ES Short Term Trading 8-24-2010

Range Based S/R

R1 = 1084.25

S1 = 1060.25

R2 = 1088.25

S2 = 1056.25

Steenbarger Pivot = 1068.875

Prices have already traded below S2 this morning.

R1 = 1084.25

S1 = 1060.25

R2 = 1088.25

S2 = 1056.25

Steenbarger Pivot = 1068.875

Prices have already traded below S2 this morning.

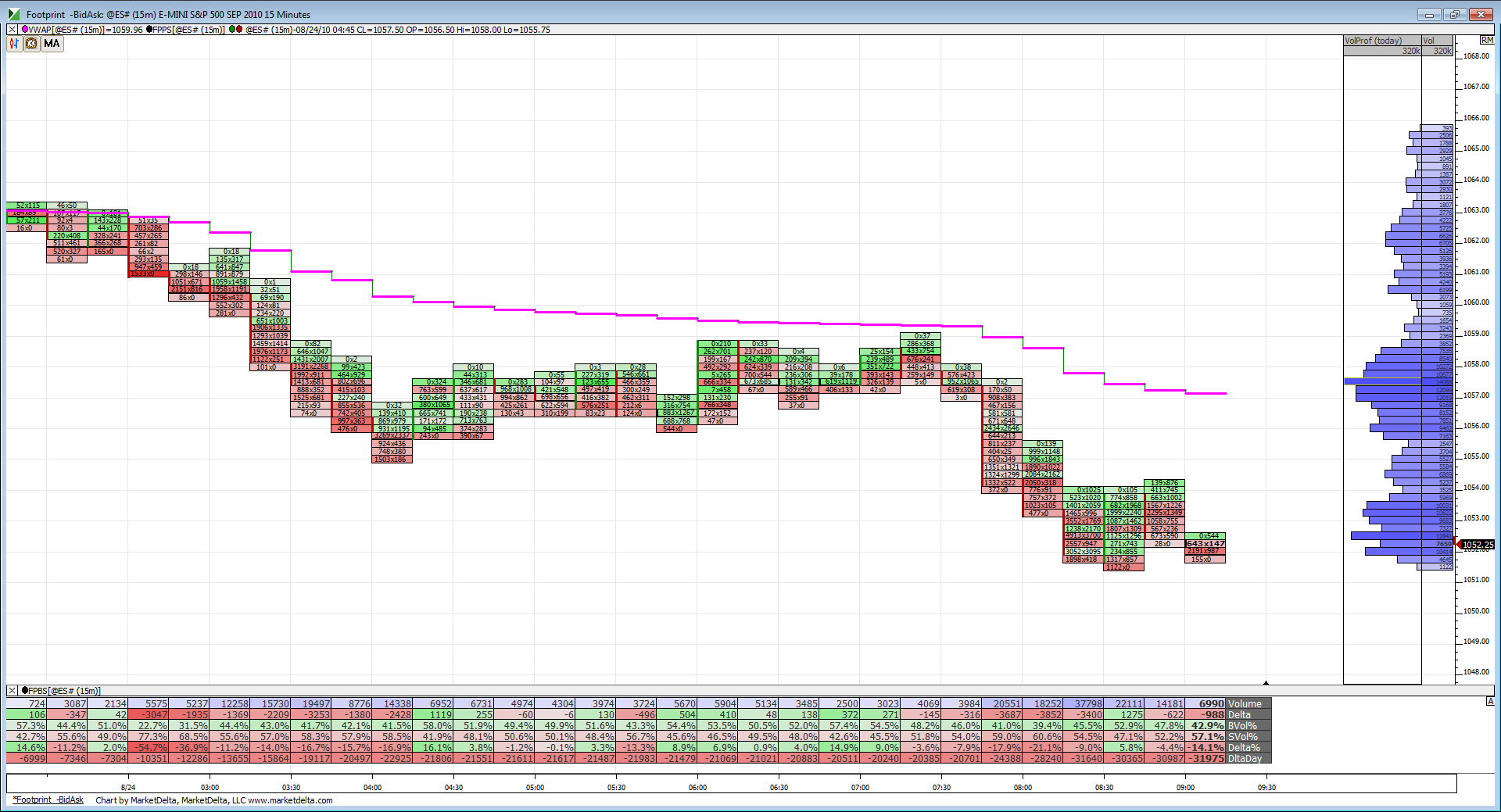

