ES Short Term Trading 8-24-2010

Range Based S/R

R1 = 1084.25

S1 = 1060.25

R2 = 1088.25

S2 = 1056.25

Steenbarger Pivot = 1068.875

Prices have already traded below S2 this morning.

R1 = 1084.25

S1 = 1060.25

R2 = 1088.25

S2 = 1056.25

Steenbarger Pivot = 1068.875

Prices have already traded below S2 this morning.

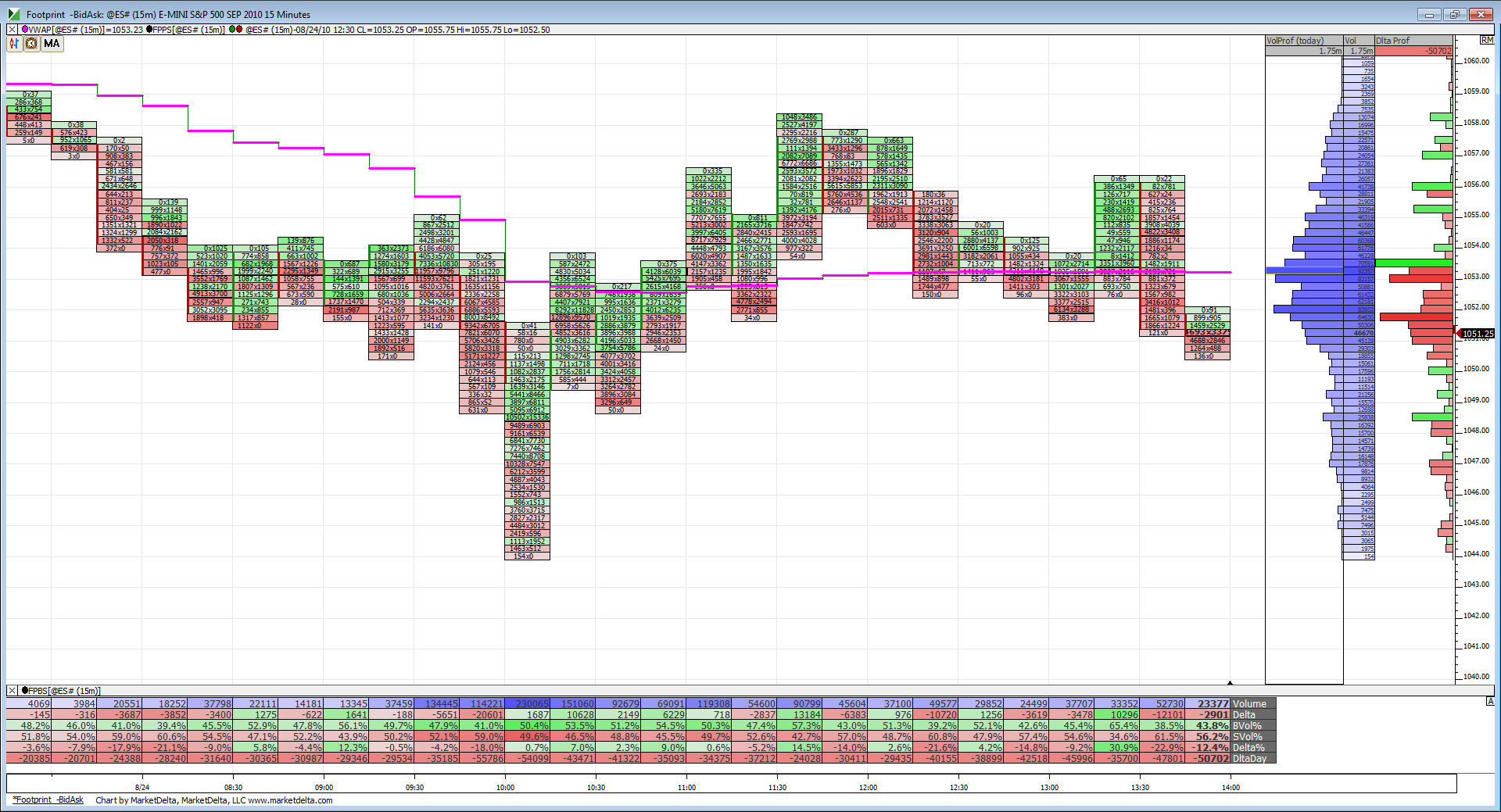

Even though we are in a pretty clear trading range for the moment delta has been quite negative all day and still increasing. This means more volume at the bid. Could be an indication of sustained breakout to the downside if breakout occurs.

Only long play I see is a vertical lift that breaks that channel. I'm not seeing it yet, but note that Europe didn't exactly puke today into their close.

