....so I took the 02.50 and along with some MP help I had another key add at 05 even...these are key numbers above the 1300 round number...

just ridiculous...but I will admit there are lots of clues with the closes outside of the Overnight high and the closes outside of the 60 minute high...the in ability to get 1/2 a gap fill or trade back to the open print.it's days like this that I burn a whole in my key board typing and marking up charts......in an effort to get better at sidestepping the trends......

A losing day today...it all started with a minor loss in the overnight and being greedy on that 96 area short later on...

volume sucks now....for reference , I always like the concept of 2.5 and 5 points above and below key areas...the problem is that we never know how far they will try and push....so I took the 02.50 and along with some MP help I had another key add at 05 even...these are key numbers above the 1300 round number...

Next stop... 1301.50-75? lol... Hopefully 1304.50 caps any rebound here, otherwise im likely dead

Well put, Bruce... im up one whole whopping handle today, but hoping for 2.5 more...(short from 1304.50)...

No votes today, understandable as i tend to post too much,so i

lll try to chill out starting tomorrow, but wanted to say the 13 min red avg is also at 1301.75, re-inforcing my above view.

lll try to chill out starting tomorrow, but wanted to say the 13 min red avg is also at 1301.75, re-inforcing my above view.

Originally posted by BruceM

Hey DT...do u know why my charts are getting crushed up ? Even full size image looks terrible.....looks great on my screen...LOL

Looks good to me - any chance that your browser is doing it?

If not, can you take a screen shot of the in-browser and on-desktop versions of the images and send them to me and I'll try and work out what the problem is?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.