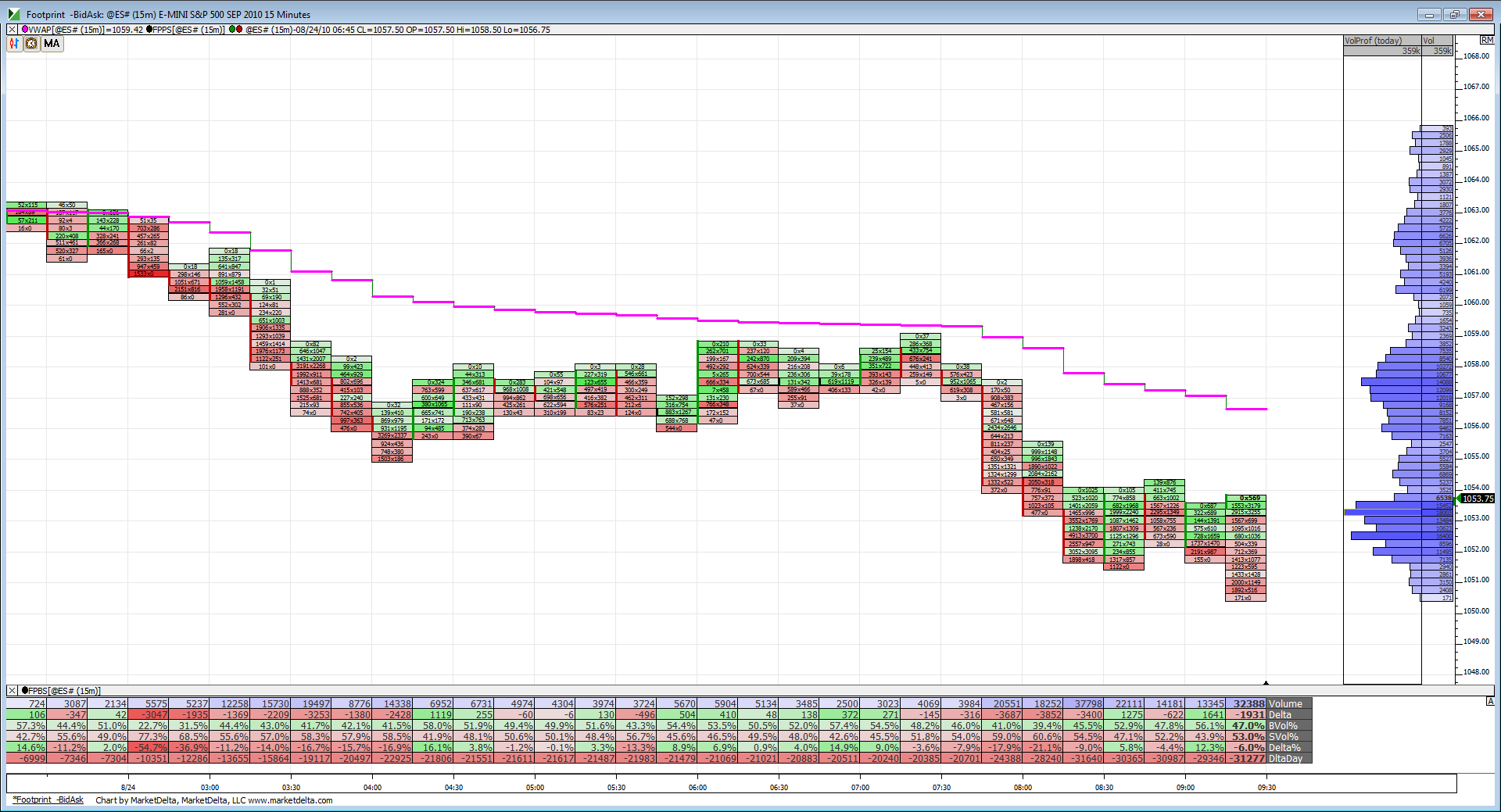

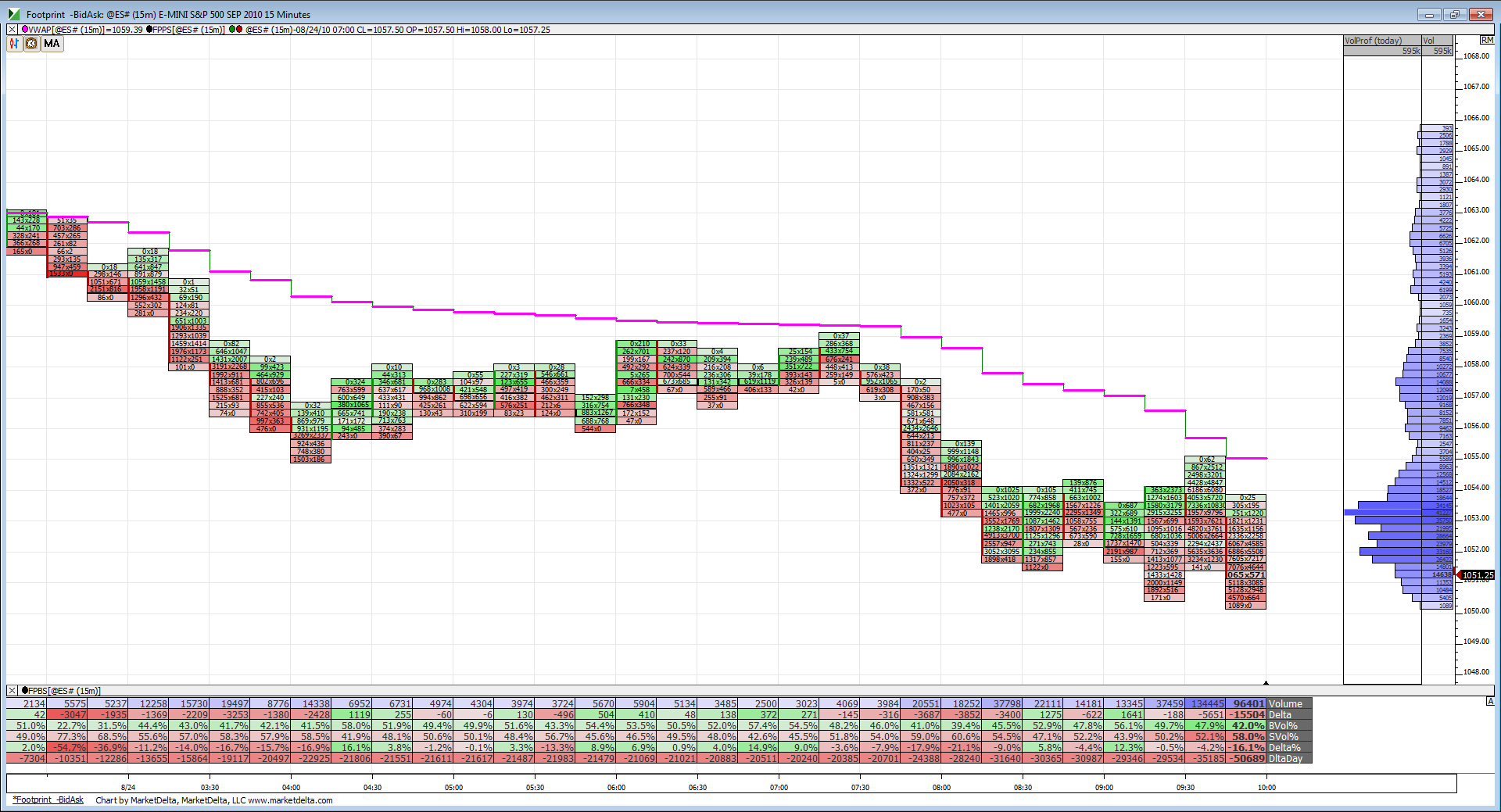

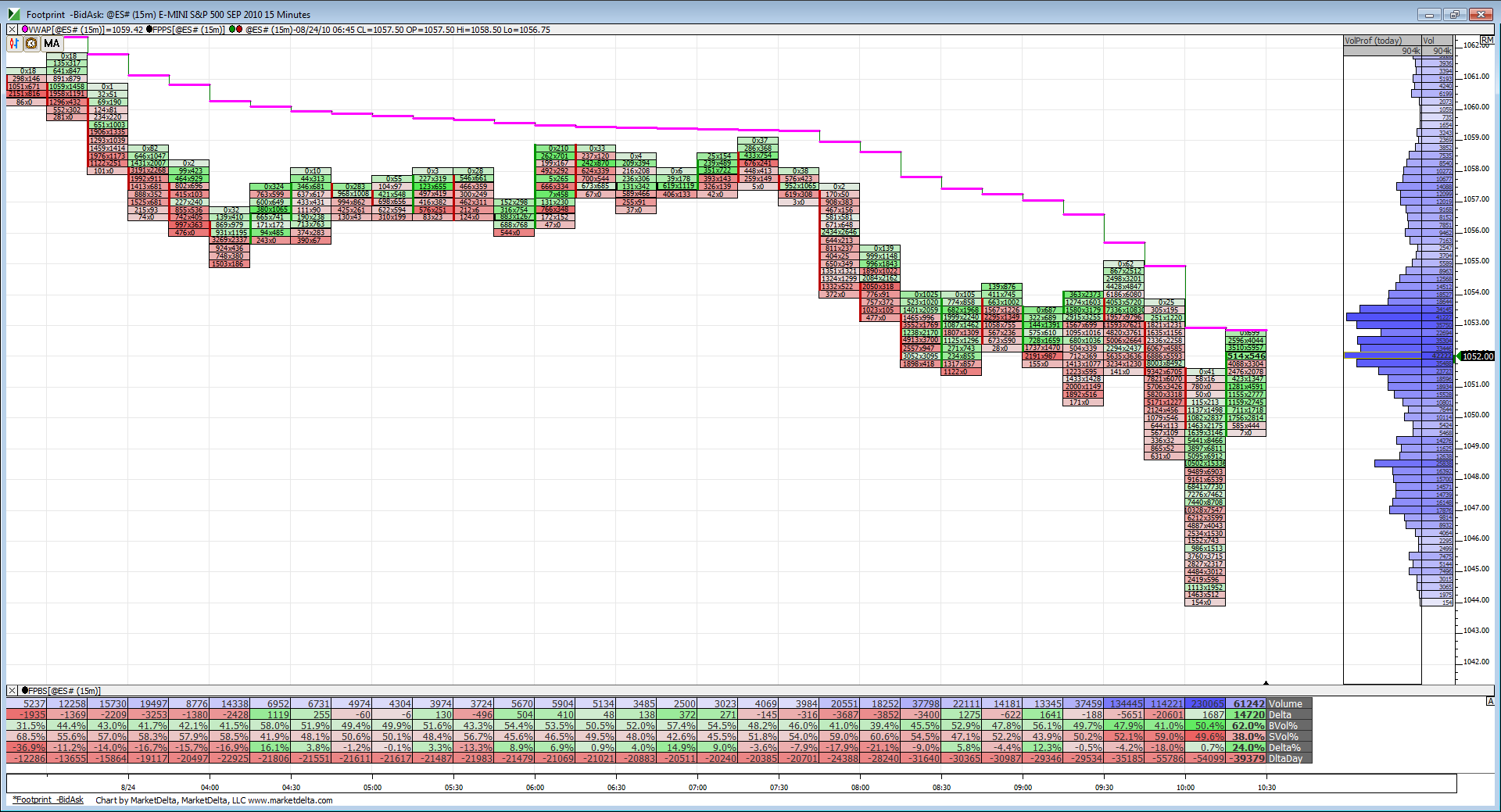

Here is footprint chart. You can see VWAP is resistance again today. We all know what that did is yesterday's trade. Until prices can get on top of VWAP the volume coming into the market is pushing prices down.