Here's the attempt. would not be long sub 1051.5

Here's the attempt. would not be long sub 1051.5

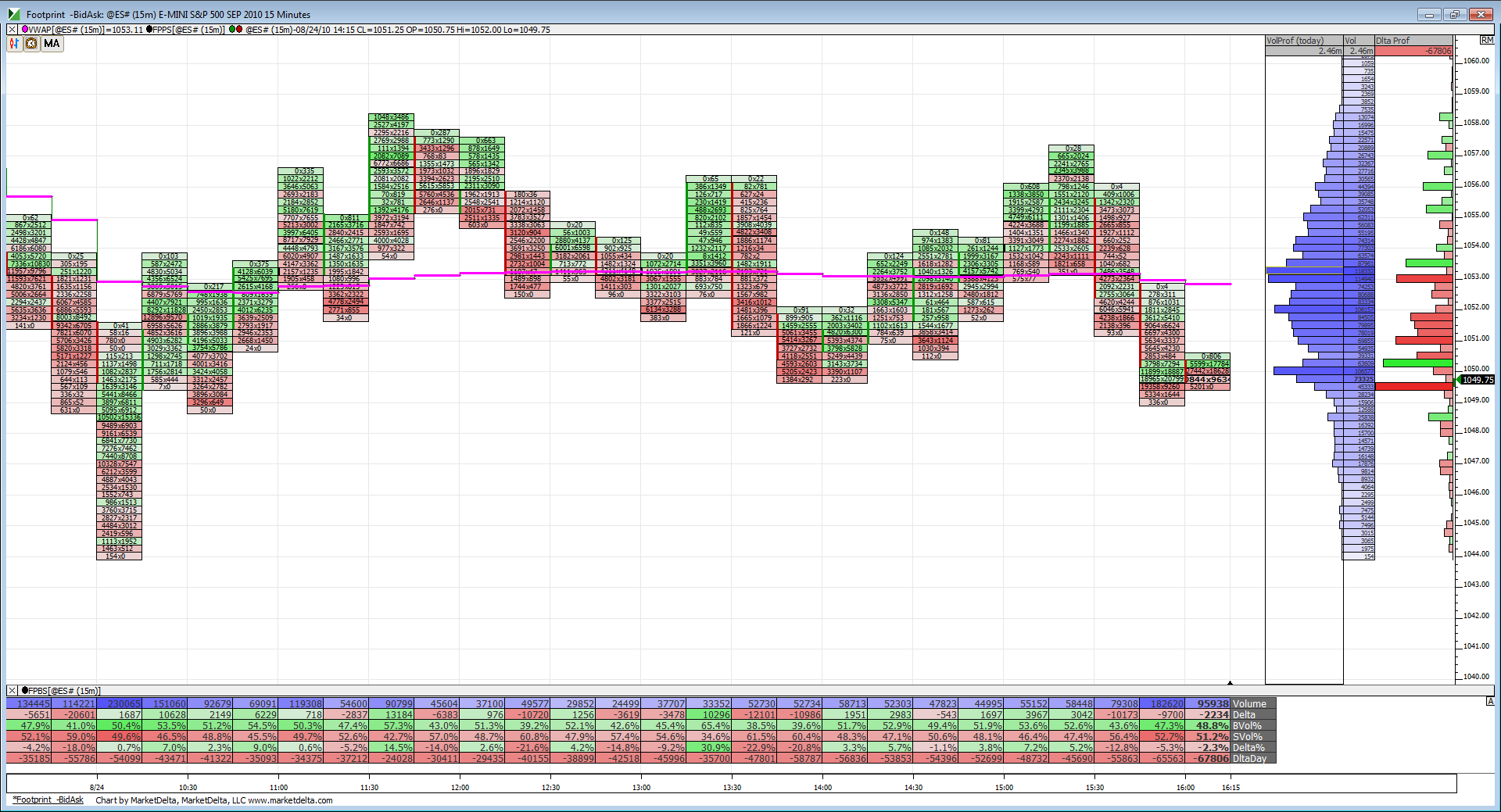

you can see how they also tried to sell that 50.25 band and again failed....we had the ledge up top to help pull up the trade which hasn't been run out yet....point is that trading inside a symetric disribution is tough unless you have damn good targets and know what to look for......getting late in the day so all fades are harder....if you aren't long and holding runners than I would avoid this...we have triples below and a ledge above.......so who is to say which way this really wants to go...perhaps they will clean them both up...

Originally posted by BruceM

the band traders would have bought the 54.75 long trade and try to push it to 57....we'll see...not me !still symetric until proven wrong

Good advice.

54 is the 50% retrace and 55 the 62% retrace of last wave down. 1053,1051.5 below.

54 is the 50% retrace and 55 the 62% retrace of last wave down. 1053,1051.5 below.

cool finish...ledges and triples run......

A good read to contemplate as we prepare for tomorrow's action.

http://traderfeed.blogspot.com/2010/03/most-common-problem-i-see-among-active.html

http://traderfeed.blogspot.com/2010/03/most-common-problem-i-see-among-active.html

The Most Common Problem I See Among Active Traders

The recent post on listening to market communications highlights one of the most common problems I see among active traders, particularly those that trade on a day time frame.

We've all known people who seem to talk at you rather than with you. It seems as if they're uninterested in anything you have to say. They just want to get things off their minds. Indeed, even as you're talking, you can see that they can't wait to blurt out whatever is in their heads.

