ES key levels on the downside

some levels as we go forward....downside only..wishful thinking perhaps as the world seems on bullish. Ranges are fairly small so zones are tight...not much room from level to level

1213.50 - 15.25 - VPOC and spike initiation point ****** key support for friday,,longs don't want it to open below that on Friday morning!!

1207.50 - 09.50 Thursdays RTH open and low volume

1202 - 1204.75 - VPOC from Thursdays O/N session

1197- 98.75 Gap and VPOC from ON

87 -91 VPOC and low volume - may rotate here a bunch to fill in the profile

84.50 - low volume area begins and HV from composite

78 - 81 ***** major support , the center of the universe....we have been watching this number for a long time

1213.50 - 15.25 - VPOC and spike initiation point ****** key support for friday,,longs don't want it to open below that on Friday morning!!

1207.50 - 09.50 Thursdays RTH open and low volume

1202 - 1204.75 - VPOC from Thursdays O/N session

1197- 98.75 Gap and VPOC from ON

87 -91 VPOC and low volume - may rotate here a bunch to fill in the profile

84.50 - low volume area begins and HV from composite

78 - 81 ***** major support , the center of the universe....we have been watching this number for a long time

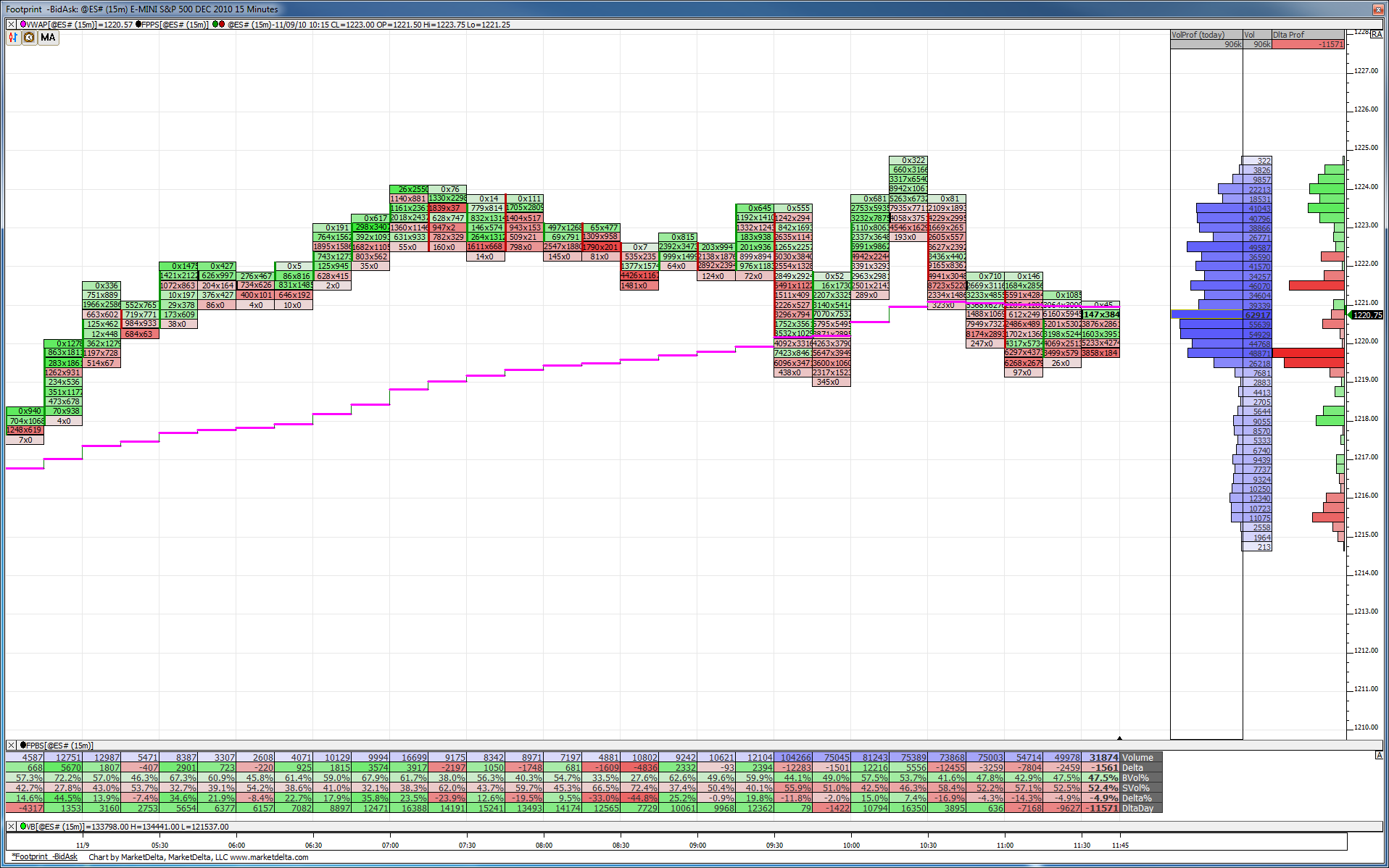

this needs to break and soon otherwise I'm afraid this may just ping-pong back and forth between 1223 and 1220....that would be a riculous tight range to try and trade from

You can see how prices are now fighting with VWAP. Earlier VWAP was support as prices challenged then rallied off them. Here prices are below but obviously making an effort to get back above VWAP.

took 1 off at yesterday's VAL at 1217.50.

stop still at 1221.50

Single Prints trying at 1218.75

final target VPOC at 1213.50

stop still at 1221.50

Single Prints trying at 1218.75

final target VPOC at 1213.50

Again using Kool's Tools,the move off the high of 24.75 before a decent retrace was to 20.0 (4.75 handles). On a move like that KB used to say to look for an intermediate target worked off the upper extreme (in this case vs. the lower extreme of an up move) with an ultimate target calculated off the lower extreme.

That said, the 4.75 handle move times 1.62 = 7.75 (rounded from 7.695). His initial move would call for 24.75 - 7.75 = 1217.0 (which we hit). The ultimate projection (unless 24.75 is taken out) is 20.0 - 7.75 = 1212.25 which sets up nice with your target PT.

That said, the 4.75 handle move times 1.62 = 7.75 (rounded from 7.695). His initial move would call for 24.75 - 7.75 = 1217.0 (which we hit). The ultimate projection (unless 24.75 is taken out) is 20.0 - 7.75 = 1212.25 which sets up nice with your target PT.

