ES Short Term Trading 7-30-10

So the POC is right at 1100 even:

http://www.mypivots.com/board/topic/5894/2/value-areas-and-point-of-control-2010-q3#64840

Economic Events for Friday:

08:30 AM GDP

08:30 AM Employment Cost Index

09:45 AM Chicago PMI

09:55 AM Consumer Sentiment

03:00 PM Farm Prices

http://www.mypivots.com/trading/economicevents

http://www.mypivots.com/board/topic/5894/2/value-areas-and-point-of-control-2010-q3#64840

Economic Events for Friday:

08:30 AM GDP

08:30 AM Employment Cost Index

09:45 AM Chicago PMI

09:55 AM Consumer Sentiment

03:00 PM Farm Prices

http://www.mypivots.com/trading/economicevents

Range S/R for 7/30/2010

R1 = 1119

S1 = 1082.75

R2 = 1125.125

S2 = 1076.625

Steenbarger Pivot = 1098.75

R1 = 1119

S1 = 1082.75

R2 = 1125.125

S2 = 1076.625

Steenbarger Pivot = 1098.75

A break below 1090 brings 1075 into play as a target IMO.

There is a gap from 1064 to 1078.25 - maybe that will get filled if we see 1075.

Originally posted by Big Mike

A break below 1090 brings 1075 into play as a target IMO.

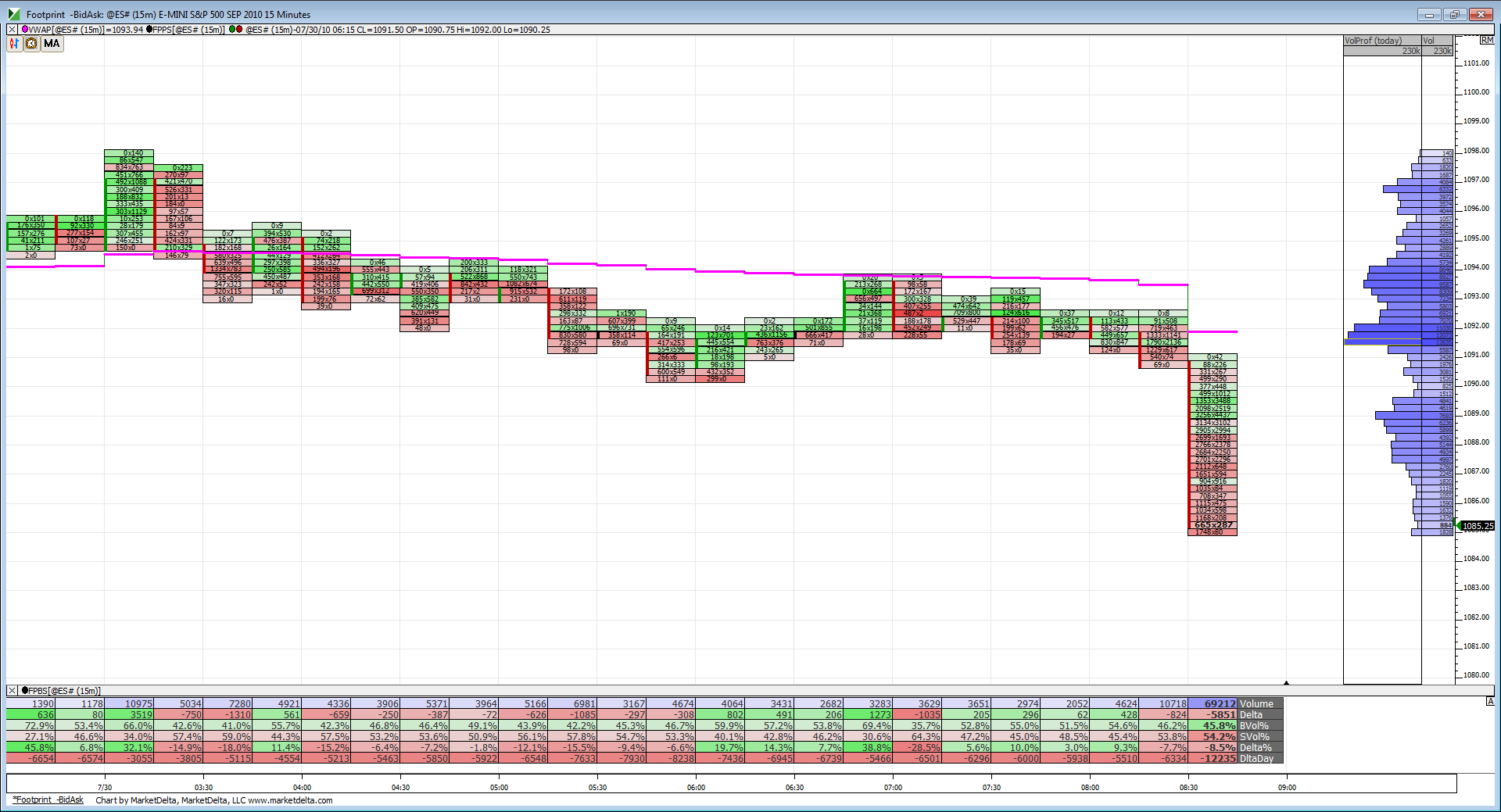

Here is a look at the action since the 8:30 news.

Trading under VWAP most of the morning and now a break away move. We will find out soon enough if this move can be sustained.

Trading under VWAP most of the morning and now a break away move. We will find out soon enough if this move can be sustained.