Can you imagine a psychologist who interacted like that? You're trying to describe your problems, and the shrink is talking right over you with whatever psychobabble he happens to be espousing at the time. That would be quite frustrating.

Well, that is how many traders approach markets. They don't listen to what the market has to say. Instead, they're looking for the next setup, the next trade to put on.

When you sit in front of the screen, the goal should be similar to the psychologist's: to understand what is going on before you take action. If you're approaching markets with your own opinions and your own need to put on trades, you'll miss the market's communications--its evolving patterns--and any hope of getting a gut feel for the action will be gone.

I often wondered why I tended to trade well after taking a break from markets. The reason, I discovered, was that I was following markets during the break, but not trying to put on trades. That freed me up to simply hear what the markets had to say.

If you have a *need* to talk, chances are you'll be a poor conversationalist because you'll be a poor listener.

And if you have a *need* to trade, odds are you'll be tone deaf with respect to what markets are actually telling you.

Lorn,

any connection between the closing volume at bid or ask and the projected trade in O/N or open for the next day sessio?

Does closing volume at the bid lead to further selling in O/N ? I guess thats the real question.

any connection between the closing volume at bid or ask and the projected trade in O/N or open for the next day sessio?

Does closing volume at the bid lead to further selling in O/N ? I guess thats the real question.

Great question. I'll do some research on the historical data I have and get back to you.

Originally posted by BruceM

Lorn,

any connection between the closing volume at bid or ask and the projected trade in O/N or open for the next day sessio?

Does closing volume at the bid lead to further selling in O/N ? I guess thats the real question.

