ES Short Term Trading 7-30-10

So the POC is right at 1100 even:

http://www.mypivots.com/board/topic/5894/2/value-areas-and-point-of-control-2010-q3#64840

Economic Events for Friday:

08:30 AM GDP

08:30 AM Employment Cost Index

09:45 AM Chicago PMI

09:55 AM Consumer Sentiment

03:00 PM Farm Prices

http://www.mypivots.com/trading/economicevents

http://www.mypivots.com/board/topic/5894/2/value-areas-and-point-of-control-2010-q3#64840

Economic Events for Friday:

08:30 AM GDP

08:30 AM Employment Cost Index

09:45 AM Chicago PMI

09:55 AM Consumer Sentiment

03:00 PM Farm Prices

http://www.mypivots.com/trading/economicevents

Thanks Bruce!

Originally posted by BruceM

short at 1100.....97.75 is target

Thx too

Originally posted by BruceM

short at 1100.....97.75 is target

that was the hour break out surge with slight tick divergence into a key number forming an air pocket..

now if buyers don't show up again our runners will get 95.25 and lower...working 3 now...

now if buyers don't show up again our runners will get 95.25 and lower...working 3 now...

trips trying to form ay 97.25...THIS BAR

adding to runners at 99.75....Trips are official now...may try to shake us over 1100 but will stay the course

seen this before...the real low volume around a key number and then a surge again...so if they make new highs be careful if fading with me

so far so good though for trip run...hopefully not too much suffering

so far so good though for trip run...hopefully not too much suffering

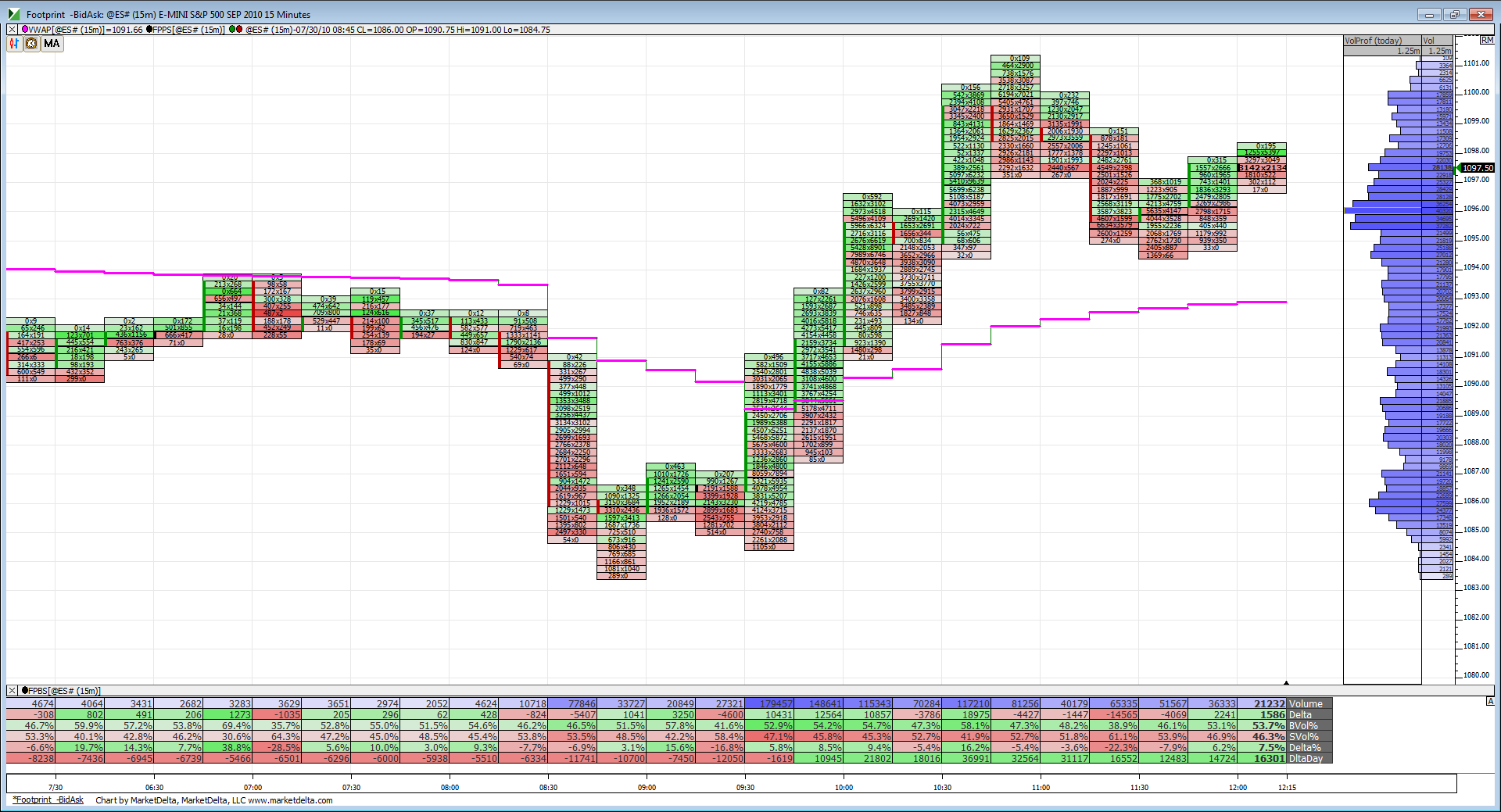

Here you can see all the buying pushing prices up and through VWAP. Volume has dropped during this pullback/consolidation. You can also see volume building in the 1096 area.

Originally posted by hari

.....

7/29 1113 H of 15min OR

.........

What is OR please? Thanks.

You're sharp,Wendy! Actually , i dont normally use fib retracements, just my Kools tools fib extentions. Sometimes, tho at what i feel may be an important high or low, I sometimes look around for any other kind of corraborating evidence to support my theory (like is there support or resistance here?,are any cycles topping or bottoming here,is this a previous high vol zone?,...etc). Probably just a confidence booster. I have never found fib retracements to be tradable. Doesnt mean they arnt, just not for me. In this case i believed the low was important in that i was looking for the daily low to be made here, and possibly for the next few sessions. I was caught a little off guard as if memory serves, i had just logged on 5-10 min before it occurred and really had no time for much study!. That in itself speaks to the power (and confidence i have) in my fib extentions. Hope this helps explain my view and actions a little better.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.