ES Short Term Trading 7/14/10

Mornin,

If there's another thread please let me know.

Here's a chart for you Bruce from your ah inquiry. Will post info for it later.

If there's another thread please let me know.

Here's a chart for you Bruce from your ah inquiry. Will post info for it later.

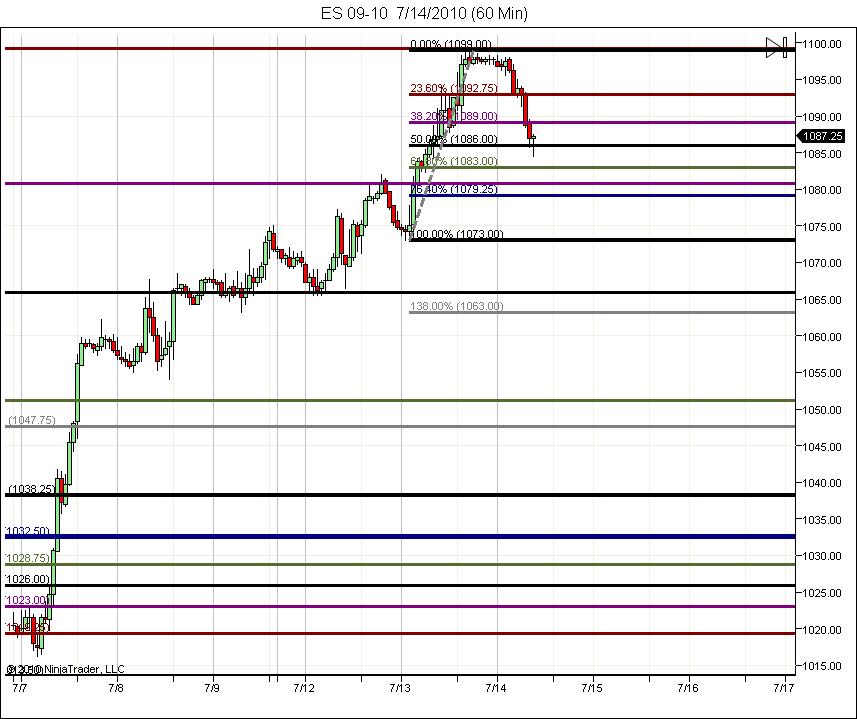

In the first chart gives the fib retrace levels for that last wave down.

Note how there was a reaction at every level except the 1051.25 .

Note the battle and retesting at 50% "Golden" S/R line (1066). Above strength, below weakness.

Doesn't matter if you draw the lines from top down or bottom up. 38.2 is the opposite of 61.8 .

Now, you can use em between any high and low or "wave" for decision assessment/analysis.

Here's a shot of this am so far.

Note how there was a reaction at every level except the 1051.25 .

Note the battle and retesting at 50% "Golden" S/R line (1066). Above strength, below weakness.

Doesn't matter if you draw the lines from top down or bottom up. 38.2 is the opposite of 61.8 .

Now, you can use em between any high and low or "wave" for decision assessment/analysis.

Here's a shot of this am so far.

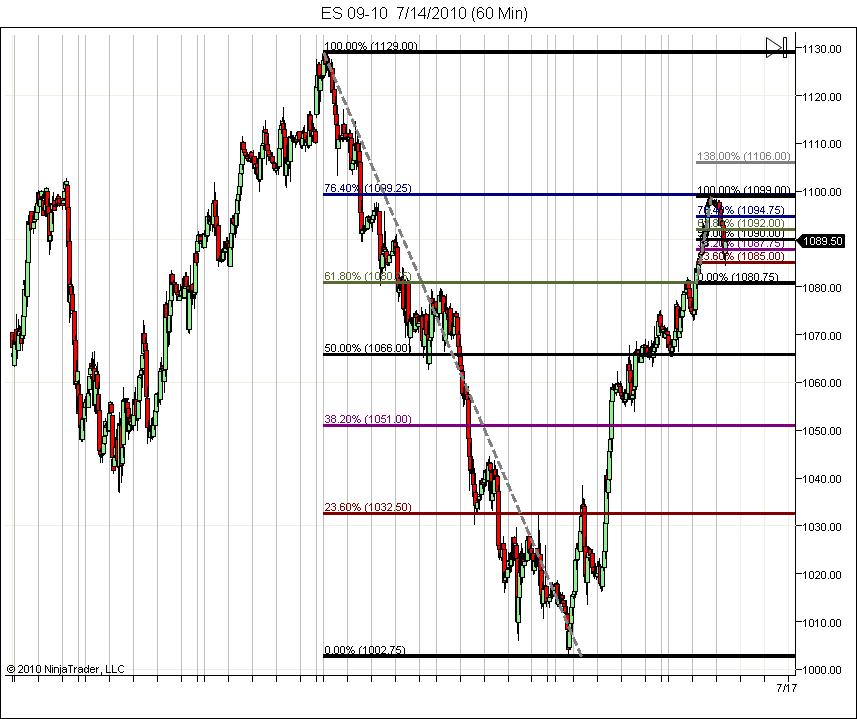

And here's one showing the fibs drawn between the larger fib lines that I was referring to yesterday for use as pivots and/or support between the larger moves.

Good stuff David.

Proportion is something the market seems to like.

Proportion is something the market seems to like.

starting shorts at 94.25 today...91.75 is target...single prints below and we still need a test of a previous 30 minute bar low......lite for me as I will add up above 97 if needed....

I am long term bearish in general until we test 81 again....

I am long term bearish in general until we test 81 again....

Hey Bruce,

What did you do with your shorts from last night? Your target 1090 was reached earlier this morning.

Cheers

What did you do with your shorts from last night? Your target 1090 was reached earlier this morning.

Cheers

thanks David...how can I remove the subjectivity of fib levels...It's easy to draw them after we are inside a range...but how about as we are going forward.....I have the same prblem in general with longer term MP levels so not picking on fibs per say..

they came off when 90.75 filled in.....here is the gap that helped me target that......from yesterday late day sell off....you may need to look at your 5 minute charts to see it

Originally posted by Lorn

Hey Bruce,

What did you do with your shorts from last night? Your target 1090 was reached earlier this morning.

Cheers

Thanks Bruce. Figured you did that just wanted to confirm since you mentioned a possible reevaluate at the 6:00pm reopen.

Just trying to see if I have a grasp on your thinking.

Just trying to see if I have a grasp on your thinking.

95 - 97.50 should be interesting now...( that was big volume in O/N session)these low volume grinds up are hard as they haven't formed gaps or air pockets..it would be nice to see a high volume flush up but we may not get it

official air pocket and single prints begin at 92.75.....

official air pocket and single prints begin at 92.75.....

in that case Rburns it was the one minute volume spikes !!!If I had my I r/t up at that time it would have helped refine it a bit...but look at all one minute volume spikes begining with the open spike..!all the major ones came in the same zone today....so 87 - 89 is still critical!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.