Thx, a little early, but i still can profit from it

Originally posted by koolblue

For the past 10 days HOD or LOD occured with in the first 60min ( 1 exception), sometimes even in the first 5 min !

Date HOD/LOD Notes

7/29 1113 H of 15min OR

7/28 1111.50 H of 15min OR

7/27 1117.75 H of 15min OR

7/26 1097.75 L of 15min OR

7/23 1084 L of 60min OR, L of 15min OR was 1084.50

7/22 1078 L of 5min OR

7/21 1085.50 H of 5min OR

7/20 1053 L of 5min OR

7/19 1071/1057 LOD occurred 82 min after open

7/16 1086.50 H of 5min OR

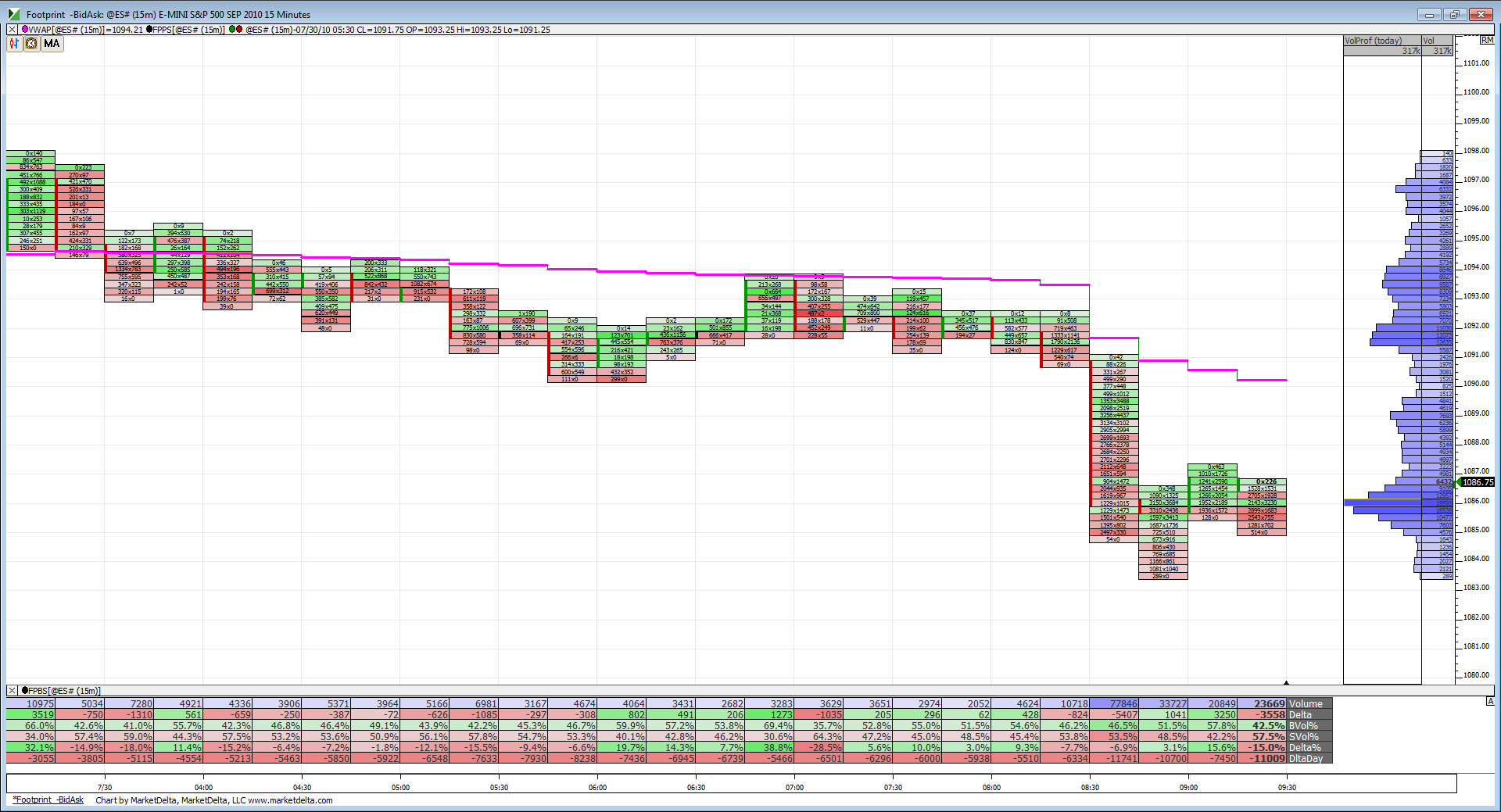

Action into the open. Notice VWAP sitting in the volume valley in the 1090 area and the volume bulge in the 1086 area.

You're sharp,Wendy! Actually , i dont normally use fib retracements, just my Kools tools fib extentions. Sometimes, tho at what i feel may be an important high or low, I sometimes look around for any other kind of corraborating evidence to support my theory (like is there support or resistance here?,are any cycles topping or bottoming here,is this a previous high vol zone?,...etc). Probably just a confidence booster. I have never found fib retracements to be tradable. Doesnt mean they arnt, just not for me. In this case i believed the low was important in that i was looking for the daily low to be made here, and possibly for the next few sessions. I was caught a little off guard as if memory serves, i had just logged on 5-10 min before it occurred and really had no time for much study!. That in itself speaks to the power (and confidence i have) in my fib extentions. Hope this helps explain my view and actions a little better.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.