Another thing I have observed using KT's technique is that if you are in anything close to a trend (even partial intraday) that a counter move should stop around the initial target I mentioned in the previous post.

If we are in any sort of intraday trend now that implies that this up move should stop around 18.75. The retrace off the move to 16.75 was to 18.0 or 1.25 handles. 1.25 times 1.62 = 2.0. 16.75 + 2.0 = 18.75. The full move projects 18.0 + 2.0 = 1220.0 but f we are going to get to that 12.75 projection posted previously we probably won't retrace up quite that far. FWIW.

If we are in any sort of intraday trend now that implies that this up move should stop around 18.75. The retrace off the move to 16.75 was to 18.0 or 1.25 handles. 1.25 times 1.62 = 2.0. 16.75 + 2.0 = 18.75. The full move projects 18.0 + 2.0 = 1220.0 but f we are going to get to that 12.75 projection posted previously we probably won't retrace up quite that far. FWIW.

Covered runner at 1214.00 ...

Originally posted by prestwickdrive

Again using Kool's Tools,the move off the high of 24.75 before a decent retrace was to 20.0 (4.75 handles). On a move like that KB used to say to look for an intermediate target worked off the upper extreme (in this case vs. the lower extreme of an up move) with an ultimate target calculated off the lower extreme.

That said, the 4.75 handle move times 1.62 = 7.75 (rounded from 7.695). His initial move would call for 24.75 - 7.75 = 1217.0 (which we hit). The ultimate projection (unless 24.75 is taken out) is 20.0 - 7.75 = 1212.25 which sets up nice with your target PT.

12.25 hit and the up move did get held although the up retrace did make it to 19.5

Back to this chart again. Strength in the dollar/weakness in the euro is certainly needed for any sustained move to the downside.

Something that bothers me is we did not get a new yearly high today in the cash S&P markets as we did in the ES.

Something that bothers me is we did not get a new yearly high today in the cash S&P markets as we did in the ES.

Nice you are keeping KT's stuff alive.

Originally posted by prestwickdrive

Another thing I have observed using KT's technique is that if you are in anything close to a trend (even partial intraday) that a counter move should stop around the initial target I mentioned in the previous post.

If we are in any sort of intraday trend now that implies that this up move should stop around 18.75. The retrace off the move to 16.75 was to 18.0 or 1.25 handles. 1.25 times 1.62 = 2.0. 16.75 + 2.0 = 18.75. The full move projects 18.0 + 2.0 = 1220.0 but f we are going to get to that 12.75 projection posted previously we probably won't retrace up quite that far. FWIW.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.