Here is a different look. A daily ES chart. You can see that 1050.75 low in July has been breached with todays action. Important thing will be where prices close in relation to that level.

Remember today is day 13 of Kool's 12-13 day cycle.

End of a C wave down or part of a 3rd wave? Channel needs to break for reversal but if a C wave might need a few more tails on the candles before that happens.

1040 next significant support level and we may see it today. 1051.5 hanging in there for S/R here.

Vertical lines signify Gann dates. New hi, lo, trend change, significant news that affects market.

Watching BKX lod 43.50

1040 next significant support level and we may see it today. 1051.5 hanging in there for S/R here.

Vertical lines signify Gann dates. New hi, lo, trend change, significant news that affects market.

Watching BKX lod 43.50

I have 59 - 60.50 as first real upside resistance...old POC's there and volume in O/N session

Broke the top of the channel. Now see if it can hold as support? About 1054.5 here.

Meandering sideways could be a 4th wave of 5 down.

Retrace fib levels 1057.75(38%, 1062(50%),1066.5(62%) from yesterdays high.

Meandering sideways could be a 4th wave of 5 down.

Retrace fib levels 1057.75(38%, 1062(50%),1066.5(62%) from yesterdays high.

Good point you bring up Jim. I've tried getting in touch with Dr. Brett about posting but he has no contact info. He does state on his blog he doesn't want links or posts re-posted but that was said in 2007 and now he is no longer blogging but keeps the site up as an archive for us blokes.

I just can't imagine at this point he would have a problem with re posts. Admin, what do you think?

I just can't imagine at this point he would have a problem with re posts. Admin, what do you think?

Originally posted by jimkane

Hey, Lorn, you should start a topic just for these kinds of posts they are so good (as long as Dr. Brett doesn't mind, I had heard something about him not wanting to be reposted or linked???). I voted you up on this one (and I think on another another one like this that you posted). Give it some thought.

Originally posted by Lorn

A good read to contemplate as we prepare for tomorrow's action.

http://traderfeed.blogspot.com/2010/03/most-common-problem-i-see-among-active.html

The Most Common Problem I See Among Active Traders

The recent post on listening to market communications highlights one of the most common problems I see among active traders, particularly those that trade on a day time frame.

We've all known people who seem to talk at you rather than with you. It seems as if they're uninterested in anything you have to say. They just want to get things off their minds. Indeed, even as you're talking, you can see that they can't wait to blurt out whatever is in their heads.

Can you imagine a psychologist who interacted like that? You're trying to describe your problems, and the shrink is talking right over you with whatever psychobabble he happens to be espousing at the time. That would be quite frustrating.

Well, that is how many traders approach markets. They don't listen to what the market has to say. Instead, they're looking for the next setup, the next trade to put on.

When you sit in front of the screen, the goal should be similar to the psychologist's: to understand what is going on before you take action. If you're approaching markets with your own opinions and your own need to put on trades, you'll miss the market's communications--its evolving patterns--and any hope of getting a gut feel for the action will be gone.

I often wondered why I tended to trade well after taking a break from markets. The reason, I discovered, was that I was following markets during the break, but not trying to put on trades. That freed me up to simply hear what the markets had to say.

If you have a *need* to talk, chances are you'll be a poor conversationalist because you'll be a poor listener.

And if you have a *need* to trade, odds are you'll be tone deaf with respect to what markets are actually telling you.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.