Hey, Lorn, you should start a topic just for these kinds of posts they are so good (as long as Dr. Brett doesn't mind, I had heard something about him not wanting to be reposted or linked???). I voted you up on this one (and I think on another another one like this that you posted). Give it some thought.

Originally posted by Lorn

A good read to contemplate as we prepare for tomorrow's action.

http://traderfeed.blogspot.com/2010/03/most-common-problem-i-see-among-active.html

The Most Common Problem I See Among Active Traders

The recent post on listening to market communications highlights one of the most common problems I see among active traders, particularly those that trade on a day time frame.

We've all known people who seem to talk at you rather than with you. It seems as if they're uninterested in anything you have to say. They just want to get things off their minds. Indeed, even as you're talking, you can see that they can't wait to blurt out whatever is in their heads.

Can you imagine a psychologist who interacted like that? You're trying to describe your problems, and the shrink is talking right over you with whatever psychobabble he happens to be espousing at the time. That would be quite frustrating.

Well, that is how many traders approach markets. They don't listen to what the market has to say. Instead, they're looking for the next setup, the next trade to put on.

When you sit in front of the screen, the goal should be similar to the psychologist's: to understand what is going on before you take action. If you're approaching markets with your own opinions and your own need to put on trades, you'll miss the market's communications--its evolving patterns--and any hope of getting a gut feel for the action will be gone.

I often wondered why I tended to trade well after taking a break from markets. The reason, I discovered, was that I was following markets during the break, but not trying to put on trades. That freed me up to simply hear what the markets had to say.

If you have a *need* to talk, chances are you'll be a poor conversationalist because you'll be a poor listener.

And if you have a *need* to trade, odds are you'll be tone deaf with respect to what markets are actually telling you.

Good point you bring up Jim. I've tried getting in touch with Dr. Brett about posting but he has no contact info. He does state on his blog he doesn't want links or posts re-posted but that was said in 2007 and now he is no longer blogging but keeps the site up as an archive for us blokes.

I just can't imagine at this point he would have a problem with re posts. Admin, what do you think?

I just can't imagine at this point he would have a problem with re posts. Admin, what do you think?

Originally posted by jimkane

Hey, Lorn, you should start a topic just for these kinds of posts they are so good (as long as Dr. Brett doesn't mind, I had heard something about him not wanting to be reposted or linked???). I voted you up on this one (and I think on another another one like this that you posted). Give it some thought.

Originally posted by Lorn

A good read to contemplate as we prepare for tomorrow's action.

http://traderfeed.blogspot.com/2010/03/most-common-problem-i-see-among-active.html

The Most Common Problem I See Among Active Traders

The recent post on listening to market communications highlights one of the most common problems I see among active traders, particularly those that trade on a day time frame.

We've all known people who seem to talk at you rather than with you. It seems as if they're uninterested in anything you have to say. They just want to get things off their minds. Indeed, even as you're talking, you can see that they can't wait to blurt out whatever is in their heads.

Can you imagine a psychologist who interacted like that? You're trying to describe your problems, and the shrink is talking right over you with whatever psychobabble he happens to be espousing at the time. That would be quite frustrating.

Well, that is how many traders approach markets. They don't listen to what the market has to say. Instead, they're looking for the next setup, the next trade to put on.

When you sit in front of the screen, the goal should be similar to the psychologist's: to understand what is going on before you take action. If you're approaching markets with your own opinions and your own need to put on trades, you'll miss the market's communications--its evolving patterns--and any hope of getting a gut feel for the action will be gone.

I often wondered why I tended to trade well after taking a break from markets. The reason, I discovered, was that I was following markets during the break, but not trying to put on trades. That freed me up to simply hear what the markets had to say.

If you have a *need* to talk, chances are you'll be a poor conversationalist because you'll be a poor listener.

And if you have a *need* to trade, odds are you'll be tone deaf with respect to what markets are actually telling you.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.